Guy on Rocks: 35 reasons why you should listen to Guy Le Page

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Well knock me down with a feather! Apparently interest rate hikes are around the corner and the world is going to mud!

Music to the ears of the doomsday preppers out there, however I know the Stockhead faithful are 100% relaxed as they would have been alerted to the inflation genie and the impending apocalypse (otherwise known as a recession) last year in this column.

A Balvenie Whisky (17 doublewood) and a Late Hour Placencia cigar are recommended for calming nerves in a bear market.

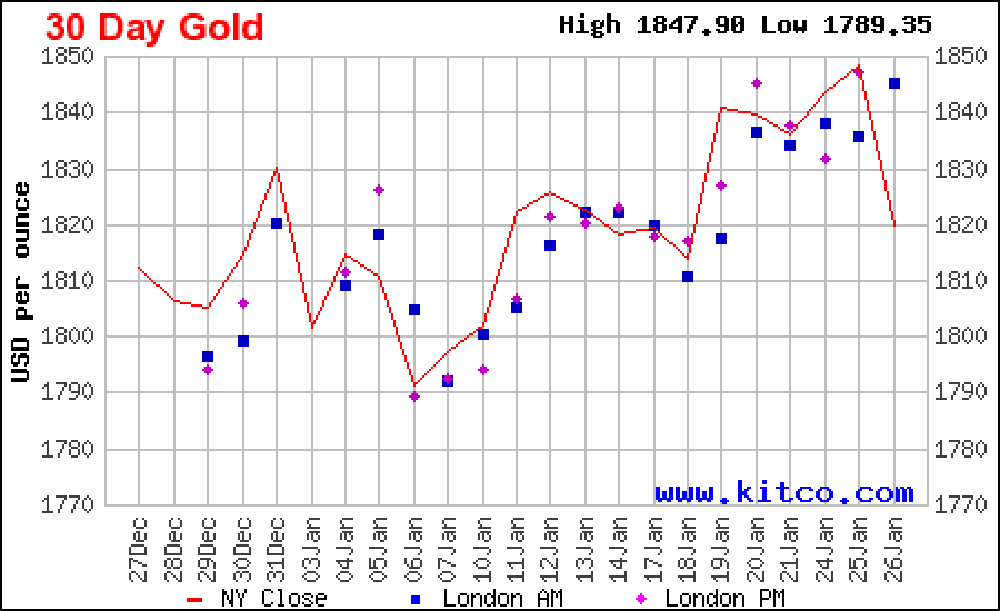

The FOMC meeting concluded with new information regarding its plan for its balance sheet reduction which immediately sent gold off $24 with the February contract trading around US$1,830 after reaching an intra-day low of US$1814.10 a few days ago.

Interestingly, Bloomberg reported last week that the world’s largest ETF saw holdings last week in SPDR Gold shares surge to the largest inflow in dollar terms topping US$1.63 billion since listing in 2004.

I think support for gold in this market should come from a weakening of the US dollar in conjunction with rising gold ETF demand combined with hedge demand.

Bitcoin for those less risk averse may also benefit. Interestingly, Chinese gold consumption (jewellery, coins, and bars) rose 36% last year to 1,120.90 tonnes over 2021 according to the China Gold Association.

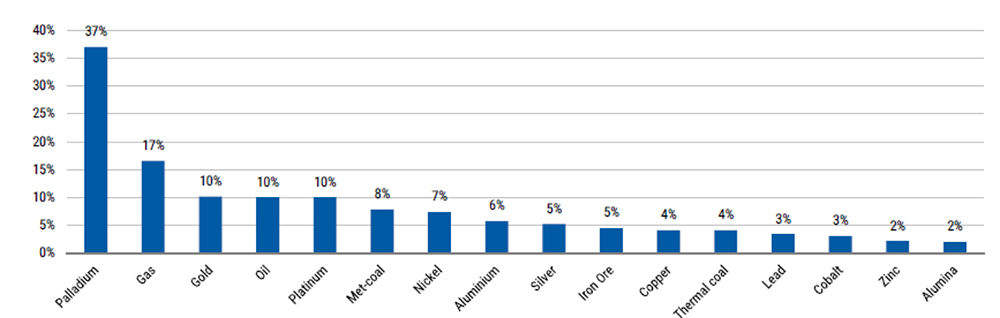

On the positive side, palladium gained $34.60 which is a net gain of 6.15% and is currently fixed at $2,323.

