You might be interested in

Mining

All the richest people in the world are stockpiling gold. These ASX stocks are racing to supply it

Mining

Gold Digger: Overvalued or racing towards US$2500/oz? Will the real gold price please stand up?

Mining

Experts

Money Talks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to see what’s hot, their top picks and what they’re looking out for.

Today, we hear from Simon Popple of UK-based Brookville Capital.

Gold, gold, gold.

Popple says there used to be two certainties in life; death and taxes. There are now three: death, taxes and escalating global debt.

“I think that ever increasing global debt provides a solid backstop for gold, so I see the price improving,” he says.

“It’s obviously impossible to predict where it will go, but I would not be surprised if it hit $US1,600 ($2,360) per ounce at some point in 2020.”

BELLEVUE GOLD (ASX:BGL)

Market Cap: $265m

If Bellevue keeps finding high-grade gold at its current rate, production may not be that far away, Popple says.

“As things stand, they’re currently sitting on resources of 1.8 million ounces of gold. That in itself is an impressive number, especially as this used to be an operating mine.

“What’s more exciting is that the resources are open – which means there’s potential for this number to become significantly higher.

“However, the financing for a new plant is not in place, so they’re still very much an explorer. Being an explorer, this cash has come from share placements.

Here is a summary of those:

“Given the current share price is 45.5c, I would view this as an attractive entry point because this year’s capital raises were done at higher prices, so I would not be expecting any significant ‘profit takes’ until the price has moved upwards from here.

“And from a balance sheet perspective, they look strong. Particularly because they have already raised the cash to fund the current (2019/20) drill program.”

READ MORE about Bellevue:

High-grade Bellevue is now 1.8moz and growing fast

90 Seconds With…Steve Parsons, Bellevue Gold

PANTORO (ASX:PNR)

Market Cap: $170.5m

At its Halls Creek project, debt free producer Pantoro has just completed a major capital investment program to lift production from ~50,000oz per annum to 80-100,000ozpa and lower all in sustaining costs (AISC) to $1,000/oz from mid-CY19.

However, a recent deal changed everything, Popple says.

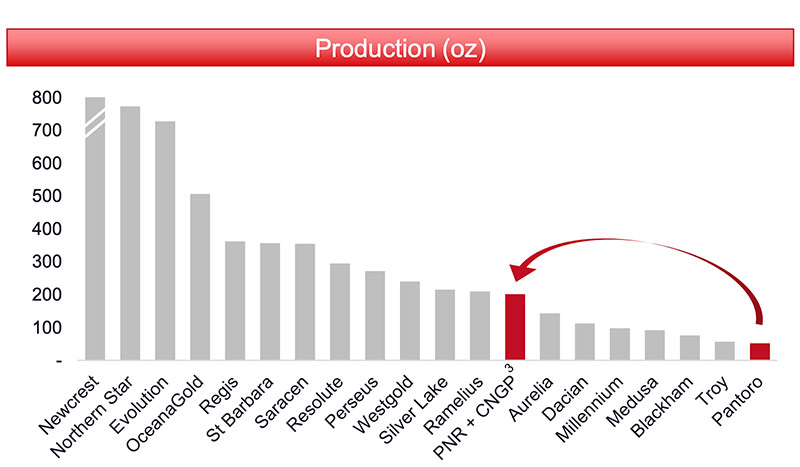

“Pantoro recently acquired a 50 per cent stake and management control of the high-grade 4.4moz Central Norseman Gold Project (CNGP),” he says.

“I think it provides a strong foundation for growth and creates the opportunity for them to execute a strategy as a high-grade, multi-mine gold producer.

“But it’s not going to be straight forward. The market does not seem to like the additional risk they’ve taken on – especially the risk of a cost over-run on the refurbishment of the [existing] mill.

“The market is also probably weary of Norseman’s somewhat chequered history.

“But there are really three reasons why I like it. Firstly, before the acquisition PNR were valued at around $360 per resource ounce – which looked a little pricey.

“Following this deal this has dropped significantly to around $69 per resource ounce. So, on this metric, it seems to be an attractive entry point. This is on the basis of them having half of CNGP’s existing resource of 4.4m ounces.”

