MoneyTalks: Three special small caps at the pinnacle of their game although one of them is totally a Kiwi but that’s cool

Experts

Experts

MoneyTalks is our regular drill down into the stock specific delights moving Australia’s best investors, right now.

Recorded live and commercial free in front of an underpaid Journalist of no fixed address, Stockhead puts the hard word on our experts to find out what’s hot, what’s not, and what’s worth sticking your neck out for in these testing times of great uncertainty.

And now in this outrageous edition of MoneyTalks … 3 x small cap stock picks from the Pinnacle Investment Summit 2022.

The dust has settled from leading Aussie multi-affiliate investment management firm, Pinnacle Investment Management Group’s (ASX:PNI) annual brain dance.

A staple on the yearly calendar for fans of small and unsung caps the summit offers a close-up inspection of what’s in the hearts and minds of the listed IM’s top CIOs and portfolio managers and across Pinnacle’s network of affiliated asset managers.

Specialist small cap fund managers, including listed Spheria Asset Management and Longwave Capital Partners presented at the summit and here’s a couple of their more unsung small cap stock picks.

Spheria co-founder and PM, Matthew Booker told investors that New Zealand Media and Entertainment (ASX:NZM) is “going from old world to new” with the growth in the digital side of their business.

“The big kicker, we believe, is the digital aspect to the business – so they’ve got a business called OneRoof and it’s similar to Domain here. It’s the number two player in the market.

It’s going from print, it’s going to digital, it’s probably 5–10 years behind the Aussie market. So, there’s going to be a lot of money made in that space.

With OneRoof NZME have the number two platform, they’ve got the number two audience, they’ve got the number two inventory and that’s a valuable position going forward.

Total OneRoof revenue was up 16% higher than the first half of 2021, with 53% growth in digital revenue despite a cooling housing market.

NZME is a structural growth story. The balance sheet has gone from $100 million of debt to net cash.

The risk is very low and there’s a rerate opportunity with this business.

We think there’s lots of money to be made here.”

NZM results summary six months to June 30:

With the backing of Pinnacle IM as a minority equity partner, Burns, Booker and Adam Lund launched Spheria Asset Management in 2016. According to Burns, the young firm has made targeted investments across some 25 takeover targets in six years.

“It’s the way the market works right now, if we buy cash flow businesses, good balance sheets, good valuations, and the market doesn’t pick it up, then in many cases a corporate comes in, or a private equity firm comes in and laps it up.

Summit Class Limited (ASX:CL1) was a recent example.

CL1 is a leading player in the SMSF software market. It develops and distributes cloud-based accounting, investment reporting, document and corporate compliance, and administration software for accountants, administrators, and advisers in Australia.

Class had, I think 30% share of that market, it was a growth market, it was a subscription business. Great cash flow, great balance sheet, it ticked all our boxes in terms of business models and the valuation was quite attractive. That eventually did get taken over – so I think it is something you do see in the small cap market and I think we’re going to see more of that going forward.”

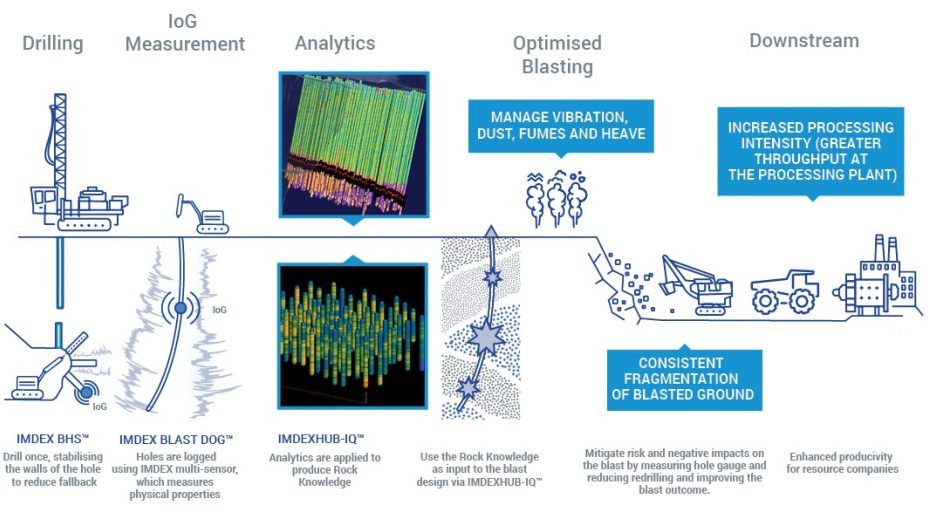

Longwave Capital Partners’ PM David Wanis is watching global mining-tech firm Imdex (ASX:IMD).

“Imdex is a mining technology business. It’s a real business – real revenues, real earnings, real cash flow – but it’s also a business that’s invested almost $100 million in R&D over the past five years in new products to grow their business into new markets.

The company reported record revenue of $341.8 million, a 29.3 per cent increase on the same time last year.

Record EBITDA of $104.9 million was an increase of 38.9 per cent on last year.

Net Profit After Tax of $44.7 million was up 41 per cent on last year.

Net cash of $24.2 million was down 49.3% on the same time last year but followed the acquisition of MinePortal 3D visualisation software to accelerate IMDEX BLAST DOG for mining production, and an investment in Datarock Holdings, which develops image machine learning and artificial intelligence software to extract value from geo-scientific images.

This is Blast Dog, BTW:

The company declared a full-year, fully franked dividend of 1.9 cents per share taking its full year dividend to 3.4 cents per share representing a 42 per cent increase on the prior year.

And if we track how the market values a company like Imdex versus some of these ‘tech hope stocks’ in the market today, there’s a massive disconnect. There’s a big disconnect between the doers – the companies who are actually innovating and executing – versus those that are promising and are built off hype.

We think what we’ll see in the very short term is an improvement in their mining technology as a percentage of their revenue that will lead to an expansion in their EBITDA margins. But strategically longer term it’ll also potentially expand their market size by four times – doubling from existing into new exploration, and then from exploration into production.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.