The White House: Cathie Wood bets against tradition but tradition doesn’t just roll over and play nice

Via Getty

In this series, global equities portfolio manager James White from Lessep IM, ditches micro and macro and embraces “The Meta” perspective.

Lessep IM runs a core portfolio of 40-50 stocks that capture the opportunities in productivity trends and reflect investments in both the drivers of productivity and the beneficiaries of productivity. James also aims to run a long-tail of stocks that have the potential to capture a greater share of new or existing markets.

Cathie Wood’s ARK ETF has been the butt of more than enough jokes in 2022. The fund’s spectacular collapse has been well chronicled. Lines such as this from the Intelligencer make the case:

To hear her talk was to feel your mind liquify in a clickbait-like flood of dopamine-inducing buzzwords — her portfolio a cornucopia of self-driving cars, crypto, genomic cancer cures, AI, streaming, and gaming.

She told risk-drunk investors exactly what they wanted to hear.

In her view, it seemed, tech stocks only went up and to the right.

Then there’s the take of the notorious short-seller Fraser Perring, of Viceroy Research and being mean on Twitter fame:

“Cathie Wood is the opposite of a short seller — she’s a capital depleter.

“The amount of capital she’s evaporated in the world, how can people even suggest she’s successful?

“She’s successful at failing.”

Strangely enough Perring’s Grand Poobah schtick is not roundly popular…

The level of emotion in a stock is surprising. $PANR is an oil & gas stock promotion. One example was in Texas, #CEO Jay Cheatham said “it was one of the most exciting plays he had seen in 30 years.” Then #PANR gave it away for ZERO + transfer of the abandonment costs, #WTF https://t.co/Vp3y7nWcKJ

— Fraser Perring – Grand Poobah of “criminal” shorts (@AIMhonesty) November 12, 2022

Back to the bubble

Recently, Bank of America’s Global Equity Strategist Michael Hartnett produced the chart below.

The bubble in price of Wood’s ARKK ETF is the second largest in my lifetime (partly because it was dragged up by the largest, Bitcoin).

As an aside, it’s interesting that gold in the late ’70s is considered a bubble. This might explain the goldbug’s demography.

There seems little that can rescue Wood’s reputation. Unless everything turns around over the long term, that is. For the meantime, it’s still genius billionaire entrepreneur/stock picker vs traditional investing.

At the heart of the ARK Innovation Fund is Wood’s philosophy:

The world is changing rapidly.

While traditional investors seek safety in benchmarks and passive strategies, ARK believes this behavior is counterproductive.

Innovation is causing disruption and the risks associated with the traditional world order are rising. We strive to invest at the pace of innovation.

It’s never sensible, and often counterproductive, to blanket dismiss tradition.

Most often, traditions fight back

Indeed, a great description of tradition is as Artificial Intelligence, incomprehensible but correct. Traditions arise from behaviours that are often essential to human survival and development. When traditions are put to the side, we learn why they have been important. Traditional benchmarks and passive strategies might have served Ark investors well.

But the broader point of investing in innovation and being aware of the risks from innovation is correct.

ASML

ASML has long been a part of the Lessep portfolio.

Its dominant position as the sole provider of EUV technology into the semiconductor manufacturing industry makes it a unique, and globally significant asset. It’s the reason Mark Rutte, the Dutch Prime Minister, is invited to Beijing.

