Money Talks: Investing in this gold producer could pay serious dividends

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Stockhead taps an extensive list of experts in Money Talks, our regular drill down into the stocks investors are looking at right now.

Today, we hear from Simon Popple of UK-based Brookville Capital.

Remember – investors don’t make a profit until they sell, Popple says.

“Never love anything that can’t love you back,” he says.

“With Chalice Mining (ASX:CHN) making over a 2000 per cent gain since I told you about them and Challenger Exploration (ASX:CEL) —my Christmas stocking filler — up over 78 per cent in just a few months, I’m selling both,” Popple says.

“To put these price movements into perspective — if you’d invested $10,000 in Chalice when I told you about them your investment would now be worth over $200,000.”

He’s hanging onto plenty of other stocks, though.

“In September 2019 I told you about Evolution Mining (ASX:EVN) when the shares were $4.62,” Popple says.

“As I write the share prices are $4.61; I’m glad to say, I’m hanging on to these. I’m going to explain why later.

“Then in November 2019 I passed on Bellevue Gold (ASX:BGL) at 47c and Gold Road Resources (ASX:GOR) at $1.07.

“These have had a good run with shares prices moving up to $1.02 and $1.22 respectively. Again, I’m hanging on.”

More recently, Popple picked:

- Metalicity (ASX:MCT) at 20 cents

- Mandrake Resources (ASX:MAN) at 8 cents

- Nex Metals (ASX:NME) at 6 cents, and

- Lynas Corporation (ASX:LYC) at $5.05

“It’s really early days with all these – so I’m hanging on to all of them,” Popple says. “At least for now.”

Big dividends

Popple loves the producers over explorers for one main reason – dividends.

A dividend is the distribution of some of a company’s earnings back to shareholders, often on a quarterly/half-yearly basis.

“In these challenging times we’re really looking for two things from our gold and silver producers – increasing production and reducing costs,” Popple says.

“Three if you factor in metal price movements, but given they’ve got no control over those we really need to focus on the first two.”

Take Evolution Mining for example. Their dividend policy is 50 per cent of free cashflow – which could result in some very nice payments to shareholders.

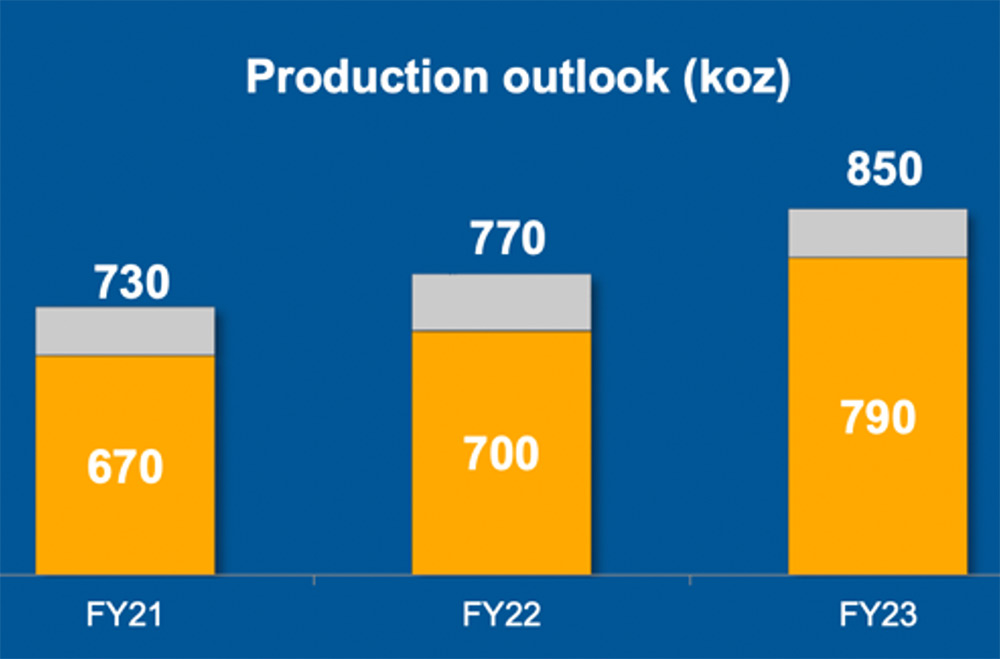

“As you can see from the chart below, over the next three years they are forecasting production to expand quite significantly,” Popple says.

