You might be interested in

IPO Watch

IPO Wrap: ASX IPO pipeline looks good for the second half of 2023, says ASX GM of Listings

IPO Watch

IPO Wrap: Fresh listees this year are flat at best, so what does Q2 have in store?

IPO Watch

It’s slim pickings for IPOs so far this year, with January’s last listee High-Tech Metals (ASX:HTM) which listed on the 23rd after IPOing at $5.5 million at $0.20 per share.

The company spiked at $0.215 on the 24th and is currently trading back down at $0.20.

HTM is acquiring the Werner Lake Cobalt Project in northwestern Ontario, within the Kenora Mining District.

Initial plans include reviewing the existing exploration and geological data, drill targets not previously drilled and establish new drill targets at the project.

New drill targets will then be established using electromagnetic techniques to consider targets outside of the existing orebody, after which an RC and/or diamond drilling program will be conducted.

SOUTH-EAST QUEENSLAND EXPLORATION (ASX:SQX)

Listing: 15 February

IPO: $5m at $0.20

SQX’s current focus is on copper and gold mineralisation at its Ollenburgs and Scrub Paddock Prospects, in the underexplored Esk Basin in southeast Queensland and situated near major regional infrastructure and population centres.

Scrub Paddock has been identified as a potential gold-copper porphyry, and features more than 20 mine workings and an area of comparable scale to Cadia/Ridgeway.

The company intends to drill high priority targets immediately upon listing, with the aim of defining an economic mineral resource.

TIGER TASMAN MINERALS (ASX:T1G)

Listing: 24 February

IPO: $8m at $0.20

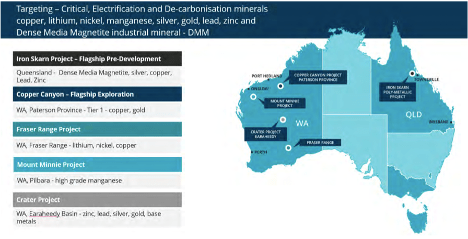

Tiger Tasman Minerals has projects in WA and QLD focused on copper, lithium, nickel, manganese, silver, gold, base metals and industrial minerals (DMM) essential to the global clean energy transition, decarbonisation and a more sustainable future.

The projects are in proven and prospective jurisdictions including Paterson Province, Fraser Range, Earaheedy Basin, Ashburton and the Townsville region.

They are the Iron Skarn silver-copper-lead-zinc project (QLD), the Copper Canyon copper-gold project (WA), the Fraser Range lithium-nickel-copper project (WA), the Mt Minnie manganese project (WA), and the Crater copper-zinc-lead-silver-gold project (WA).

Listing: 9 March

IPO: $25m at $0.20

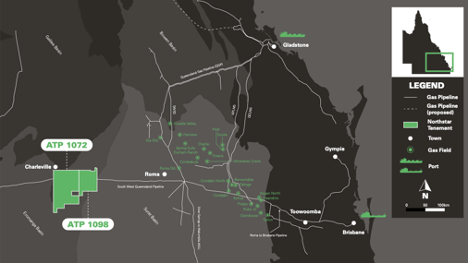

The gas company is focussed on the exploration and delineation of hydrocarbon resources at its flagship project, Project Cosmos, in southwest Queensland which is in the under-explored region of the Surat, Eromanga and Adavale basins.

Following its listing on the ASX, NTH will focus on undertaking systematic exploration aimed at increasing the confidence and scale of the existing prospective resource estimated by an independent technical expert at approximately 1,150 (bcf) and 209 (bcf) within the ATP1072 and ATP1098 tenements, respectively.

The company also plans to undertake pilot production testing to further delineate the reservoir characteristics.

Listing: 10 March

IPO: $7m at $0.20

Evergreen’s flagship Bynoe lithium project is adjacent to Core Lithium (ASX:CXO) and its producing Finniss mine in the Northern Territory.

To date the company has completed an Ambient Noise Topography (ANT) Survey and commenced field mapping and stage 2 soil, rock chip and termite mound sampling at the Bynoe project and says the soil sampling has confirmed its view of strong anomalous lithium in soil anomalies along strike from Finniss.

The company has also completed a comprehensive auger program, drilling 1,731 holes at the Kenny lithium project, with results expected shortly after listing.

EG1 also holds the Fortune project – also in the NT.