Experts react to ASX indices rebalance as mining stocks promoted, Zip booted

Pic: Getty Images

- ASX indices rebalance see speculators trading around scheduled rebalances with speculation stocks added will have positive returns

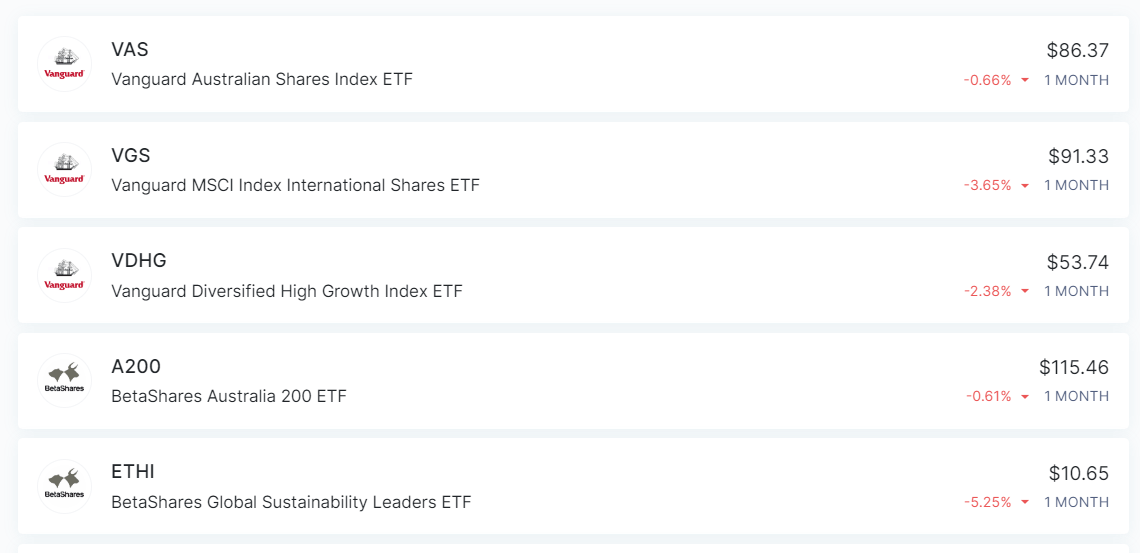

- Pearler takes note of removal of BNPL play Zip Co and said a BetaShares ETF tracking the S&P/ASX200 is fourth most traded on site

- ETF Securities said the rebalancing is a regular anticipated event by investors and the markets with elevation a positive for companies

It’s September ASX rebalancing time and companies have found themselves promoted up the ranks into the important S&P/ASX 200 index and S&P/ASX 300, while some have found themselves relegated from the indices. You can see the full list here, and we’ve taken a deep dive into the ASX 200 and 300 entrants here, and their performance since making the grade..

So what do the financial experts have to say about the latest rebalancing and what will it mean for various companies?

Players of ASX indices rebalance

Vanguard Australia chief investment officer Duncan Burns said a complex ecosystem of market participants emerges around ASX indices rebalance events with the two main players:

1. Index funds – designed to track an index as specified by an index provider

“While their primary mandate may be to track an index, they may also try to add or save value for shareholders when opportunity exists and risk is within acceptable levels,” Burns said.

2 Liquidity providers

“Other investors that attempt to profit by trading in advance of index funds so that they can take the contra side of a trade when index fund demand/supply hits the market,” Burns said.

“To some speculators, trading around scheduled rebalances, with the expectation that stocks that will be added to the index could have positive excess returns, and vice versa for stocks deleted from an index, may sound like an easy way of making a profit.”

However he said given the complex and noisy nature of this trading ecosystem, with players on all sides entering and exiting the market and responding to evolving incentives, the profitability of this trade after costs is questionable.

“We would classify this as speculation, akin to market timing and caution everyday investors against engaging in this behaviour without understanding the risks involved,” he said.

“Rather than chase after that potential lucky needle in a haystack trade, we would urge investors to consider buying the whole haystack (i.e. a broadly diversified index fund) and invest for the long-term.”

He said ultimately, buying a broadly diversified fund can probably help you achieve your investment goals with less risk than ASX indices rebalance trading.

Zip Co removed from ASX 200

While in our story on the rebalancing we noted the promotions more than relegations, CEO of investing app Pearler Nick Nicolaides was quick to note the removal of BNPL player Zip Co (ASX:ZIP).

“Pearler started as a simple app to improve financial literacy and help everyday people avoid common pitfalls of share trading,” Nicolaides told Stockhead.

“If spending less than what you earn and then invest into low-cost ETF is the cornerstone of our community, then BNPL is the antithesis.

“There will be plenty of Pearler investors happily waving ZIP goodbye from their ASX 200 holdings.”

He also noted also that on Pearler BetaShares Australia ASX 200 ETF (ASX:A200) remains the fourth most invested asset across the past 18 months, showing the appeal of the index.

Much anticipated event

ETF Securities head of distribution Kanish Chugh told Stockhead the ASX indices rebalance is a regular anticipated event by investors and the markets and its effect is mainly felt on individual stock prices with additions generally being a positive price influence and removal negative.

“Having said that many movements are priced in before they actually occur, as is the way with markets,” Chugh said.

“For investors in our ETF Securities Australian equities-based ETFs such as ETFS S&P/ASX 300 High Yield Plus ETF (ASX:ZYAU) which invests in 40 stocks drawn from the ASX 300, the focus is on long term hold to grow income, so the rebalancing is not an event to cause any change in their holding.

“This fund is next scheduled for rebalancing in October.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.