You might be interested in

Experts

SUNDAY ROAST: The small caps that lit a fire under Stockhead's experts this week

News

Market Highlights: Google, Microsoft boost Wall Street post-hours; and what's the risk for gold from here?

Mining

Welcome to Tru Datt, a Stockhead exclusive featuring the insights and opportunities as per Emanuel Datt – founder and chief investment officer at Datt Capital – a Melbourne-based investment manager focused on identifying growth and special situation investments.

Emanuel has built a team of ‘highly opportunistic and disciplined investors’ – with a strong emphasis on risk control.

In this series, Emanuel will discuss investment opportunities from a long-term philosophy, targeting nothing less than SAWA – Sustainable Absolute Wealth Accumulation.

According to Emanuel Datt the best way to get a handle on just how much the Australian small cap sector has been left unloved in recent times is to simply take its current valuation, and compare.

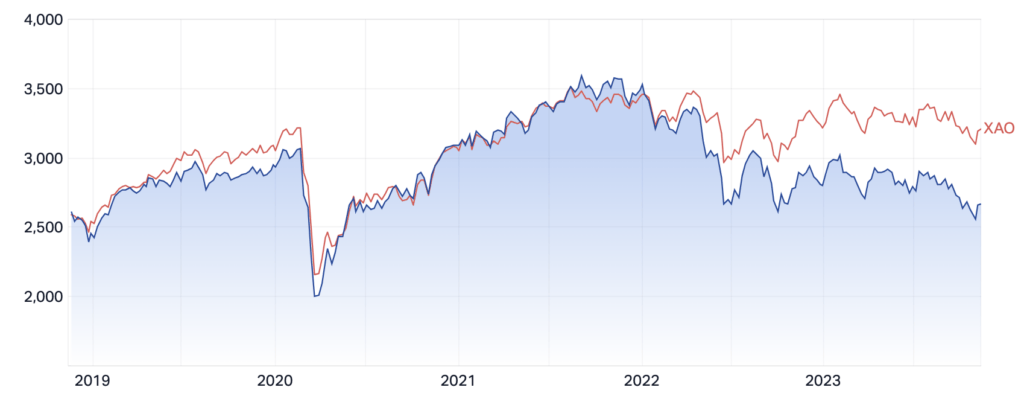

“On a five-year rolling time frame the ASX small cap in index is trading at a substantial divergence from the broader All Ords market index.”

According to Datt Capital research, right now this discount is about 30%.

“This compares to historical norms of the small cap index typically trading at a premium of circa 20%. Accordingly, in terms of relative valuation there is a 50% divergence from the historical norm.”

Whenever this has occurred it has portended periods of strong returns for small cap investors, says Datt’s CIO.

“We see the small cap space providing an investible universe of more than 1500 separate listed companies identified with a market cap of above $20 million and outside the ASX100 index. Many of these companies are not dependent on macroeconomic considerations, which provide the potential for strong idiosyncratic returns.

“This allows investors to capture a pure form of sector exposure as small companies are typically more focused and concentrated in their operations.

“In the current soft economic environment, we have observed that smaller companies are tightening their belt and squeezing cost efficiencies out of their operations given the cost of capital has risen considerably over the past year or so. We definitely believe the value of a company is driven not only by the top line but by the bottom line.

“The size of these companies means they fall under the radar of many or most institutions. There is much less investor interest generally in this sector and therefore greater opportunity of strong returns for those investors who believe in conducting intensive research in this sector.

“Given this scenario and market uncertainties globally, the recent move by Australia’s $206 billion Future Fund to publicly draw attention to the ‘persistent alpha opportunity’ that exists in the Australian small cap space should not shock.”

“The September 2023 call by Australia’s sovereign wealth fund to mandate an external investment manager marks the first time the Future Fund has focused on the small cap space and the return of the fund to active management strategies following a move to passive and smart beta equity investing in 2017.”

Emanuel warns that to find hidden gems in the small cap arena, primary research is critical.

“As investors, we must take time to understand not only the technical aspects of a company’s performance but also how the macro and micro factors affect the fundamentals of any company. Investors should look for invisible data that lies outside the standard stock screening software, using primary data.”

Adriatic Metals is focused on the development of the 100%-owned, Vares high-grade silver project in Bosnia & Herzegovina, and exploration at

the Raska base & precious metals project in Serbia.

The base and precious metals developer starts production from the Rupice mine in Bosnia in two months.

The project is expected to generate circa $200 million in free cash flow in each of the first five years of production. Current life-of-mine is 20 years, with scope to extend.

The Paul Cronin managed ADT has a resource upgrade for Vares scheduled this quarter following drilling at Rupice NorthWest as well as ongoing metallurgical test work and new mining studies, the company noted.

Additonal drilling has just been completed on other targets at Rupice West and Semizova Ponikva, both within the Vares footprint, while assays from the Semizova Ponikva brownfield are also expected this quarter.

Cash balances were US$68 million at the end of September.

Value Catalyst – derisking from first production in January.

(Ed: And it just so happens ADT dropped this video update on Friday)

This is a road fleet technology provider with operations in Australia, New Zealand and the US. It is undergoing a significant cost restructure, and recently recapitalised, subject to M&A interest from its major shareholder, Canadian-based Volaris, run by billionaire Mark Leonard.

The Auckland-based Eroad is listed on the ASX and in New Zealand. It’s a tech firm specialising in making paper-systems redundant with digital for road, tax, health and safety compliance for transport.

The company has a US business based in Portland, Oregon that serves customers operating in every US mainland state.

In 2009 Eroad introduced the world’s first nationwide electronic road user charging system in New Zealand. Now more than 50pc of heavy transport RUC is collected electronically.

Eroad also provides health and safety compliance services, including vehicle management and driver behaviour and performance measures.

Value Catalyst – improvement in cash flow generation from operations, firming in M&A interest.

Funds management conglomerate undervalued on NTA. As recently as November 2, GQG Partners (ASX:GQG) confirmed its amended, non-binding indicative proposal (NBIO) of $11.00 in cash consideration per PAC share by way of a scheme of arrangement, following the completion of due diligence. GQG called it ‘an attractive outcome for all PAC shareholders.’

“GQG continues to see significant strategic merit in a combination with PAC, and GQG will continue to engage with PAC in this regard,” the company added.

With a portfolio of 16 specialist boutiques across Australia, India, Luxembourg, the US, and the UK, the PAC group is a multi-boutique asset management business which partners with ‘exceptional’ investment managers. PAC secures capital through ‘bespoke’ economic structures and combines it with strategic business development to help build businesses.

It’s subject to multiple expressions of interest for M&A.

Value Catalyst – a potential exit at a higher price closer to Net Tangible Assets (NTA), or corporate restructure where embedded value is distributed to shareholders.

Released last week, Morningstar’s inaugural Active/Passive Barometer measures the performance of active funds against a composite of passive fund performance in nine categories over the three-, five- and 10-year periods through June 30, 2023.

Datt says the report highlights the outperformance of active funds in the Australia small-cap space and nails the current positive assessment of the state of small caps and the opportunity for active management.

“The study reinforces some of the long-held Morningstar views such as the superiority of active funds in categories like Australia mid/small blend and Australia large value equities, whereas low-cost passive funds remain dominant in efficient markets when representative indexes are available.

“Happy hunting!”

Emanuel Datt is the founder and chief investment officer at Datt Capital.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.