Guy on Rocks: Lacking energy? Get active – the rare earths race is on and you’re already behind

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

The risk-off sentiment has been compounded by soft demand and fresh coronavirus outbreaksin China, and a realisation of slowing global growth as inflation bites.

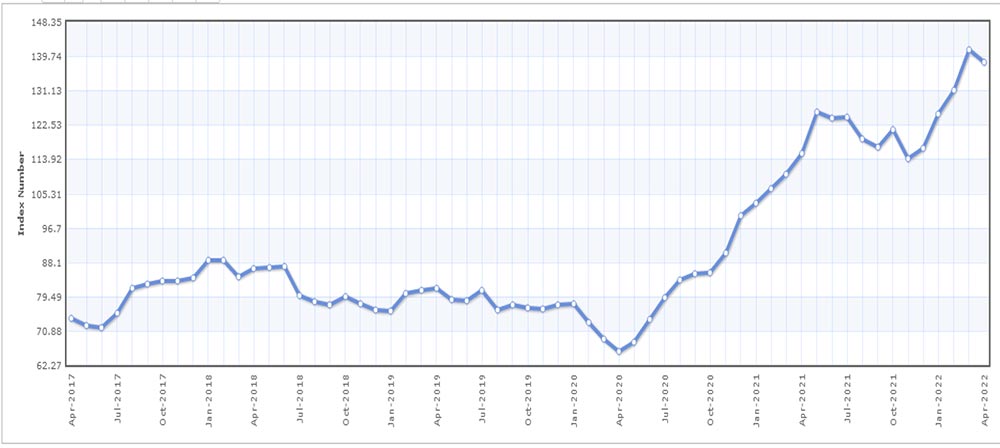

Having said that, the Commodities Metals Price Index (figure 1) has performed strongly over CY 2022 returning around 10% and since April 2020 has returned over 100%.

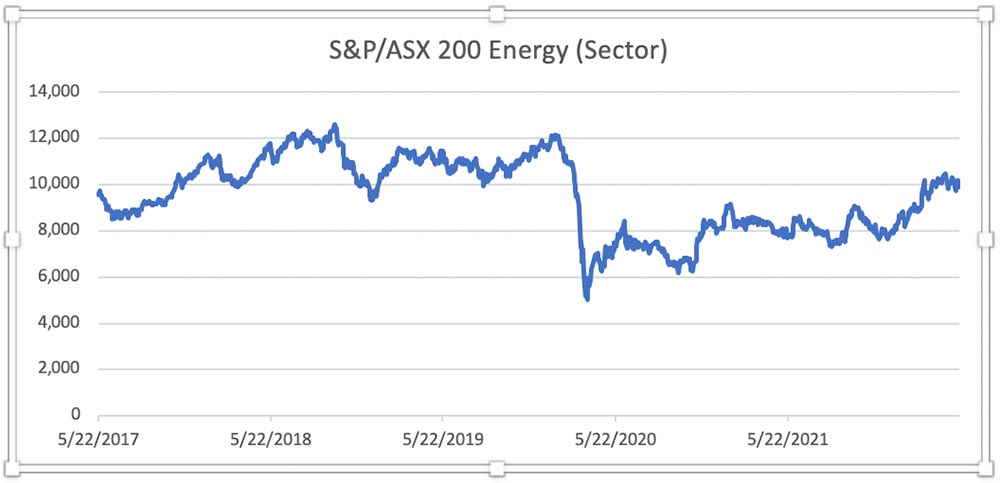

The S&P/ASX 200 Energy sector (figure 2) is up over 20% YTD or 27% over the last 12 months. By comparison the S&P/ASX All Ord Accumulation Index has returned around 30% since April 2020 and is off around 5% this calendar year.

We saw a slight rebound in metal prices last week with the US dollar taking a 1% hit which in turn saw gold finish up nearly 2% for the week to US$1,845/ounce.

Platinum was up US$15/ounce or 1.6% to close at US$953/ounce and palladium closed at US$1,898, up US$40/ounce or 2% for the week.

Copper closed at US$4.28/lb, however the three-month forward market remains in backwardation which would indicate the broader market sees a softer short-term outlook for copper.

Not surprisingly, oil rallied towards the end of the week to close at US$112.70/bbl for a 2% gain as the Russians are now threatening to stop gas supply to Finland who are refusing to pay in roubles.

Gasoline prices recently hit an ‘oil time high’ a few weeks ago in the US and put on another 16 cents last week to close at US$4.49/gallon.

