Good morning. Wall Street just had a big bare, naked sell-off

Via Getty

Wall Street, huh? There was Black Monday back in 1987, the collapse of dot-com bubble, (also known as the dot-com boom, the tech bubble, and the Internet thingy), in the late 1990s, and who that lived through it might ever forget the 2008 sub-prime mortgage crisis?

All memorable, memorable moments of market blood-letting. And all with their own differing flavours of hubris, denial and the vanity of men.

But not since the COVID-19 crash, back in June 2020 (go figure) has Wall Street recoiled in such primal terror as it did last night, while you slept, and I ate fingernails.

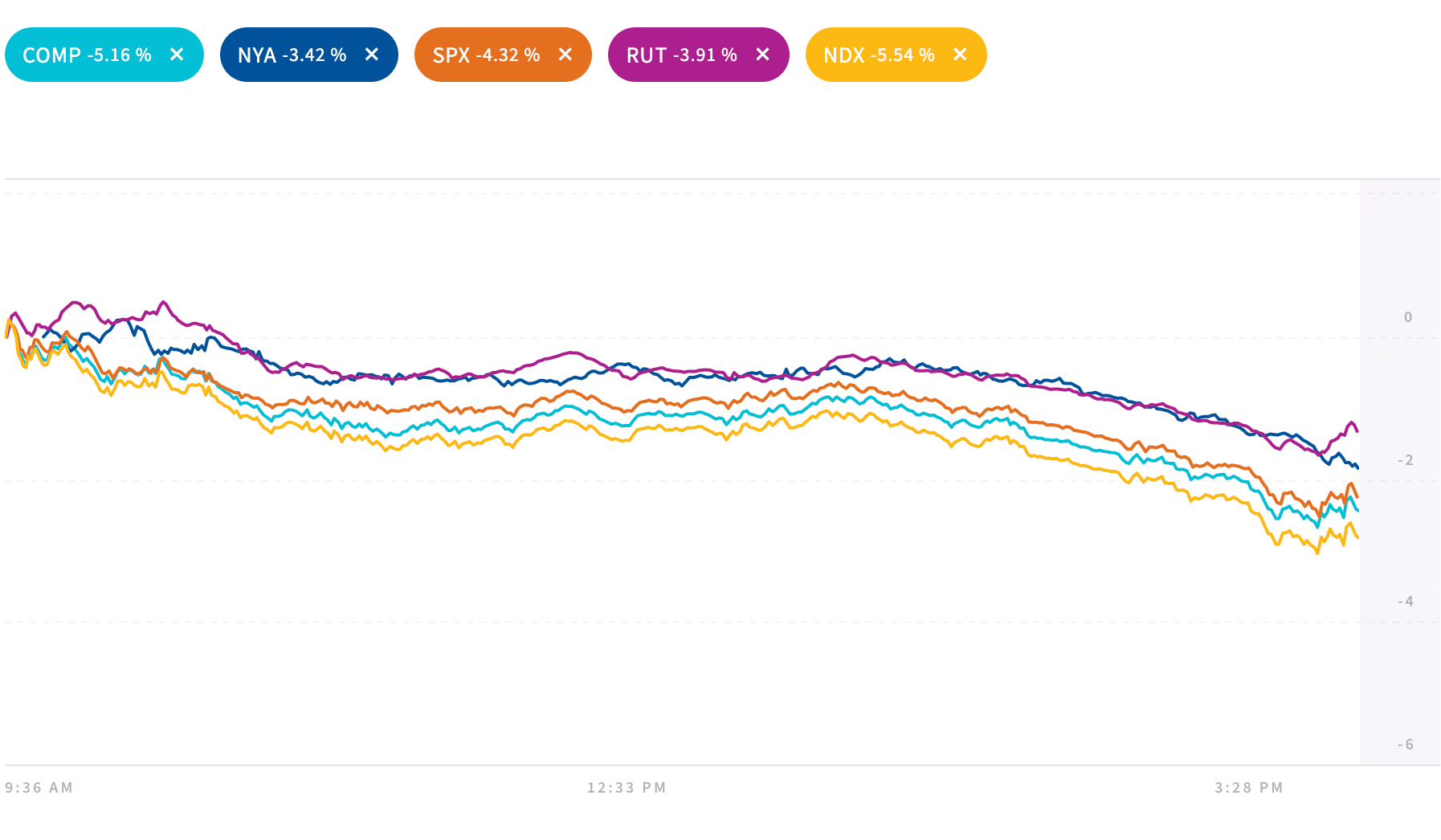

The now very, very average Dow Jones industrial took a plunge of more than 1,200 points or a whisker away from 4%. The tech-heavy Nasdaq fell from an even greater height and at a more impressive velocity, diving 5.2%. The purely tech-heavy Nasdaq 100 dropped 5.5%. The S&P 500 collapsed 4.3% and the Russell 2000, 3.9%.

Technicolor Wall Street:

It was the stock market’s biggest one-day decline in more than two years and followed the latest US Labour Dept read on the consumer price index (CPI) – and it was Stephen King all the way.

Not only did the CPI came in above consensus, the Core CPI – which strips out the sometimes misleading impact of volatile food and energy prices – was double the forecast of economists who honestly, must be kicking themselves for the umpteenth time this year for being so obviously wrong.

The August US Core CPI is now at 6.3% from 5.9% in July and that has rudely awoken economists, investors, US President Joe Biden and his sleepy administration and anyone with a sliver of skin in the game that the dream of easing central bank rate hikes is forlorn. And starting to get nightmarish.

The bare naked sell-off is the truest measurement of just how magnified those dreams of receeding US inflation had become.

After global central bankers met at Jackson Hole last month, lashing with tongue the dangers of such inflation-less reveries, equity markets paused for a long weekend before keenly charging ahead and damning the torpedoes literally flying from every central bank within distance of a stockmarket.

Careful now, down with this sort of thing

However, the biggest one-day Wall Street decline in two years is not the end of the world.

Every cat with a tongue knows this was in the post. A correction of runaway sentiment. A broad sell-off where every single name on the NASDAQ 100 fell (except maybe Twitter). And all off the back of a big week of US market gains and four straight days of tiny, brave little bulls charging about as if inflation was as busted up as the resolve of the Russian army in Ukraine (See: Battle of Stalingrad 23 August 1942 – 2 February 1943).

All 11 major sectors of the S&P 500 ended last night deep in red territory.

The reddest flag of all – bond yield inversion on the US 2-year and 10-year Treasury notes – dilated like their water just broke.

Needless to say our local futures index is looking a bit unkepmt and very anxious.

It’s time to grab a rifle, dig a trench in the frozen ground and hunker down for a long cold summer.

By the numbers:

- The Dow Jones Industrial Average fell 1,276.37 points, or 3.94%, to 31,104.97

- The S&P 500 lost 177.72 points, or 4.32%, to 3,932.69

- The Nasdaq Composite dropped 632.84 points, or 5.16%, to 11,633.57.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.