Guy on Rocks: This gold-antimony discovery could be ‘bigger than Texas’

Pic: Yuri_Arcurs, E+/ Via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Gold momentum builds

I am going to have to apologise for the lateness of this week’s column. I have been suffering from Cristalitis, a rare condition that afflicts people as they withdraw from drinking Cristal Champagne, which I was consuming in ample qualities at the St Regis Hotel in Bali earlier this week.

King Salaman of Saudi Arabia had booked the entire hotel out for the week during the G20 and called me in for some advice just prior to his departure on 16 November. My recommendation was to go long oil and short camels…

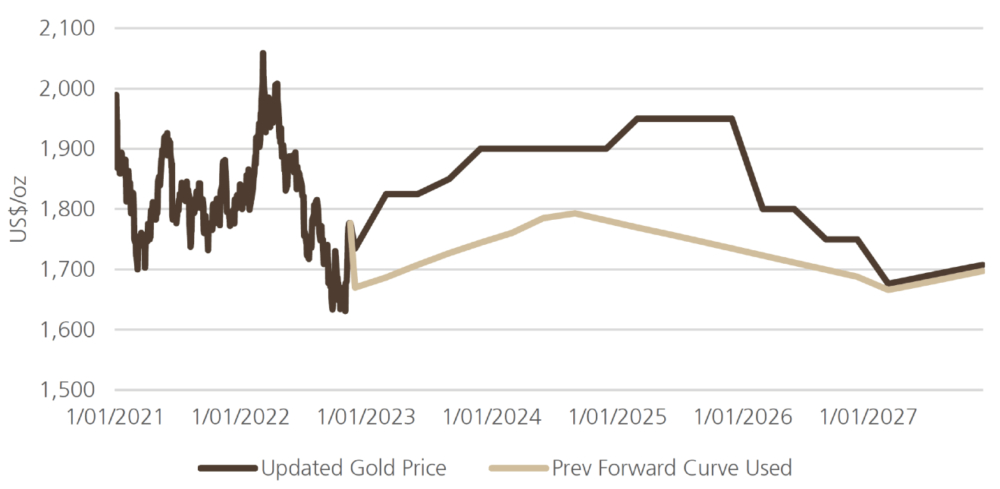

Speaking of commodities, UBS are getting a little more bullish on gold (figure 1) and are now expecting the Federal Reserve to cut rates from 5% to 3.25% by the end of CY 2023 with major gold miner earnings forecast to rise by over 25% for gold producers with NPVs rising 9-18%.

The reasoning was based around: (1) their observation that longer term investors (particularly central banks) were starting to accumulate gold, 2) the proportion of gold holdings relative to overall assets held by institutional investors remains at low levels and (3) important physical gold markets such as India and China have maintained a strong presence in the gold market this year.

With anaemic global growth in the range of around 2% next year, UBS can foresee a switch into gold, particularly in a falling USD environment.

On the base metal front, they see a reversal in the USD Index as an important turning point which has seen strengthening in the metals market, notwithstanding there is a significant risk as demand from Europe/US is likely to slow further and impacts of China reopening are unlikely to provide significant support to physical markets until 2H23.

Their conclusion is that the next 3-6 months should see the bottom of the metals cycle.

New ideas: an update on SXG

As I am withdrawing from a weeklong champagne addiction I thought it safer to have a brief recap on one of my recent picks rather than roll the dice on something new.

