Guy on Rocks: Is it almost time to dive into ASX uranium stocks again?

Pic: mihtiander, iStock / Getty Images Plus

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Uranium to continue run

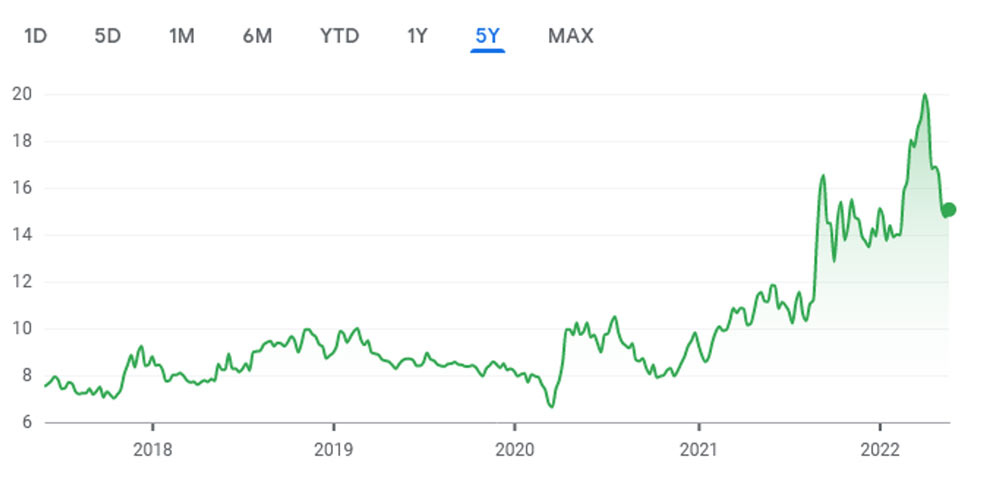

Uranium spot prices were off 45 cents during last week to close at a three-month low of US$46.25/lb (figure 1).

Interestingly the Sprott Uranium trust did not buy any uranium for the entire month of May and was trading around 14% below its NTA a few weeks ago (figure 2).

I have talked about the supply-demand outlook previously as being one that is likely to support significantly higher uranium prices in the medium to longer term.

Admir Adnani, the CEO of Uranium Energy Corp (NYSE:UEC), believes that we are unlikely to see any meaningful uptake in uranium production until US$75/lb is breached, or US$30/lb higher than current spot prices.

Having said that, the spot price is only a reference point and longer term offtake prices are likely to be signed on significant premiums to this.

