A2M and SM1: Milking a China nod for all it’s worth

News

The a2 Milk Company jumped out of the blocks on Monday, gaining about 3% in early trade thanks to its Kiwi manufacturing partner Synlait Milk (ASK:SM1) getting the nod-of-renewal from China’s State Administration for Market Renewal (SAMR).

That’s calmed down a lot – A2M has already backtracked some, while SM1 is almost flat – and TBH that’s probably for the best.

A2 Milk controls a circa 20% stake of Synlait, and SM1 is a very central cog in the former market darling’s milk-making machinery.

Synlait makes A2 Milk’s (ASX:A2M) very, very important China-label infant milk formula (IMF) and this official Chinese approval is tantamount for the survival of both businesses, which still depend heavily on the riches of the Middle Kingdom’s shark-infested regulatory markets.

The latest SAMR stamp of ok-for-now means SM1 can keep on keeping on making the A2M IMF for Chinese families until exactly February 21 next year.

For now anyway, A2M looks on the mend and a far cry from some of the brutal lessons it learned to great cost at the whimsical hands of SAMR and China’s arbitrary system of central governance.

A sadder and a wiser A2M finally delivered some very welcome growth at its FY22 earnings a few weeks ago, taking the opportunity to call a NZ$150 million share buyback.

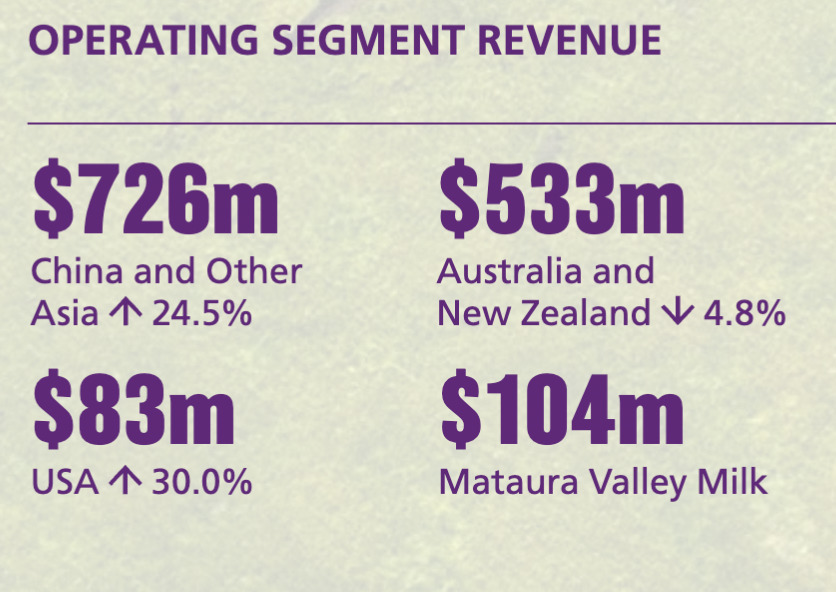

Markets cheered and grown men cried when the former market darling proclaimed a ‘refreshed growth strategy and improved execution’ led to gains in both revenue and profits, boosted largely by resurgent sales in its ultra-critical China market.

After hitting a low around $4 at the bottom of the market in June, A2M shares have regained about a full-third of their value and jumped about 10% on the 31st of last month when it dropped the results.

A2M is trying hard to diversify but the competition is getting stiffer, the disastrously low birth rate in China is scary and that kindergarten failure to secure the right regulatory approval for a giant US market still screaming for baby formula are decent headwinds. When you add the full-weight of inflationary pressures, supply dramas and the higher costs of doing bidness, it’s fair to say the dairy group which took the opportunity to declare an on-market share buy-back was sweating bullets on the Synlait approvals.

Then boss Jayne Hrdlicka has downplayed worries that new Chinese regulations will hurt its position in the biggest formula market in the world, which is seeking to support local players as it looks to become more self-sufficient.

