Guy on Rocks: Nickel prices will likely run through $US20K ‘in the near term’

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Gold finished a volatile week closing at US$1,812/ounce with physical bullion ETFs still showing net redemptions, at a pace north of ~1t/day in July with net positioning on COMEX futures/options appearing historically weak at sub-100k contracts (figure 1), well below normal net length of ~125k lots.

Gold prices have also underperformed in US$ terms versus the broader G10 FX basket by some 2.5pp since early June.

A recent sharp fall in real yields in my view should be bullish for gold in the short term.

Palladium also saw modest inflows recovering from its recent sell-off with the percentage of commercial longs for palladium picking up to 33% from 26% in the last week of June, as consumers took advantage of the sub-$2,500/oz palladium prices following the unwind.

The palladium thematic still looks strong on the back of a global auto recovery as chip shortages ease over the next 6 months or so.

Prices, according to Citi (Citi Research, 12 July 2021) are anticipated to breach US$3,000/oz over the coming months.

This should be further buoyed as Chinese auto producers restock ahead of a projected market uptick over Sep-Oct. Palladium ETFs saw modest holdings growth to 555koz as of July 8th, while Pt investor demand remained weak.

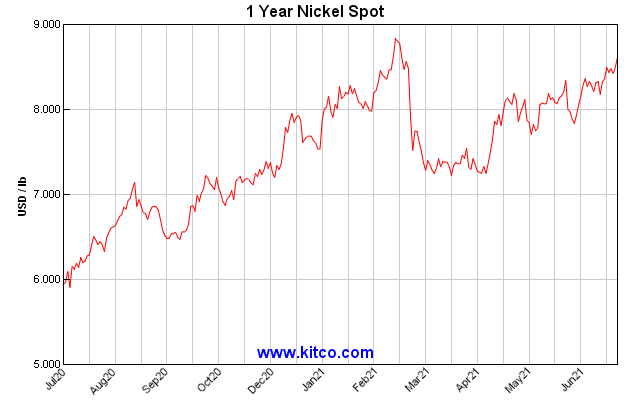

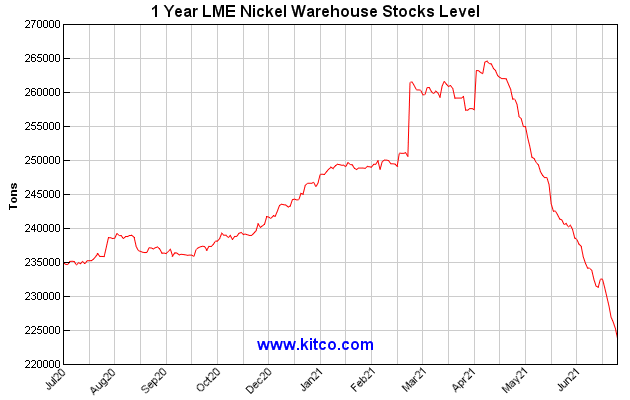

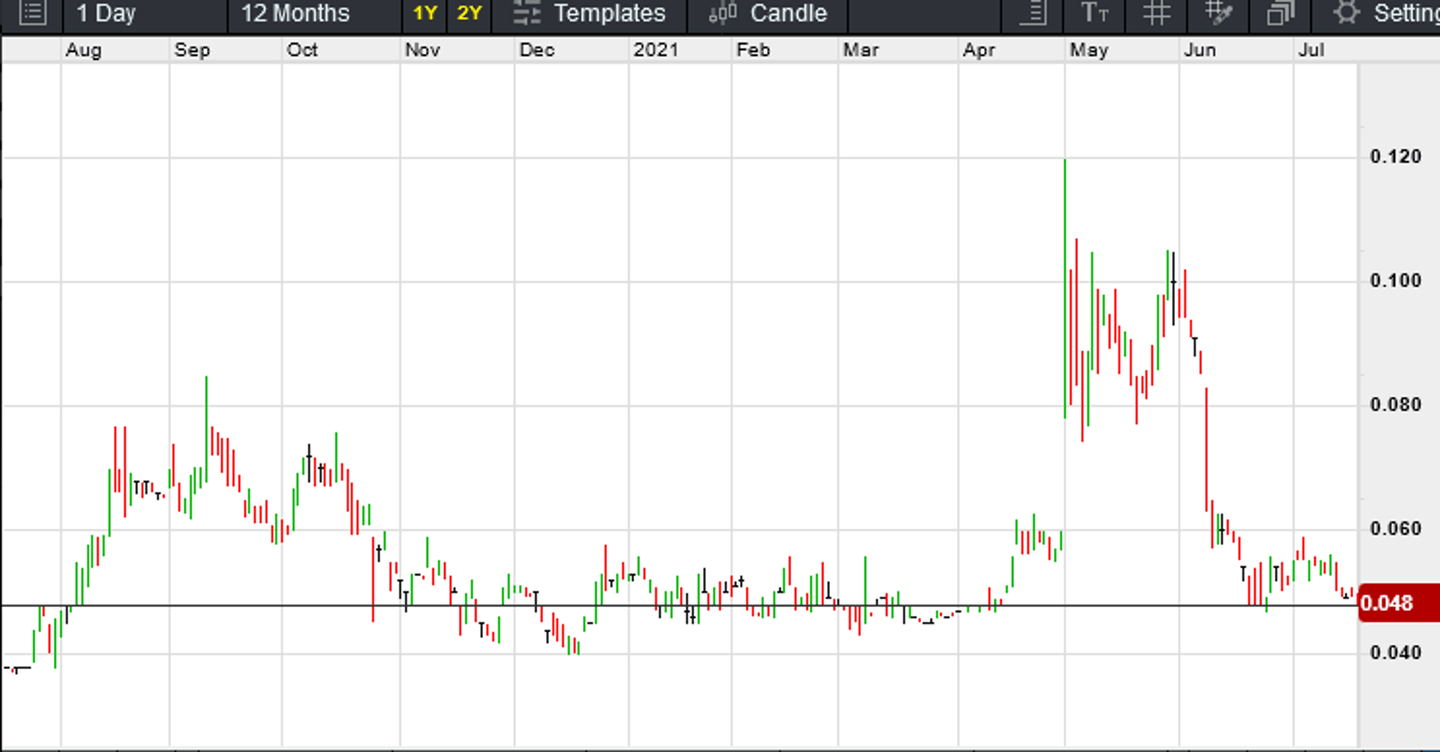

Nickel (figure 4) has continued to perform strongly finishing the week at around US$8.60/lb with tighter LME spreads pointing to emerging physical tightness, diminishing LME stockpiles (figure 5).