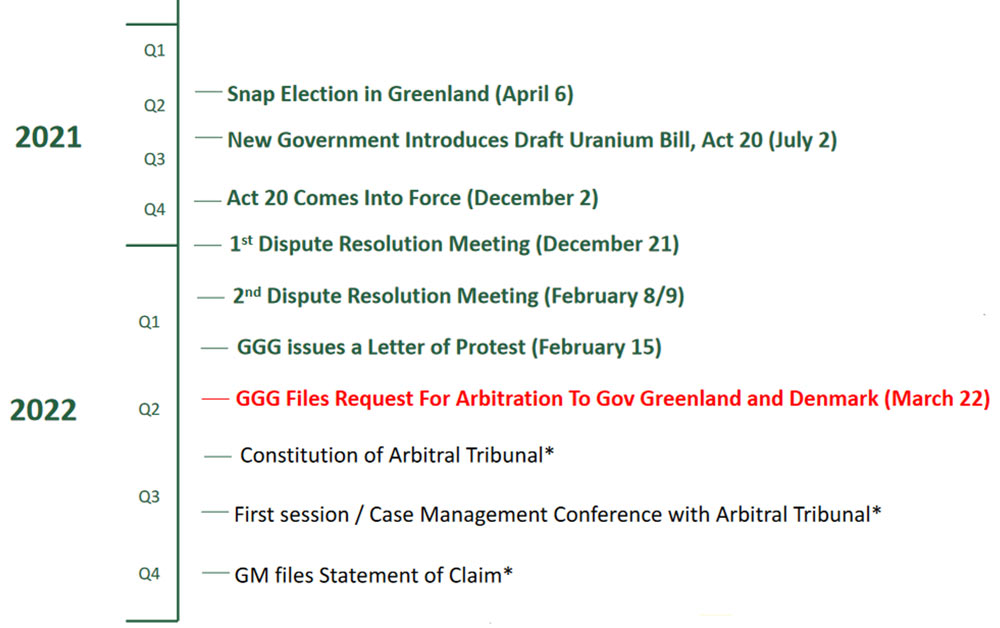

The Greenland Minerals (ASX:GGG) AGM yesterday, now under the helm of managing director Daniel Mamadou, was a little more upbeat on its prospects of an outcome on its Kvanefjeld Project, one of the world’s largest under-developed REE-U deposits (11.1 million tonnes of rare earth oxide, 593 million pounds U3O8).

The newly formed coalition Government of Greenland recently initiated a revised public consultation process with scope to “modify the development strategy to realign with Greenland’s outlook and the global agenda” in consultation with its arbitration process in Denmark pursuant to the Danish Arbitration Act (figure 3).

Now that the IA party (led by current Prime Minister Mute Egede) has formed an alliance with the previous ruling party, Siumuit, who were in fact in favour of the development of Kvanefjeld in accordance with the feasibility study submitted by the company, progress towards development is possible.

Shareholder and Shanghai listed rare earth giant Shenghe Resources has also invested significant capital in their downstream REE processing capability so they will no doubt be interested in an outcome here.

One could assume that if the licence is not forthcoming, there may well be a damages claim against the Greenland and Danish Governments.

Given that Denmark ponies up a cheque for US$600 million a year to Greenland to keep the lights on (equivalent to 20% of the GDP) you would think that the odds of a favourable outcome for GGG are now looking more promising.

It’s been a long road for GGG (figure 4) but there is some hope of a turnaround before the incumbent directors end up in an aged care facility.