Platinum gained 0.6% over April and is currently trading around $1031.

The majority of palladium as well as a large percentage of platinum is mined in Russia (figure 2) and South Africa (together around 93% of world production) so ongoing politically instability is likely to see the PGMs move higher, particularly with all the pop guns lined up on the Ukraine border.

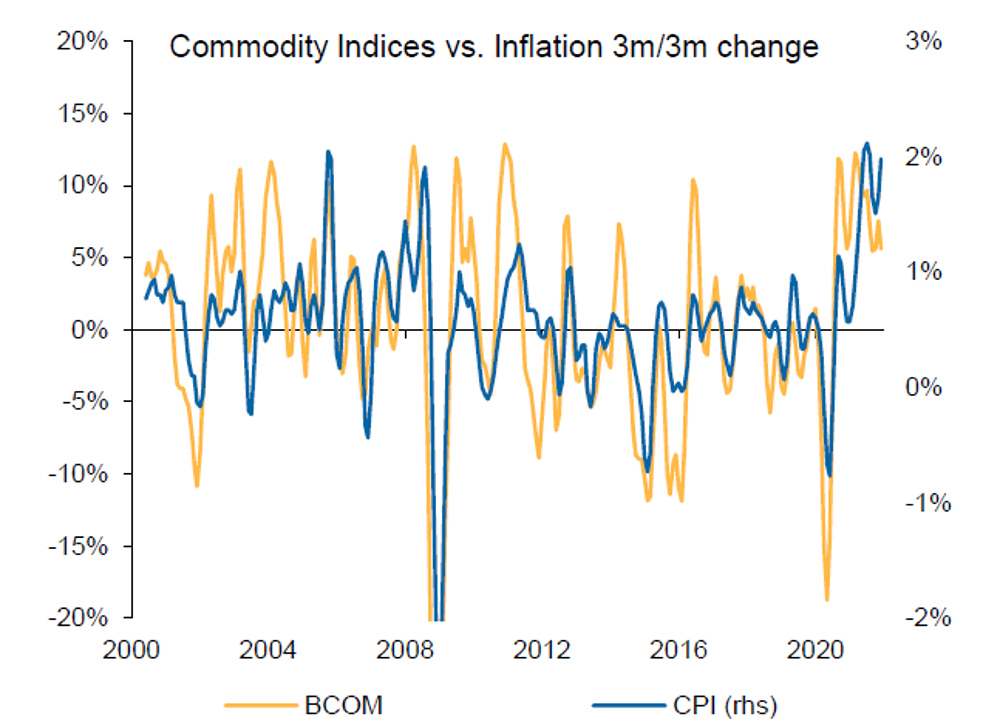

Commodities have more or less tracked (figure 3) in line with inflation caused by, according to Macquarie (Macquarie Strategy, January 2022), primarily an increase in aggregate demand.

Danielle DiMartino Booth, CEO of Quill Intelligence considers the switch in fiscal and monetary policy could result in three rate hikes in quick succession which could in turn lead to an inversion of the yield curve (difference between long-maturity Treasury bond yield and a short-maturity yield) with an inverted or zero yield curve historically followed by a recession within 12 months.