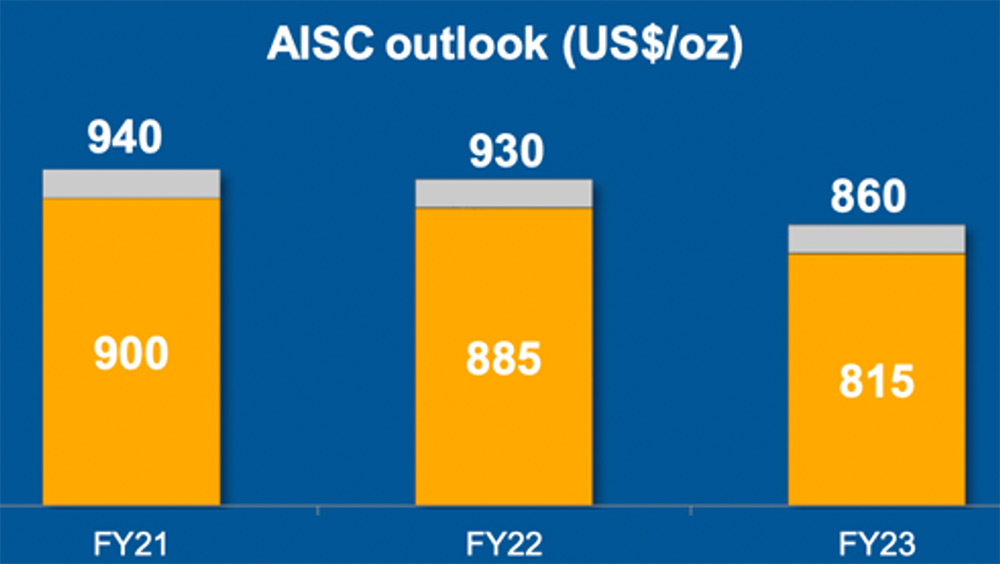

“Not only that, but their costs are also heading the right way. Here is a chart from the same presentation:”

This increasing production forecast, coupled with a lower cost outlook should result in much stronger cashflow – especially if the gold price is kind, Popple says.

“They’re already leading their peers on cashflow. And I’m hoping this will get better!”

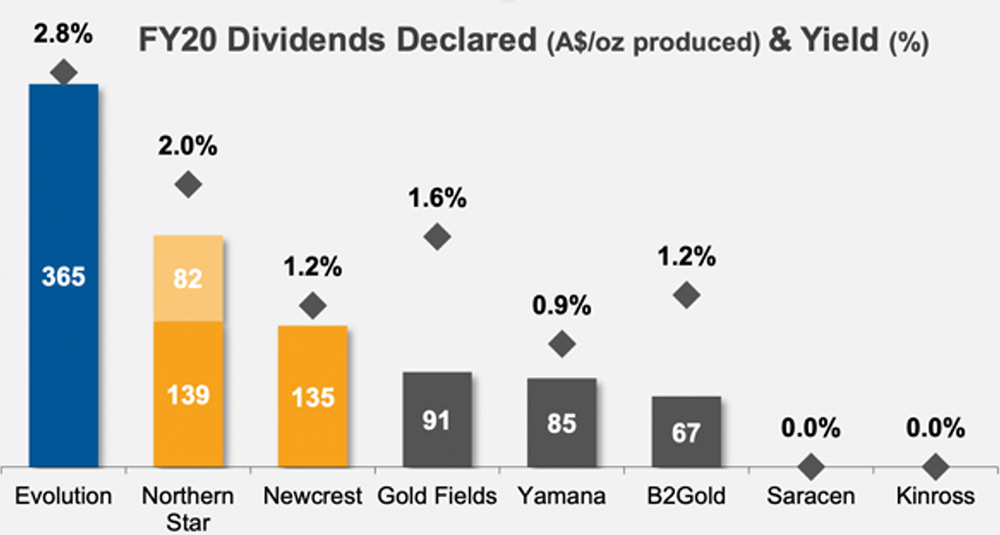

Which brings us to dividends. There are two important areas here – dividend growth and how Evolution compares to the peer group.

“As you can see from the chart below, they’ve become good dividend payers, with an increasing percentage of their revenue being distributed as a dividend,” Popple says.

Then the next chart, which compares them to their peer group:

“The number you should focus on is the 2.8% yield (which is better than you’re likely to get from a fixed instrument),” Popple says.

Why could dividends be exciting?

The price of Evolution shares today is ~$4.61. The total dividend per share in FY 2020 was 16 cents per share, which is a yield of 3.47 per cent, Popple says.

“Now let’s say [the dividend] increases to 22 cents per share – a big ‘if’”.

“That means a dividend yield of 22/461 = 4.77 per cent.”

Check out this share price chart:

“Let’s assume you bought your shares when they were around $2 and held on them,” Popple says.

“Not only would you have been sitting on a nice capital gain… but with a dividend of 16 cents a share in FY2020 – that’s a yield of 8 per cent on your initial investment.

“If the dividend keeps going up, then even if the share price jumps around, that income could be very important.”

Popple’s point is really simple.

“If you believe the gold price will improve and hold these shares for their dividends, then over time you could be getting a very nice dividend yield,” he says.

After completing his MBA at Birmingham University in 1993, Simon joined the corporate finance team at Singer & Friedlander working on small and mid-cap mergers and acquisitions. In 1997, he joined the senior banker team at ABN AMRO before moving into their corporate finance department in 1999, where he specialised in private equity. He then became head of investment management at Strutt & Parker’s Real Estate Financial Services before becoming a director of Topland, one of Europe’s largest private investment companies.

In 2008, he set up Brookville Capital, a capital-raising business which subsequently won mandates with, amongst others, Bunge, the Bank of China (Suisse) and Fleming Family & Partners. He now writes the Brookville Capital Intelligence Report which covers gold and silver mining stocks.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.