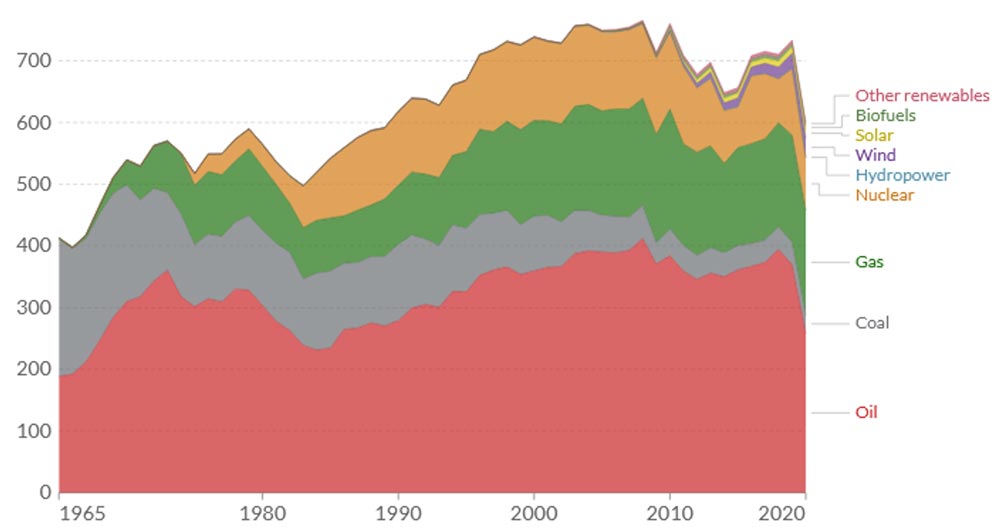

While not a big piece of the European economy, Belgium (which remains largely dependent on fossil fuels; figure 3) still appears to be committed to shutting down all seven of its nuclear reactors by 2025 while leaving the door open on new-generation nuclear technology with an allowance of around €100 million for the small modular reactors that I talked about a few weeks ago.

This policy has been in place since 2003 and appears suicidal given recent developments in energy markets.

