Guy on Rocks: For sale – 5Moz of gold, at 50pc off? Now that’s an African discount

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Gold was softer last week, off US$15/ounce to close at a five-month low of US$1,889/ounce, no doubt in response to a rising DYX which was up 56 basis points on the week and is now trading around 1023.43.

US 10-year treasuries were also pushing a nine-month high last week of 4.25% with the 10-to-2-year treasuries remaining inverted. Volatility as measured by the VIX remains slightly higher than last week approaching 12-month averages of around 17.

Silver was up 22 cents to US$22.78/ounce after a big sell-off the week before while platinum was up US$1/ounce to finish the week at US$912/ounce. Palladium, which has been under heavy selling pressure all year, was down US$40 to close at US$1,228/ounce.

In a risk-off week the strong USD also put pressure on industrial metals with copper three-month futures now back in a slight contango relative to the closing spot price of copper at US$3.72/lb (figure 1) as China’s deflating economy puts pressure on demand along with disappointed trade and softer PMIs, reaffirmed weak growth in July.

Yesterday, the PBoC reduced the Medium Term Lending Facility (MLF) rate to 2.50% in response.

Chile’s Centre for Copper and Mining Studies (CESCO) recently reported that Chile’s Codelco, the world’s largest copper producer, is at risk of insolvency due to rising costs and a growing debt stemming from projects that have fallen short of production targets. Current debt levels are now sitting at US$18 billion with CESCO looking to upgrade five of Codelco’s mines, which could see debt balloon to $30 billion by 2030.

In other metals news, Mercenary Geologist Mickey Fulp reported that Citibank has made a big speculative zinc play on the London Metals Exchange (LME) which is currently trading at US$1.03/lb (three-year low).

Overall Barrenjoey (August 2023) believe that weaker-than-estimated exports and falling imports, along with modest PMI figures, high-frequency auto and property sales data, all paint a gloomy picture for the Chinese economic recovery moving into Q3.

Plenty of cracks appearing in China with Country Garden’s bonds and shares plunging this week after bondholders failed to receive coupon payments of two-dollar notes by an initial deadline. This has raised the concern of another default.

In other copper news, The Australian last week reported that South32 and Sandfire Resources were considering a joint bid for the $US2 billion Khoemacau copper mine, owned by private equity and situated in Botswana. The mine has a 22-year mine life, producing 60kt of copper a year and has potential to ramp up to 130ktpa.

Despite the challenging market conditions, speculation at the LME appears to be on the rise with the highest ever recorded open interest in long contracts in industrial metals with a corresponding rising interest in short positions.

It’s no secret that inflation has hit global miners hard with cash costs of production for copper, nickel and gold rising substantially (figures 2 – 4).

While US inflation numbers came in at 3.2% the week before last, slightly below market expectations, arguably showing that inflation is coming off the boil, investors should be concerned about rising oil prices which have responded to recent OPEC production cuts.

WTI ended a seven-week rally closing the week at US$81/bbl down US$2/bbl over the previous week (figure 5) with US gasoline prices also remaining high at US$3.85/gallon, up a further 3 cents from the preceding week.

The number of US active drill rigs declined by five last week with the Energy Information Administration claiming that oil production is now at post-pandemic highs of 16.6Mbopd (compared to an average of 13.2bopd over 2018-2019) despite US President Joe Biden indicating to a CNN reporter last week that his administration would like to stop oil drilling on Federal lands (both onshore and offshore).

Yes, you read that right.

Federal lands currently account for production of around 1Mbopd.

Uranium (figure 6) extended gains into a fifth week, closing the week at US$57/lb, approaching the 14-month high of US$57.75 reached in June in response to supply risks and bullish demand in the long term.

Utilities across the US and Europe are increasingly conscious of the need to reduce dependency on Russian uranium, which is responsible for around half of the world’s share of uranium conversion and enrichment.

In July it was reported that a ship carrying uranium was prevented from leaving St. Petersburg due to a lack of proper insurance coverage.

Ongoing political upheaval in Niger (backed by Wagner?) also put further uranium exports at risk. Longer term demand however looks robust with a steady pipeline of mega power plants, particularly in China.

