Guy on Rocks: This report is about to have a significant impact on smouldering gold prices

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

A good week for precious metals on the back of spiralling US inflation figures which came in at an eye-watering 6.2% year-on-year (figure 1) and the PPI (Producer Price Index) at 8.6% (figure 2).

Federal Reserve chair Johnathon Williams calculates his inflation figures the old way (using the same inputs applied in the 1980s) and comes in at a whopping 14%.

If this isn’t a good platform for gold I don’t know what is!

Anyway, gold touched US$1,885/oz on Wednesday before pulling back to US$1,854/oz (figure 3) with silver, platinum, and palladium all stronger.

The pull-back in gold from five-month highs was more than likely a reaction to a rising US dollar (up 52 points – figure 4) responding to strong monthly advance sales in the US that were up 1.7% year-on-year to US$638.2 billion.

This was just over double the growth of retail and food services in September, which came in at $627.5 billion, an increase of 0.8%. Industrial production was also up over 1.6% in October.

These figures aren’t surprising given the underlying inflationary affects boosting sales figures.

The gold bulls will be watching the updated PCE core inflation index for October which is due for release on November 24. They’re likely to have a significant influence on gold prices.

Turns out that Kitco gold survey showed the Wall Street bulls, who were in the majority, got it right on the gold price trajectory.

I suppose that is why the Main Street pundits who forecast a fall in gold are on Main Street.

In other news, the copper market remains chaotic with sellers outnumbering buyers and trading around US$4.40/lb with the futures remaining in backwardation.

Finally, there is some light at the end of the tunnel for iron ore which is sitting around US$89/tonne (62% fines) with the likelihood of monetary easing in China over the next quarter which is likely to see a reversal of Chinese steel production that was off 21% in September and 9% in August (figure 5).

Steel consumption over September was also down over 20%.

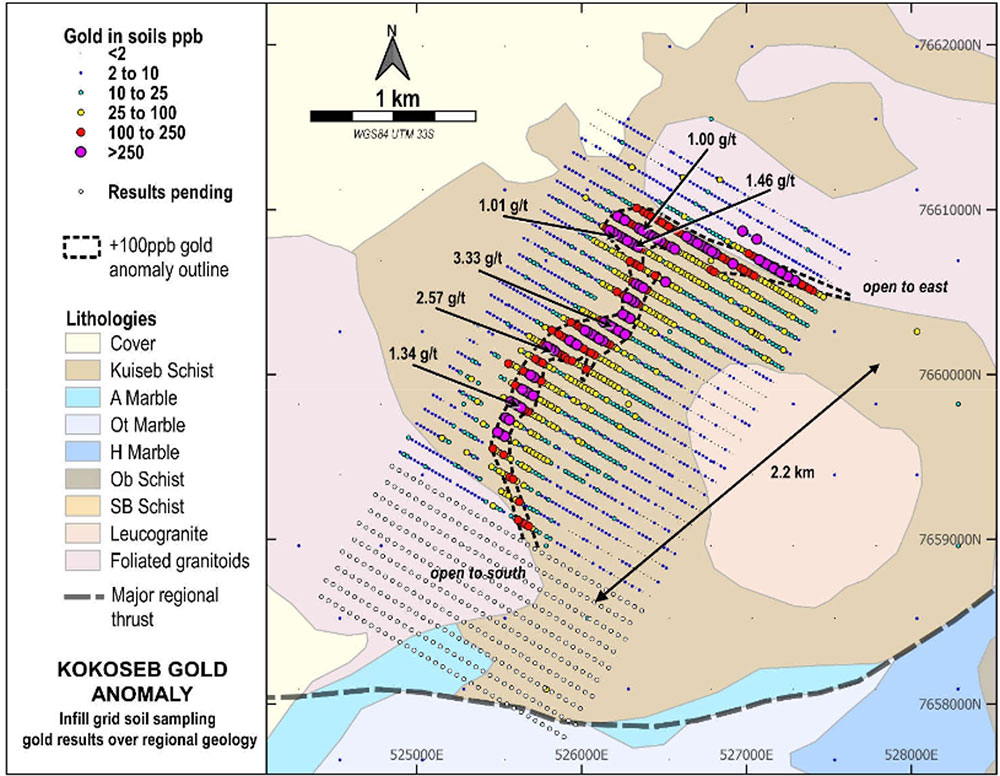

Tanga Resources (ASX:TRL) (figure 6) has recently completed a $4.6 million capital raising (ASX Announcement 15 November 2021) at 5 cents to fund exploration at its Okombahe gold permit (part of the Damaran Project covering 2,838sqkm) in Namibia where a recently completed soil survey returned a +2.2km undulating strike defined by the “Kokoseb” +100ppb gold anomaly coincident with elevated arsenic and antimony.

This included peak values in excess of 1g/t Au with the anomaly remaining open in both directions along strike.

Mapping and trenching along the anomaly has also identified an abundance of felsic intrusions (dykes, sills etc) within folded fine-grained quartz-biotite schist with gold anomalism appearing to be situated along the contact zone between these granites and the metamorphic sediments.

Reconnaissance soil sampling, mapping, and trenching is ongoing with results due shortly.

I am not sure what the gold anomalism thresholds are like in that part of the world, but I do recall in the Tanami (North Flinders Mines Ltd) we used to dance a merry jig (when I wasn’t half-asleep in the back of the Toyota Landcruiser) if we could string something together at +5ppb Au, so I am thinking 100ppb should do the job.

At an EV of just under $20 million the stock isn’t cheap (nothing is cheap as we know) however I am quietly optimistic that drilling in early 2022 will hit something of interest.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.