It’s June 3 2019 and Beijing decides to create a bigger hole for local producers to snap up infant formula market share. The tool is legislating sales via e-commerce platforms used by Daigou shoppers but it just comes down to whacking A2M with a stick until it moves over.

Although the news lopped about a billion dollars off A2M’s market cap in just 48 hours, then boss Jayne Hrdlicka brushed aside fears of what the new Chinese regulations might do to A2M’s position.

A few months later, as markets came to realise what the Chinese regulatory intervention actually did to A2M’s position, Hrdlicka herself was brushed aside and by then the stock had fallen all in a puddle.

Today Chinese consumers are no longer loving the security and classiness of Aussie and or foreign brands. They’re looking to local names like Feihe, Mengniu in Mongolia and Yili.

Beijing, always willing to get involved in a bit of universal family planning, has been pushing hard for more breastfeeding.

So yesterday’s renewal is a re-start down an ever-ongoing and super-slippery path. It’s really more of a muddy goat track at night than an actual path.

And what’s been greenlit here is not the whole milkshake, if I may. SAMR’s latest generosity will allow Synlait to make A2 Milk’s current registered product in China – as mentioned till a little bit into 2023.

Then the process starts all over again and the dairy group will have to re-register the formula under new, updated… even tweaked food GB (Guobiao/国标/national) safety standards.

The Guobiao standards or GB standards are issued by the Standardisation Administration of China (SAC) and the Chinese National Committee for ISO and IEC.

Basically they target foreign products and make sure that they either comply – or in some cases do not comply – with everything from security, marketing, labelling, safety, usage, and so on.

Yesterday morning, A2 Milk’s current CEO and MD, David Bortolussi, spoke thus:

“We are pleased that our current product registration has been renewed, effectively to late February 2023, and we will continue to work collaboratively with Synlait and SAMR in relation to the registration of our China-label IMF product formulated in line with China’s new GB standards.”

The A2M CEO is no mug of hot cocoa either though.

Here is a man who worked his way up at McDonalds until they literally had to make him CFO, before giving up a decade of his life to serve the home of everything dairy, the NZ-based cooperative multi-national terror that is Fonterra.

When, back in October ’21, Bortolussi decided it was time for A2M to ‘fess-up about some of those headwinds (China’s birth rate, the GB registration and even crapper bilateral relations, not to mention the real impact of COVID-19), the market turned its back on the company, shedding 12% that day and establishing A2M’s sour and curdling image as a once great market darling, now one trick pony without a pony.

But Bortolussi has helped A2M face some tough music and it’s come out roughed up, but dammit, the company looks cleaner and leaner than it has for years.

During FY22, the A2M Board and the CEO’s team did a 360/holistic review of the market, branding, product and distribution outlook and came up with Bortolussi’s “refreshed growth strategy”:

This refreshed growth strategy was in response to the rapidly changing infant milk formula (IMF) market dynamics in China. There is strong evidence at many levels in the FY22 result that the plans developed from that strategy are already gaining significant traction and that the significant investments we made in restructuring our business, especially on the supply-side, have definitely shown their worth.

While infant formula is A2M’s main earnings game, the CEO has made certain the dairy group’s market share at home ensures a healthy balance sheet as well as a healthy family (I could be in marketing). And he’s done this during a share price collapse and the popular persuasion that China spells trouble.

And yet, China’s IFM market is by far still the biggest and best. Who could resist annual retail sales in the $50 billion zone anyway?

“We remain focused on the China market and are looking forward to the opportunity to make our newly formulated infant milk product available to parents and infants in China,” he added.

Also this morning, A2M felt it pertinent to tell the exchange(s) that the New Zealand Ministry for Primary Industries has cooperation agreements already in place with Chinese regulators “which positioned New Zealand well in relation to China’s registration processes.”

Reassuring.

But if there was a laurel nearby I might not just sit on it like that.