Uranium prices have gone against the trend despite the Biden administration stating that it intended to protect land in Arizona, known as the Arizona strip, that is highly prospective for uranium. This isn’t the first time the Democrats have attempted such a move with the Trump administration rolling back some of these regulations/moratoriums a few years ago.

Good to see some local support for nuclear power with Gina Rinehart stating the obvious in the AFR that farmers can’t afford electric powered machinery and that if we want to achieve a goal of net zero, nuclear remains a viable option. Good on you Gina; the Cigar Social Climate Change Sceptic Committee is going to raise a cigar to you this Friday as a show of support.

In lithium news, Australia’s Liontown and Japan’s Sumitomo last week announced the signing of a joint feasibility study, to be conducted over two years, to develop a lithium supply chain between Australia and Japan. More specifically this study will interrogate the use of lithium concentrate (spodumene) from Liontown’s Kathleen Valley project in Western Australia (and possibly a lithium sulphate product produced at the Australian plant) to produce downstream lithium hydroxide in Japan.

While the focus of Diggers and Dealers this year was very much about lithium and related battery metals, there was some excellent value in the junior/mid-tier gold space if you looked hard enough.

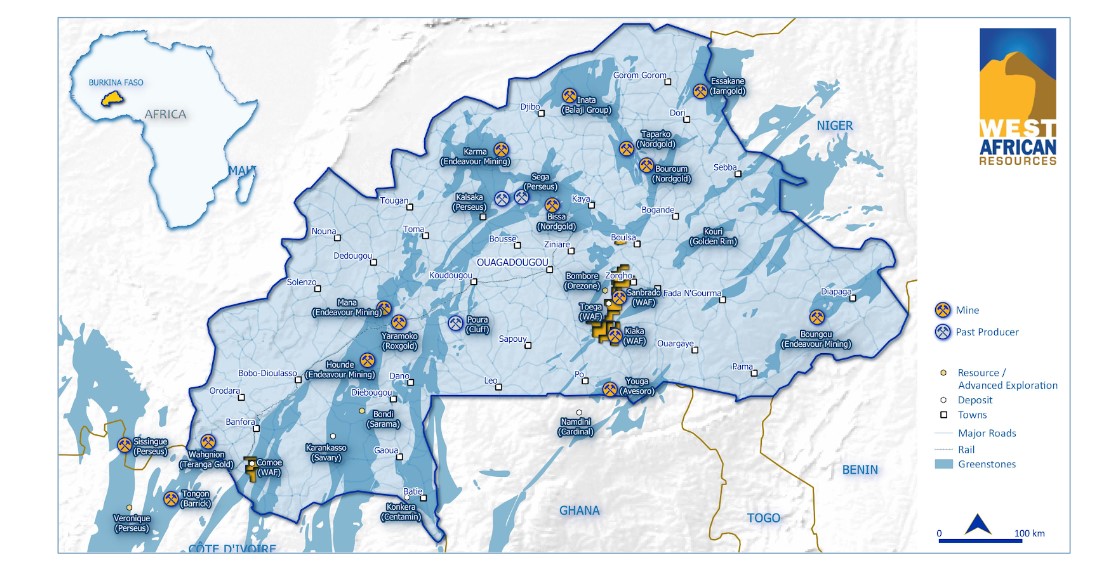

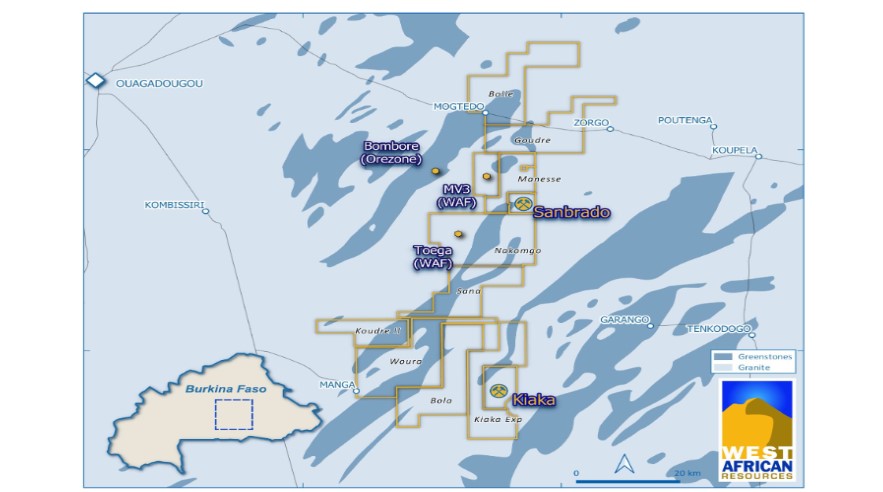

There have been a few rumblings in West Africa this year with the recent Wagner-backed coup d’etat in Niger not making life any easier in the region. There have been some security concerns in Burkina Faso but this hasn’t stopped West African Resources (ASX: WAF), chaired by regular NextGen gym goer Richard Hyde, from powering on at its Sabrado Gold Mine.

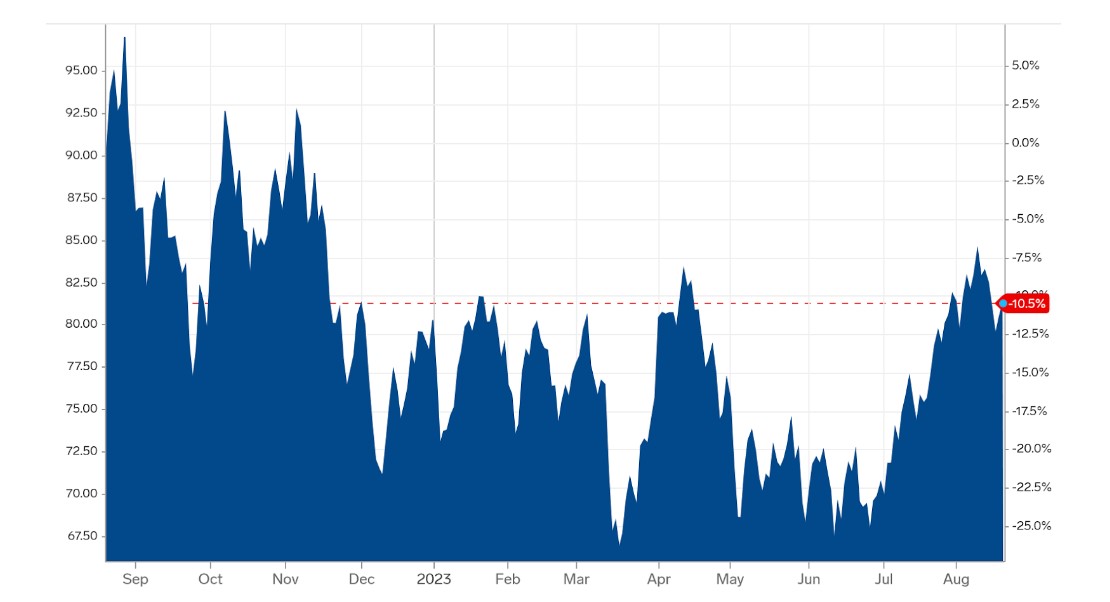

Some recent USD strength and political instability have seen a sell-down in WAF from just over $1.40 to around 79 cents per share. Macquarie Research (July 2023) however have a some-of-parts valuation of $1.60/share which I wouldn’t disagree with.