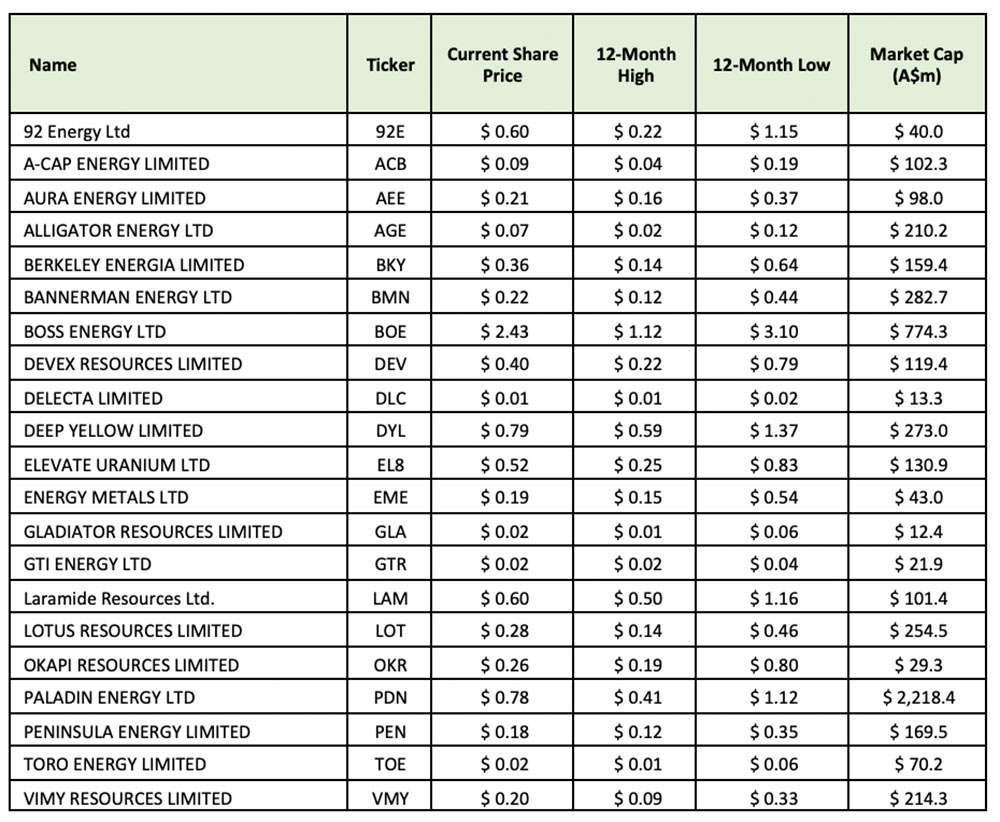

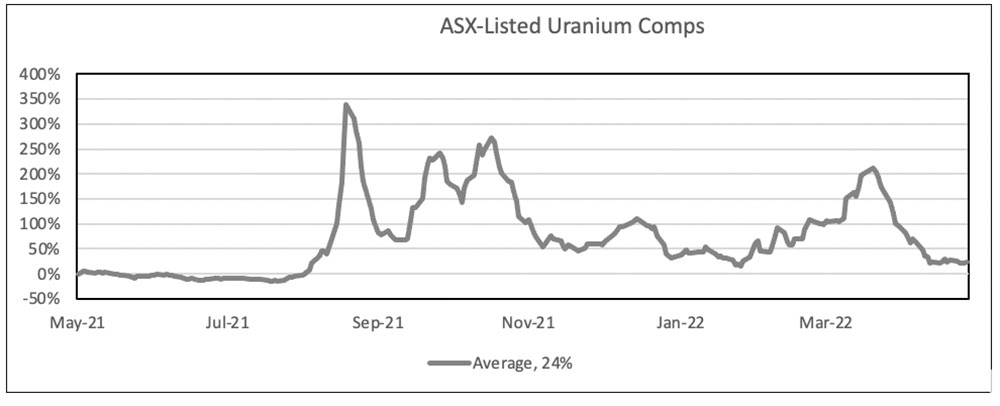

The ASX listed uranium developers and explorers have come off the boil recently (table 1, figure 5) with the uranium price, however I believe it may be getting close to dipping the toe in the water again…

