IPO Watch: Panther sets exploration sights local with nickel-gold play

IPO Watch

IPO Watch

Kismet. Serendipity. Fate. Call it what you will, Panther Metals’ upcoming ASX IPO as a nickel and gold explorer is a story of twists, turns, and some outstanding mineral targets.

Were it not for a COVID-enforced extension to a stay in Australia by Dr Kerim Sener – chairman of London-listed Panther Metals PLC – the listing of a namesake local subsidiary (to be ASX:PNT), which has bucked recent broader ASX IPO deal fatigue to close its IPO early and 30% oversubscribed, may never have come to be.

When a visit to the in-laws was extended by the pandemic, Dr Sener started to explore his project options locally. Over a coffee with Auralia Mining Consulting co-founder and managing director Daniel Tuffin, the wheels were set in motion.

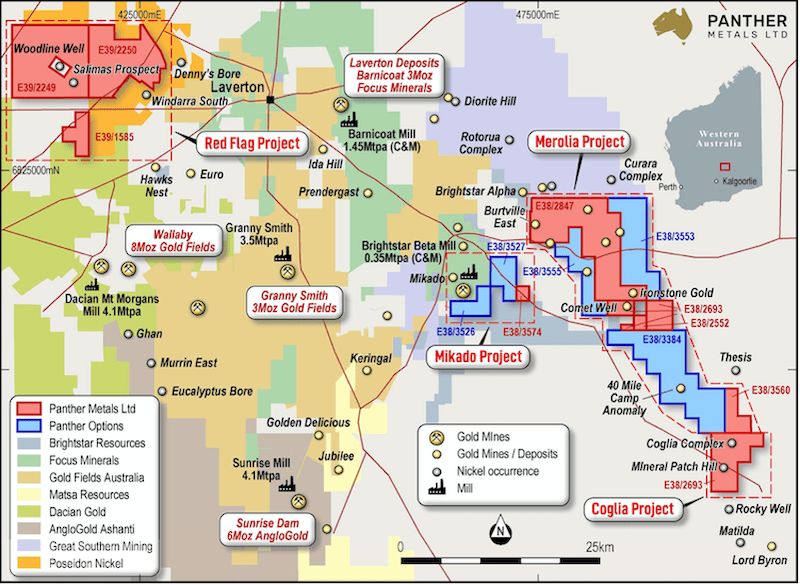

A highly prospective portfolio was assembled, initially under the umbrella of the London-listed parent company. This includes the Coglia and Red Flag nickel-cobalt projects near the Tier 1 district of Laverton, as well as the Merolia and Mikado gold projects in the same region.

In the Northern Territory, on the Pine Creek Orogen which was the topic of Dr Sener’s doctorate, Panther Metals took hold of the Annaburroo and Marrakai gold projects.

Tuffin, who will be managing director and CEO of the Australian Panther entity, told Stockhead that the parent company recognised the need to spin out its Aussie assets to give them the attention they deserved.

“The UK company decided it would actually see a lot more value from these assets by holding a cornerstone stake in a local company and taking the projects to market-leading local experts in Australia, who could develop them and take them forward,” he said.

As such, the UK Panther Metals will hold a 36.6% stake in the Australian-listed entity, with Dr Sener to apply his local knowledge and expertise as chairman.

The company’s IPO raising $5 million at 20c per share recently closed 30% oversubscribed, with Sanlam Private Wealth and Kerr Allan Financial joint lead managers.

Post-listing it is expected to have an enterprise value of $5.25 million, with no shortage of newsflow to come.

Panther Metals Ltd plans to hit its first two years hard, with a detailed plan in place for exploration work spanning its nickel and gold interests, and drills at the ready post-listing.

“With some IPOs you sometimes find you have to try to look for the hidden jewel among the projects,” Tuffin said.

“In this instance we’ve actually had to prioritise some targets as second or third, when in most other floats they would have priority potential – we’re spoiled for choice.”

Initial drilling will take place at the Coglia nickel-cobalt project, where a JORC compliant exploration target of 30-50 million tonnes at 0.6-0.8% nickel and 400-600 parts per million cobalt has already been defined.

Panther’s intention at Coglia is to investigate the potential for unexplored nickel-cobalt sulphides beneath the project’s nickel-cobalt bearing laterites, while converting the exploration target to a JORC-compliant mineral resource estimate in the first half of next year.

The project sits 70km east by road of Glencore’s Murrin Murrin nickel-cobalt project and plant.

