Cathie Wood’s Ark Invest: The bargains came in two by two

Picture: Getty Images

There was a moment last week when headline-making investor Cathie Wood’s ARK Innovation exchange-traded fund (ETFARKK) stock price swam well against the current and surfaced 1% higher at the end of trade. The fund’s founding tech-investor snapped up a profound chunk of equity in a string of bold company purchases following Wall Street’s market rout.

As foretold and forewarned, Ark collected the animals, waited for the rain and off Wood floated with new positions in 27 stocks across its eight exchange-traded funds.

The Ark Investment Management CEO has said throughout the bloodletting of 2022 that the sharp falls in the stock prices of her fav tech names simply represent buying opportunities.

Wood’s flagship investment fund, the $8 billion ARK ETFARKK has deployed some of the dry powder in her armaments and augmented positions in its run-down holdings, acquiring some 15,000 Nvidia shares, 208,500 Zoom Video shares, and 250,500 Roku shares.

The Wood-led Ark IM also dipped in for over 100,000 shares of Jack Dorsey’s Block Inc valued at over $7m (based on Wednesday’s closing price). The purchase via ETFARKK and comes at a time the stock has lost over 20% in one month. Block is now the sixth-largest holding in the ARK Innovation ETF.

Nvidia meanwhile is down 56% year to date, Zoom stock has lost nearly 60% since January, and Roku has been particularly nailed to the wall, short some 70% of its value since the new year.

Across all the purchases Wood’s eight ETFs made last Tuesday, Roku was the biggest buy. Previously the beleaguered Roku was the 3rd-top holding. The previous Ark Innovation ETF saw $803 million rush out in August, the biggest monthly outflow since last September, Bloomberg reported.

As a matter of fact, in 2022 so far, Ark Invest itself has backtracked around 55% as the Fed fights high inflation, traders worry over ongoing recession signals and fund managers continue to shift from growth names to defensive positions.

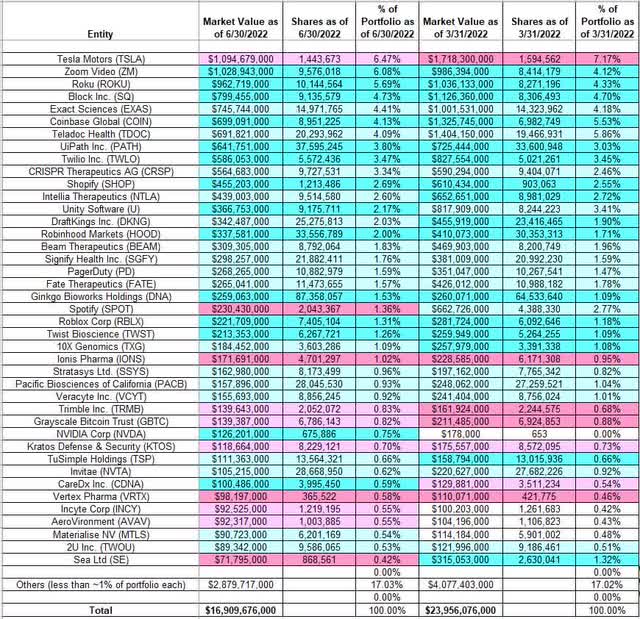

ARK Invest Q2 2022 13F Report Q/Q Comparison

And per our colleagues over at Bloomberg, Wood’s Ark took the opportunity of last week’s broad Wall Street sell-off to continue her big, long-term bets on cutting-edge technology firms.

Tesla, Zoom, Roku, CRISPR Therapeutics, Intellia Therapeutics, Block Inc, Teladoc Health, Exact Sciences, Beam Therapeutics, and UiPath are all among the top stocks in Wood’s ARK Innovation ETF.

Gloomier-than-wanted US inflation figures – namely, August consumer prices tore the heart out of Wall Street earlier – saw Wall Street lost 4% and the tech-heavy Nasdaq sank nearly 5%

The day before the US inflation numbers were released, Wood re-tweeted her rather contrary belief that deflation – not inflation – was the core problem in the US and the hero of start-ups and tech pumpers everywhere appears to be positioning for exactly that, given her biggest purchases continue to be leaning heavily into tech firms which’ve copped the brunt of all those previously mentioned and not insignificant headwinds.

But first…

Who is Cathie Wood?

The daughter of an Irish-born US Air Force engineer, she studied economics at the Uni of Southern California under Arthur “Art” Laffer, a legendary, slightly screwball economist and the inspiration behind The Laffer Curve, which posits something important going on between tax rates and tax revenue. Laffer has been Wood’s key mentor.

The LA-born and bred ESG investor was en early punter for innovative ideation – hi-tech solution meets commercial application. The broad philosophy has made her – if not a rockstar stock-picker – then at least a folk market sensation.