“The second reason is that if they can get CGNP back into production, they’ll ‘leapfrog’ several other companies to become one of the smaller mid-tier producers – which should put them on more radars as far as investors are concerned.”

“The third reason I like it is the vendor is taking $20m in PNR shares. Appreciate there’s also a cash element, but there’s an alignment of interests which I like.”

READ MORE about Pantoro:

Tim Treadgold: Pantoro is trying to solve the puzzle at one of Australia’s richest goldfields

More than 4 million oz says Pantoro could be running with the big boys very soon

GOLD ROAD RESOURCES (ASX:GOR)

Market Cap: $936m

Gold Road is Australia’s newest mid-tier gold producer. Its flagship project is the Gruyere JV with Gold Fields, 200km east of Laverton in WA.

Gold Road announced commercial production at the end of September 2019 which shows things are going the right way, Popple says.

“More importantly, they recently provided an update on production – which I’m relieved to say – was very encouraging.

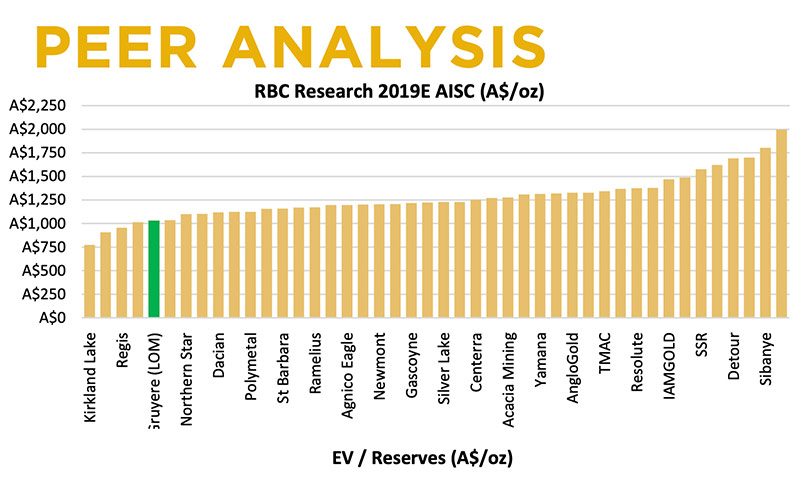

“Not only do they expect production to be at the upper end of annual guidance for 2019 – the range was 75,000 to 100,000 ounces (on a 100 per cent basis), but AISC are still expected to come in between $1,050 and $1,150 per ounce.

“If you take a look at the chart below that sets out AISC, it gives you a good feel as to how they compare to their peer group (they are the green bar):

“It’s also worth remembering that the guidance for this year is only for a few months of production. Now the Gruyere project is up and running they are looking to produce between 275,000 and 300,000 ounces per annum.

“In addition to the low-cost base, there’s a second reason I like this company so much.

“The JV only covers a fraction (144sqkm) of their extensive land package of around 5,000sqkm. Gold Road owns 100 per cent of these tenements outside of the JV.

“There’s clearly huge potential for more discoveries. For example, at Yaffler South, bedrock RC drilling intersected some decent mineralisation, with assays expected by the end of the year.

“There could be more good news to come.”

READ MORE about Gold Road:

How this small cap explorer became a +$1.2 billion success story

Gruyere is proof that dreams do come true for small cap explorers

After completing his MBA at Birmingham University in 1993, Simon joined the corporate finance team at Singer & Friedlander working on small and mid-cap mergers and acquisitions. In 1997, he joined the senior banker team at ABN AMRO before moving into their corporate finance department in 1999, where he specialised in private equity. He then became head of investment management at Strutt & Parker’s Real Estate Financial Services before becoming a director of Topland, one of Europe’s largest private investment companies.

In 2008, he set up Brookville Capital, a capital-raising business which subsequently won mandates with, amongst others, Bunge, the Bank of China (Suisse) and Fleming Family & Partners.He now writes the Brookville Capital Newsletter which covers gold and silver mining stocks.