Wellnex: This is the summer when Australia will discover the real cannabidiol (CBD) opportunity

Health & Biotech

Health & Biotech

If you haven’t heard of Aussie-listed Wellnex Life (ASX: WNX) yet, you’re going to in the lead up to Christmas ‘22 and into the New Year.

This is a unique beast in the ASX Emerging Companies (XEC) index: a trend-identifying, insanely well-connected brand and product innovator sitting pretty inside the fast-growing health and wellness space – a huge as yet untapped market with evolving needs.

And while this Victorian-based innovator already has a portfolio of recognised brands, there’s so many branches of diversification about to come online, that the next few months could be the company’s very own pre-Cambrian explosion.

Even before the pandemic shook things up, health and wellness was a leading priority in consumer spending around the globe and in the 24 months since, retail and e-commerce have been driven by this increased consumer focus on health and wellness.

And it’s not a mug’s market. That’s to say, people are extraordinarily well-informed – they’re already looking for innovation in health, they want wellness products that offer prevention but also understand there’s treatments coming online which can offer respite as well.

And with the increased focus on health and wellness, a new high watermark in R&D and a boom in global online sales across the category is underway.

Wellnex Life is already close to becoming one of the first companies to launch an over-the-counter medicinal cannabis product under Australia’s new Schedule 3 (S3) classification.

Wellnex will then utilise its established sales channels to distribute the product.

The existing Special Access Scheme (SAS) market, which allows certain health practitioners to access therapeutic goods not included in the Australian Register of Therapeutic Goods (ARTG), is forecast to be worth $423m in 2022 for Australia.

But that’s been heavily limited by its prescription requirement which is about to be lifted under the S3 scheme.

This lowers the entry bar for Australians to get the product they need from their pharmacist without a prescription, which – considering the massive demand here in Australia – is why CEO George Karafotias expects the S3 market is about to bear fruit.

Back in 2020, the Therapeutic Goods Administration (TGA) announced a final decision to down-schedule certain low dose cannabidiol (CBD) preparations from Schedule 4 (Prescription only Medicine) to Schedule 3 (Pharmacist Only Medicine, or over-the-counter – OTC).

According to the Sydney University’s Lambert Initiative for Cannabinoid Therapeutics, the move brings low-dose CBD products an OTC status, supplied by a pharmacist, without a prescription.

And importantly, it likewise limits OTC supply to only those products that are approved by the TGA and included on the Australian Register of Therapeutic Goods (ARTG).

While there are currently no TGA approved products on the ARTG that meet the Schedule 3 criteria, the moment is coming and Wellnex is in “pole position” to be one of the first companies to launch an OTC Schedule 3 medicinal cannabis product in Australia.

WNX says it will approach the S3 market opportunity utilising the tried and tested go-to-market approach which has already allowed it to deliver similar products – like pain relief – to millions of Australians through its partnership with market-share dominant names like Chemist Warehouse and Priceline.

In a CBD market full of “game-changing” moments, this actually was one, George Karafotias told Stockhead this week – it’s just that both consumers and market participants didn’t understand why nothing’s changed.

“Now there was a lot of hype around this initially when the TGA made the decision, but really, very few understood what it requires to get S3 approval.

“We did, obviously, because we’ve gone through this process many times already with the TGA.”

Karafotias says Wellnex’s core competencies around required regulatory approvals and distribution networks, in combination with the production capabilities secured through its joint venture with OneLife Botanicals, provide WNX with ‘all the essential ingredients’ to be among the few first-movers set to dominate this soon-to-emerge market.

“They do not just hand out approvals. It is a 12-18 month process. And it does require about $3.5 million every time. But, when you’re a first mover – like we were for this back in 2020 – then you’ll be among the first approved, which we will be,” he says.

“And then this market everyone’s been speculating on without understanding the fine print, will, in many ways, be cornered.”

So what’s the difference between the Wellnex offering and the gaggle of CBD offerings out there?

“Well, a hell of a lot, but only one that’s really important,” Karafotias says. “Our market features extremely high regulatory hurdles for competitors and shelving priority for Australian pharmacies.”

“There’s a lot of listed firms experimenting in the unregulated (SAS) market. They might be wholesaling, exporting or just coming up with packageable ideas – like selling food bars with entirely ornamental benefits, speculative at best and exploitative at worst.