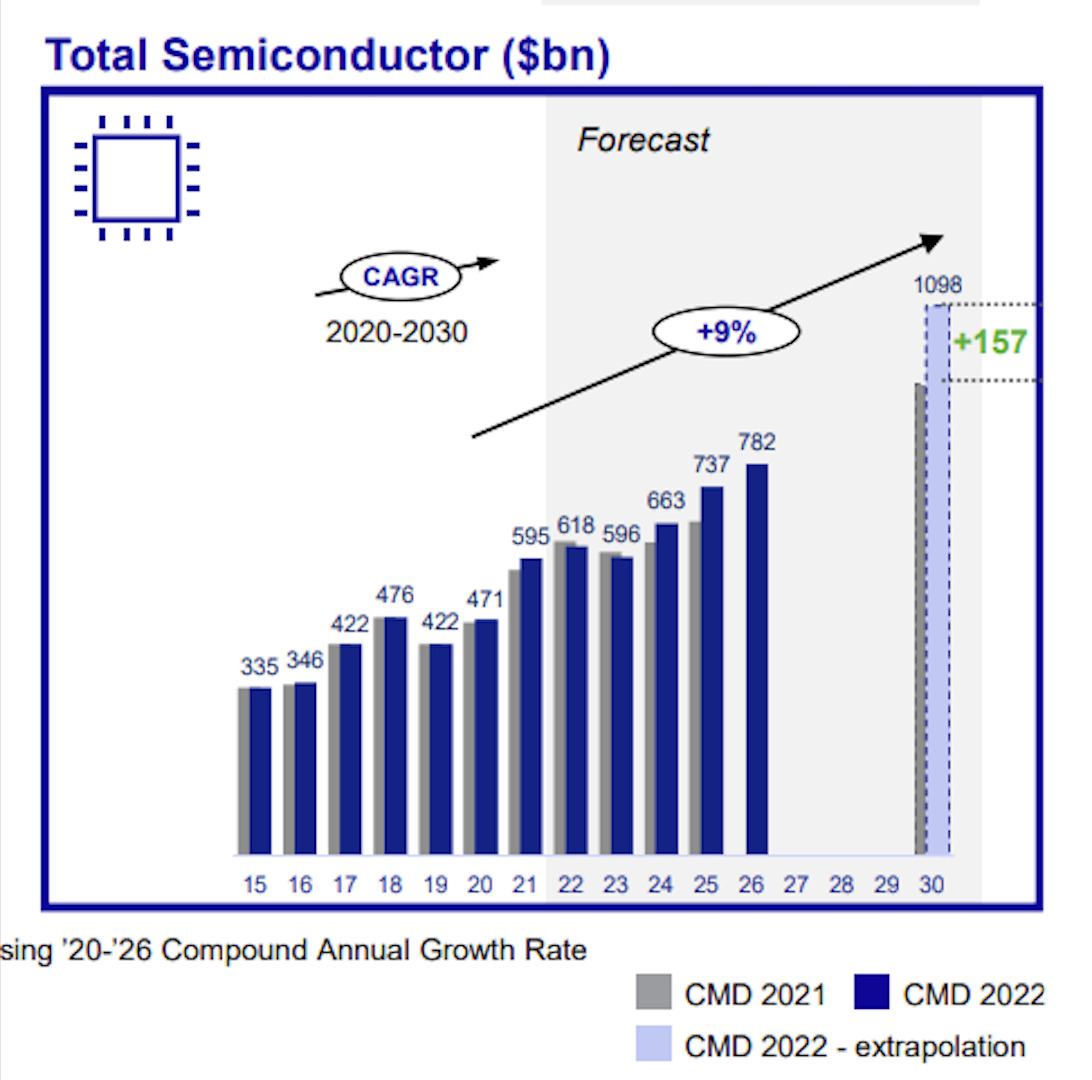

At its recent Capital Market’s Day, ASML announced changes to its long-term revenue forecasts issued just last year:

- 2025: annual revenue between approximately €30 billion and €40 billion with a gross margin between approximately 54% and 56%

- 2030: annual revenue between approximately €44 billion and €60 billion with a gross margin between approximately 56% and 60%

The 2025 forecast represents, from the mid-point, a 30% increase in expected revenue compared to last year’s 2025 forecast. In addition, ASML has announced a euro 12bn share buyback program.

CEO Peter Wennink is a sober, dare it be said, Protestant, Dutchman.

He understands the market doesn’t like surprises. But he was clear, ASML the business, has been surprised by demand for its product. Indeed, a key mega trend, energy transition, was ignored in last year’s forecast. It wasn’t in the conversation. It couldn’t be forecast.

Innovation creates growth from nowhere you know

No one looks so silly as a growth investor, Cathie Wood being the latest in a long line. Growth investors would look even sillier, were they to argue that they don’t know where the growth will come from.

Yet that’s exactly what happens.

ASML, as a company, with full inside knowledge didn’t know. But its position, at the leading edge of technology, makes it ideally placed to benefit from innovation driven change.

Nike is similar, with a longer history. An investor in Nike’s IPO has been fantastically rewarded. The returns to shareholders, in capital gains, excluding dividends, have been 16% per annum since 1982.

A $1,000 investment in 1984 (when the stock reached a post-IPO peak), would be worth $1,000,000 today.

These returns don’t reflect a bubble, but earnings growth. Nike trades at a slight premium to its historic Price to Earnings ratio. But could that investor identify any of Nike’s long-term growth drivers in 1984? Would they have held through the 1984 bear market?

A growth investor of acquaintance was asked by an asset consultant when he had been wrong about estimates. Expecting a mea culpa for excessive growth estimates, the consultant instead received a litany of companies where growth had been under-estimated over years, if not decades.

Over time, in many names, growth investors will be right, by holding the stock, yet not know why they were right, ex-ante. Nike, on its way to 1,000x-ing an investment, has fallen as much as 63% in one go. In that light, 2022 is but a blip for many of the best growth stocks of today.

The challenge is staying the course, and it’s here that Wood has failed.

Staying the course

Ark has failed, not because the philosophy is wrong, but because the portfolio lacks the ability to ride out these tough periods for growth. This reflects two, broad, challenges.

First, the portfolio has too much Zoom, CRSPR, and Roblox, and no ASML, ServiceNow, and Microsoft.

The difference is not innovation, all six companies are at the leading edge in their field. The difference is that for the latter three, the future has arrived, and is already profitable. They all have business models that are robust, and a history of delivering growth through economic cycles. Even in a growth portfolio, these companies add ballast, and make long-term holding an easier task.

For the former, the future may never come.

Second, the impact of innovation creates opportunities away from the leading edge, in places traditional investors might like to look, and value. This year, relatively, homebuilders and luxury goods makers have performed well.

Miners, and oil and gas companies, have provided strong absolute returns. They, too, are participating in the innovation driven economy and not being left behind.

Take aways

2022 shakes the foundations of growth investors. In the long-term, it will be but a blip on a chart.

It’s always good to invest at the leading edge of innovation and change. But those who see it through, will be those that invest in business models that are growing today, and have the diversification of return paths, to make the losses in the core of the portfolio palatable. That’s what Lessep is trying to do.

Financial regulators, for instance, demand explainable Artificial Intelligence so as to understand why decisions have been made.

“Explainable AI (XAI), or Interpretable AI, or Explainable Machine Learning (XML), is artificial intelligence (AI) in which humans can understand the decisions or predictions made by the AI. It contrasts with the ‘black box’ concept in machine learning where even its designers cannot explain why an AI arrived at a specific decision.”

These forecasts are also likely too low.

ASML suggests increased prices are not part of this forecast. At some point, ASML must raise prices.

Best Regards,

James White

Sign up for James’ Lessep IM’s newsletter.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.