Money Talks: Excuse me, this stock is a little on the rare side

Pic: Getty

Stockhead taps an extensive list of experts in Money Talks, our regular drill down into the stocks investors are looking at right now.

Today, we hear from Simon Popple of UK-based Brookville Capital.

Over the past year and a bit Popple, who specialises in junior mining companies, has highlighted a number of ASX mining and exploration stocks with growth potential.

A fair few of them – mostly gold — have performed well since.

“In September 2019 I told you about Chalice Gold Mines (ASX:CHN) (22c) and Evolution Mining (ASX:EVN) ($4.62),” he says.

“As I write the share prices are $4.08 and $4.77. I’m glad to say, I’m hanging on to both of these.

“Then in November I passed on Bellevue Gold (ASX:BGL) at 47c and Gold Road Resources (ASX:GOR) at $1.07.

“These have also had a good run with shares prices moving up to $1.03 and $1.22 respectively. Again, I’m hanging on.

“On 17 December I then told you about Challenger Exploration (ASX:CEL) when the shares were 21 cents; today they’re at 34.5 cents.

“Again, I’m not selling.”

Popple also flagged Metalicity (ASX:MCT) (20 cents) Nex Metals (ASX:NME) (6 cents) and Mandrake (ASX:MAN) (8 cents).

Three very high-risk plays – but he is holding on to them as well.

“They are yet to deliver, and the current share prices are 18 cents, 4.5 cents and 8 cents,” he says.

“As far as I’m concerned, the best is yet to come.”

Here’s another slightly different stock for punters to consider.

LYNAS CORPORATION (ASX:LYC)

Rare Earth Elements (REE) are a group of 15 elements in the periodic table known as the Lanthanide series, plus yttrium and scandium used in many high tech and future facing industries, including electronics, wind turbines, catalytic converters, and electric and hybrid motor vehicles.

As these sectors boom, so will rare earths demand.

“They are often called the ‘vitamins of modern technology’ because of their special properties which help improve technologies,” Popple says.

“They are an essential part of many high-tech devices.

“They’re called rare for good reason. There’s not a huge amount of them about, especially outside China.

“In a nutshell – they’re important.”

In 2008, China accounted for more than 90 per cent of world production of REEs, and by 2011, China accounted for 97 per cent of world production.

As the only integrated miner and processor of scale outside China, Lynas provides an important alternative for manufacturers in high tech markets who are based outside of China, Popple says.

Lynas is the only large scale producer of separated rare earths outside of China and the second largest in the world. Its flagship project is Mt Weld near Laverton in WA, which is widely regarded as one of the highest-grade rare earth mines in the world.

Lynas also operate the world’s largest single rare earths processing plant in Malaysia, and there are plans to build another processing plant in Australia.

The Lynas 2025 growth strategy — announced in May 2019 — aims to expand Lynas’ industrial footprint with a planned processing facility in Kalgoorlie, WA.

Proceeds from a $425m equity raising that took place last year will be used to fund the Lynas 2025 foundation projects, namely – the planned Kalgoorlie Rare Earths Processing Facility and associated upgrades at the Lynas Malaysia Plant.

The offer price was A$2.30 per new share.

“If things go to plan, they are hoping to have completed the Kalgoorlie plant as well as the upgrades to the processing plant in Malaysia by the end of 2023,” Popple says.

“In July 2020 they also signed a contract with the US Department of Defense (DoD) for detailed design of a heavy rare earth separation facility.

“[This] facility is an attractive and strategic proposition, providing an expanded product suite as well as the only source of separated Heavy Rare Earths outside China.”

Let’s evaluate Lynas using Popple’s B.R.I.D.G.E. system.

Balance sheet

“On 30 September Lynas had closing cash balance (cash and short term deposits) of A$522.0m,” Popple says.

“Although this is a huge leap from their year-end cash balance, it does take into account the capital raise of A$425 million.

“As things stand their debt at 30th September was US$145m, which, given their cashflow from operations was US$78.8m in the year to 30th June 2019, is not something I’m unduly worried about.

“(I’ve used 2019 numbers because they had to close down their operations last year because of COVID-19.)

“Given the value of the overall business which has a market value of around A$4.5 billion, should they ever need to pay this [debt] off, then only a very modest capital raise would be required.”

Resources

“When looking at rare earths, the analysis is slightly different to gold and silver companies,” Popple says.

“But the important thing – potential cashflow – remains the same.

