ASX September rebalance: Which ASX stocks made the 200 club this quarter and why it matters

Pic:Getty Images

- Since release of the ASX September rebalance many companies elevated to the S&P/ASX 200 have seen their five-day share prices lifted

- Resources stocks dominate additions to both the S&P/ASX 200 and S&P/ASX 300, including those linked to green energy transition

- Low-cost jeweller Lovisa Holdings is shining after being promoted to the S&P/ASX 200 and reporting a strong FY22, including international expansion

Spring is in the air, the birds are chirping, magpies swooping and footy finals are upon us. Spring also signals the ASX September rebalance of some key indices.

Responsibility for the great rebalancing act falls on S&P Dow Jones Indices, part of credit rating agency S&P Global. Different indices are rebalanced at various times and frequencies throughout the year. The latest September quarterly review were released on Friday and come into effect on Monday, 19 September. Indices rebalanced include:

- S&P/ASX 20

- S&P/ASX 50

- S&P/ASX 200,

- S&P/ASX 300,

- S&P/ASX 100 and

- S&P/ASX All Technology Index

You can read all of ASX September rebalance changes here but basically there were no changes to the S&P/ASX 20 and S&P/ASX 50. The indices worth noting are the S&P/ASX200 and S&P/ASX300 and are ones many fund managers or investors use as a cutoff for investments.

Entering the S&P/ASX 300 can be a major milestone for companies, signifying they’ve made it to the big league.

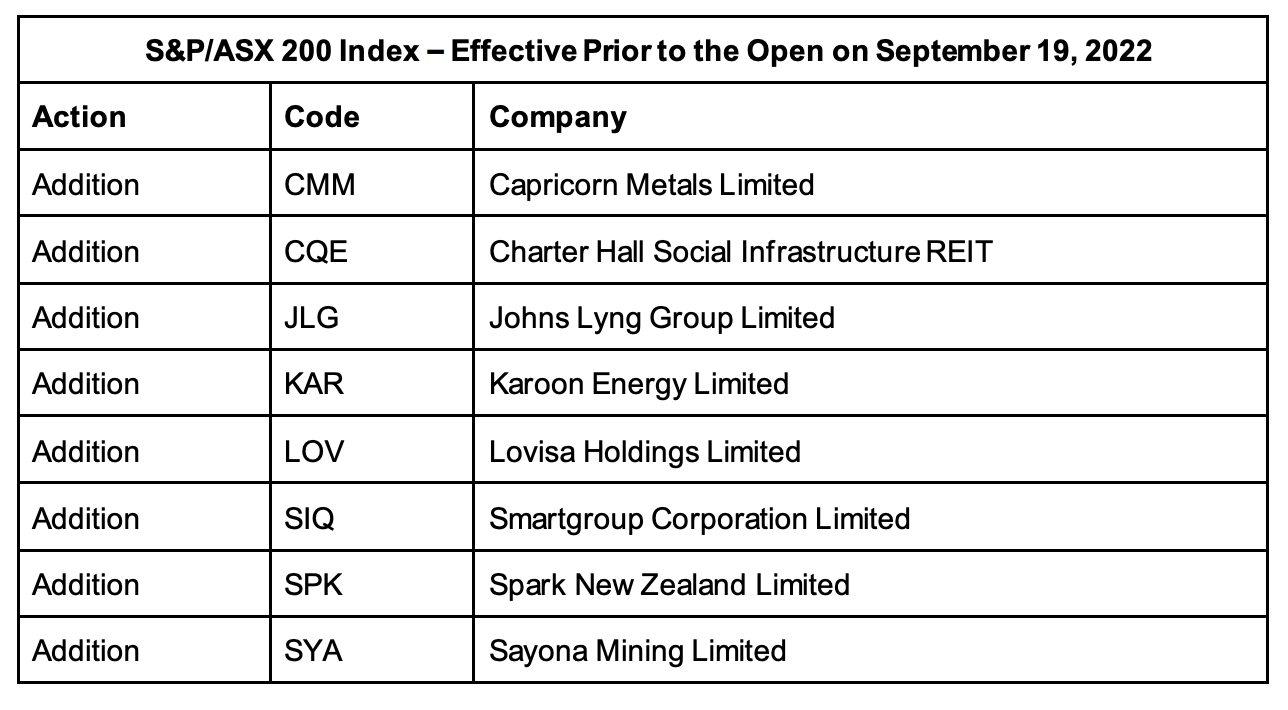

ASX September rebalance S&P/ASX200 – Additions

Since the updated indices were released many of companies elevated to the S&P/ASX 200 have seen their five-day share prices lifted, although some have also made positive announcements to the market during this time.

