You might be interested in

Mining

Monsters of Rock: BHP's $60 billion Anglo American gambit far from a done deal

News

ASX Small Caps Lunch Wrap: Inflation a little higher than expected, but then so is the ASX

Mining

News

Local markets are overcast with a chance of heavy rain this arvo after a 25 US cent slide in New York overnight for mega-miner BHP drags like an albatross around the neck of the local index.

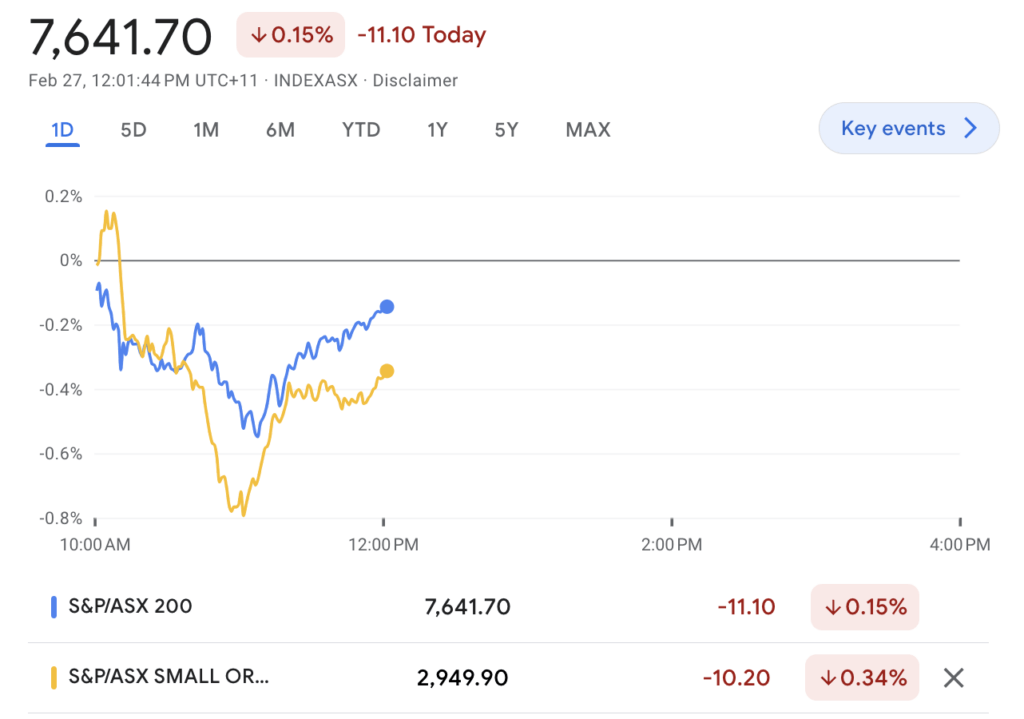

At lunchtime in Sydney the ASX200 was down by about 11 points or 0.15% to 7,641.70

The ASX is tracking Wall Street as investors await key inflation data later this week for direction after the S&P 500 edged lower on Monday.

The broader market index retreated from its latest record struck on Friday with US Treasuries on the ascendant.

But, if equity markets look overbought, FFS, don’t tell any of the free-wheeling, asset hungry private equity firms who rumour has it, are sitting on dry powder to the tune of $US2.5 trillion.

We’ve already seen a fraction of it deployed this week, with the French winning over CSR (ASX:CSR) with Paris-based Saint-Gobain Group’s welcome $4.3bn takeover offer.

Monday also sawAussie Broadband (ASX:ABB) has just bid $466m for Superloop (ASX:SLC).

And putting to bed the weirdest ASX version of Ernie and Bert, Alcoa has made market love with an offer to Australian partner Alumina (ASX:AWC).

With interest rates appearing to have peaked, high equity valuatins are being offset by AI-optimism and a spreading warmth about a global economy which doesn’t look like it’s headed to a recession.

Well, if you’re feeling put upon by the higher-for-longer nonsense around interest rates, spare a thought for the persecuted New York hotelier Donald Trump.