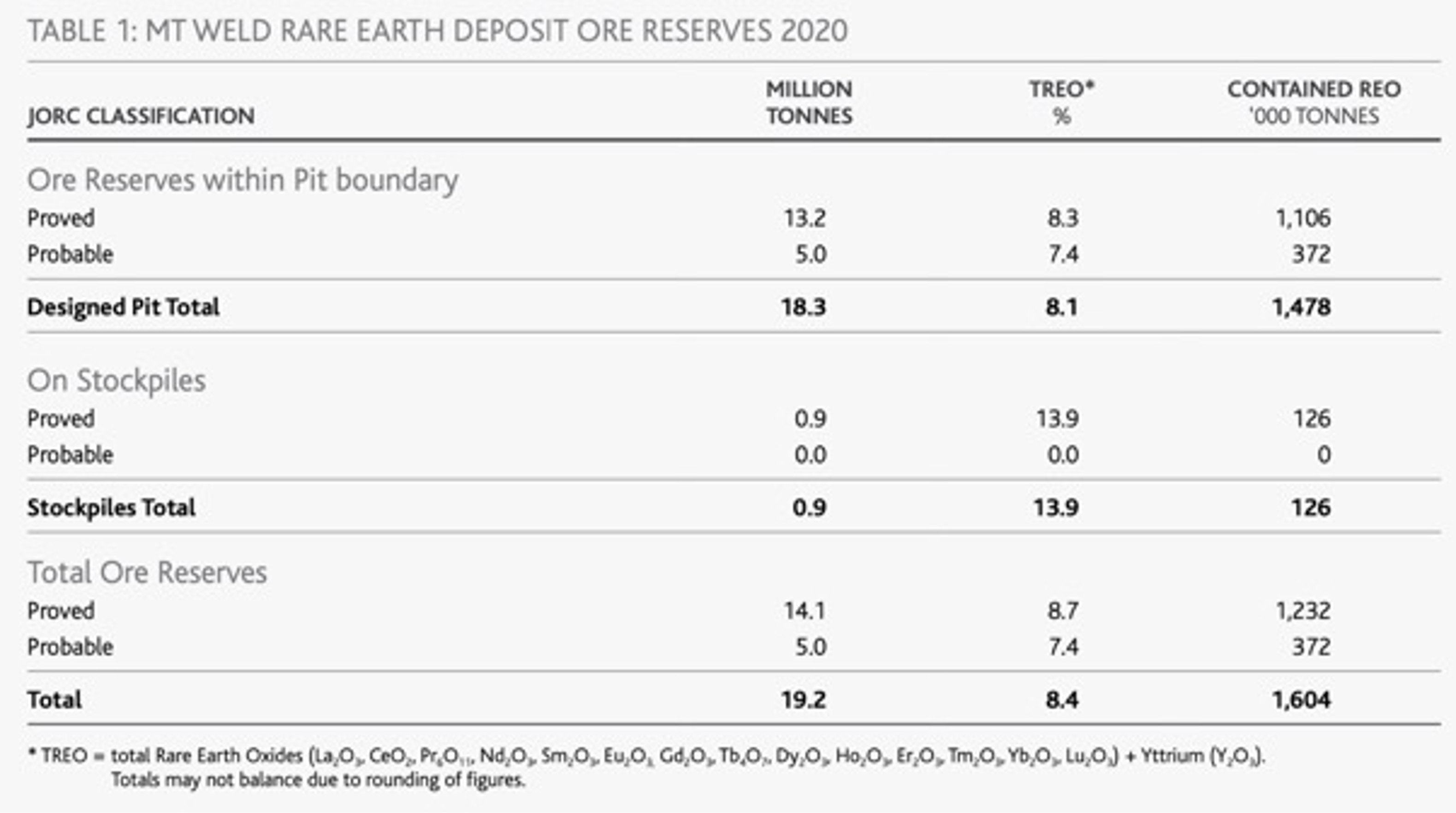

“Set out below are the reserves for Mt Weld, their flagship asset.

“The key things to look at are the TREO (Total Rare Earth Oxide) numbers.

“I’ve done some digging around on this and although there’s no firm evidence that I’ve found, several sources have indicated that it’s a ‘high grade’ project.

“The second point to note is that these reserves are expected to last for at least 25 years. So, the cash should be flowing for a long time.”

Infrastructure

“As the mine has been operating for several years, I think it’s fair to say that the infrastructure is fine,” Popple says.

Diversification

“I would view producing several rare earths as a positive – if a market for one softens, the market for the others will hopefully provide some diversification,” Popple says.

“They are however very dependent on one asset – Mt Weld.

“So, from a market (demand) perspective, I would view them as quite well diversified, but from a production (supply) point of view – they are not.”

Grade

“Because there are several rare earths it’s not as easy to determine what is high and not high grade,” Popple says.

“But as I said earlier, there are several sources that suggest this is a high grade project.”

Exploration potential

If you look at the lower of the two lines in the diagram below, you’ll see that the existing reserves go down to that level,” Popple says.

“That’s our 25 years of reserves. Over the past year they’ve been exploring below this level.

“As this is not an area I’m familiar with, I asked the company to comment and this is what they said:

The depths are well within what can be mined by an open cut pit. A very significant point is that the current reserve is within an oxidised enriched zone (fine grained, high grade).

Below this is a transition zone and then the primary mineralisation (the source of the oxidised enriched zone) which is lower grade but the mineralisation is much coarser grained (so potentially easier to process).

If the current reserve is mined first – there is less stripping required. The deposit is open at depth (we don’t know how fair it extends into the earth).

“Given the existing reserve is already 25 years and I see some solid demand for rare earths over the next few years, I’m less concerned about the exploration potential,” Popple says.

“f they find anything then great, but as we don’t know how important rare earths will be in 10 years let alone 25 years, I’m happy with what they already have.

“For me this play is more to do with the price of rare earths over the next few years rather than what they find through exploration.”

After completing his MBA at Birmingham University in 1993, Simon joined the corporate finance team at Singer & Friedlander working on small and mid-cap mergers and acquisitions. In 1997, he joined the senior banker team at ABN AMRO before moving into their corporate finance department in 1999, where he specialised in private equity. He then became head of investment management at Strutt & Parker’s Real Estate Financial Services before becoming a director of Topland, one of Europe’s largest private investment companies.

In 2008, he set up Brookville Capital, a capital-raising business which subsequently won mandates with, amongst others, Bunge, the Bank of China (Suisse) and Fleming Family & Partners. He now writes the Brookville Capital Intelligence Report which covers gold and silver mining stocks.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.