Most importantly and influentially Wood is the founder of the 2014-launched, tech-touting, genomics-gunning ARK Invest – carrying some US$60 billion in assets. Wood picked Musk from the outset and has been among the die-hardest Tesla boosters outside of Elon.

Ark runs eight exchange-traded funds (ETFs) focused on different areas of the tech sector from robotics to space exploration, and they hold a total of 34 different stocks.

Until last year, Wood’s Ark Innovation Fund was returning circa 45% annually over the past five years.

Wood has been warning about deflation since last year on the belief that disruptive innovation will push down the price of obsolete goods and artificial intelligence will help reduce production cost.

‘We buy fear and sell greed’

Not long after Wood was buying up, Andrew Slimmon, an MD at Morgan Stanley IM, went on the telly to endorse her position but in a a less prosaic fashion, warning investors instead that “it’s too late” to buy defensive or go chase energy positions.

“We buy fear and sell greed,” he told CNBC on Thursday morning our time in a pretty cool show of fiscal bravado.

“The time to buy energy was in late 2020 when the futures curve was negative,” he said, adding that fear on Wall Street is now hiding in the consumer sector, an easy observation to make after the Uni of Michigan consumer sentiment index hit a near 50-year low last week.

And nothing about the August inflation print or the market’s reaction changes Slimmon’s view that the S&P 500 will climb before Christmas and “end the year closer to” where it started.

“We are adding consumer discretionary names that have been hit into this low consumer sentiment as the rate of change turns positive,” Slimmon said.

He named three stocks that the firm likes: Home Depot, the security products firm Fortune Brands Home as well as Security, and homebuilder Lennar Corporation.

“I suspect that will flip at some point in Q4 pushing (markets) higher into year-end, not lower.”

Totally deflating

Wood’s also been making headlines for another reason. She’s backing her long-time call that the key leading indicators freaking out wall Streat are showing deflationary forces instead of inflationary pressures.

Elon Musk naturally jumped on the Wood bandwagon via Twitter, the Tesla CEO calling falling commodity prices “neither subtle nor secret” and tweeting to his 100 million followers that “a major Fed rate hike risks deflation.”

“We are getting some loud voices now accompanying us on this deflation risk,” Wood said in an investor webcast Tuesday, name-checking Gundlach and Musk in her comments.

Deflation in the pipeline, heading for the PPI, CPI, PCE Deflator: from post-COVID price peaks, lumber -60%, copper -35%, oil -35%, iron ore -60%, DRAM -46%, corn -17%, Baltic freight rates -79%, gold -17%, and silver -39%. https://t.co/nVpU1cdf1L

— Cathie Wood (@CathieDWood) September 12, 2022

Last week’s stiffer-than-stocks-could-cope-with 8.3% CPI monthly jump, year-over-year has the universe – sans Cathie and Elon – betting, fearing and banking that The Fed will reach into the big bag of outsized rate hikes, and pull out the 100 basis point whacker at this week’s rates meet.

Here’s how YoY CPI would look going forward with a constant 0.1% MoM print like today’s headline reading. pic.twitter.com/QIGL7fMP5l

— Bespoke (@bespokeinvest) September 13, 2022

At home, the ASX200 was clobbered over -2.5% wiping over $59bn from the local index following the steep losses on Wall Street. The small cap index fell only 1%, but Market Matters founder James Gerrish says while Tuesday’s CPI read suggested US inflation is stubbornly high, it’s more opportunity than just awful.

“Waking up to a 1300-point rout on Wall Street is enough to scare any investor but we should consider the previous few sessions before throwing the baby out with the proverbial bathwater,” he said.

This is why, Gerrish argues:

Equities in both Australia and the US ran up strongly into the CPI leaving plenty of room for disappointment which of course they received – August saw inflation rise by +0.1% as opposed to the largely anticipated fall of -0.1% MoM.

Hence we feel the subsequent drops weren’t too bad i.e. the ASX200 retraced only 60% of its 4-day gain while it was a touch tougher for the tech-heavy S&P500 where the number was over 75%.

However, while ongoing volatility and lower prices into next week’s Fed rate hike wouldn’t surprise MM we remain bullish over the coming months into Christmas and in “buy mode” until our forecasted roadmap for financial markets deviates from our path.

Gerrish said the moves just “reiterate our view that this would be a buying opportunity.”

At the start of 2022 MM called this a year to “buy weakness and sell strength, with the emphasis on the sell side of the equation for the first time since the GFC”. Again, there’s no change to this standpoint, Gerrish added.

“MM has relatively elevated cash holdings across our portfolios leaving us in the solid position of accumulating stocks into the current weakness i.e. so you should expect us to be active in the coming days and weeks.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.