Guy on Rocks: Some men just want to watch the world burn… and a fine cigar

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Apologies for the delay in this week’s column however the extreme volatility resulted in some out-of-date commentary by the time I got to the end of my cigar as the VIX Index spiked from 12.8 to 19.8 over the last three weeks. VIX is now sitting at somewhat elevated levels of 18.48. So, the solution last week was to continue doing what I do best and that is lighting up another cigar and looking out the window while chaos reigned supreme.

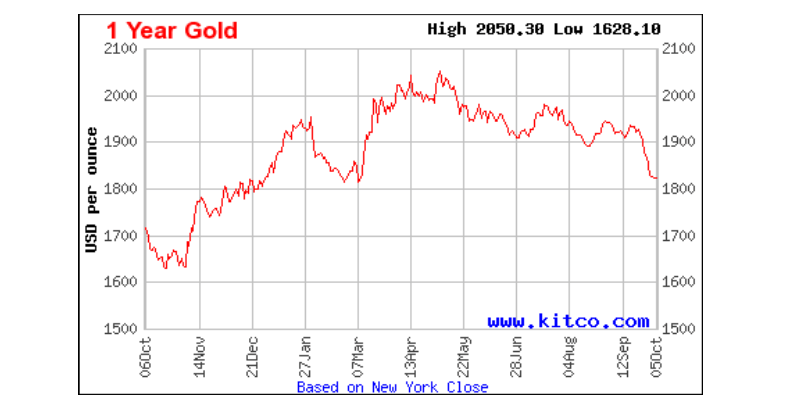

All eyes were on the bond market last week with US treasuries surging and base and precious metals remaining under pressure. Gold (figure 1) had a tough week down US$16 closing at US$1,831/ounce after a late rally on Friday as US 10-year treasuries (figure 2) surged to 4.83% up over 30 basis points in the last week representing a 16 year high before pulling back to 4.79% on Friday. Silver closed the week at US$21.5/ounce down 2.8%.

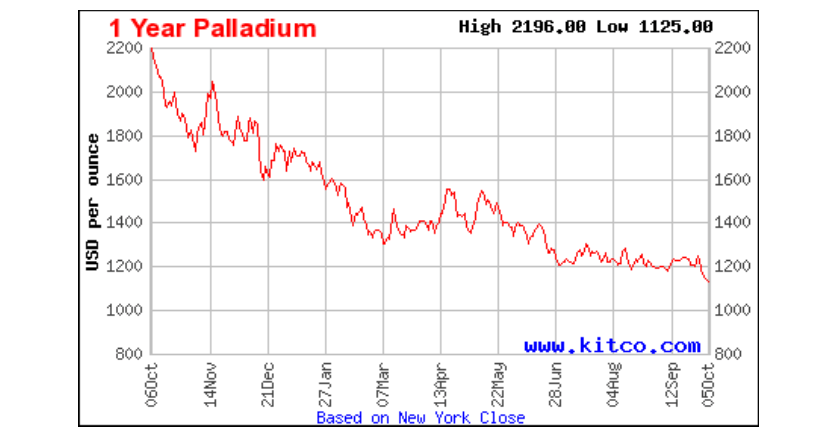

Other pressure metals sold off last week included palladium which was off 7.13% to close at US$1,135/ounce. Palladium has declined over US$1,000/ounce over the preceding 12 months (figure 3) representing a 4.5 year low. Platinum was also off 3.1% last week and closed at US$877/ounce.

It appears that the market is now factoring in inflation as being higher for longer as the risk-off sentiment continues. PMI figures in the US came in under 50 (bearish) with a late rally in the DOW on Friday to 33,407 (up 0.87%) in response to a stronger than expected US jobs report that saw 335,000 jobs added. Mercenary Geologist Mickey Fulp, however, points out that 50% of this number were part-time jobs with the balance mostly government positions that had been filled.

On the domestic front, last week’s August CPI rose from 4.9% to 5.2% suggesting that inflation is very much alive and well. Inflation in the US last week came in at 3.9%, down from August’s revised increase of 4.3%, more or less in line with market expectations.

Unfortunately, gold is likely to remain under pressure in the near term as the Federal Reserve is likely to maintain its aggressive monetary policy for longer than expected which will no doubt see rising bond yields and a stronger US dollar. Andrew Hunter from Capital Economics however believes that core PCE inflation will fall below the Fed’s 3.7% projection for the end of this year which should see the Federal Reserve cutting rates early next year.

Lithium hasn’t been spared either with slumping lithium prices in response to the outlook for Chinese demand, a key ingredient in electric vehicle batteries. Lithium carbonate prices in China fell to 166,500 yuan (US$22,814) a ton last Wednesday representing a loss of almost half compared to record highs of 598,000 yuan mid last year.

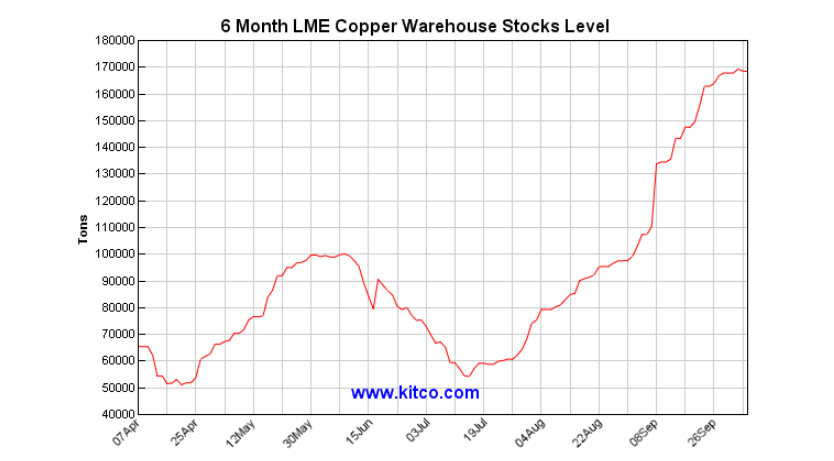

Copper was up 2 cents and was trading at US$3.73/lb earlier last week with some positive signs emerging from China. Morgan Stanley (September 2023) reported that Chinese copper and copper product imports (refined + alloys) rose to 473kt in August, the highest levels since December last year and up 5% month-on-month.