Not only has a New York court hit the colourful businessman with a rapacious US$455m penalty for getting the square metreage of his apartment wrong, but it seems the interest rates for plucky entrepreneurs these days is different than for the dole bludgeing masses.

In fact the self-made TV star and semi-pro golfer is now being persecuted online by the very New York Attorney General – Letitia James – who charged the man and his entire entourage with bad math in the first place.

Post-judgment interest is building at a rate of 9% on the US$464m penalty.

Ms James who has said she’s totes ready to seize the octagenarian’s assets if necessary, is not going to let Mr Trump forget his new and horrifying fiscal burden.

When the final judgment in the sprawling fraud trial against Mr Trump, his adult sons Donald Jr and Eric Trump, and former Trump Organization executives was approved on Friday, the attorney general’s X account posted the exact figure down to the last cent.

+$114,553.04 = $464,805,336.70 https://t.co/gugrACDTpC

— NY AG James (@NewYorkStateAG) February 25, 2024

24 hours later, her account wrote: “+$114,553.04”.

First, my goodness, we’re getting sucked back into the vortex of iron ore prices, which ran headlong into a four-month low on Monday due to increased inventories in China and rain-slowed construction activity.

Uncertainty around Chinese stimulus, rising port inventories and easing supply concerns are all weighing on the price.

And when the steel fundamentals in China go bearish, so do the monstrous local majors which make up a large portion of the market.

All three – Fortescue (ASX:FMG), BHP (ASX:BHP), and Rio Tinto (ASX:RIO) – were all significantly lower at lunch in Sydney.

Over the road in nickel land, local producers look like copping an ongoing struggle with global prices after S&P research suggests that major producer Indonesia will likely add 300k tons of capacity this year alone with the oversupply to continue bubbling over beyond 2025.

S&P says (literally) that “Indonesia is flooding the nickel market with low-cost supply.”

It’s just a hurricane of earnings reports on Tuesday.

Education exporter G8 Education is laughing it in, after a fully 50% improvement in full year profit.

City Chic is down double digits amid what it seems to always refer to as “challenging market conditions and consumer demand pressures.”

1H sales revenue is down 29% taking the net loss to $21m, compared to $5.2m same time last year.