US$20K per tonne looking likely in the near term.

Nickel is likely to be a significant beneficiary due to EV battery re-stocking and is generally stronger anyway in Q3 as Chinese stainless comes on top of already elevated levels of output and end demand.

As I indicated last week, supply disruptions in New Caledonia and Indonesian supply concerns (on the back of surging Covid-19 cases and possible NPI restrictions) together with Russian export taxes are likely to put significant upward pressure on nickel prices.

There has been some serious disruption in South Africa as rioting ensured in the wake of the High Court dismissing Jacob Zuma’s bid to have his arrest overturned.

Multiple operations such as Ferromanganese producer Assmang — (a 50/50 joint venture between African Rainbow Minerals and Assore) — declared force majeure on customer contracts in South Africa’s KwaZulu-Natal province due to unrest in the region that resulted in road closures and disruption of port activities.

In addition, Transalloys — South Africa’s largest silicomanganese producer — also declared force majeure on July 14 as trucks were not allowed on the roads, with both companies, as well as other operators, unable to get the gases required to produce, as well as having safety concerns for its staff.

Glencore’s ferrochrome and cobalt deliveries are also likely to be impacted as the company transports via road and export’s both commodities through Durban and Richards Bay.

I believe the continued social and political unrest combined with COVID-19 restrictions in some key economies (such as Brazil-iron ore) will potentially have decade long impacts on supply not to mention inhibiting the exploration and ultimately the development of new mines.

