ASX Lunch Wrap: S32 tumbles amid Mozambique unrest; Chemist Warehouse could be listed by February

South32 drops amid unrest in Mozambique. Picture via Getty Images

- ASX edges lower as profit-taking continues

- South32 drops amid unrest in Mozambique

- Chemist Warehouse to list on ASX after merger with Sigma

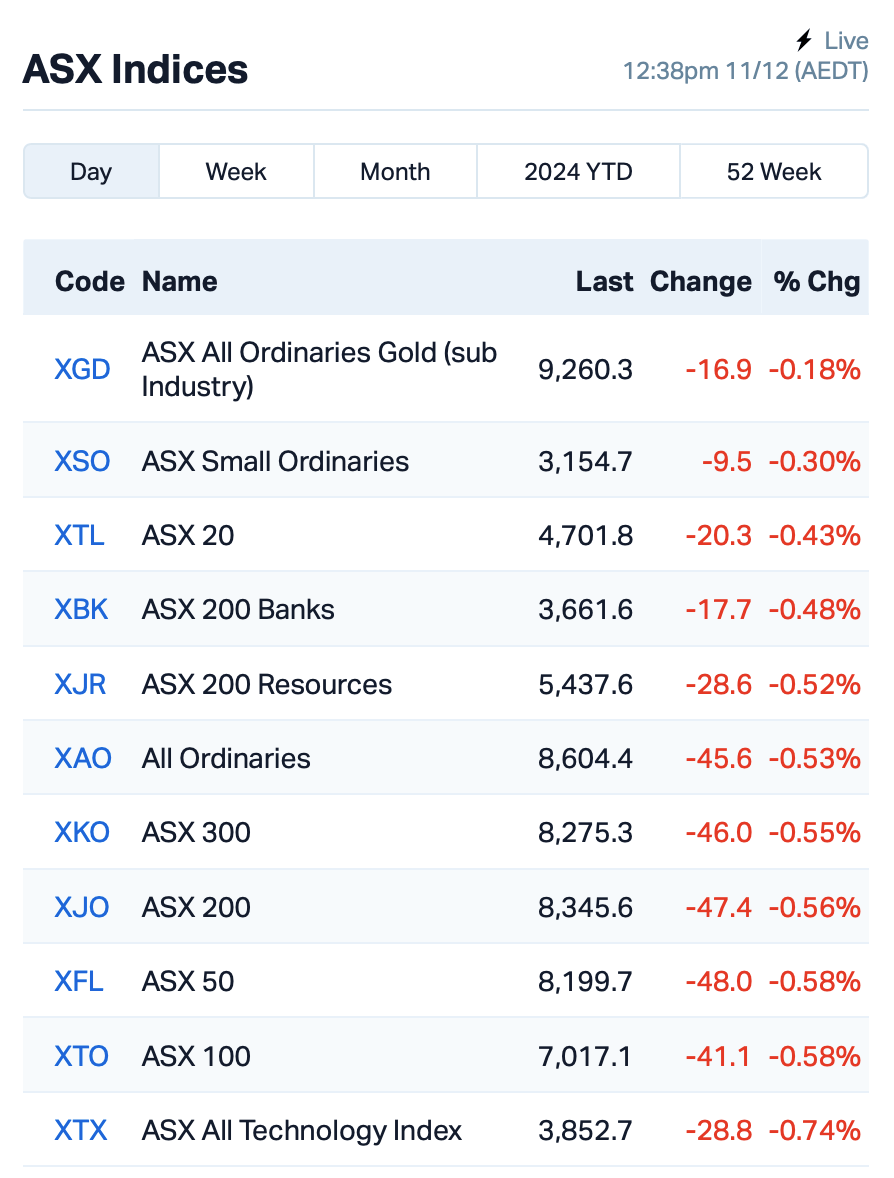

The ASX edged lower by around 0.5% at lunch on Wednesday, following a weak session on Wall Street.

Investors continue to take profits ahead of key US inflation data expected on Thursday (US time).

The Aussie dollar also lost nearly 1% against the US dollar this morning as traders speculate that an interest rate cut from the RBA could be nearer than thought after yesterday’s dovish comments from the central bank.