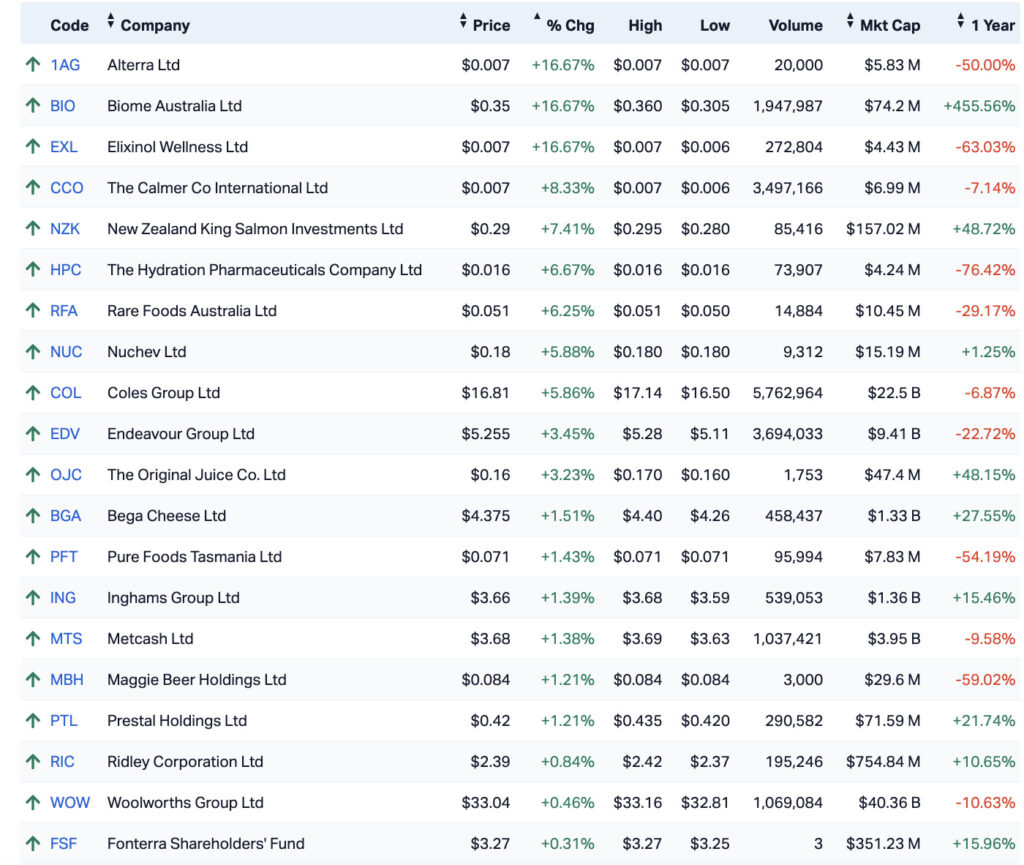

Elsewhere on the bourse, it’s the Consumer Staples sector having the dream run among a field littered with failure.

While familiar small caps like Elixinol Global (ASX:EXL), Biome Australia (ASX:BIO) and New Zealand King Salmon (ASX:NZK) are enjoying strong support on the back of individual earnings and – in some cases – positive regulatory decision-making out of Berlin, the sector’s strength derives from blue chips – Messrs Coles Group (ASX:COL) and Endeavour Group (ASX:EDV) .

Coles has thrown shade at its detractors – saying no-one’s gouging nuthin’ – and the stock has risen along with revenue over the December half by 6.8% to $22.2bn, thanks to Christmas, Halloween and Father’s Day bingeing (that’s what they said).

Profit fell 8.4%t to $589mn. Ergo sum: NO price gouging.

Other funny winners include plumbing supplier Reece which has declared an interim dividend of 8 cents a pop on the back of a 20% surge in 1H net profit.

Abacus Group (ASX:ABG)

Adbri (ASX:ABC)

Altium (ASX:ALU)

Alumina (ASX:AWC)

Appen (ASX:APX)

Articore Group Ltd. (ASX:ATG)

Austin Engineering (ASX:ANG)

City Chic Collective (ASX:CCX)

Coles Group (ASX:COL)

Woodside Energy Group (ASX:WDS)

Helia Group (ASX:HLI)

Johns Lyng Group (ASX:JLG)

Reece (ASX:REH)

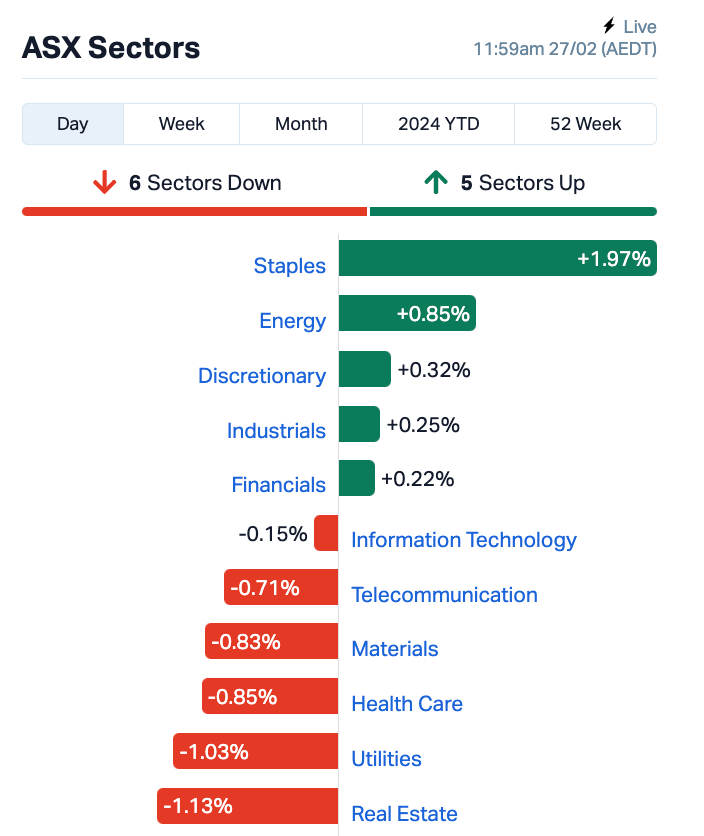

Six out of the 11 ASX sectors were trading in the red at midday.

