You might be interested in

News

ASX Large Caps: Another win day for ASX, but BHP down after revealing impairments worth billions

News

ASX Large Caps: Bapcor on a high, BHP says it never got court memo, GOR plunges 17pc on poor update

News

News

After opening lower, the ASX200 index finished Thursday up by +0.3%.

Earlier today, the House voted 314-117 and advanced the bill to the Senate. The outcome is billed as a rare moment of bipartisan accord in a bitterly divided House.

Josh Gilbert, analyst at eToro, is optimistic the deal could boost markets.

“The prospect of a debt-ceiling deal and a pause from the Federal Reserve at its June 15th meeting could help boost US markets in the short term,” he said.

On the ASX, gains in Healthcare and Tech stocks were offset by losses in Energy stocks.

Oil stocks came under pressure again after crude prices fell another -2.5% overnight. Mining stocks were also mostly down today following weaker China data.

“China’s May PMI survey has sparked the latest warning of mounting economic trouble in the region,” said Gilbert.

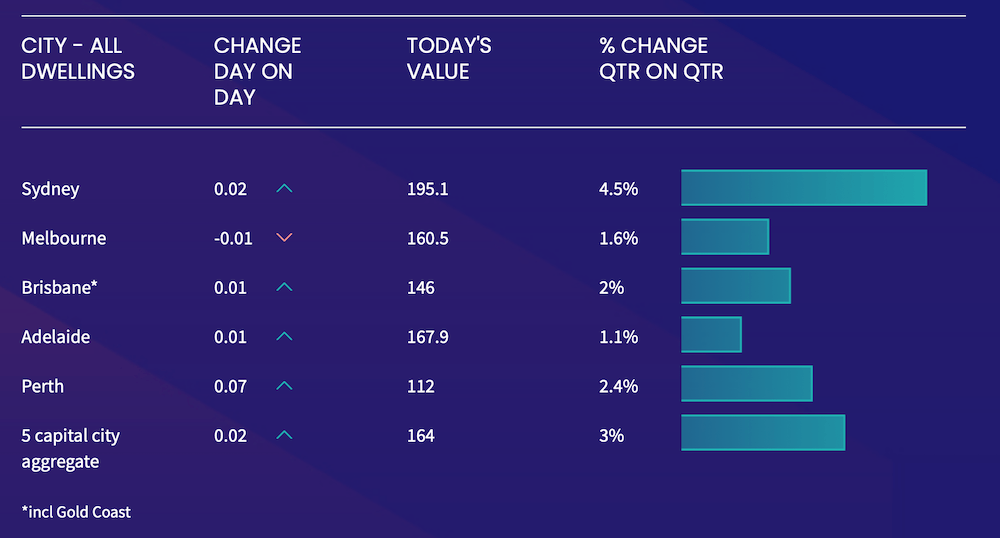

The rebound in Australian housing prices is accelerating, with data released today showing national home prices increase by 0.33% in May.

According to the report from CoreLogic, Sydney continues to lead the recovery trend, posting a 1.8% lift in values over the month, recording the city’s highest monthly gain since September 2021.

Brisbane (+1.4%) and Perth (+1.3%) are the only other capitals to record a monthly gain of more than 1.0%, however, the rise in values was broad-based with the rate of growth accelerating across every capital city last month.

CoreLogic’s Research Director, Tim Lawless, noted the positive trend is a symptom of persistently low levels of available housing supply running up against rising housing demand.

“Amid increased competition, auction clearance rates have trended higher, holding at 70% or above over the past three weeks. For private treaty sales, homes are selling faster and with less vendor discounting,” he said.

Despite the recent gains, most housing markets are still recording housing values that are well below recent peaks.