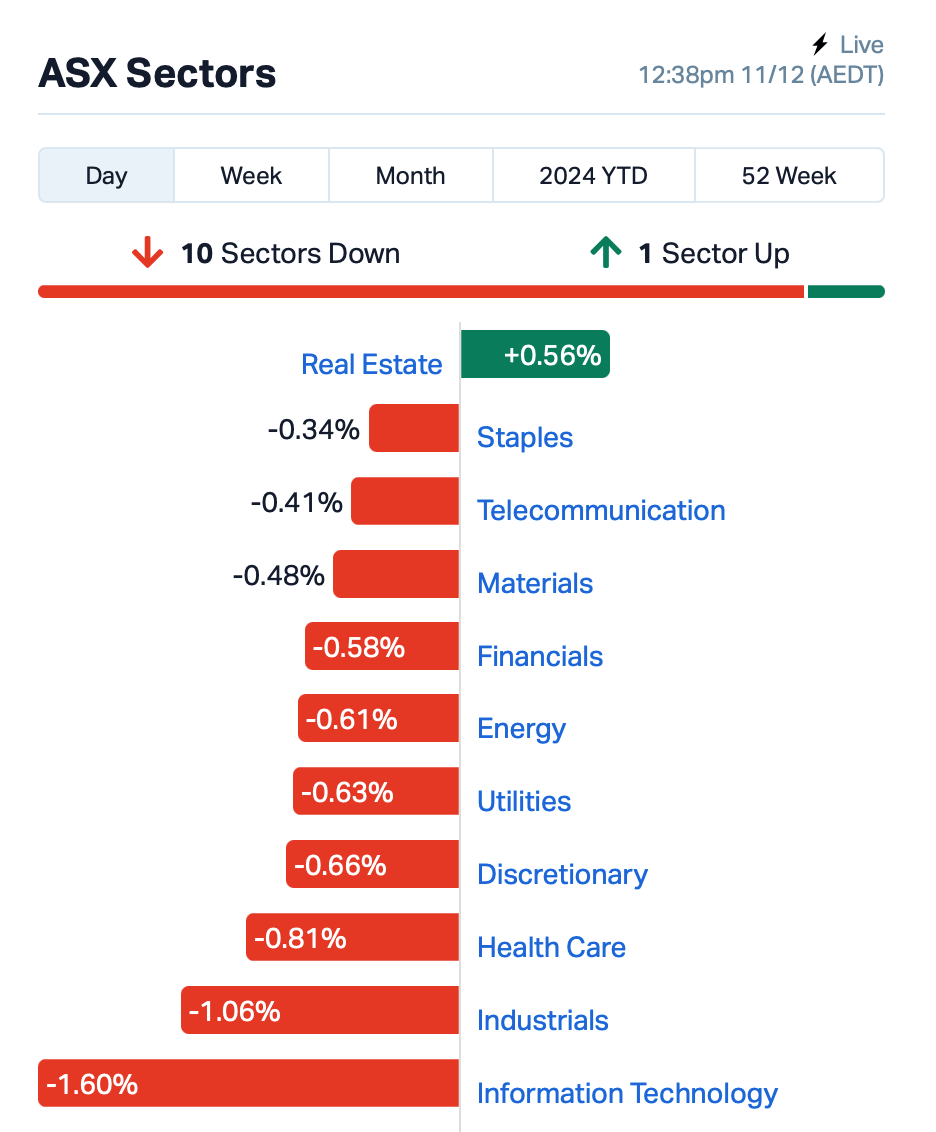

On the ASX today, the Info Tech sector dragged the bourse lower. Here’s where we stood at 12.40pm AEDT:

In the large end of town, mining company South32 (ASX:S32) fell 5% after it withdrew its production forecast for its Mozal aluminium smelter in Mozambique.

Widespread protests and violence over disputed elections in the country have disrupted transport to the plant. Though the company says its workforce is safe, the unrest has caused uncertainty over its production targets.

And in the healthcare space, Chemist Warehouse could list on the ASX by as early as February 2025 after a $28.9 billion merger with Sigma Healthcare (ASX:SIG), pending shareholder voting on certain resolutions. SIG’s shares rose 0.35%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 11 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NXD | Nexted Group Limited | 0.175 | 52% | 1,329,647 | $25,474,429 |

| 1TT | Thrive Tribe Tech | 0.002 | 50% | 275,092 | $703,362 |

| GGE | Grand Gulf Energy | 0.003 | 50% | 100,000 | $4,900,774 |

| AXL | Axel Ree Limited | 0.103 | 46% | 14,051,381 | $6,363,131 |

| GCR | Golden Cross | 0.004 | 33% | 2,484 | $3,291,768 |

| JAV | Javelin Minerals Ltd | 0.004 | 33% | 480,224 | $16,559,796 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | 506,000 | $9,863,776 |

| YAR | Yari Minerals Ltd | 0.004 | 33% | 2,621 | $1,447,073 |

| AAU | Antilles Gold Ltd | 0.005 | 25% | 4,270,264 | $7,431,504 |

| NES | Nelson Resources. | 0.003 | 25% | 872,900 | $4,343,855 |

| TFL | Tasfoods Ltd | 0.017 | 21% | 104,746 | $6,119,337 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 850,000 | $12,497,745 |