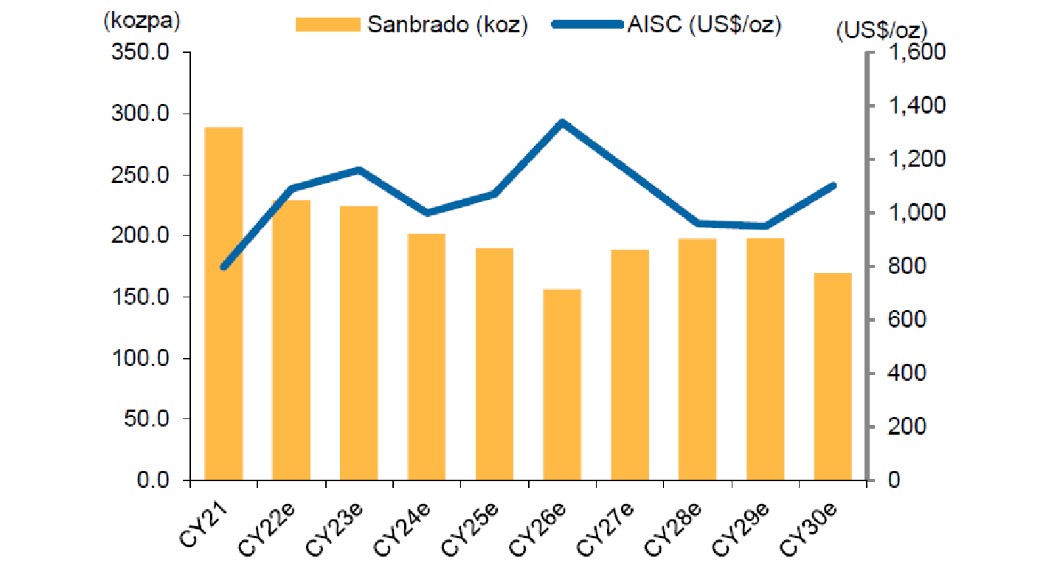

The company, which has total JORC Resources of 80Mt at 1.9g/t for 4.9 Moz gold, appears on track for FY 2023 production of around 210,000 to 230,000 ounces of gold at an all-in sustaining cost of under US$1,200/ounce and is aiming for around average annual production of around 185,000 ounces per annum over the next 10 years or so (figure 9).

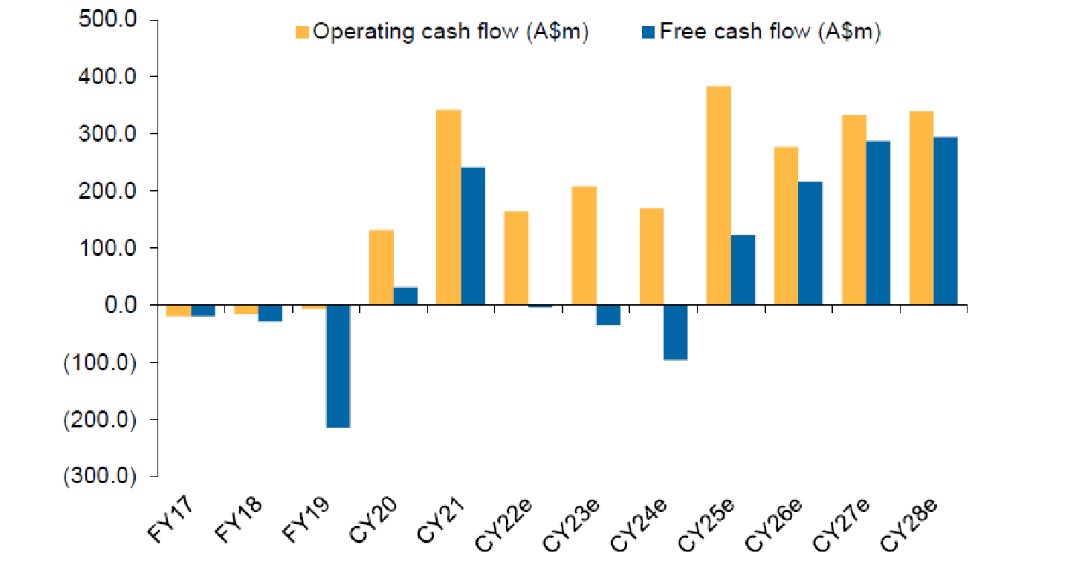

This is projected by Macquarie to deliver some substantial free cash flow over the coming years (figure 10).

There is plenty of earnings upside with Kiaka Gold project to produce over 200Koz of gold per annum over an 18-year (from mid-2025) mine life (figure 11).

I am a big believer that Australian mining companies operating in Africa have been good corporate citizens and have been adept at pushing through periods of instability. Many of the Stockhead faithful would remember legendary Perth mining executive Bill Turner who headed up Anvil Mining which became a successful copper producer in the DRC, and was, for a period of time, embroiled in controversy in the middle of insurgent territory.

I think when sentiment turns around, WAF are going to have their day in the sun again…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.