Stockhead’s Josh Chiat has looked at the resources stocks which have found themselves cracking the S&P/ASX 200 and S&P/ASX 300, including the $1.3 billion capped Capricorn Metals (ASX:CMM) with the Mark Clark led gold miner lifting 4.15% year to date as both gold prices and fellow gold equities have faltered.

LOVISA HOLDINGS (ASX:LOV)

The vertically integrated low cost-jeweller is a top pick for 8020 Invest investment manager Angie Ellis. Lovisa reported a solid FY22 including sales growth of almost 20%. It added 85 new stores during FY22 including 55 of those in the US and had a total of 629 at EOFY.

The company’s share price is up ~8% in the past five days and ~18% year to date.

Johns Lyng Group (ASX:JLG)

The insurance builder posted a 57.5% increase in revenue to $895 million and EBITDA increased 58.9% to $83.6 million in FY22. JLG said the result was underpinned by a strong performance from its core Insurance Building and Restoration Services (IB&RS) division, which contributed business as usual revenue of $586.5 million, an increase of 63.8% on FY21.

JLG was admitted to the ASX/300 index in September 2021. While its share price lost ground in the June sell-off it is up ~11% in over a one year period.

Spark New Zealand (ASX:SPK)

The telecommunications and digitals services company announced in July it would sell a 70% stake in its TowerCo business to the Ontario Teachers’ Pension Plan Board. In its FY22 announcement SPK said proceeds from the $900 million sale will be used to “maximise shareholder value, invest for growth and maintain financial strength and flexibility”.

“In a year marked by ongoing Covid-19 disruption and increasing economic volatility, Spark has delivered an incredibly strong results, returning to revenue growth and delivering earnings at the top end of guidance,” chair Justine Smythe said.

Revenue increased 2.5% yoy $3.72 million. SPK is up ~13% year to date and has risen 1.88% in the past five days.

Charter Hall Social Infrastructure REIT (ASX:CQE)

The largest Australian ASX listed real estate investment trust (A-REIT) reported statutory profit of $385 million for FY22, up $184.4 million on pcp and operating earnings up $62.9 million, up 8.4% on pcp.

Operating earnings of 17.3 cents per unit was an 8.1% rise on pcp, while gross assets of $2.1 billion was up 25% since June 2021. The company’s property portfolio valuation rose $269 million or 19.4%.

Smart Group Corporation (ASX:SIQ)

SIQ has a product suite providing salary packaging, novated leasing, fleet management, payroll administration, share plan administration and workforce optimisation services. The company reported revenue of $113.6 million, up 4% on pcp and operating EBITDA of $49.4 million in line with pcp for H1 FY22.

In its ASX H1 FY22 announcement SIQ CEO Tim Looi said the company had been able to deliver a good financial result for the half year, despite lengthening vehicle delivery timeframes.

Karoon Energy (ASX:KAR)

In the oil space, Karoon Energy is VP Capital co-founder and portfolio manager John So’s pick. Karoon has oil production and exploration assets in Brazil. There’s been a a drop of more than 20% in global oil prices since the beginning of June. However, the Organisation of Petroleum Exporting Countries (OPEC) has agreed to cut production by 100,000 barrels a day, which is set to see oil prices shoot up.

The KAR share price has risen more than 12% in the past five days and ~87% in the past year.

