ASX Large Caps: ASX falls 1.28pc to hit 100-day low, RBA keeps rates on hold for now

News

News

Local markets have closed at a 100-day low as the RBA kept rates on hold at an 11-month high of 4.1% at Michele Bullock’s first meeting as governor.

While temporarily regaining some ground following the announcement of the continued rate pause the S&P ASX 200 then went on a slippery downward spiral to close 1.28% lower.

Bullock said higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so.

“In light of this and the uncertainty surrounding the economic outlook, the board again decided to hold interest rates steady this month,” Bullock said in a statement.

However, Bullock maintained the hawkish tone of predecessor Philip Lowe, saying the decision to retain the cash rate as is simply gives the central bank time to maintain key economic indicators.

“Timely indicators on inflation suggest that goods price inflation has eased further, but the prices of many services are continuing to rise briskly and fuel prices have risen noticeably of late,” she said.

“Rent inflation also remains elevated.”

The central bank forecast is for CPI inflation to be back within the 2–3% target range in late 2025.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks,” Bullock said.

“In making its decisions, the board will continue to pay close attention to developments in the global economy, trends in household spending, and the outlook for inflation and the labour market.”

So while the RBA is taking a hawkish stand, the ASX has also taken a battering from what’s been happening on the US 10-year bond scene with yields climbing fast, to a 16-year high of 4.7% which in turn is tough on stocks and other securities.

As Stockhead’s Gregor Stronach explained, yields are rising because of the hawkish stance of the US Fed, which continues to raise interest rates (or at least threaten to). The higher yields go, the more attractive bonds become for investors, so they start selling shares, which in turns sends share prices lower.

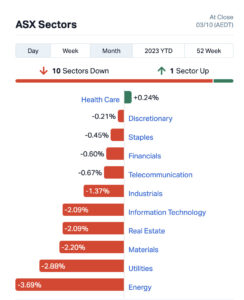

Healthcare was the only sector in the green today, up 0.24% on close with the remaining all in the red with energy leading the laggards down 3.69%

Asian stocks were mostly down today with Japanese stocks falling after gains yesterday and US rising treasury yields playing on markets.

The Hang Seng fell in its first day of trade as traders returned from a long weekend, giving up gains from Friday with debt-ridden developer Evergrande also remaining a focus.

Shares in Evergrande were up today following last week’s suspension, at one point rising as high as 60% before dropping to 10% and then rising again. At 4.25pm (AEDT) Evergrande shares were up ~22%.

Mainland China has been shut since Friday for the Golden Week holiday, which continues until the end of this week.

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LFG | Liberty Financial Group | 3.86 | 10% | 36,277 | $1,063,313,556 |

| MEZ | Meridian Energy | 4.86 | 3% | 41,517 | $5,964,624,220 |

| MAD | Mader Group Limited | 6.86 | 3% | 172,391 | $1,332,000,000 |

| NEU | Neuren Pharmaceuticals | 11.46 | 3% | 518,331 | $1,415,004,258 |

| TAH | TABCORP Holdings Ltd | 0.95 | 2% | 3,748,413 | $2,134,054,275 |

| FBU | Fletcher Building | 4.44 | 2% | 418,433 | $3,421,900,515 |

| SNZ | Summerset Group Holdings | 9.3 | 2% | 219 | $2,146,017,459 |

| RDX | Redox Limited | 2.21 | 1% | 151,975 | $1,144,677,513 |

| LNW | Light & Wonder Inc. | 111.76 | 1% | 2,323 | $1,359,606,250 |

| GNC | GrainCorp Limited | 6.85 | 1% | 900,950 | $1,521,004,840 |

| MGF | Magellan Global Fund | 1.66 | 1% | 3,357,295 | $2,366,746,336 |

| DDR | Dicker Data Limited | 9.655 | 1% | 165,701 | $1,724,928,697 |

| CEN | Contact Energy Ltd | 7.56 | 1% | 20 | $1,903,604,243 |

| MFF | MFF Capital Investments | 2.98 | 1% | 288,829 | $1,711,549,093 |

| CDA | Codan Limited | 7.82 | 1% | 212,689 | $1,408,826,198 |

| CSL | CSL Limited | 247.89 | 1% | 706,760 | $119,007,853,243 |

| AFI | Australian Foundation | 6.88 | 1% | 308,737 | $8,526,398,204 |

| AD8 | Audinate Group Ltd | 13.31 | 1% | 83,464 | $1,079,985,701 |

| HVN | Harvey Norman | 3.85 | 1% | 1,836,255 | $4,772,205,485 |

Australia’s biggest healthcare stock blood products giant CSL (ASX:CSL) helped push the sector up today as broker Morgan Stanley put an overweight rating on the healthcare stock and a $334 price target.

The broker reckons CSL shares could have 33% upside potential from current levels if it can deliver on EPS delivery in patient blood management programs (PGM).

Continuing a solid day for healthcare, Neuren Pharmaceuticals (ASX:NEU) also went higher on no news.

Building products company Fletcher Building (ASX:FBU) was also up today after announcing it has been assigned an investment grade credit rating from Moody’s Investors Service of Baa2 with stable outlook.

“Obtaining an investment grade credit rating is an important step in respect of our long-term funding strategy which will allow us to further diversify our funding sources,” FBU CFO Bevan McKenzie said.

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SYA | Sayona Mining Ltd | 0.0955 | -9% | 78,024,032 | $1,080,796,081 |

| EVN | Evolution Mining Ltd | 3.09 | -6% | 5,979,870 | $6,025,963,087 |

| PDN | Paladin Energy Ltd | 1.04 | -5% | 24,143,858 | $3,279,241,842 |

| BPT | Beach Energy Limited | 1.5425 | -5% | 6,168,438 | $3,718,573,859 |

| ARB | ARB Corporation. | 29.3 | -5% | 128,961 | $2,536,047,346 |

| PRU | Perseus Mining Ltd | 1.57 | -5% | 3,775,698 | $2,272,357,833 |

| MIN | Mineral Resources | 64.07 | -5% | 1,016,271 | $13,177,512,133 |

| ILU | Iluka Resources | 7.4 | -5% | 2,051,509 | $3,314,531,310 |

| BOE | Boss Energy Ltd | 4.62 | -5% | 1,665,510 | $1,708,198,450 |

| AKE | Allkem Limited | 11.18 | -5% | 1,944,271 | $7,486,452,341 |

| WOR | Worley Limited | 16.71 | -5% | 742,191 | $9,189,088,335 |

| DYL | Deep Yellow Limited | 1.275 | -4% | 4,071,547 | $1,012,447,891 |

| NST | Northern Star | 10.03 | -4% | 3,954,565 | $12,081,381,925 |

| IRE | IRESS Limited | 5.52 | -4% | 685,307 | $1,077,775,265 |

| AGL | AGL Energy Limited. | 10.23 | -4% | 1,564,758 | $7,191,667,921 |

| CRN | Coronado Global Res | 1.78 | -4% | 3,612,209 | $3,118,203,938 |

And Boss Energy (ASX:BOE) is on the losers list today as the energy sector took a dive, despite announcing under a mineral rights sharing arrangement the company and Coda Minerals (ASX:COD) has been granted four tenements considered highly prospective for uranium and copper mineralisation.

The tenements form the Kinloch Project, which is situated in the northern Murray Basin just ~130km south of the Honeymoon Uranium Mine and cover an area of ~3,184 km2.