Utilities have tracked the S&P500 sector lower while Real Estate Investment Trusts (down 1.1%) led the declines in morning trade.

Wall Street was unnervingly quiet overnight.

The tech-heavy finished unchanged, the S&P500 lost -0.4% and the Dow Jones Industrial Average also edged lower Monday as Tesla (TSLA) finally had a win vs its fellow Magnificent Seven-or-so stocks like Messrs Apple (AAPL) and Nvidia (NVDA).

The S&P 500 sectors ended mostly negative. Consumer discretionary and energy outperformed. Communication services and Utilities struggled.

In corporate news Domino’s Pizza (DPZ) in the States rose like a big pizza pie, up 6% on strong earnings. DPZ is also raising its dividend by 25% and increasing its share buyback program.

Berkshire Hathaway (BRKB) fell after Our Warren Buffett wondered aloud why progress has been difficult for the conglomerate lately.

US traders are bracing for the plethora of economic data this week, topped by the PCE, the US Fed’s preferred measure on inflation, as well as the unending rhetoric from various Fedspeakers certain to shape the view on interest rates.

We’re also watching oil…

Global oil prices have added more than 1% overnight, supported by further nonsense, including the Mid East, Houthi rebels, bargain hunters and Libya.

WTI crude futures have recovered to over US$77.50 per barrel recapturing a little of the near 2.7% lost over the last tumultuous week.

The ongoing market weakness, aided and abetted by problems in the giant Wafa oil field out of Libya, encouraged both the big US refineries and opportunistic foreign buyers to binge on bargain US crude prices and simultaneously avoid wondering if a Houthi rocket will spill your oil all over the Red Sea.

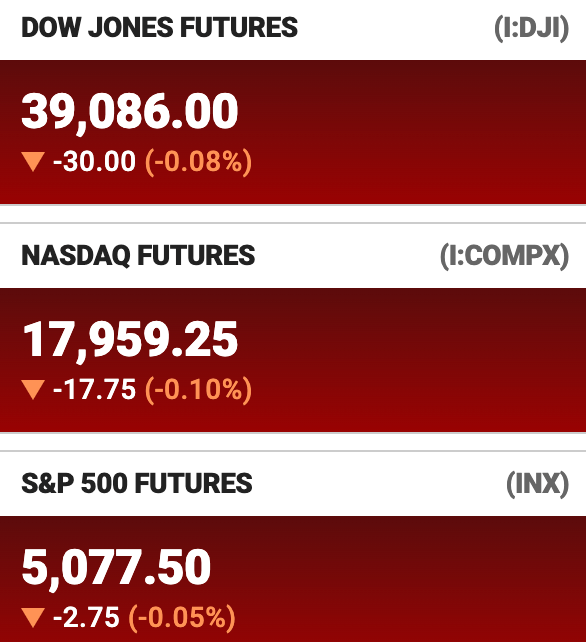

Futures tied to the Dow Jones Industrial Average, the S&P 500 and the Nasdaq were all around 0.1% lower at lunch in Sydney.

