You might be interested in

Uncategorized

ASX April Winners: The best 50 stocks as inflation and Middle East tension cloud markets

Mining

Up, Up, Down, Down: Everyone's a winner in an astounding April for major metals

Uncategorized

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Gold was down US$4 last week to US$1,956/ounce and is holding up well around US$1,952/ounce as it continues a sideways trading pattern after the Federal Reserve paused rate hikes this month but has promised two more in the near term.

When this will occur is unknown given Chairman Powell indicated that any further decisions were likely to be data dependent. In contrast, the European Central Bank raised rates by 25 basis points while China cut rates.

Inflation (figure 1), at least in Europe, appears to be heading in the right direction and was down to 6.1% in May compared to April’s figure of 7%.

Silver finished the week down 0.50% to US$24.12/ounce while platinum (figure 2) was down 3% to US$981/ounce and palladium’s extreme volatility continued closing up 7.5% to US$1,393/ounce (figure 3).

Hydrogen, according to Kitco contributor Neils Christensen (16 June 2023), is gaining traction as a potential source of clean energy and could be positive for platinum group metals longer term. This was confirmed by the World Platinum Investment Council that suggested green hydrogen production could account for the largest source of platinum demand by 2040.

ANZ Bank (June 2023) also remain bullish on platinum pointing to a finely balanced market, particularly with supply from South Africa severely compromised by ongoing power shortages in South Africa. In contrast, ANZ also believe that substitution and higher penetration of electric vehicles are likely to weigh on auto catalyst demand for palladium.

Platinum and iridium are major components of proton exchange membrane (PEM) technology, used in electrolysers that separate hydrogen and oxygen molecules in water. PEM technology is also used in hydrogen fuel cells to convert the gas into electricity.

Hydrogen, as the Stockhead faithful are well aware, is extremely difficult to store and transport given its atomic weight however centralised refuelling stations could make it viable for fleet vehicles/trucks and power stations.

The attraction of green hydrogen is that it doesn’t have a carbon footprint, however its production is energy intensive accounting for 80% of its production costs.

Copper prices strengthened this week up 2.4% for the week to close at US$3.88/lb as China continues to try and stimulate its flagging economy with incentives for the agricultural sector, infrastructure spending (up to US$140 billion) and rule changes geared to encourage property investors to buy more homes.

Not surprisingly, JP Morgan, UBS and StanChart have lowered their Chinese GDP forecasts to 5.5% or below.

Iron ore (figure 4) has responded to the proposed Chinese stimulus hitting its highest level in two months and is now trading at US$117/tonne (62% fines).

Uranium, after a stellar 2023 was off US$1 to US$56.5/lb as of last Thursday.

In a surprising move the world’s second largest gold producer had a swing at copper producer First Quantum Minerals only to be rejected. This is a big move on behalf of Barrick and knowing the tenacity of Mark Bristow, I don’t think we have heard the end of this one.

I am sure the Stockhead faithful out there think I am sounding like a broken record, however if you want to make some serious coin, you need to position yourself in copper over the next six months.

Data out this week includes US building permits and housing starts (Tuesday), the Bank of England rate decision on Thursday followed by US jobless claims and existing home sales.

On Friday US manufacturing PMI is due for release.

Tanzanian nickel explorer Adavale Resources (ASX: ADD) came onto my radar back in July of last year following a share placement at 2 cents.

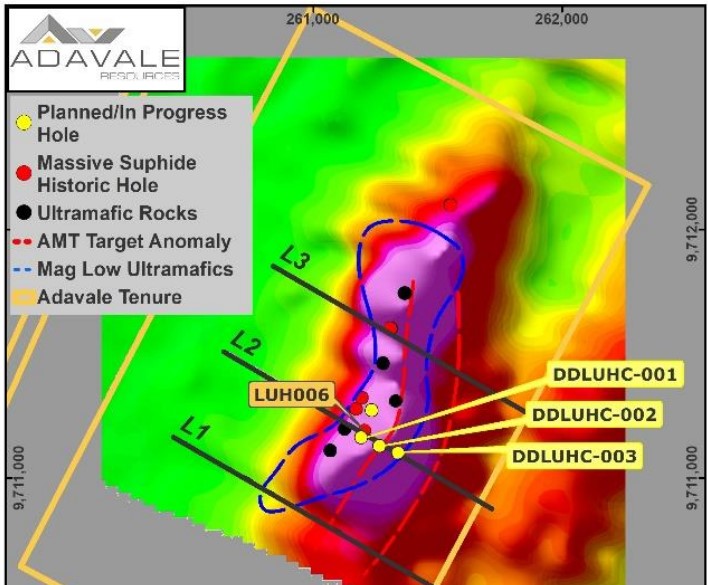

I picked the Kabanga Jirani and Luhuma projects, which cover around 1,316km2 in the Kabanga-Musongati mafic-ultramafic belt (figure 6), as having good potential for Ni, Cu, Co, Cr and PGEs hosted in layered intrusions. Significantly the six southernmost licences are adjacent to the world-class Kabanga Nickel Deposit (JORC Resources of 58Mt @ 2.62% Ni).

More recently ADD farmed-in to two more licences contiguous to the southernmost licences.

The 19 June 2023 ASX announcement returned two sulphide intersections in its first two drill holes at Luhuma Central, including one intersection approximately 60m up-dip within the same mafic-ultramafic intrusion that hosts the 4.15m of massive sulphides recently intersected by DDLUHC001.

Sulphide mineralisation appears to be associated with an AMT anomaly which the Stockhead faithful will know as audio-magneto-tellurics. More AMT targets are due to be followed up in the course of step out drilling with DDLUHC002 (figure 7) planned to reach a total depth of 450m and is also testing a deeper AMT anomaly.

The company is also targeting AMT anomalies south of its Luhuma Central Prospect with drilling to commence at the HEM 2 anomaly (figure 8).

Genuine sulphide nickel-PGE plays are a rarity and while nickel is projected to be in surplus over the next year or so I think the investor and corporate interest will return.

One luminary pointed out (on HotCopper as I recall), that the common factor with many of the nickel-copper-PGM plays in Australia is that they are all in the ground. Why? Because none of them are economic and you have some idle time while having a cigar and scotch, convert some of these resources to gold equivalent then times by 65% (payability) and that will give you a rough payable grade per tonne (less royalties, tax etc).

If you want any more detail you will have to come to Cigar Social where I have the equivalent of Parliamentary immunity.

ADD will need to get some assays back before we get too excited, however it’s off to a good start. Obviously having disseminated and semi-massive sulphides is a positive however what proportion of these sulphides are nickel bearing (e.g., pentlandite) as opposed to just iron rich sulphides (e.g., pyrrhotite) remains to be seen.

The company has around 520 million shares on issue and a market capitalisation of $14 million at 2.7 cents per share. There are just over 100m options exercisable at 3 cents expiring late September this year which are likely to keep a lid on the share price as well as another 78 million options exercisable at 3 cents expiring late in 2025.

One to certainly put on the watch list.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.