Pitt Street Research thinks Skin Elements’ stock price is well undervalued

Health & Biotech

Health & Biotech

Skin Elements growth in its organic skin care and cosmetics products, along with its disinfectant and sanitisers for Covid-19 are expected to grow faster than the market is pricing in, according to Pitt Street Research.

Pitt Street Research has released a report which said the stock price of Australian natural healthcare company Skin Elements Limited (ASX: SKN) is undervalued considering its unique positioning and projected growth in target markets.

SKN’s goal with natural antimicrobials has been to create organic products that surpass their chemical alternatives.

Founded in 2005 and headquartered in Perth, SKN is focused on developing natural organic products that perform better and last longer than their chemical counterparts.

The company has four main product lines. It sells all natural sunscreen products under the Soléo Organics brand, therapeutic papaya skin treatment products under the PapayaActivs brand and cosmetic skin care products under the Elizabeth Jane brand.

SKN recently developed plant-based hospital-grade disinfectant under the InvisiShield SuprCuvr brand, which has been found to be effective against Covid-19 and included in the Australian Register of Therapeutic Goods (ARTG).

Image: Skin Elements

Pitt Street believes SKN is undervalued at its current market value of 2.8 cents, which has felt the brunt of bearish sentiment sell-downs among growth stocks during global market volatility in 2022.

“We value the company at 21 cents per share base case and 40 cents per share optimistic case using the DCF approach with reasonable assumptions on growth of its existing skin care product lines and the recently launched InvisiShield product range,” the report stated.

SKN is operating in rapidly growing markets. Consumers are increasingly becoming health conscious and prefer natural alternatives to chemical-based products.

Organic and natural products are seen to be the key drivers for the cosmetics market in coming years.

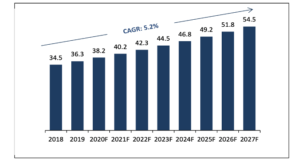

Pitt Street research reported the global natural and organic cosmetics and personal care market is expected to grow from ~US$38bn in 2020 to ~US$55bn in 2027.

Global market value for natural and organic cosmetics and personal care (US$bn)

Source: Statista

All SKN’s products are based on naturopathic principles and use only organic and natural ingredients.

From non-whitening (micronised) zinc to botanically fortifying extracts with anti-oxidants, SKN has spent more than 15 years and $35m developing its formula and products.

SKN’s Solèo Organics and PapayaActivs products have bagged FDA, TGA and other international approvals.

The company has also regularly collaborated with other natural product companies to enhance its organic product lines.

In 2017, SKN acquired McArthur Skincare and in 2018, it entered a Memorandum of Understanding with Affinity Energy and Health Ltd aimed at developing a new range of algae and cannabidiol (CBD) based skincare products.

SKN’s products have a presence in the major markets of the Americas, Europe and Asia. The company is present across 16 countries worldwide.

Pitt Street believes SKN is well-funded to continue to support its R&D and mass market its products, having raised over $24m in equity funding during 2021.

With SuprCuvr receiving TGA approval and SKN now funded for further growth, management plans to penetrate further into international markets.

In 2020, SKN’s management decided to pivot its strategy and make a foray into the market for sanitisers and disinfectants, following the onset of the Covid-19 pandemic.

SKN, using its expertise in advanced organic anti-microbial formulations, developed a range of natural and alcohol-free hand sanitisers.

It launched the InvisiShield Natural hand sanitiser in April 2020, which proved to be 99.99% effective against coronavirus.

The sanitisers are made from organic plant extracts including lemongrass, sage, and thyme combined with natural anti-microbial compounds. The company later developed SuprCuvr.

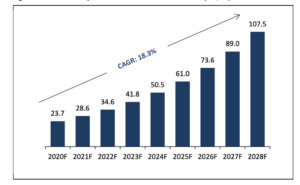

The global market for antiseptics and disinfectants was valued at US$24bn in 2020, and the market is predicted to grow at 18% CAGR between 2021 and 2028.

Pitt Street said besides Covid-19, occurrence of diseases such as cholera, typhoid, Hepatitis A and dengue, due to a lack of cleanliness, is expected to support demand for sanitisers and disinfectants.

Global antiseptics and disinfectants market size (US$bn)

Source: Grand View Research

The equity analyst firm said SKN is well-placed to gain from the fast-growing sanitiser and disinfectant market. SuprCuvr is the first and only approved disinfectant globally that can bring about 7 log reduction (99.99999%) in Covid-19 coronavirus on surfaces.

TGA registration of SuprCuvr has opened new doors for the company, since settings such as hospitals and aged care facilities are obliged to use only TGA-registered disinfectants in their cleaning protocols.

Having signed a distribution agreement with medical distributor Pacific Healthcare, Pitt Street expects many commercial sales agreements, not only in healthcare but in government, hotels, offices, airports, public transport hubs, and even private homes.

Pitt Street also highlighted the company’s highly experienced leadership as being an asset to the company, with board members having strong past records.

Executive chairman and CEO Peter Malone has more than 30 years’ experience in global financial markets.

He has raised more than $150m for innovative technology development programs in the past.

Pitt Street said in its valuation of Skin Elements, it considered the revenue growth of SKN’s existing skin care product lines and recently launched SuprCurv range.

In its forecasts, Pitt Street assumed a greater contribution and assumed a steady increase in commercial-scale contracts, and average value of such contracts, for SuprCuvr out to 2031.

“At that time, we model revenues for the entire InvisiShield SuprCuvr product range at between A$180m and A$300m,” the report said.

However, it said the company will need to execute well to make the most of SuprCuvr.

“To state the obvious, Skin Elements is not S.C. Johnson, Reckitt Benckiser, Procter & Gamble, 3M, or Clorox, to name a few leading players in the disinfection space,” the report said.

“We argue that the lion’s share of the market will stay with companies like these. However, there is plenty of room for emerging players cognisant of the new needs of the market, like Skin Elements.”

This article was developed in collaboration with Skin Elements, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.