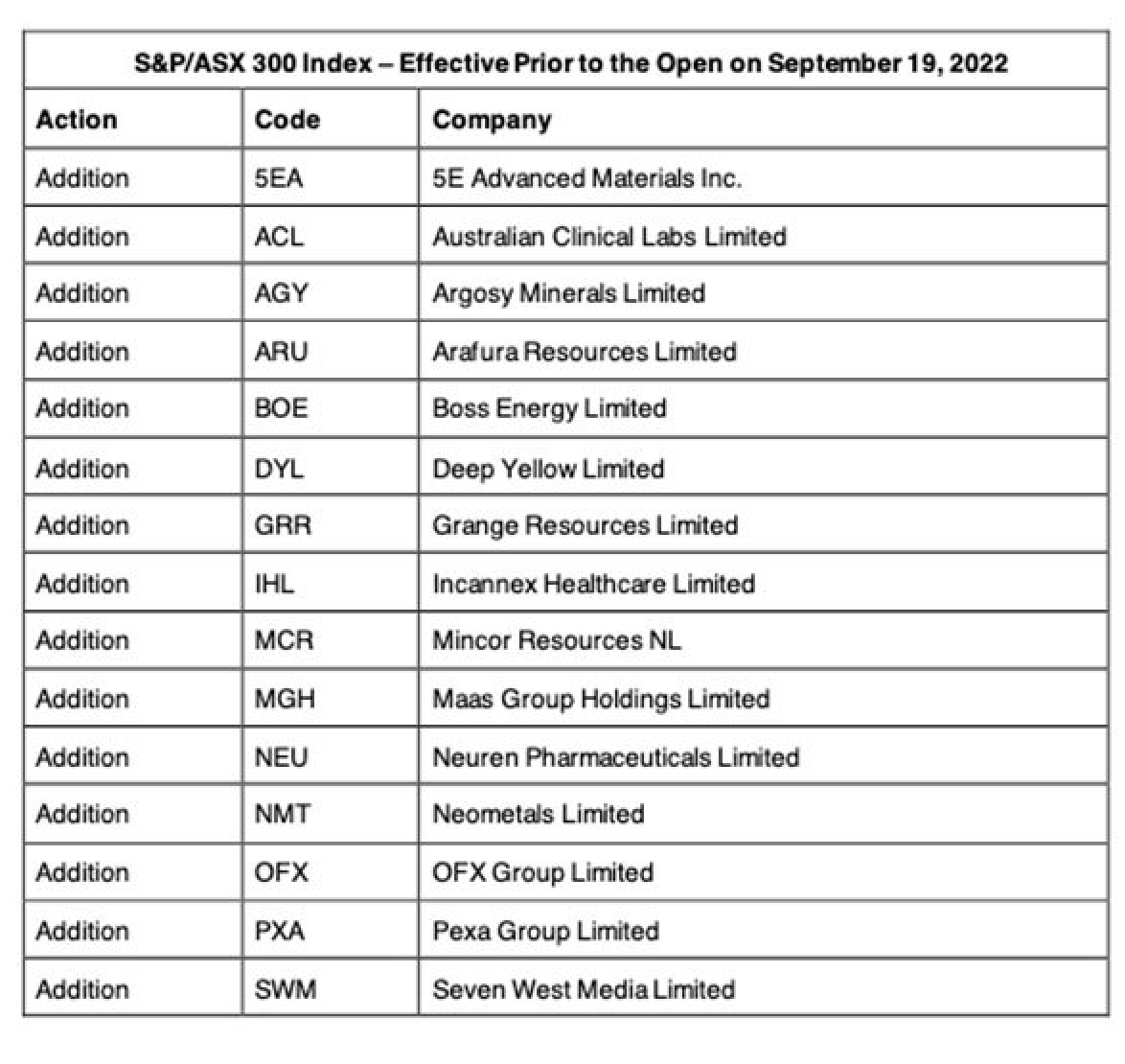

ASX September rebalance S&P/ASX 300

While there are too many additions to this significant index there are some patterns worth noting including the addition of many resource and health stocks. As Josh noted the big flavour in the inclusions for the ASX September rebalance of the S&P/ASX 300 is the growing desire of investors to put their money into miners linked to the energy transition.

High growth health stocks hard hit during volatility which has plagued global markets during 2022 also benefited from a July rally.

Not fitting the medical and resources theme is OFX Group (ASX:OFX) a provider of forex services to consumers and corporates globally. Venetia Services (ASX:VNT) operates as a telecommunications, infrastructure and utilities services company, while online conveyancing Pexa Group (ASX:PXA) is the jewel in the crown asset of Link Administration Holdings (ASX:LNK).

All three companies have seen their share price rally in the past five days. Experts have had a mix reaction to the latest rebalance.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.