Money Talks: Here’s a special small cap stock(ing stuffer) for gold bugs

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Stockhead taps an extensive list of experts in Money Talks, our regular drill down into the stocks investors are looking at right now.

Today, we hear from Simon Popple of UK-based Brookville Capital.

Popple’s small cap stock picks have been right on the money in 2020.

He says he made a “tidy profit” selling out of some stocks like Silver Lake, Newcrest, Pantoro, St Barbara and Silver Mines. Others he is hanging on to.

In late 2019, he picked Chalice Gold (ASX:CHN) at 22c, Evolution Mining (ASX:EVN) at $4.62, Bellevue Gold (ASX:BGL) at 47c, and Gold Road at $1.07.

He’s hanging to all of these stocks, which have since gained 1600%, 6%, 187% and 18% respectively.

More recently, he flagged Metalicity (ASX: MCT) at 20c, Nex Metals (ASX:NME) at 6c, and Mandrake Resources (ASX:MAN) at 8c.

These are three high risk, high reward exploration plays, he says, “but I’m holding on to them as well”.

Here’s one more stocking filler for punters to consider prior to the Christmas break.

Challenger Exploration (ASX:CEL)

Market Cap: ~$140m

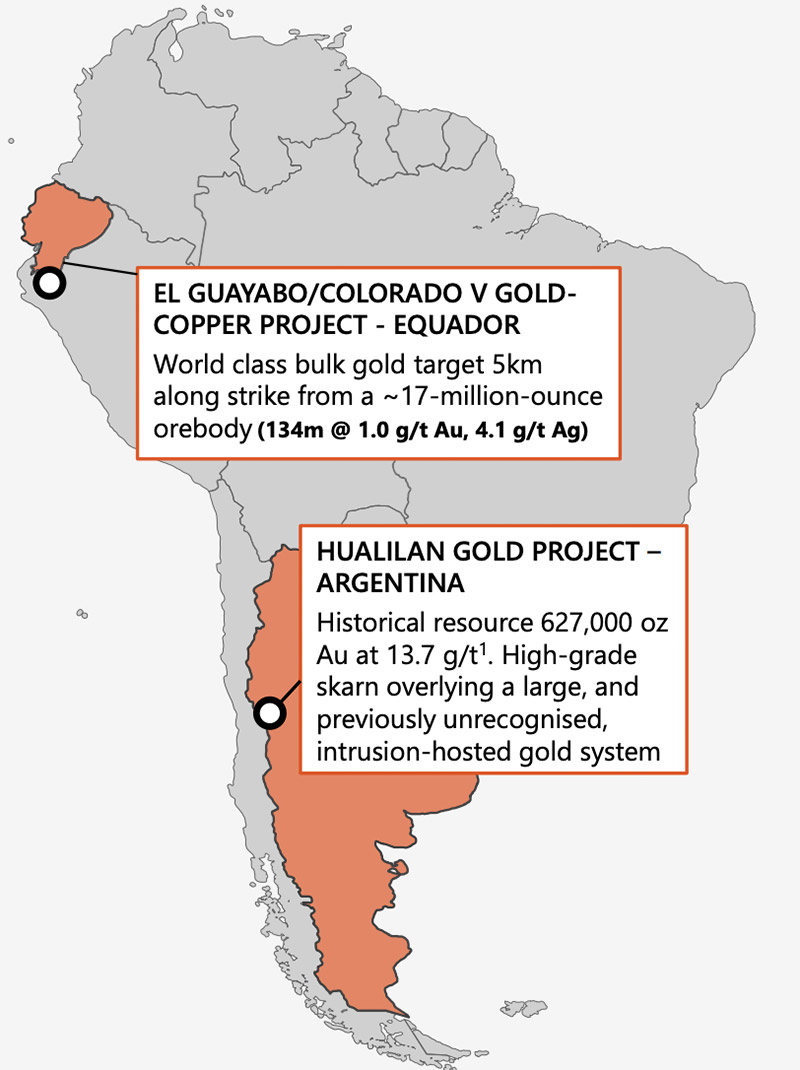

Challenger has two exploration projects: the Hualilan gold project in Argentina, and the El Guayabo gold-copper project in Ecuador.

Hualilan is in San Juan, Argentina, which is viewed as a Tier 1 mining jurisdiction.

“They can earn up to 75 per cent in this exciting project which already has a historical resource of 627,000oz of gold at a high grade of 13.7g/t,” Popple says.

“Because of a dispute — that did not involve Challenger and is now settled — there has been no modern exploration on the project over the past 15 years.

