Australia’s biotech industry is thriving, with ASX-listed companies up 19% since 2019

Health & Biotech

Health & Biotech

Australia’s biotech industry is on a strong growth trajectory, having grown more than 40% in two years, with the market cap figure of those listed on the ASX up almost $16 billion in six months.

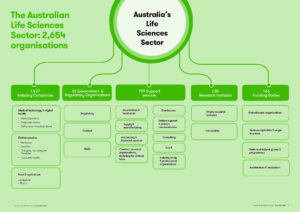

Figures by representative body AusBiotech show how much the industry has matured and become a critical part of the Australian economy. Other key figures include:

AusBiotech was established in 1986 with less than 100 members with a mission to foster a growing, strong, and profitable biotechnology and life science industry in Australia.

The company provides a biennial Australian Biotechnology Sector Snapshot to track growth.

AusBiotech CEO Lorraine Chiroiu told Stockhead through representation, advocacy and the provision of services and benefits to its members the organisation has worked to realise the sector’s nationally important economic potential.

“In the 35 years since AusBiotech was founded, the industry has grown from a mere handful of companies, to having an ASX-listed market capitalisation of more than $248.7 billion, “ she said.

This market cap figure has grown almost $16bn in six months and the influx of investment and value into these companies is in line with global biotech trends.

Chiroiu said the substantial strength of Australia’s biotech industry, through the substantially increasing numbers of organisations and the people employed within it, depicts an actively thriving ecosystem.

“This maturity is a key factor for the industry’s ability to attract and retain high-value jobs and backs its ability to compete on the world stage in a knowledge-based economy,” she said.

The Covid-19 pandemic put the sector firmly in the global spotlight as a global race began to find effective vaccines and treatment for the virus which brought the world to a halt.

A host of ASX listings has taken place since 2020, with 27 new biotech and medical technology companies entering the local bourse.

“This has resulted in the total number of life sciences companies working on commercialising Australia’s leading science and developing and/or delivering for patients and consumers rising to 193,” she said.

The number of ASX-listed biotechs has grown significantly, with a 20% increase since 2019 from 161 and a 38% rise since 2017 from 140 companies.

“Of the 193 companies, 14 or 7% are now worth more than $1 billion, which is one quantifiable measure of the life science sector’s contribution to the Australian economy,” Chiroiu said.

“The proportion of biotech companies achieving market valuations greater than $100 million, which is 34% also measures the industry’s ability to create companies of significant future value.”

Furthermore, she said the year-on-year record-breaking capital raising indicates support of investors and recognition of the biotech industry’s future growth, as well as buoyant capital attraction globally.

New South Wales and Victoria have become critical life science hubs, supporting 73% of Australia’s life sciences sector.

Queensland retains the third largest number of life sciences organisations, while Western Australia continues to steadily grow, increasing 9% in the past two years.

South Australia represents 5% of the sector, growing 39% to 135 organisations.

AusBiotech recently released a Biotechnology Blueprint, a strategic decadal framework developed by the industry to offer a framework for further developing the local life sciences industry over the next decade.

The Blueprint metrics seek to track the maturity and vibrancy growth in our ecosystem, and to measure the Australian biotechnology industry’s global and local standing, and the industry’s positive contribution to Australian prosperity.

According to Victorian Government research, every dollar of Victorian Government funding invested to support the health and medical and pharmaceutical sectors has generated an additional gross state product (GSP) of $3.66 and an additional income of $4.54 in the state.

With a market cap of more than $143 billion CSL (AX:CSL) is Australia’s largest healthcare company. However, the chief financial officer Joy Linton told Stockhead the Australian biotech sector has enormous potential.

She said CSL was strongly barracking for the success of smaller companies in the life sciences sector.

“CSL is proud to be a major bio-therapeutic company that has successfully translated research into a commercial business that now has a truly global reach,” Linton said.

“Our great Australian success story has relied on the biotech ecosystem here – from research, through clinical and product development, to large scale manufacturing.

“As this environment continues to develop, I see great potential for the sector into the future.”

With the wind behind the biotech sector AusBiotech is holding an investment conference in Perth on October 27.

AusBioInvest 2022 offers qualified investors a chance to hear up to 30 companies pitch their work, hear in-depth market insights, and engage with global investment leaders on industry trends.