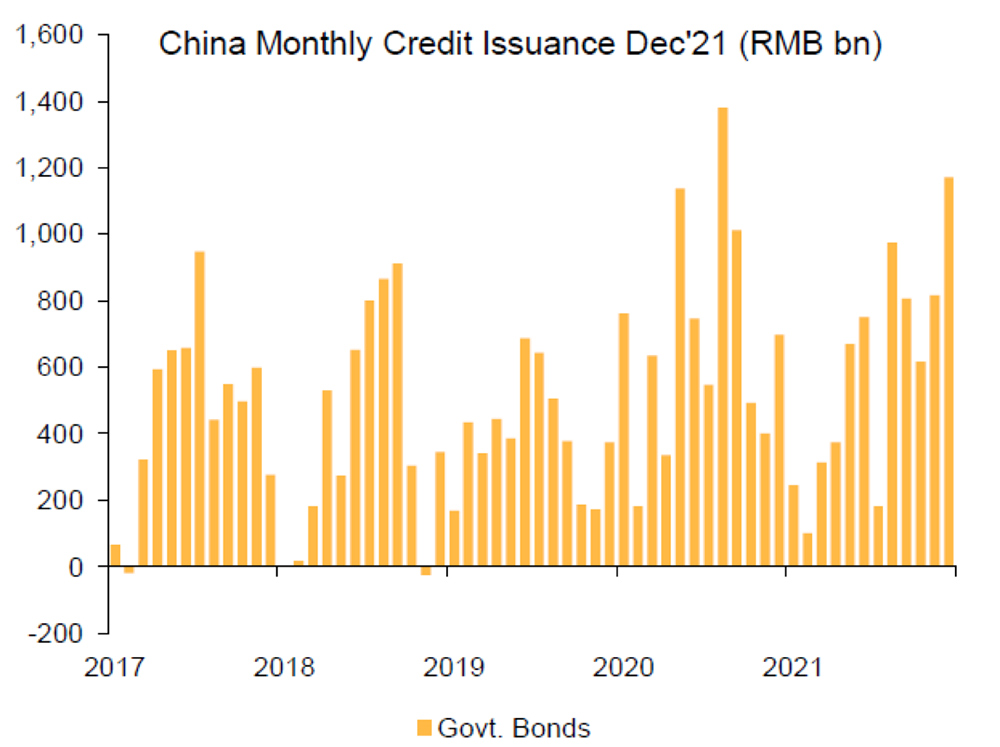

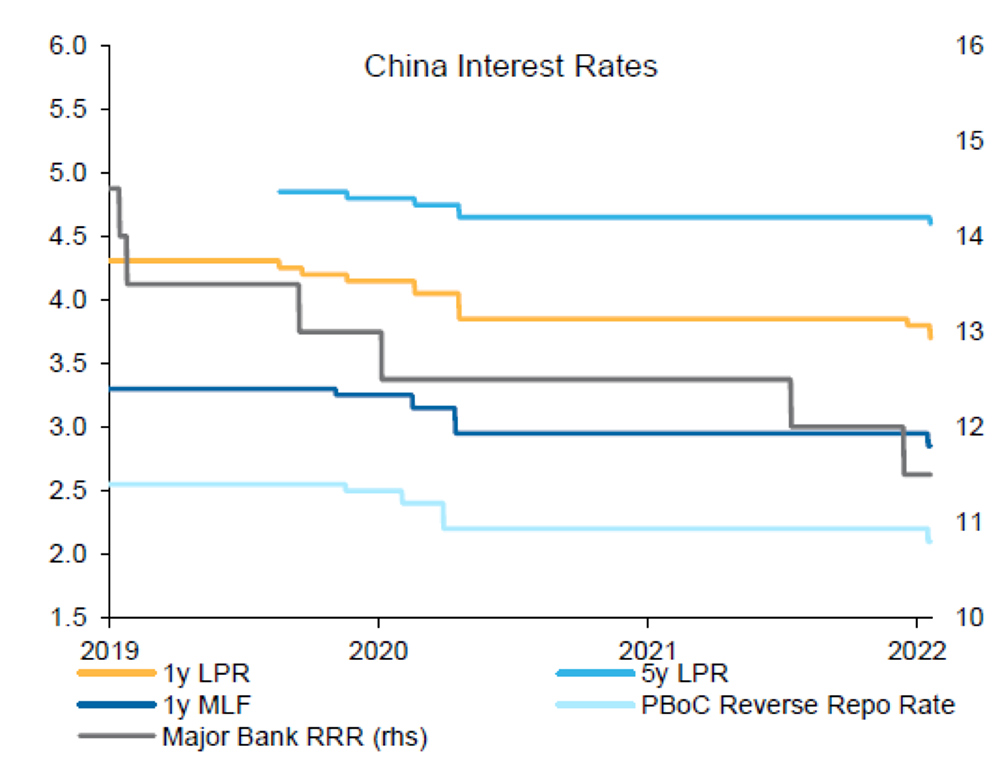

With stocks of base metals at critical lows China seems to be heading on a different fiscal and monetary (figure 4, 5) policy pathway as the PBoC’s embarks on a 10bps cut with easing measures for the remainder of FY 2022 (figure 5).

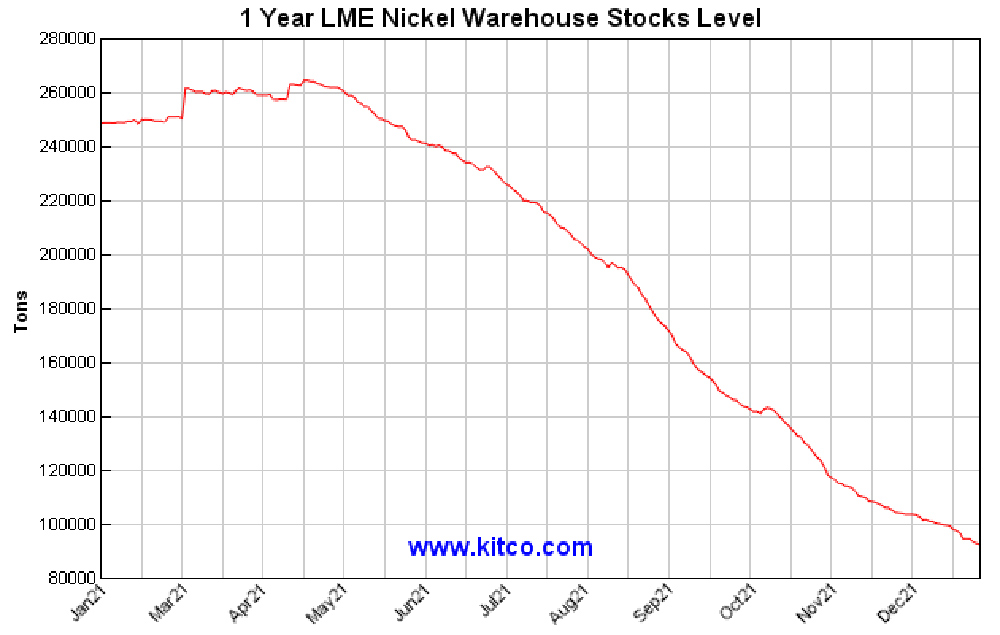

SHFE futures for nickel, aluminium and zinc also rose over the previous week as inventories of nickel in particular fell to critical levels (figure 6).

SHFE nickel inventories have fallen to very low levels of 3.9kt (compared to 300,000 tonnes of open interest), resulting in the nickel market going into backwardation. Further Chinese easing may put further upward pressure on the nickel price.

Talk of hyper-inflation and the debauching of currencies is also rife, with Bitcoin bull Max Keiser, host of The Keiser Report, telling Michelle Makori, editor-in-chief of Kitco News:

“I think over the next 10 years, as you see these major economies like the U.S. and China, who are carrying debt loads at 300% of GDP, and they’re going to just print their way out of this, we’re talking about a fiat money apocalypse.”

Interestingly El Salvador was in the news for becoming the first country in the world to make Bitcoin legal tender.

All this volatility is likely to have immediate flow on effects in both the precious and base metal markets as well as Bitcoin.