Here are the best performing ASX small cap stocks for 27 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap BP8 BPH Global Ltd 0.002 100% 274,588 $1,954,116 AUA Audeara 0.053 61% 277,126 $4,772,055 OD6 OD6 Metals 0.115 28% 135,848 $4,951,395 IVX Invion Ltd 0.005 25% 956,423 $25,698,129 MTL Mantle Minerals Ltd 0.0025 25% 14,618,018 $12,394,892 TMK TMK Energy Limited 0.005 25% 4,645,411 $24,490,317 5EA 5E Advanced 0.215 23% 793,493 $54,804,972 QIP Qantm Intellectual 1.375 20% 358,596 $160,358,229 INP Incentiapay Ltd 0.006 20% 843,578 $6,219,650 SIT Site Group Int Ltd 0.003 20% 314,000 $6,506,226 YAR Yari Minerals Ltd 0.006 20% 83,160 $2,411,789 NIM Nimy Resources 0.065 18% 22,096 $7,723,298 LGM Legacy Minerals 0.165 18% 108,437 $14,763,700 TG6 TG Metals 0.34 17% 1,626,764 $15,684,988 BIO Biome Australia Ltd 0.35 17% 1,946,553 $63,603,194 1AG Alterra Limited 0.007 17% 20,000 $4,992,883 EXL Elixinol Wellness 0.007 17% 272,804 $3,797,230 ICG Inca Minerals Ltd 0.007 17% 167,776 $3,526,958 LML Lincoln Minerals 0.007 17% 710,500 $10,224,272 SHE Stonehorse Energy Lt 0.015 15% 50,655 $8,897,656 ARC ARC Funds Limited 0.115 15% 10,000 $3,007,635 BVR Bellavista Resources 0.115 15% 59,335 $4,961,097 DEL Delorean Corporation 0.063 15% 405,665 $11,864,650 BLZ Blaze Minerals Ltd 0.008 14% 2,769,950 $4,399,908 SP8 Streamplay Studio 0.008 14% 206,500 $8,054,366

OD6 Metals (ASX:OD6) says it’s just pumped about the quality of the metallurgical recoveries from samples tested at the Australian Nuclear Science Organisation (ANSTO), including – apparently – up to 90% of Magnet Rare Earth Elements (MagREE) in multiple Prospect areas, across 60 new samples.

Lots and lots happening out of these samples from Splinter Rock with OD6 claiming that recoveries for all MagREO are inclusive of Nd, Pr, Dy, Tb similar.

This is the key to overall project economics for any clay hosted rare earth project.

MD Brett Hazelden says the metrics align closely with the essential value drivers we believe are crucial for the economic viability of clay-hosted rare earth projects.

“The outstanding results from our metallurgical leaching studies continue to affirm the Splinter Rock project as Australia’s premier clay-hosted rare earth deposit. With consistent recoveries averaging over 60% across multiple prospects, and notably high recoveries observed for each of the fifteen rare earth elements, our confidence in the project’s potential remains high.”

Meanwhile, Audeara (ASX:AUA) has made its maiden sale order to mass manufacture AUA audio tech for a third party brand and the purchase order from Avedis Zildjian of$2.1m is also the largest single order Audeara has received since inception.

Audeara co-founder and CTO Alex Afflick says the purchase is “expected to have a significant positive impact on the Company’s cashflow and its push toward breakeven and profitability.”

First announced early last year, the project AUA says, is nearing mass production, ahead of a commercial launch anticipated in H1 FY25.

5E Advanced Materials (ASX:5EA) has dropped a startlingly comprehensive update on progress at the 5E Boron Americas Complex in California.

CEO Susan Brennan says the company remains on track to start commercial ops in CY Q2 2024, with all mining operations and related activities on track as it moves closer to initial boron and lithium production.

Just how big a deal is it, Ms Brennan?

“I cannot emphasize enough the importance 5E will represent in the US in the coming months as a new and secure producer of critical materials needed for clean energy economies.”

That’s how much.

Also up handsomely is Impact Minerals (ASX:IPT) touting what it says is a new proprietary metallurgical process “identified for producing high-value High Purity Alumina (HPA) from the lake clays at Impact Minerals Limited’s (ASX:IPT) Lake Hope project.”

Located 500km east of Perth, Impact says it can earn an 80% interest in Playa One, which owns the Lake Hope project, by completing a Pre-Feasibility Study (which is in progress.)

IPT’s snazzy new process, (called the LTL Process), has reportedly produced High Purity Alumina (HPA) at 99.99% purity from the raw lake clay in only a few months of laboratory test work

“This is one of the fastest times to produce HPA from raw materials reported by ASX-listed companies and attests to the relatively straightforward nature of the process.”

Investors like it. The stock is up 20%.

