Guy on Rocks: Resources ‘supercycle’ is hitting its stride

Pic: Getty

Guy on Rocks is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

Gold finished the week up $US4 to $US1,843 ($2,375) in a week where most precious metals were sold down following higher-than-expected Consumer Price Index (CPI) figures mid-week.

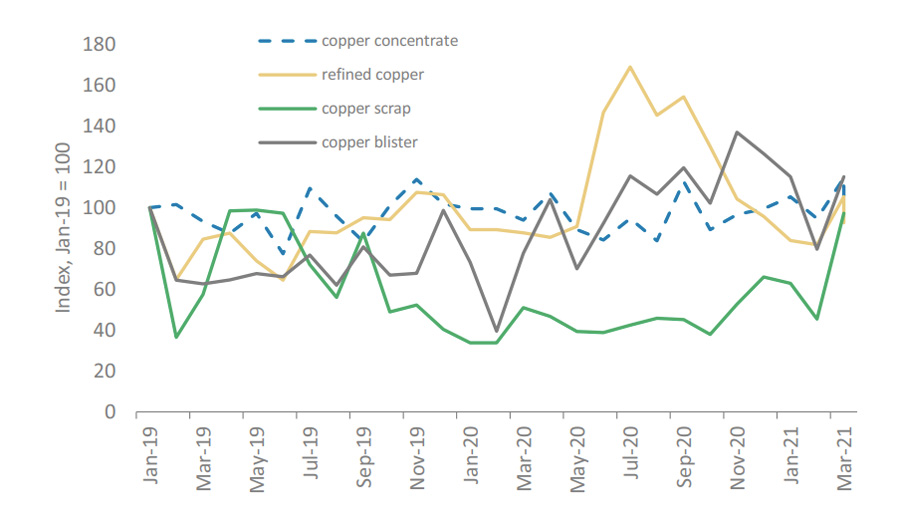

Copper reached all-time nominal highs last week before finishing the week down 6c. We are currently observing reduced concentrate imports in China with a corresponding increase in scrap consumption.

Near-term futures for copper however are showing a negative forward curve out six months, suggesting short-term pressure on the price.

While China appears to be purchasing around 1.26 million tonnes less copper concentrate in 2021 (compared to CY 2020), in response to carbon neutral targets, this reduction in concentrate purchases has seen a corresponding increase in scrap and blister copper purchases in addition to rising domestic mine supply.

Imports of copper blister (98 per cent copper) increased by 245,000 tonnes over 2020, to 1 million tonnes, with a further 63 per cent gain year-on-year over the period January to March 2021.

Scrap imports also increased and were up 150,000 tonnes year-on-year (+73 per cent). Overall domestic refined copper in China was up 4.1 per cent year-to-date. While there is likely to be a decline over May due to smelter maintenance shutdowns, this is likely to have little impact on longer term production.

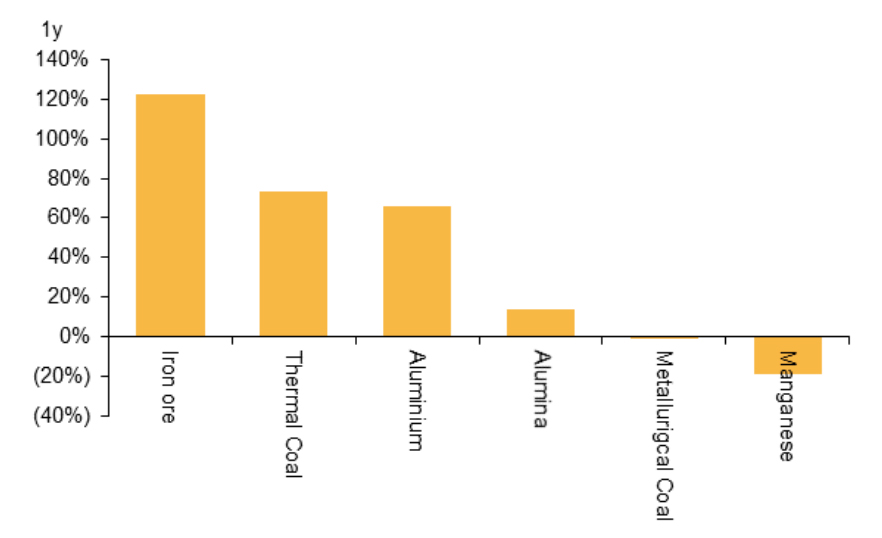

Iron ore, palladium, steel rebar and tin also reached nominal all-time highs last week, giving some weight to the “super cycle” we are in. As I have been saying for some time, this cycle is being driven by supply side constraints coupled with strong demand from China and more intensive metals recovery in other developed markets as unprecedented stimulus measures bite.