The London Metals Exchange – Shanghai Futures Exchange import arbitrage has also widened with the Yangshan copper premium touching just under US$60/tonne, the highest since December.

Mid-week surging bond yields helped push copper down to US$3.51/lb, heading closer towards the 12-month lows of US$3.40/lb we saw in late CY 2022. After a volatile week copper closed at US$3.56/lb with the three-month futures remaining in a 3 cent contango.

As I mentioned last week, LME stockpiles have risen sharply in the last few months on the back of tepid Chinese demand (figure 4). Bloomberg is now calling on copper to touch US$3/lb, despite BloombergNEF projecting a 50% increase in copper demand over the period 2022 to 2040.

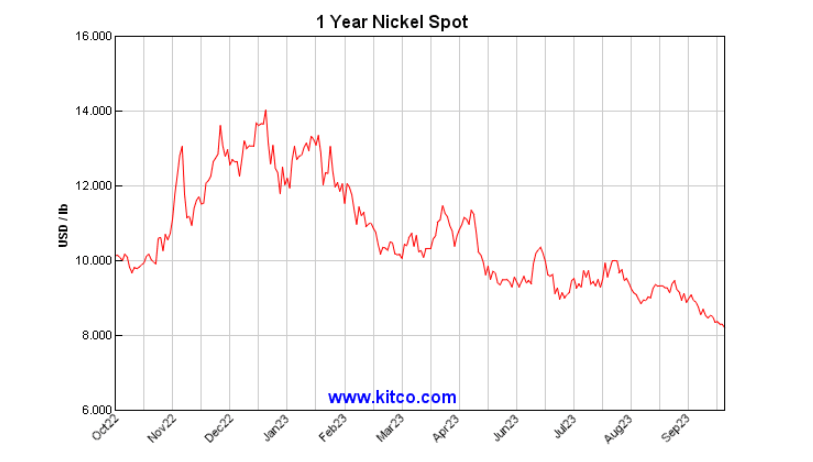

Nickel also remained under pressure last week with surpluses projected over the next two years.

While all eyes are currently on the surging bond market, Robert Minter, director of ETF Investment Strategy at abrdn, pointed out in a recent interview on Kitco News that investors continue to underestimate the growing supply imbalance, impacting the global economy and keeping inflation persistently elevated.

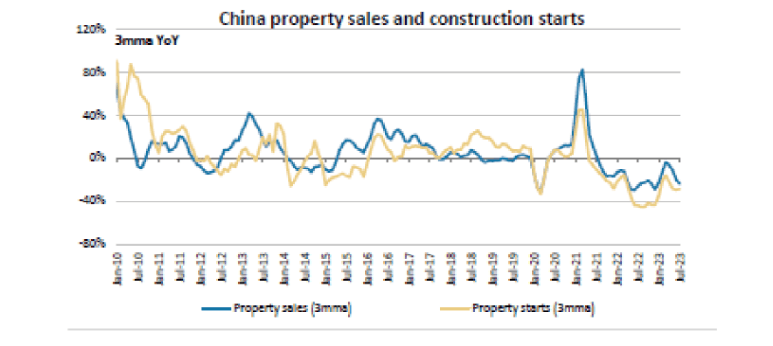

Clearing the flagging property market in China has continued to weigh heavily on the copper price over the last year or so (figure 6). The 17% jump in Industrial profit, however, reported in August may be a sign that the fiscal stimulus is having a positive effect on the Chinese economy.

The market appears to be pricing in a 22% chance of a further rate cut on November 23rd so I anticipate the anti-inflationary monetary policies and strong USD will contribute to downward pressure on both pressure and base metals which, in the case of copper, is hovering around long term incentive prices of US$3.59/lb (Morgan Stanley Research, September 2023).

After surging past US$93/BBL late last month, crude oil pulled back to US$82.97/BBL down 8.5% for the week in response to the collapse of the US bond market. Rigs in the US are now down 160 year to date with oil production flat at 12.9M BOPD. Inventories were off to 2.2M BOPD last week and refineries were down 200,000 BOPD. Not surprisingly gasoline demand was down in the US last week.

The bright spot on the horizon of course remains uranium which traded over US73/lb (a post Fukushima high) before settling at US$69.75/lb late last week. The uranium price is edging closer to incentive prices of US$80/lb which Deep Yellow managing director John Borshoff pointed out at last week’s Morgans Uranium Conference is required to switch on much of the uranium currently sitting in the ground.

As the smoke haze cleared at Cigar Social this week I thought I might stand back and let the dust settle before rolling out another chestnut for consumption by the Stockhead Faithful. With the collapse of the bond market and the flight from risk assets it appears no company has been spared.

A couple of stocks I have mentioned in the last few months are back in to buying territory if you want to take a medium-term view. On this list would include one of the brighter lights of the REE sector namely Malawi rare earth developer Lindian Resources (ASX: LIN) off 5 cents per share to 20 cents since my mid-September mention and American West (ASX: AW1) off a whopping 16 cents per share to 13 cents since early August despite a string of promising copper intersections and a confirmed Elvis sighting.

Despite the volatility, the 12-month outlook for these companies looks extremely positive.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.