Here are the most-worst performing ASX small cap stocks for 27 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap DGL DGL Group Limited 0.6 -42% 6,869,770 $293,711,154.83 ICL Iceni Gold 0.017 -37% 1,492,440 $6,657,148.40 AVW Avira Resources Ltd 0.001 -33% 1,285,000 $3,200,685.00 ATG Articore Group Ltd 0.565 -29% 1,029,474 $226,226,630.40 ACE Acusensus Limited 0.85 -25% 1,163,672 $144,095,971.50 BRN Brainchip Ltd 0.38 -22% 32,895,299 $884,849,195.65 T3D 333D Limited 0.007 -22% 5,393 $1,075,004.42 ASH Ashley Services Group 0.27 -22% 693,540 $49,671,686.88 MPK Many Peaks Minerals 0.094 -22% 11,566 $4,370,476.44 OXT Orexplore Technologies 0.022 -19% 20,871 $5,276,222.44 BBC Bnk Bank Corp Ltd 0.3 -17% 151,007 $42,738,985.80 NOX Noxopharm Limited 0.061 -16% 116,120 $21,333,370.35 TRJ Trajan Group Holding 1.09 -16% 2,101,071 $197,880,910.50 CDT Castle Minerals 0.006 -14% 42,066 $8,571,450.89 RGS Regeneus Ltd 0.006 -14% 1 $2,145,058.40 TYR Tyro Payments 1.03 -14% 9,049,050 $628,118,913.60 BIT Biotron Limited 0.073 -14% 5,122,039 $76,693,418.01 ARR American Rare Earths 0.25 -14% 4,757,817 $130,042,756.71 JLG Johns Lyng Group 6.27 -13% 3,347,731 $2,000,691,280.80 SLH Silk Logistics 1.56 -13% 172,012 $145,970,200.42 1MC Morella Corporation 0.0035 -13% 1,908,706 $24,715,197.70 EPM Eclipse Metals 0.007 -13% 567,201 $16,600,433.90 ODE Odessa Minerals Ltd 0.007 -13% 11,357,591 $8,346,260.29 PSC Prospect Res Ltd 0.063 -13% 1,050,249 $33,359,901.26 CCX City Chic Collective 0.49 -13% 1,762,062 $129,875,248.16

Headline-making Aussie Biopharma Dimerix (ASX:DXB) has reported the successful gathering of data from the initial 72 patients enrolled in its ACTION3 Phase III trial for DMX-200 for kidney disease focal segmental glomerulosclerosis (FSGS).

CEO and MD Dr Nina Webster says incoming interim analysis is scheduled for review by the independent Data Safety Monitoring Committee (IDMC) in March 2024.

“We are now only a matter of days away from our Part 1 analysis outcome and, on the presumption of success, are continuing to prepare for Part 2 of the Phase III study.

“Success in Part 1 would signal that DMX-200 is performing better than placebo in reducing proteinuria, an important marker of kidney disease progression, in a larger cohort of patients than our prior Phase II study and validates our strategy and our prioritisation of this potentially valuable program.”

Battery Age Minerals (ASX:BM8) has secured 100 years of historical mining data to help fast track targeted extensions of known mineralisation and develop an exploration plan for its Bleiberg zinc-germanium project in Austria.

Desktop studies have recorded >172 tonnes of germanium production at only a portion of the Bleiberg mine which was ranked as the 6th largest in the world during its final years in production before being closed in 1993.

Since then, germanium and gallium have both become essential elements in the manufacture of semiconductors and China’s recent export restrictions on the materials have placed a strategic importance on developing assets such as Bleiberg.

Calima Energy (ASX:CE1) has completed the sale of Blackspur Oil Corp to Astara Energy for the gorgeously shaped figure of $81.6 million. Already in the bank, the company says.

Calima chairman Glenn Whiddon says CE1 plans to distribute some $80 million from the Blackspur Sale to Calima shareholders in the most tax effective form.

CE1 is in talks with the ATO on how best to do this which will take up to 3 months.

Post distribution, Calima will have ~A$5-6 million cash and a 100% interest in the Paradise Field in British Columbia which generates approximately A$350,000 in free cash flow annually.