Iron ore is up a staggering 120 per cent in 2021 (figure 4) after surpassing another record over $US230/tonne, driven in part by fears of import restrictions on Australian iron ore.

This flowed from a number of reports, according to Macquarie Research, that two Chinese LNG importers were ordered not to take Australian spot cargoes.

As Australia accounts for just under two-thirds of iron ore imports to China, I don’t think a ban on Australian iron ore is likely given the lack of alternative suppliers.

It’s interesting to note the Australian government is assuming medium to longer term prices for 62 per cent fines in the range of $US55/tonne.

The non-believers consider the current strength in bulk commodities, precious and base metal prices is due to a unique set of circumstances – unprecedented government stimulus, supply side constraints and a recovery from the economic contraction in 2020, which is probably true, however the rise of EVs may well take up much of the slack in the battery metal space (nickel, copper, lithium, cobalt, REE).

While credit tightening (figure 5) in China may be seen as a brake on growth, it may well result in a more sustainable increase in economic growth.

Movers and shakers

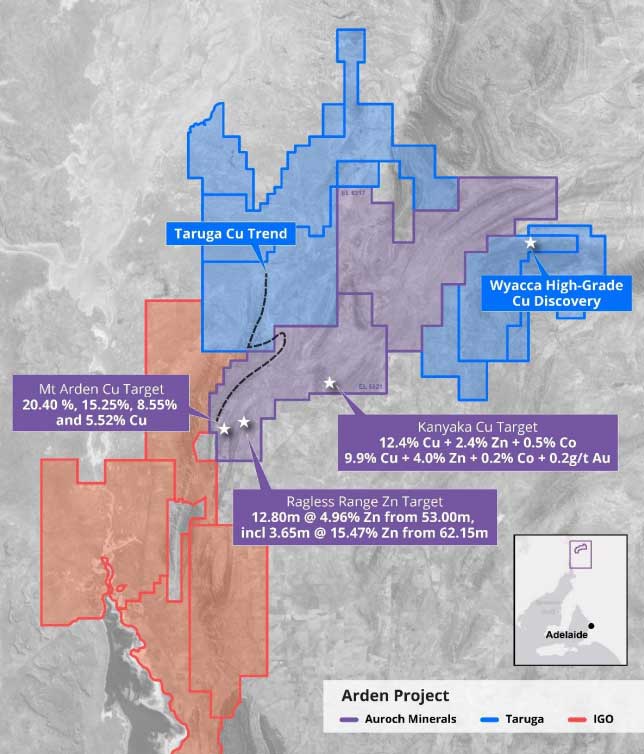

With the exception of Challenger (gold), Prominent Hill (copper-gold) and some reactivated iron ore projects, the last 30 years or so haven’t yielded a great deal in South Australia given the investment by both the public and private sector. So it’s good to see Auroch Minerals (ASX:AOU) having a red-hot go in SA.

Its 100 per cent-owned Arden copper project is situated just north of Port Augusta (figure 6) where soil and surface rock-chip sampling is about to recommence, following up strike extensions to regional copper trends identified by neighbouring Taruga Minerals (ASX:TAR).

Exploration undertaken last year at the southern end of the tenement returned rock chip samples up to 20.4 per cent copper.

Reverse circulation (RC) drilling is also planned to follow up a 2km-long gravity anomaly at the Ragless Range zinc prospect, where previous drilling (RRDD-007) returned 12.8m at 4.96 per cent zinc from 53m downhole.

A work permit application has been lodged with the SA Mines Department and is designed to test a 2km-long gravity anomaly that is also coincident with a surface zinc anomaly, which also returned high-grade zinc values including 3.65m at 15.47 per cent zinc from 62.15m downhole (RRDD-007).

Along with Auroch’s Nepean and Leinster nickel projects I have referred to previously, AOU has set itself up for an action-packed 12 months on the exploration front.

I had previously made the ground-breaking observation that American Pacific Borates (ASX:ABR) was Teflon coated, however it appears this may have been attributed to my failing eyesight.

The ABR share price (figure 8) took a nosedive (having broken through $2.50 in late April 2021) in the wake of an announcement last Monday that revealed the financial metrics of the three-stage rollout of the Fort Cady borate mine in California were in fact marginal, with a meaningful EBITDA only delivered on the completion of phase 1C.

