Guy on Rocks: Gold selloff overshoots making juniors look attractive again

Experts

Experts

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

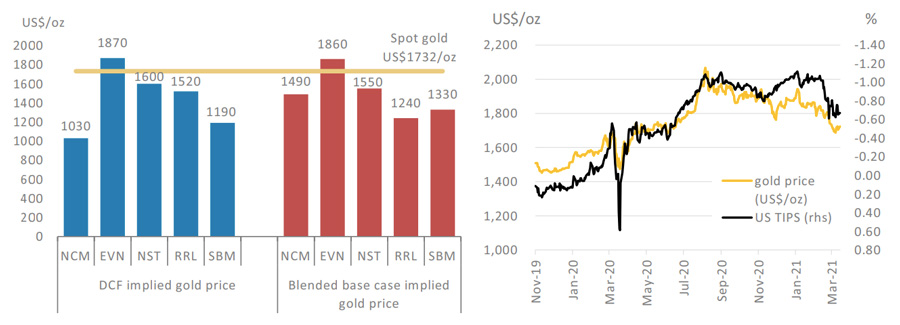

Gold equities have moved from premium in July-August 2020 (figure 1) to discount (figure 2) with listed gold producers now trading at a discount based on spot price gold assumptions.

The valuations of larger gold stocks always have a knock-on effect on the junior end which implies to me (assuming gold levels out or goes higher) that this is a good buying opportunity. November spot gold is now off 17 per cent from November 2020 with gold producers off 32 per cent.

With drilling programs about to restart following the wet season, keep an eye out for Pilbara gold explorers such as De Grey Mining (ASX:DEG), Caeneus Minerals (ASX:CAD) and Kairos Minerals (ASX:KAI), which are set for some aggressive exploration over the dry season. Also worth watching closely is some of our previously mentioned gold explorers set to make an impact this year such as Odyssey Gold (ASX:ODY), Challenger Exploration (ASX:CEL) and Apollo Consolidated (ASX:AOP).

Iron ore reached a 10-year high of $US178 ($230) a tonne mid-week but retraced back to $US168/tonne on the back of more noise on China’s new five-year plan calling for ambitious targets to reduce environmental pollution, with steelmaking accounting for around 15 per cent of the country’s total emissions.

The target is to accelerate the adoption of electric arc furnaces with blast furnaces now using more scrap to reduce emissions.

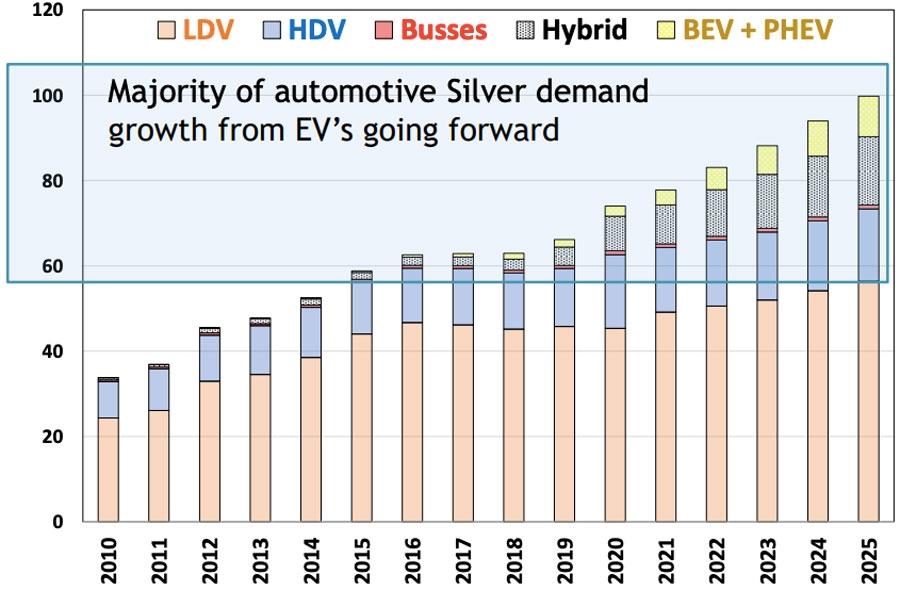

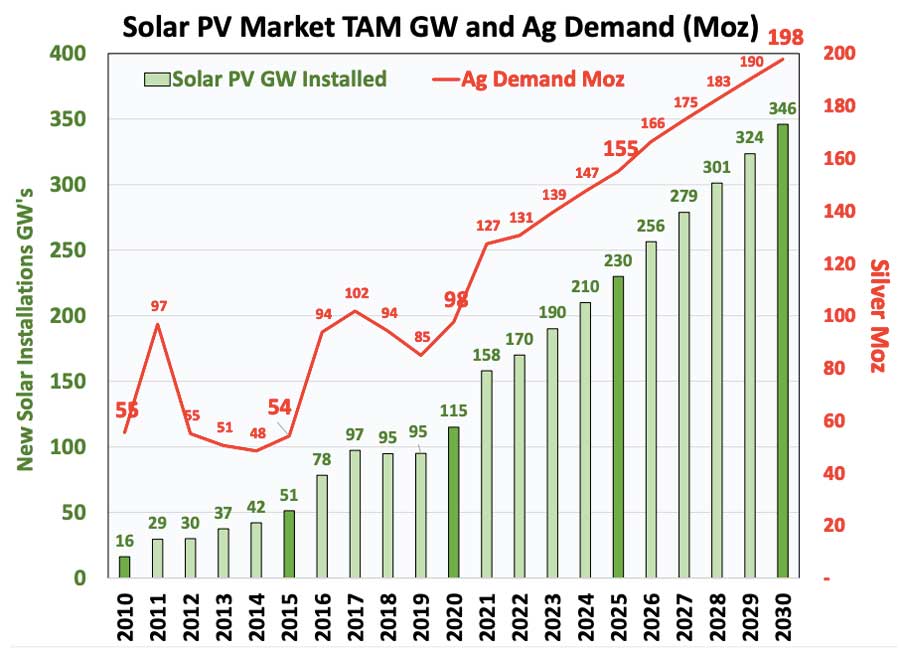

Last week I talked about the implications of the “electrification of everything” on copper and this week I am going to focus on silver.