I think residents would be well advised to buy an axe and head into the forests…

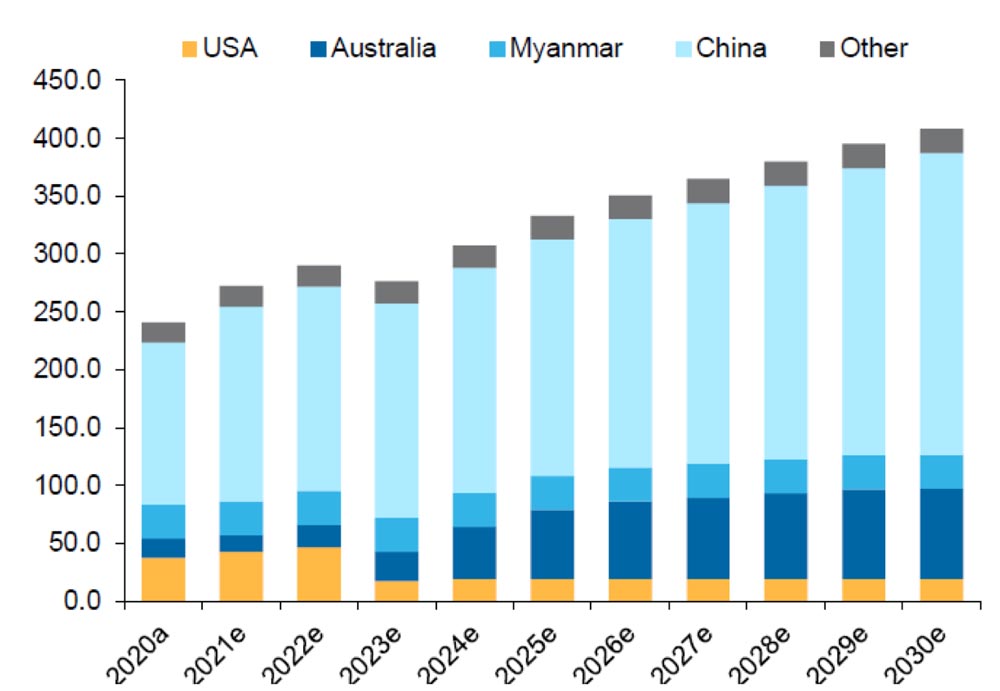

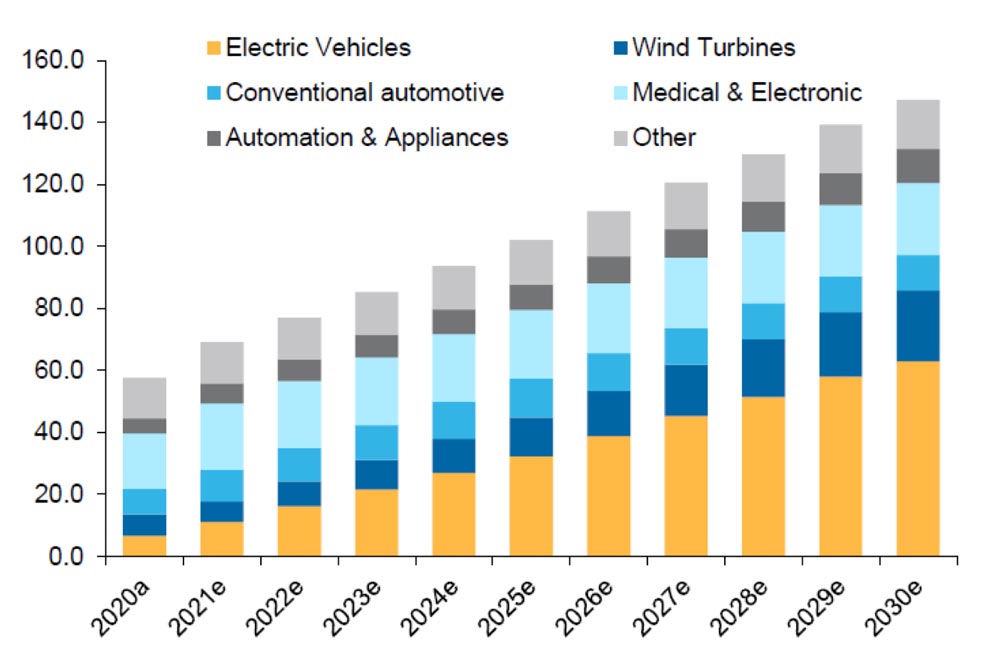

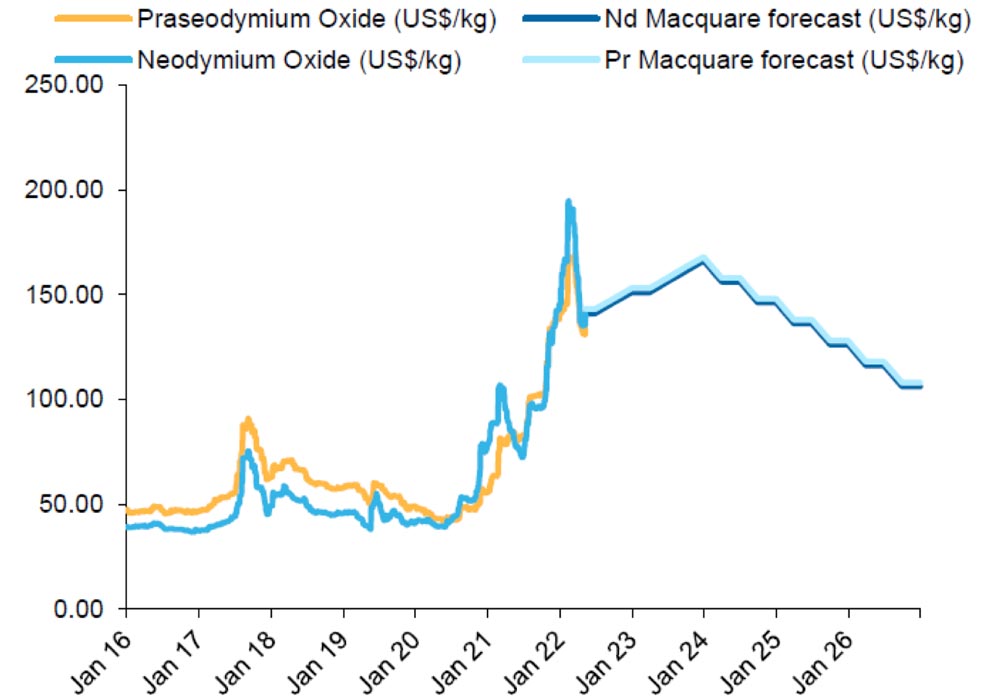

Investors should be chasing projects with more exposure to in-demand REE such as Nd/Pr that likely to be highly sought after (figure 6):