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PDN | Paladin Energy Ltd | 0.60 | 10.55 | 32,713,453 | $1,624,179,814 |

| DEG | De Grey Mining | 1.40 | 4.66 | 3,565,901 | $2,091,963,666 |

| PRU | Perseus Mining Ltd | 1.91 | 4.38 | 4,412,023 | $2,496,576,001 |

| GOR | Gold Road Res Ltd | 1.84 | 4.26 | 2,153,493 | $1,898,021,648 |

| RMS | Ramelius Resources | 1.42 | 4.23 | 1,797,379 | $1,338,430,109 |

| PME | Pro Medicus Limited | 61.76 | 4.06 | 99,310 | $6,198,054,216 |

| MP1 | Megaport Limited | 7.09 | 3.89 | 1,120,516 | $1,080,448,952 |

| EMR | Emerald Res NL | 1.96 | 3.71 | 404,711 | $1,119,382,685 |

| NST | Northern Star | 13.31 | 3.10 | 3,136,201 | $14,849,142,212 |

| JLG | Johns Lyng Group | 6.55 | 3.07 | 413,833 | $1,665,591,005 |

| NHC | New Hope | 4.75 | 3.04 | 3,111,153 | $4,067,262,289 |

| NAN | Nanosonics Limited | 5.17 | 2.99 | 534,843 | $1,517,597,716 |

| BGL | Bellevue Gold Ltd | 1.32 | 2.92 | 2,245,937 | $1,452,101,052 |

| NCM | Newcrest Mining | 26.43 | 2.86 | 3,039,757 | $22,972,787,505 |

| ALU | Altium Limited | 39.81 | 2.82 | 206,782 | $5,097,375,673 |

Paladin Energy (ASX:PDN) regained some of its 20pc loss on Tuesday, up by 10.5% today. Paladin had fallen on news that Namibia was considering taking minority stakes in mining and petroleum production companies, which turned out to be incorrect.

We are pleased to have worked alongside our industry colleagues and the Namibian Uranium Association to have achieved clarification on this issue.

To be absolutely clear: existing licence holders, including $BMN, have nothing to be concerned about.https://t.co/3W0ArPY4KS— Brandon Munro (@brandon_munro) June 1, 2023

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CIA | Champion Iron Ltd | 5.65 | -5.83 | 5,108,022 | $3,103,158,756 |

| SMR | Stanmore Resources | 2.47 | -5.00 | 1,692,295 | $2,343,618,248 |

| IEL | Idp Education Ltd | 20.80 | -4.67 | 2,246,901 | $6,073,296,124 |

| AWC | Alumina Limited | 1.38 | -4.66 | 5,474,139 | $4,207,438,055 |

| AKE | Allkem Limited | 14.20 | -4.38 | 2,132,924 | $9,469,222,577 |

| MIN | Mineral Resources. | 68.10 | -3.80 | 1,110,802 | $13,721,697,869 |

| IGO | IGO Limited | 13.78 | -3.37 | 1,477,711 | $10,798,639,013 |

| YAL | Yancoal Aust Ltd | 4.41 | -3.29 | 2,770,110 | $6,021,203,833 |

| DRR | Deterra | 4.35 | -3.23 | 1,083,256 | $2,373,145,080 |

| MAD | Mader Group Limited | 5.49 | -3.17 | 192,644 | $1,134,000,000 |

| NIC | Nickel Industries | 0.87 | -3.07 | 5,052,625 | $2,706,710,259 |

BHP (ASX:BHP) was down -0.10% today after admitting it underpaid a large number of its current and former employees in Australia.

Based on currently available information, BHP estimated that the cost of remediating the leave issue and the contracting issue will be up to US$280 million pre tax, incorporating on costs including associated superannuation and interest payments.

BHP is continuing to investigate and an update will be provided in its full year results in August.

BHP has admitted to underpaying 28,500 Australian workers by $430 million since 2010, with the company copping to one of the biggest underpayment scandals in Australian corporate history on Thursday. By @crankynick @australian https://t.co/TBaUPNACLF

— Ewin Hannan (@EwinHannan) May 31, 2023