“Science says there’s no benefit to a lot of it, but I think it can be good that its incrementally available – so consumers can learn and understand the broader market.

“In the end, like with any medicine or wellness product, if the consumer doesn’t feel better then, they’ll not respond. It’s not rocket science.”

Karafotias says – as a company and as an investment – WNX is an entirely different animal.

“We’re working in the highly-regulated space within the strictest TGA confirmed guidelines which endorse products with confirmed benefits, be it pain relief or relief of other symptoms.”

“A lot of listed firms might be targeting exports or trying to sell to companies like ours. But if you think about it, the value here is in the brand and whether or not it exists somewhere on a shelf.

“And ours will.”

“Think for a second – pharmacists have extraordinarily limited shelf space, and this is not a product which has regulatory approval for consumer marketing. You can’t just shout the loudest or hope you’ll make connections somehow with the pharmacy guild,” Karafotias says.

“That high barrier to entry is both good for consumers and good for a company like Wellnex which is already a trusted, go-to partner for critical players like Chemist Warehouse.”

Wellnex was also a first-mover in forming an early strategic partnership with producer OneLife Botanicals. On Monday, Wellnex announced OneLife had completed the acquisition of one of Australia’s leading cannabis manufacturing facilities, MediPharm Labs Australia. This acquisition puts Wellnex a step closer to obtaining approval for over-the-counter medicinal cannabis products under Schedule 3 classification. It also opens up a new, untapped market for medicinal cannabis products that don’t require a prescription, and has considerable public demand.

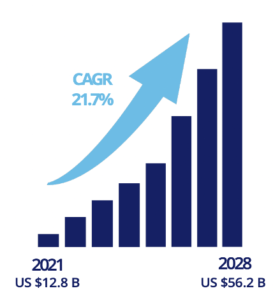

Image supplied. Global CBD market.

The JV delivers Wellnex exclusive access to OneLife’s state-of-the-art TGA, Office of Drug Control (ODC) and Good Manufacturing Practice (GMP) approved medicinal cannabis cultivation and processing facility.

“Now we have a joint venture with OneLife – who have a TGA-approved, probably the best cannabis cultivation facility in Australia. Apart from being fully-licensed, it has already serviced domestic and international markets – and that’s where we grow, test and package our own product. We do it here in Victoria and it ensures both quality and price control.”

Upon obtaining registration of an S3 product, Wellnex will also earn a 4% stake in OneLife, giving WNX ownership across the entire value chain. The OneLife facility boasts an enormous 20 tonne p/a capacity.

“And that means greater margins for us, greater confidence for the retailers and many of these products will be available via the SAS scheme this year, January at the latest.”

“When you have an established joint venture brand with Chemist Warehouse, as we do in pain relief products – paracetamol (Karafotias says WNX was the first to market with liquid capsules) and nurofen – then our S3 medicinal cannabis brands will simply be a natural extension of that.”

“And as I’ve said we have the established sales channels, the shelf space and the relationships to distribute the product nationally, instantly.”

Wellnex Life Chief Strategy Officer Zack Bozinovski will be presenting at ‘The Future of Medicinal Cannabis’ Summit, alongside Shane Duncan, COO of Cann Group (ASX: CAN) on Thursday, 13th October at 12pm (AEDT).

Together they will outline the opportunity for first-movers in the medicinal cannabis market and how businesses are positioning themselves, as well as the challenges and key milestones to getting TGA approval and successfully taking market share. Click here to register for the session.

The news follows the launch of Mark Wahlberg’s nutrition and supplements brand – Performance Inspired – and Australia’s first organic A2 infant formula – Ocean Road Dairies – and as Wellnex reveals record quarterly revenue for Q1 FY 23.

For the September quarter just gone, Wellnex reaped a record $6.88 million in revenue – a more than 80% lift on the prior corresponding period – with sales growth driven by its wholly-owned brands and strong success in contract manufacturing.

The cracking revenue boost to kick off the new fiscal year, coupled with WNX strong outlook – not just for the sea-changing medicinal cannabis market but also for the twin product launches AND the looming platform launch in November – is why the company has already reaffirmed its previous, ambitious guidance of total FY23 revenue of $29 million.

This article was developed in collaboration with Wellnex, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.