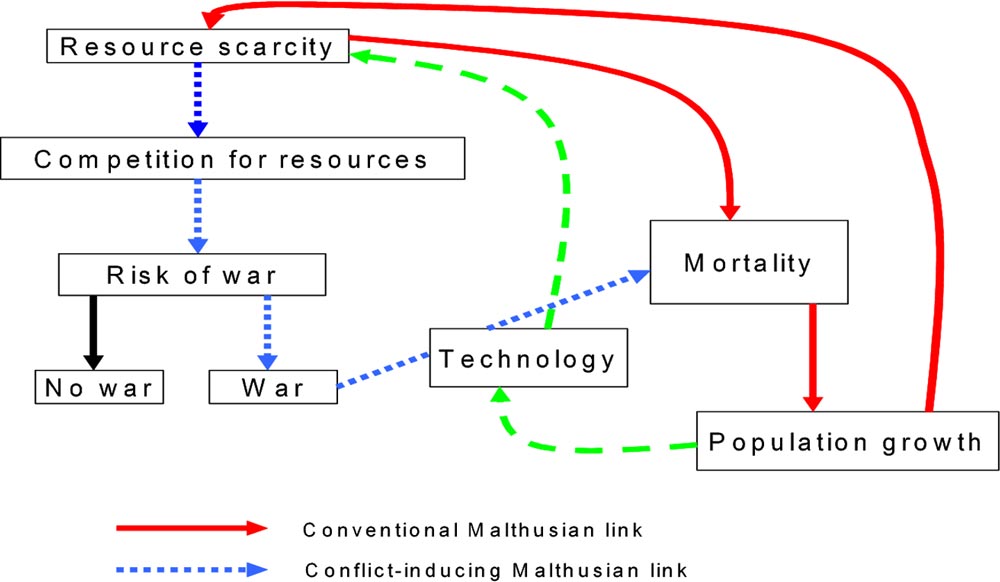

The competition for energy, and associated inputs, has never been more intense and governments will be weighing up the scarcity of resources and their relevance to their respective energy.

China and the US are in the forefront of this struggle and with so much at stake; escalating global conflicts remain a real risk.

Countries such as Greenland, with potentially large mineral resources, are likely to be at the centre of competing interests between the East and West.

You can follow the lines and dots in figure 8 and make your own mind up as to where we are heading but it appears the strategic value of rare earths (together with iron ore and base metals for that matter) will prompt more aggressive moves from sovereign nations over the medium to long term to make sure their critical supply lines are not held hostage by non-aligned countries.

The Roman Empire was the master at conquering countries, integrating the indigenous people to the Roman way of life, promoting supportive local officials, and generating tax revenue as it exploited available resources.

Caesar was well aware of Britain’s vast tin resources before his conquest of 55BC. In the world of ESG, climate change paralysis and the United Nations, extracting resources from foreign countries is no longer an easy task and will provide serious challenges for sovereign nations attempting to shore up their supply lines as far as critical metals goes.

They say that every dog has its day, and I am hoping that Moho Resources Ltd (ASX:MOH), which has been something of a disappointment (and a dog) over the last two years, is about to have at least 15 minutes in the sun.

The company went into a trading halt on 24/5/2022 pending an $800K capital raising (managed by the luminaries at RM Corporate Finance no less) at 3.3 cents (with 1:1 free attaching options exercisable at 5 cents, expiring January 2024).