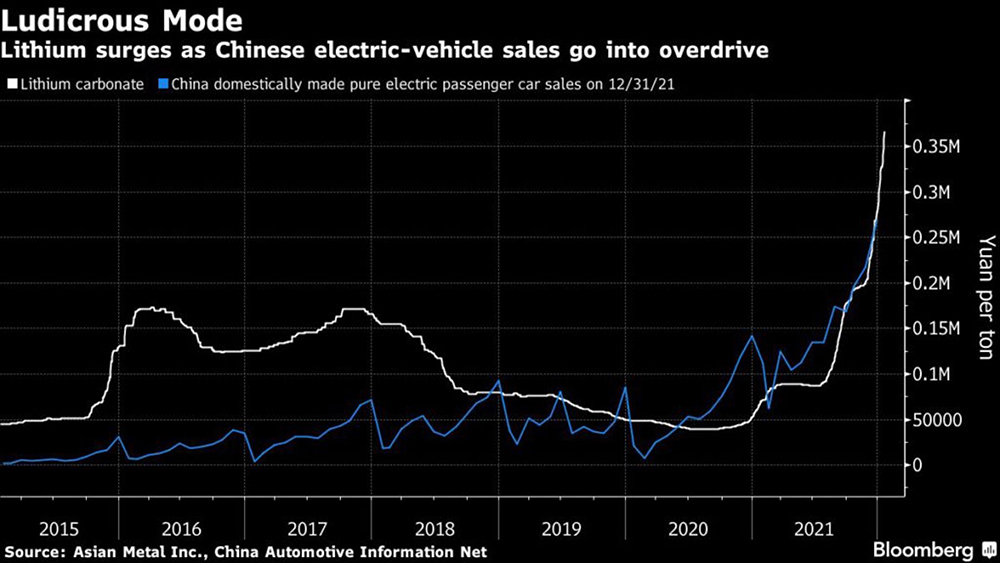

Finally, lithium prices have gone into a Low Earth Orbit with sales of spodumene concentrate recently being recorded above US$3,100/tonne.

Prices have surged fivefold in the last year. It was only 18 months ago I was crunching numbers on an AVZ Minerals (ASX:AVZ) report at US$750 thinking how robust the Manono project was despite the logistical challenges.

Chinese lithium carbonate prices (figure 7) also reached a fresh record earlier in the week on the back of a 35% month-on-month jump in Chinese electric-vehicle registrations in December, according to China Automotive.

With supply side pressures some brave analysts are projecting growing deficits in the lithium market this year.

And as I have said many times before, sovereign risk is the elephant in the room as Rio Tinto (ASX:RIO) know only too well with Serbia cancelling the licence on the Jadar mine in response to local opposition.