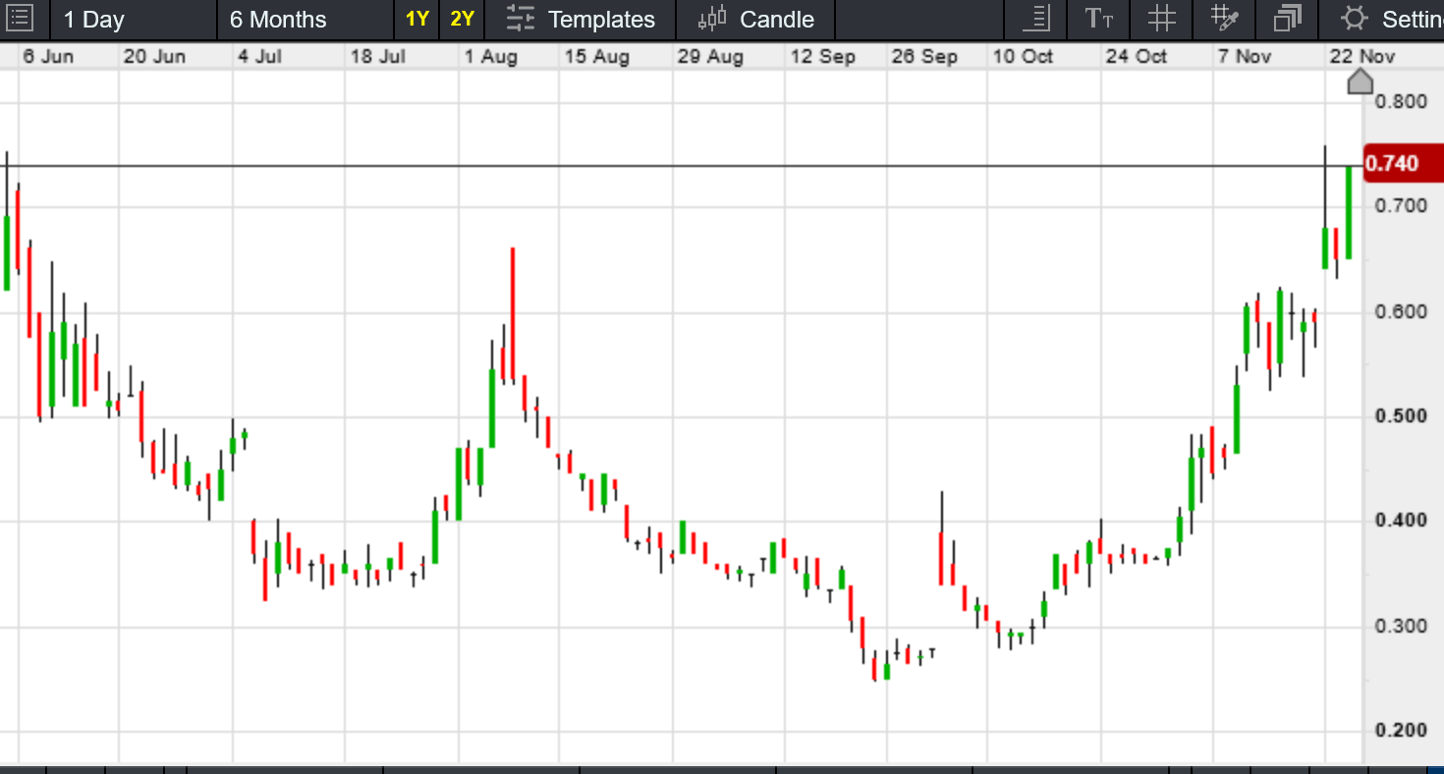

Not often I mention a stock twice in one month, however I couldn’t help noticing the recent announcement of Southern Cross Gold (ASX: SXG) (figure 3) whose gold-antimony project appears to be growing by the hour.

The company announced a capital raising of $16 million at 58 cents per share last week which took about as long as I took to respond to the St Regis waiter when he asked me “excuse me sir would you like some more?”

Not surprising the punters were lining up for this with SXG also announcing a monster intersection of 305.8 metres @ 2.4 g/t AuEq (1.6g/t gold and 0.50% antimony) from 319.2 metres downhole from its 100% owned Sunday Creek project in Victoria.

Significantly the hole also contained 12 high-grade intersections >20 g/t gold including 5 over 100g/t gold. Things are going so well I hear that geologist Lisa Gibbons has changed her name by deed poll to “Life’s Good”.

Who could blame her? This could be bigger than Elvis and Texas…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.