“It is very early days, but Challenger have already had some decent drill results including 8.3m at 17.7g/t gold, 257 g/t silver and 0.3 per cent zinc.”

There’s a lot more exploration to be done with the mineralisation remaining ‘open’ in all directions.

The El Guayabo gold-copper project is a low grade, large tonnage project 5km away from a huge 17+ million ounce gold orebody in Ecuador.

“The BIG question being – does this orebody extend on to their land?” Popple says.

“If it does, we could have a hugely valuable asset.”

Popple evaluates potential investments like Challenger using his B.R.I.D.G.E. system – an acronym for which stands for:

- Balance sheet

- Resources

- Infrastructure

- Diversification

- Grade, and

- Exploration potential.

Balance sheet

The company has no debt and following a recent capital raise, there is about $21 million in cash. Over the next 12 months the current budget includes around 50,000m of drilling, geophysics, metallurgy, resource work as well as a scoping study, Popple says.

“I’d expect this drill program to be extended – assuming they deliver some decent results,” he says.

“I’m not expecting them to come back to the market for at least 12 months.

“If the exploration delivers, they hope to raise more money at a higher share price.”

Resources

There is a non-JORC compliant resource for Hualilan, which Popple expects Challenger to update if they get some decent exploration results – probably Q2 next year.

“The target is to get the resource over 1 million ounces – time will tell as to whether they manage to do this,” he says.

“Although the initial resource was 627,000oz @ 13.7 g/t AuEq (around 11 g/t Au, 45 g/t Ag, 2.5 per cent zinc), I want to point out that this is gold equivalent.

“To be a little more conservative, I’d suggest you view this as an 11 g/t gold resource.”

There is no resource at the earlier stage El Guayabo/Colorado V project yet.

Infrastructure

This is particularly important for explorers like this.

It doesn’t really matter how great a resource is if the cost to put infrastructure in place makes it uneconomic to mine.

Fortunately, Hualilan has a paved road 400m away, power 2km away, and a source of permanent water 4km away.

“[And] If they do decide to take it into production there is a 2Mtpa CIL plant on care and maintenance about 40km away,” Popple says.

“If they make some major discoveries they could well choose to build their own plant.

“But it’s a nice option to have if the project turns out to be smaller than envisaged.”

At El Guayabo/Colorado V there is a sealed road 3km from the site with grid power, water, and internet — so Challenger in good shape from an infrastructure perspective if they find anything.

Diversification

This is more about having a diversified portfolio, however it’s worth pointing out they’re working on two projects, Popple says.

“They don’t have all their eggs in one basket.”

Grade

There is a lot of excitement about the higher grade ore at Hualilan – anything above 4 g/t is generally viewed as viable and Challenger have a resource of around 11 g/t of gold.

“It’s worth pointing out that in addition to these high grades — which are at depth — there is also some potential for some porphyry gold – which tend to be shallower and therefore often suitable for open-pit mining,” Popple says.

The El Guayabo/Colorado V Project is a lower grade “bulk” project.

“The grade so far has largely been between 0.7-1 g/t gold,” Popple says.

“This compares with Cangrejos which has 17 million ounces at 0.6 g/t Au, 0.1 per cent copper.

“But clearly, they are hoping to find a lot more ore.”

Exploration potential

With less than 10 per cent of both projects having already been explored, there is a lot of potential to find more gold.

“7,500m of drilling has been completed at Hualilan, but there’s still 44,000m of drilling to be done in the current program,” Popple says. “They’ve got 5 rigs turning and it’s expected to take a further 7 to 8 months to complete this.”

Overall, Challenger represents a high risk, high reward opportunity.

“Although a favourable gold price is likely to help, this is really all about the exploration results – and we are very much in the hands of mother nature on those,” Popple says.

“All I would say, is they seem to be looking in the right place!”

After completing his MBA at Birmingham University in 1993, Simon joined the corporate finance team at Singer & Friedlander working on small and mid-cap mergers and acquisitions. In 1997, he joined the senior banker team at ABN AMRO before moving into their corporate finance department in 1999, where he specialised in private equity. He then became head of investment management at Strutt & Parker’s Real Estate Financial Services before becoming a director of Topland, one of Europe’s largest private investment companies.

In 2008, he set up Brookville Capital, a capital-raising business which subsequently won mandates with, amongst others, Bunge, the Bank of China (Suisse) and Fleming Family & Partners. He now writes the Brookville Capital Intelligence Report which covers gold and silver mining stocks.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.