It’s always a difficult one to get exposure through ASX-listed explorers/developers (as opposed to TSX-V in Toronto that does have a few listed silver plays), however I have discussed the Sorby Hills JV (75 per cent) of Boab Metals (ASX:BML), where silver will contribute over 23 per cent of life-of-mine revenue with lead (77 per cent) contributing the balance. This offers a good opportunity to gain some silver exposure from a fairly robust project.

As figure 3 and 4 clearly demonstrate, silver solar PV demand is growing strongly, consuming 10 per cent of global silver supply (115 gigawatts) in 2020 and projected to rise to over 30 per cent by 2050. This is on the back of a number of clean energy advocates who are calling for 3-4 terrawatts of installed solar PV per year by 2050, which equates to eight times the current silver demand.

Another junior I discussed last year is Venture Minerals (ASX:VMS) (figure 5), which appears to be making a successful transition from explorer to producer with the Riley iron ore project in northwest Tasmania (JORC resources 1.6 million tonnes at 57 per cent iron) starting to take shape.

Construction of the wet-screening plant is well underway with commissioning scheduled for late next month. Geoff Halloran has been appointed general manager with John Hall in charge of construction and commissioning.

The low CAPEX operation should be delivering its first shipment in the June quarter. Based on mineable resources and all-in sustaining costs of $85/tonne, the project should generate EBITDA in excess of $150m over the next two years.

With an enterprise value around $60m, active exploration at Orcus (Golden Grove, 7 per cent zinc assays from recent drilling) and drilling results pending from Kulin Gold (gold and platinum group elements), I think this year could see VMS in a very strong position despite the market not rewarding short mine-life projects.

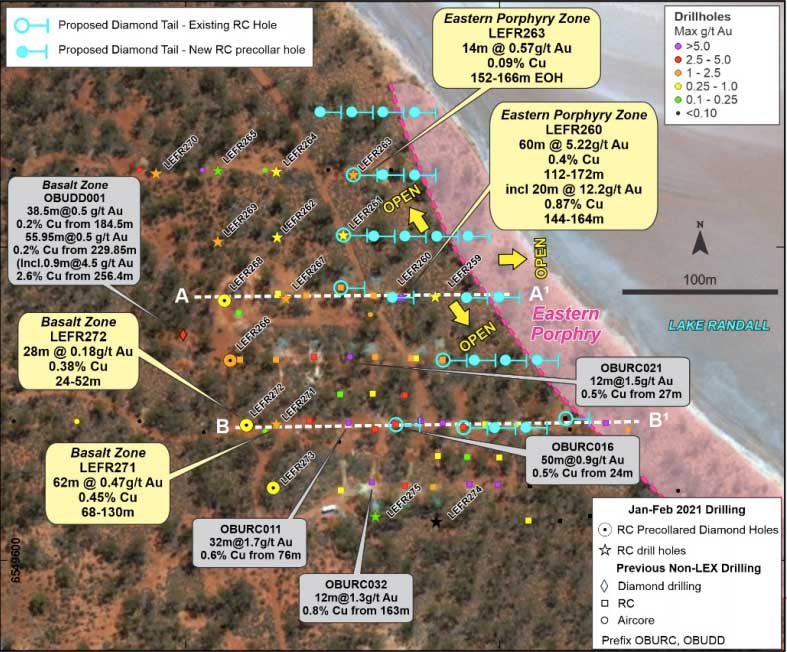

I have been a bit slow on the uptake with respect to Lefroy Exploration (ASX:LEX), which probably warranted a mention earlier last year on the back of some impressive results at its Lefroy gold project covering 621sqkm southeast of Kalgoorlie, WA.

The recently consolidated land package seems to be paying off, with LEFR 260 at the Burns gold-copper prospect (part of the 100 per cent owned Eastern Lefroy project) near Kambalda returning an impressive 60m at 5.2 grams per tonne (g/t) gold and 0.38 per cent copper from 112m downhole.

Managing director Wade Johnson considers this mineralisation has an apparent strike of a minimum of 200m based on LEFR263, which intersected 14m at 0.6g/t gold and 0.09 per cent copper from 152m downhole.

The company also has a $25m farm-in and JV with Gold Fields on the West Lefroy project.

As any experienced miner will tell you, the best place to find gold is in and amongst existing operations. The Lefroy project adjoins Gold Fields’ St Ives Gold operation (350,000oz of gold per annum) and Silver Lake’s Mt Monger project (130,000oz of gold per annum). In addition, there are five operating mills in the district with combined milling capacity in excess of 8 million tonnes per annum.

At a market capitalisation of over $70m I wouldn’t say the stock is cheap, but on the other hand, quality exploration results are always rewarded, particularly with multiple treatment and M&A options surrounding the project.

Anyway, there are likely to be as many eyes on LEX as there were on me after I not only won first prize, but also third prize in Friday’s raffle at Cigar Social in West Perth. A quality place that generates some of the better ideas for this report.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.