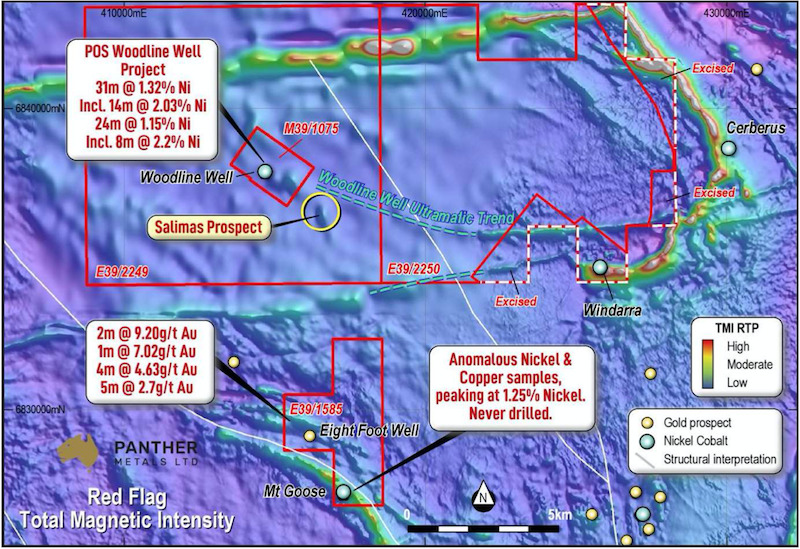

Sulphides are also on the agenda at the Red Flag nickel sulphide project sitting between the historic Windarra South mine, which produced 42,646 tonnes of nickel at 1.35%, and the aforementioned Murrin Murrin plant.

The company plans to conduct soil sampling, aeromagnetics and electromagnetic surveying at Red Flag in the first half of next year, following up leads at the Salamas target near Poseidon Nickel’s Woodline Well project, and the undrilled Mt Goose target.

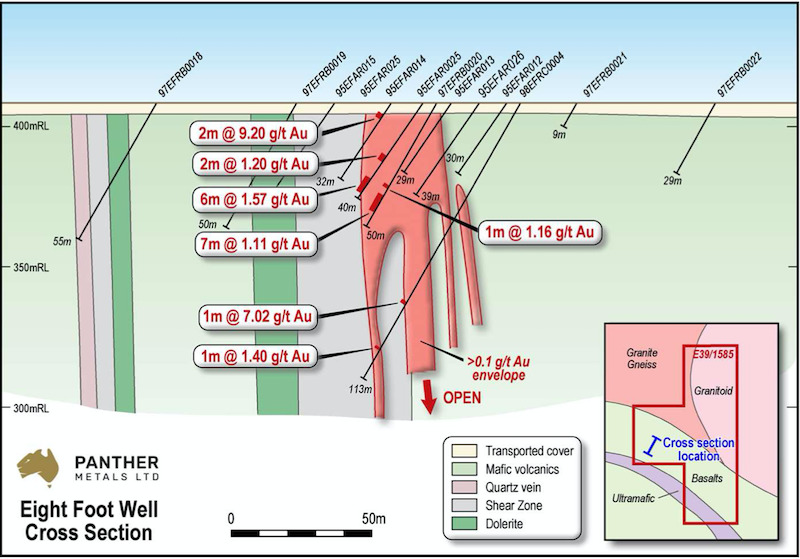

A gold target, Eight Foot Well, also occurs at Red Flag on the same mafic-ultramafic sequence which hosts Mt Goose. Best intercepts here from initial drill testing include 2m at 9.2 grams per tonne gold and 6m at 1.57g/t, both within 40m of surface.