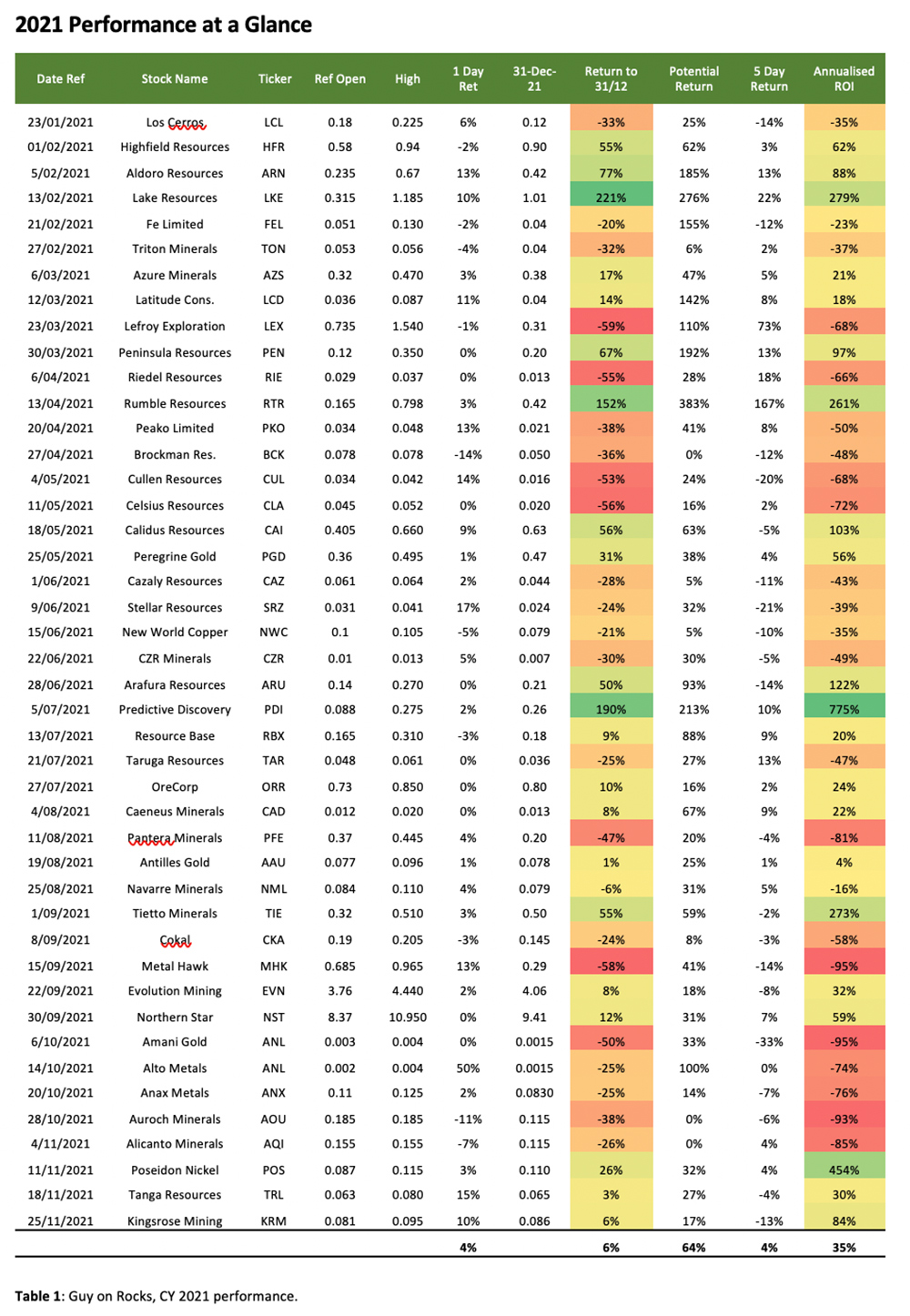

The CY 2021 annualised return on investments of the “Guy on Rocks” recommendations was 35% compared to the S&P/ASX 200 Resources index total return of 9.3% over the same period.

The maximum possible return if you sold at the top was 64%.

The absolute return based on a simple average was 6% if you sat there like a stunned mullet all year and took a long-only approach.

Of course, most of the Stockhead luminaries would have taken a few shekels off the table as the market heated up last year – there was plenty of evidence of an overheated market over CY 2021.

Fortunately, some of the better performers such as gold developers Predictive Discovery (ASX:PDI), Tietto Minerals (ASX:TIE) and Rumble Resources (ASX:RTR) have plenty of growth left in them and the recent sell down has presented some attractive re-entry opportunities.

The same is true for some of the laggards such as Auroch Minerals (ASX:AOU) and Amani Gold (ASX:AMI).

As overpriced juniors (and some fairly priced ones) are getting smashed I am keeping my powder dry on my next recommendation.

Clearly I don’t won’t to upset my impeccable record with my time best served puffing away at Cigar Social until the smoke haze parts and I can see the light.

As in any boom, there are sectors that overshoot, and this is certainly true of many of the junior ASX listed explorers last year. Cave Canem or “beware of the dog”.

Clearly someone in Pompeii 2,000 years ago had also fallen victim to a toppy market as the visitor was reminded at the front door. ….

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.