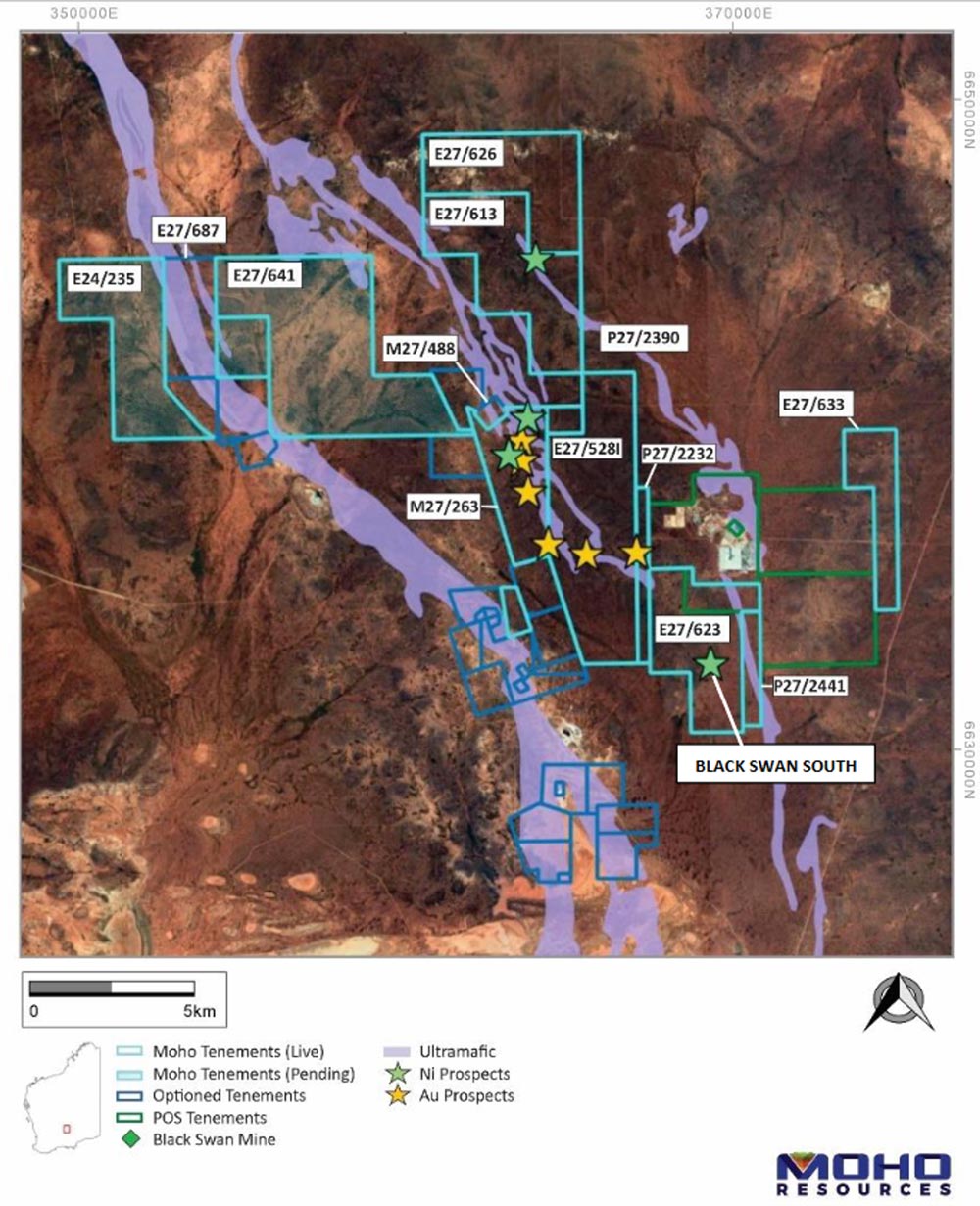

Funds are to be applied principally to the Black Swan South project (figure 11) located approximately 50km northeast of Kalgoorlie (WA) and covering approximately 55km2.

MOH have been drilling gold targets on the tenements (Black Swan North) over the last few years with limited success, however I believe the nickel prospectivity is far more interesting.

An 1,800 metre RC program is planned to test the basal contact of an interpreted komatiite with down hole electromagnetics planned for each hole to search for “off hole” conductors. A ground electromagnetic survey is also planned.

The hope is that mineralisation found at the adjacent Silver Swan (130,000 tonnes @ 9.6% Ni for 12,400 tonnes Ni) and Black Swan Mines owned by Poseidon Nickel (ASX: POS) could be replicated on MOH’s tenements.

The Black Swan South Nickel Prospect is a zone of ultramafic rocks identified that was identified by MOH from historical drilling and appears to be associated with a 600 metre long elliptical magnetic anomaly, bound on its western side by a NW trending structure.

With an enterprise value just over $4.0 million you could argue MOH is almost shell value so any bottom feeder like me should be interested in this play.

I do recall having written off Jubilee Gold (Cosmos Nickel Project; 127Kt of nickel in concentrate from 2000-2012 averaging 4.8% Ni) back in early 1997 when it was trading at around 7 cents. Good thing I didn’t invest as it only went to $23/share in January 2008 after X-Strata came in like a low flying bomber and lobbed a bid valuing the company at A$3.1 billion.

Anyway, it’s a sea of red over in WA after the Federal Election so all entrants will need to show their Labor (or union) card at the border, wear a red arm band (a red star or red hammer and sickle are also acceptable) and bring a bag full of stolen GST money back from the east.

I know the Stockhead faithful would have been desperate to know who I voted for. Well, that is easy to work out. I live in the seat of Curtin and voted for the best-looking candidate. What could possibly go wrong?

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.