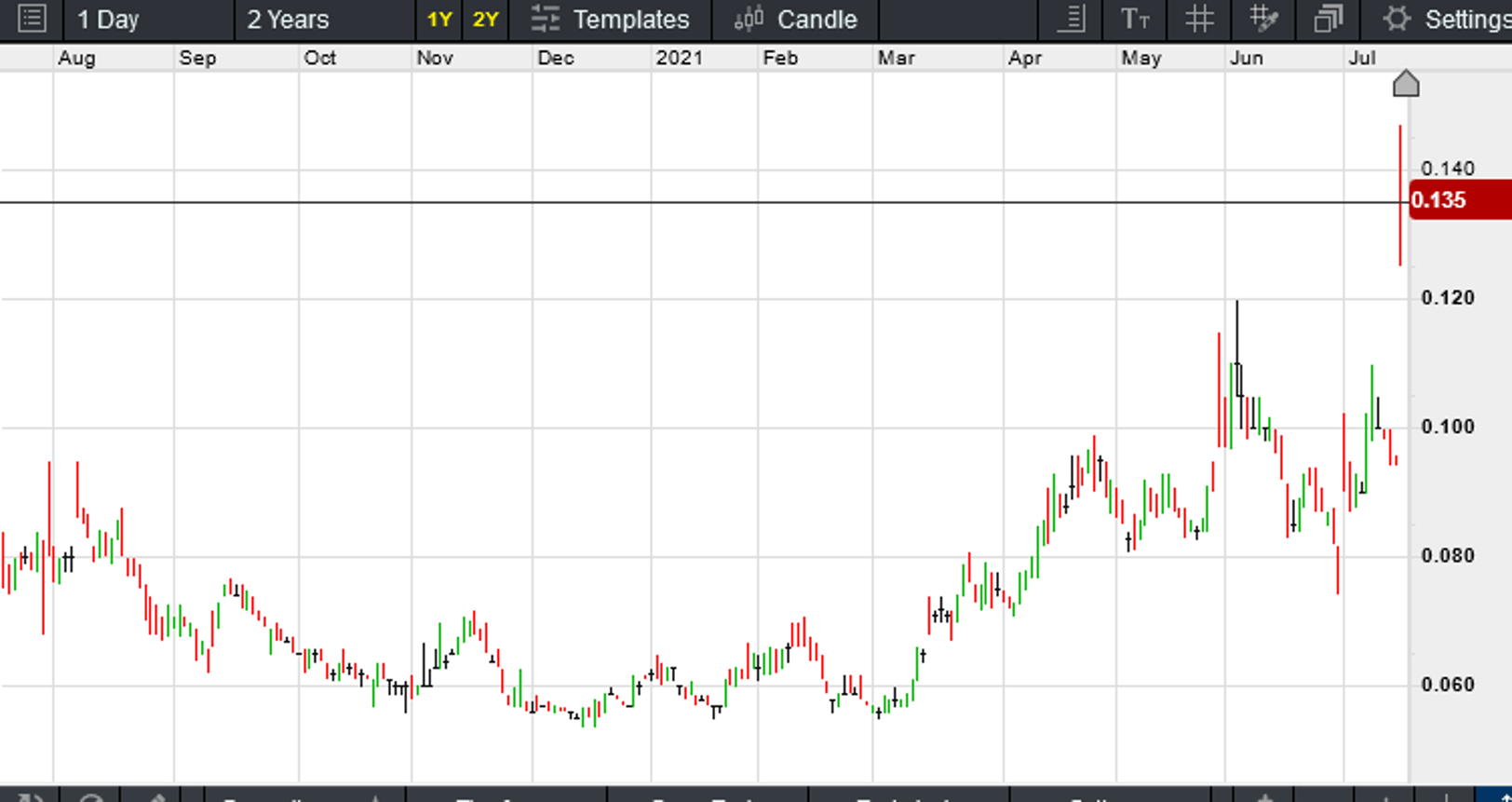

Closer to home, our pick from last week Predictive Discovery Limited (ASX:PDI) finished the week up 42% (figure 6) to close at 13.5 cents on heavy volume after delivering some impressive intersections at its Bankan Project (Guinea) from four diamond drill holes over decent widths including:

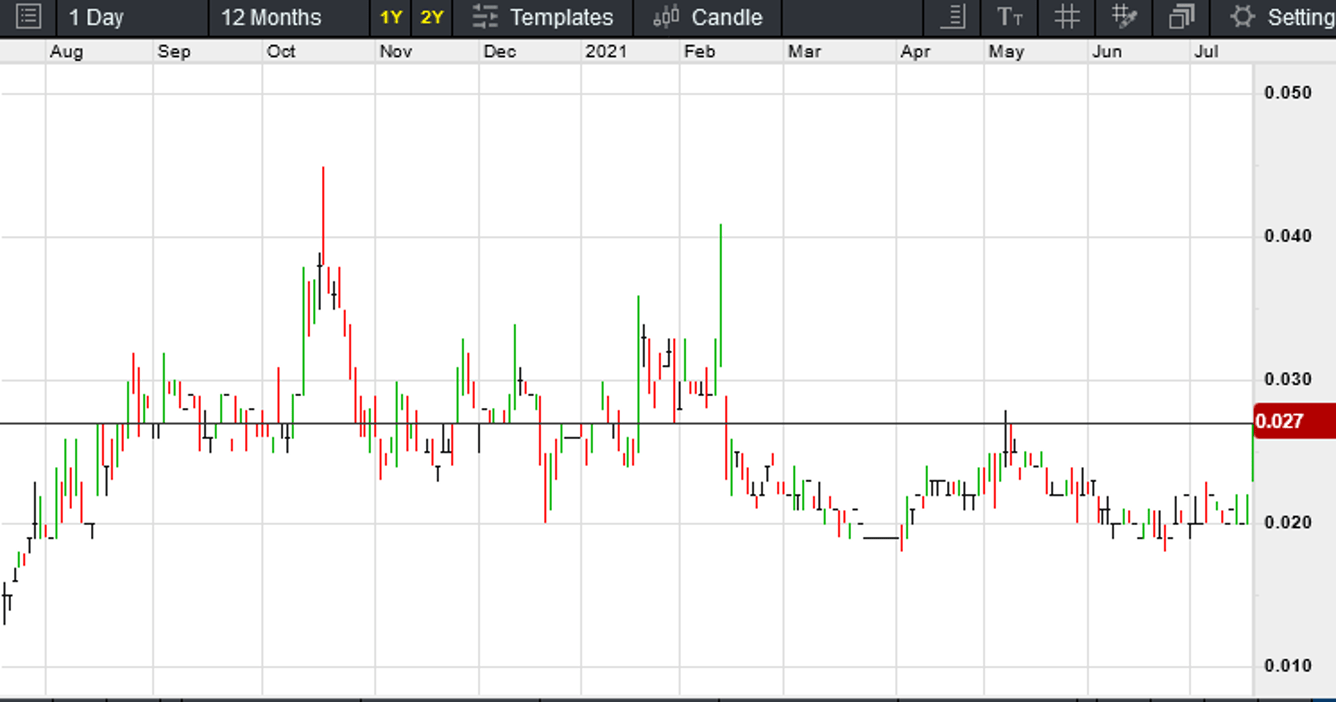

Woomera Mining Limited (ASX:WML) closed up 23% on Friday to finish at 2.7c.

The company is now suspended pending an announcement on drilling results at their 80% owned Mt Venn Project (WA). The program targeted high-grade gold mineralisation at Chapman’s Reward, Lang’s Find, and lower saprolite gold anomalies at the Three Bears prospect.

I think the market is suggesting these results might be pretty good!

It’s good to see the likes of cashed up ($4.1 million) Taruga Resources Ltd (ASX:TAR) (figure 8) having a real crack in South Australia. The state, that derives its revenue from agriculture, Olympic Dam, wine and making movies about mass murders (or documentaries depending on who you talk to), could certainly use a little exploration success.

The Company has locked on to some high-grade surface copper showings at its 100% owned Mt Craig Copper Project (figure 9 ) in the process identifying a 34km mineralised breccia incorporating numerous old workings. With little modern exploration, the Company is bullish about its chances particularly with the recently identified magnetic and gravity anomalies that remain untested.

The Wyacca copper discovery is the most promising prospect to date with a number of RC drill holes returning high grade hits including WCR 006 with 5 metres @ 2.4% copper and WCR 021 with 11 metre at 1.5% copper (figure 9).

TAR announced (13 July 2021) that results from a 22 hole, 2,100 metre RC program that targeted the Morgan’s Creek breccia (figure 10) are due in mid-August 2021. The program anomalous copper and zinc within the diapiric breccia and included oxidised sediments and reduced black shales differentiated dolerites and hematite-altered breccias.

Mineralisation appears to be hosted by reduced black shales similar to the Tindelpina Shale Member which host the high-grade copper mineralisation found ~30 km north along strike at the Wyacca Prospect. Cu:Zn values appear to have similarities, according to TAR, with Zambian-style base metal mineralisation.

The majority of mineralisation found in the Adelaide Geosyncline have been relatively small, with a number exceptions, so let’s hope the geophysics is pointing to something bigger!

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.