| IBG | Ironbark Zinc Ltd | 0.003 | 20% | 1,055,175 | $4,584,120 |

| JRV | Jervois Global Ltd | 0.012 | 20% | 5,780,942 | $27,027,638 |

| TEM | Tempest Minerals | 0.006 | 20% | 100,000 | $3,136,349 |

| DYM | Dynamicmetalslimited | 0.235 | 18% | 27,499 | $7,200,000 |

| AVD | Avada Group Limited | 0.440 | 17% | 37,976 | $31,850,634 |

| APC | Aust Potash Ltd | 0.021 | 17% | 450,661 | $1,831,601 |

| ADN | Andromeda Metals Ltd | 0.007 | 17% | 705,815 | $20,572,366 |

| GCM | Green Critical Min | 0.007 | 17% | 940,001 | $11,445,320 |

| SLZ | Sultan Resources Ltd | 0.007 | 17% | 33,000 | $1,388,819 |

NextEd Group (ASX:NXD) has secured exclusive rights to re-enrol around 1,800 students from International House (IH) after IH entered administration. This includes both English language and vocational students across Sydney, Melbourne, Adelaide and the Gold Coast.

NextEd will also acquire relevant course materials, but will not be acquiring IH’s business or employees. The move is expected to give NextEd an additional $6-7 million in revenue for the second half of FY25.

Axel REE (ASX:AXL) has announced record high assay results from its Caladão Project in Brazil, including grades of 28,321ppm TREO and 7,606ppm MREO.

The results, from a 2,600m drilling program, show strong near-surface mineralisation with impressive lateral continuity across a 30km² area, which represents just 10% of the total target area. The company believes these high grades highlight the scalability of the deposit.

Dynamic Metals (ASX:DYM) has defined strong drill targets at the Cognac West gold prospect in WA, based on recent soil sampling and rock chip assays, including results of up to 2,040g/t gold.

The company has refined high-grade zones with 755 infill soil samples, which will guide drilling in early 2025. Dynamic said it’s well-funded with $5.3 million in cash as of September 30.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 11 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VML | Vital Metals Limited | 0.002 | -33% | 1,049,000 | $17,685,201 |

| BUY | Bounty Oil & Gas NL | 0.003 | -25% | 4,000,000 | $5,994,004 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 100,000 | $8,216,419 |

| ENT | Enterprise Metals | 0.003 | -25% | 3,018 | $4,713,269 |

| OLH | Oldfields Holdings | 0.060 | -20% | 95,000 | $15,904,435 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 236,357 | $15,392,639 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 356,043 | $11,058,736 |

| AOK | Australian Oil. | 0.003 | -17% | 610,000 | $3,005,349 |

| AUK | Aumake Limited | 0.005 | -17% | 5,000 | $18,064,153 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 1,487,805 | $9,597,195 |

| INF | Infinity Lithium | 0.028 | -15% | 490,376 | $15,265,539 |

| ACR | Acrux Limited | 0.034 | -15% | 2,469,941 | $11,628,674 |

| AHK | Ark Mines Limited | 0.170 | -15% | 121,312 | $11,089,283 |

| CCO | The Calmer Co Int | 0.006 | -14% | 7,841,220 | $15,465,705 |

| CHM | Chimeric Therapeutic | 0.006 | -14% | 1,258,269 | $10,851,049 |

| PLC | Premier1 Lithium Ltd | 0.006 | -14% | 4,000,000 | $1,405,321 |

| ESR | Estrella Res Ltd | 0.020 | -13% | 5,275,592 | $43,723,886 |

| AX8 | Accelerate Resources | 0.007 | -13% | 500 | $4,974,031 |

| HLX | Helix Resources | 0.004 | -13% | 2,000,000 | $13,056,775 |

| M2R | Miramar | 0.004 | -13% | 388,118 | $1,587,293 |

| LOM | Lucapa Diamond Ltd | 0.021 | -13% | 1,756,824 | $6,962,928 |

| SBW | Shekel Brainweigh | 0.021 | -13% | 6,900 | $5,473,470 |

| GDM | Greatdivideminingltd | 0.220 | -12% | 151,743 | $7,027,083 |

IN CASE YOU MISSED IT

Island Pharmaceuticals (ASX:ILA) has secured a key US patent for its lead drug candidate, ISLA-101, designed to reduce symptoms of dengue virus.

“Method of viral inhibition” was granted by the United States Patent and Trademark Office, and covers the use of ISLA-101 to limit the severity of symptoms through its administration.

It adds to a growing IP portfolio for Island, which includes Australia, Canada, Brazil and Singapore.

ADX Energy (ASX:ADX) is monitoring well pressure, sampling, and analysing fluid data at the Welchau-1 discovery in Upper Austria to determine the next steps.

Results are expected early in the new year and will guide decisions on further stimulation and testing operations.

At Stockhead, we tell it like it is. While Island Pharmaceuticals and ADX Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.