New Ideas: Victoria’s gold Renaissance continues…

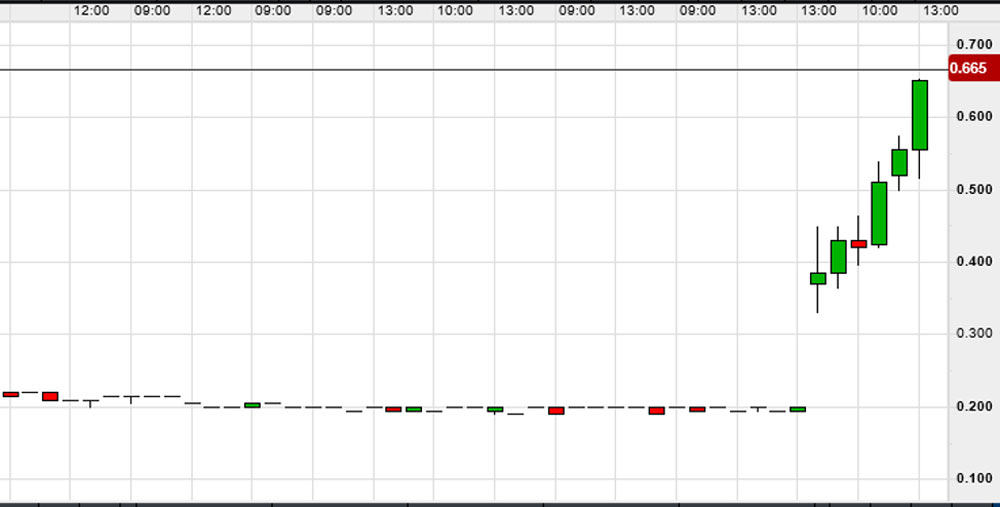

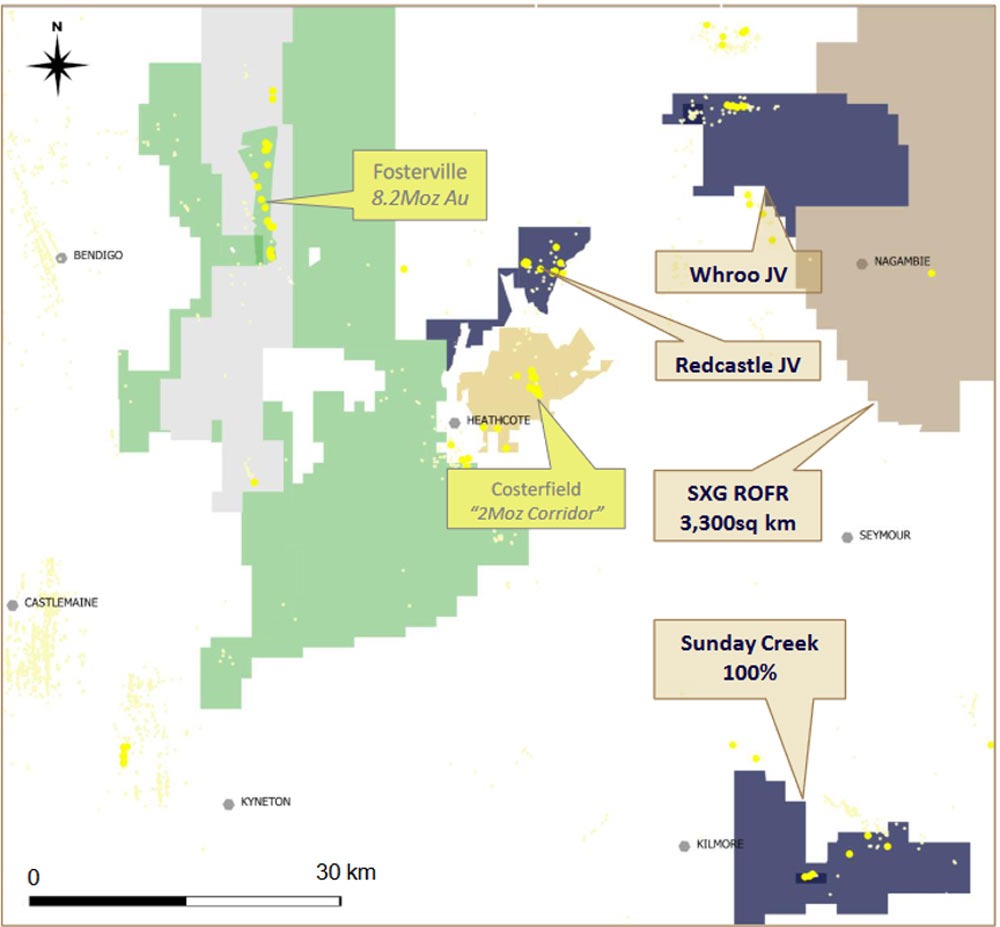

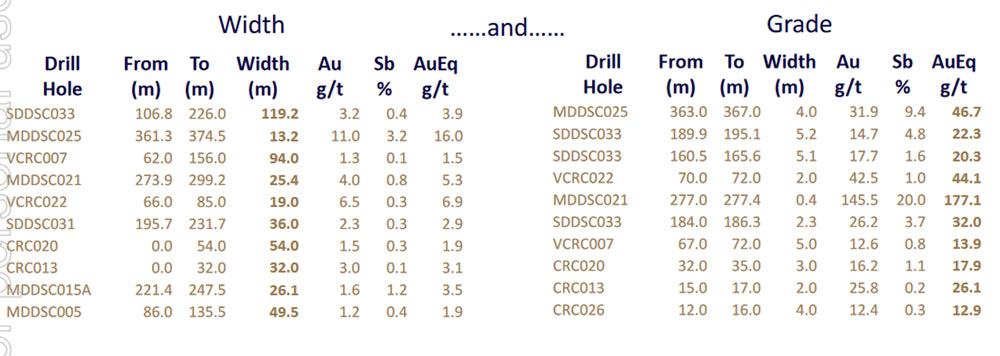

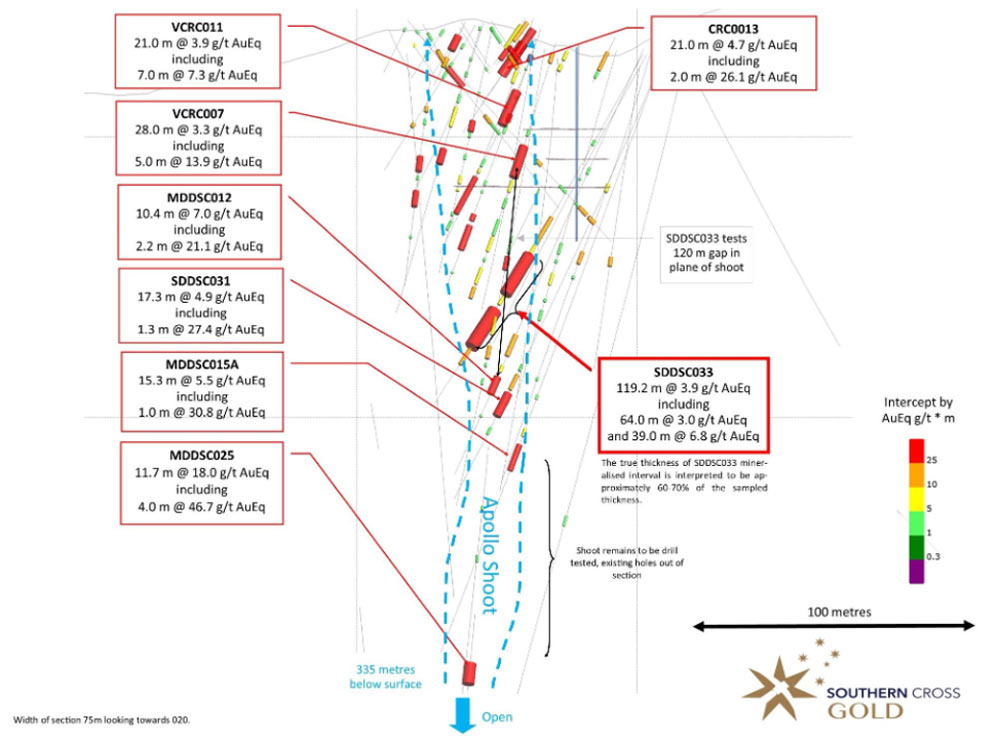

Southern Cross Gold (ASX:SXG) only listed earlier this month and have come out with a smoking intersection of 119.2m @3.9g/t Au Equiv. (gold and antimony) from 106.8 metres downhole at its Sunday Creek Project located just 60km from Melbourne.

According to the ASX announcement yesterday widths are in the order of 10-120m at 2-16g/t gold) mostly in areas overlooked by previous miners.

There also appear to be plenty of high-grade hits as table 2 and figure 8 demonstrate with a peak gold intercept of 145g/t gold.

The Stockhead faithful will take comfort that general manager Lisa Gibbons is directing traffic at SXG so we should have every confidence of further exploration success.

I worked with Lisa at North Flinders Ltd (later acquired by Normandy Mining Ltd) back in the mid-1990s and have vague recollections of being asleep in the back of the Toyota Hilux while Lisa toiled away in the searing heat.

At the time I thought this was an efficient allocation of resources as I prepared to enter the financial services sector where many hours are spent staring into the abyss. Turned out I was right, with Lisa winning the 2022 Victorian Women in Resources Awards earlier this year and delivering some early success for SXG…

The 37 holes drilled by SXG to date is starting to show good continuity down-dip (to 335m vertical depth) and with 10km of prospective strike length defined by soil geochemistry and old workings, the company is not short on attractive drill targets.

Given this is the first modern comprehensive drill program on this structure, early signs are encouraging.

With an undiluted market capitalisation of just over $100 million it shows the market rewards high-quality exploration results; the company couldn’t have wished for a better start.

No doubt share price volatility is set to increase but I think this could be a standout for 2022. In the interim I will go and lie down on the couch and dream of another Fosterville (Agnico Eagle Mines Limited: TSX: AEM; 640,000 ounces of gold annually at 19.8g/t Au).

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.