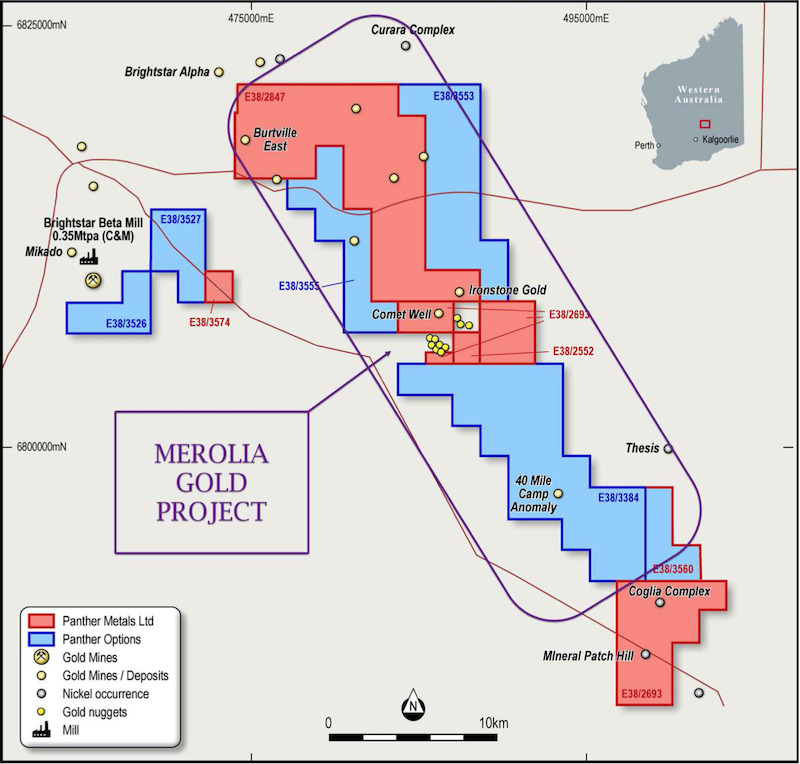

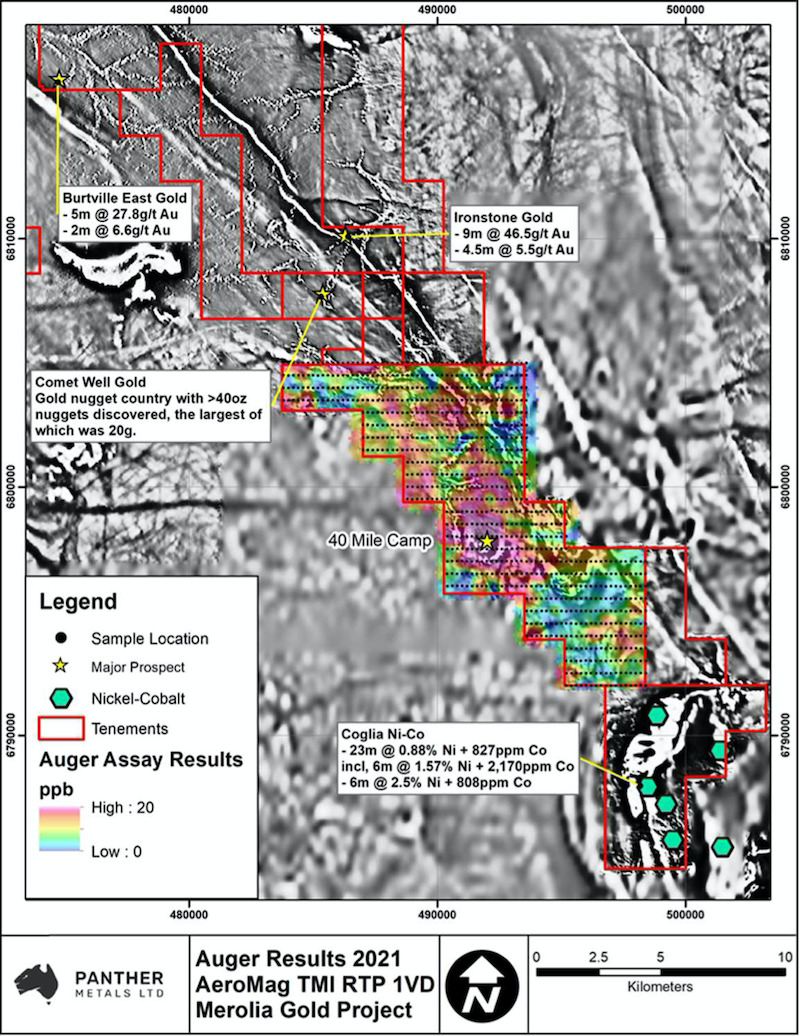

The Merolia gold project is also high on Panther’s agenda, with immediate drilling also planned at the exciting 40 Mile Camp 2.5km by 5km gold anomaly.

“That anomaly was detected during a fairly intensive auger drilling program of around 870-odd 1.5m holes gridded across the whole lease, along with some magnetics,” Tuffin said.

“When we overlapped the results of those there were a couple of gold anomalies, but the biggest that stuck out was 40 Mile Camp, which we’re really looking forward to getting in and exploring.

“That’s one we’re really excited by – at 2.5km wide by 5km long if there’s a blue sky, that’s it right there.”

The Ironstone target – where historic assays include one hit of 9m at 46.5g/t gold – will also receive early drill holes, while Burtville and Comet Well are also in line for exploration drilling in the second half of next year.

Panther’s NT gold interests – Annaburro and Marrakai – will be the subject of field mapping in H1 2022.

“We expect to have multiple newsflows across nickel and gold in WA and the NT over the next few years. There will be no shortage of work to do,” Tuffin said.

It was a twist of fate which will soon see Panther Minerals’ Australian subsidiary listed on the ASX. Will fortune run hand in-hand? Time will tell.