Construction delays and procurement lags from European suppliers appear likely to stretch the construction period beyond the original timetable. A disappointing result given phase 1a showed a very respectable internal rate of return (IRR) of 46 per cent, according to a March announcement.

On a positive note, the borate market still looks strong. However, there is some uncertainty around the economics of the project and an expectation of a large capital raising as part of a US listing – both of these factors are likely to continue to weigh on the ABR share price in the short term.

Total CAPEX (no doubt due to be revised) for phases 1, 2 and 3 was $US318m according to a March presentation. So it’s not an insurmountable hurdle as far as resource projects go.

Anyway, it’s been quite a ride since we picked this up under 30c last year and hopefully there will be a re-entry point when there is further clarity around the development pathway at Fort Cady and importantly the financial metrics for ABR.

Hot stocks to watch

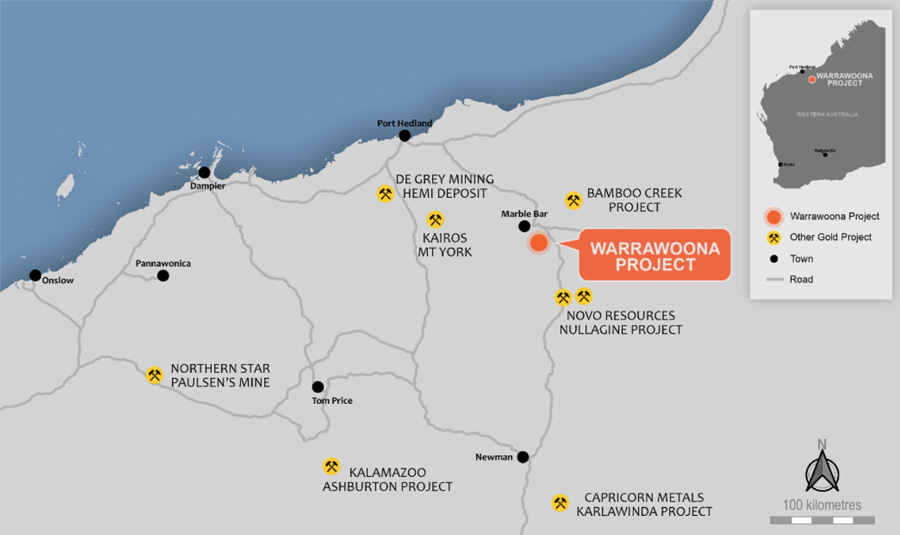

Calidus Resources (ASX:CAI) appears to be on track to begin mining mid-year at its 100 per cent-owned Warrawoona gold project situated in the Pilbara (figures 9 and 10).

The project is fully permitted and Calidus has a $110m facility in place with Macquarie Bank.

The company also recently completed a $12.5m placement at 40c per share to fund the Blue Spec high-grade gold deposit containing JORC resources of 219,000oz at 16.3 grams per tonne (g/t) gold.

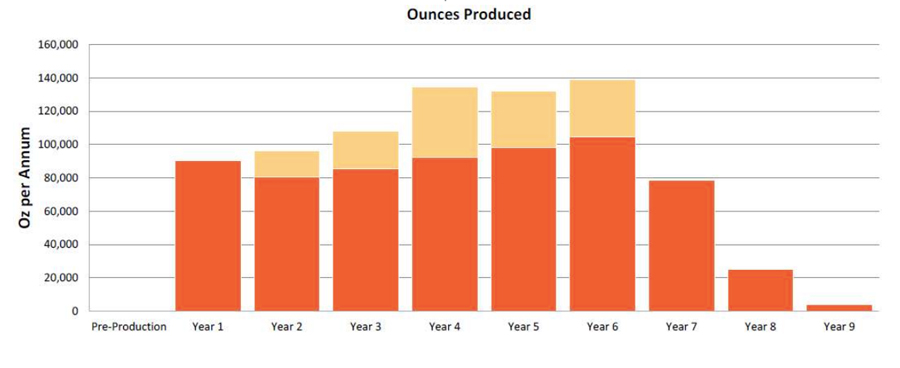

The revised feasibility study further enhanced the production profile and financial metrics at Warrawoona, returning an unrisked post-tax net present value (NPV) of $302m based on a $28m CAPEX and production of 110,000oz of gold per annum (figure 11) over an eight-year mine life at an all-in sustaining cost of $1,292/oz.

The company is fully funded and currently trading at around 45 per cent of NPV at a market capitalisation of around $140m.

With further upside from the recent Blue Spec acquisition, which is open along strike and at depth, I suspect the gradual slide in the share price may be about to reverse as it nears first production.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.