Guy on Rocks: Chalice at $1.03? Don’t be cruel…

Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

Plenty of seismic activity in WA this week, and I am not talking the geological type.

First the Fortescue Metals Group (ASX: FMG) annual foot race with senior managers namely Fiona Hick (chief executive), Christine Morris (chief financial officer) gone, and Guy de Belle (Future Industries director) being the third executive out of the blocks.

Well Guy was a handy 800m in our track and field days in Adelaide however I do recall edging him out of a 100m after he was a little slow out of the blocks; so, third place is about right for him.

According to the AFR that brings the total to 11 over the past three years. Maybe the next one could be 12th man or women?

Let me guess – they thought the renewable energy transformation to FMG’s operations as it was laid out to them was potentially going to send FMG to the wall? Maybe green hydrogen doesn’t work given reasonable expectations of the development of the technology over the short to medium term?

Maybe the whole carbon dioxide/global warming link driving renewables is… crap?

The three luminaries that left the building are some of the more capable among us and I am sure they would appreciate the fact that ice core sampling shows that in the past when carbon dioxide was up to 100 times higher than now, there were a number of Ice Ages.

Emeritus Professor Ian Plimer (May 2022) goes on to point out that Australian forests adsorb 940 million tonnes of carbon dioxide per annum compared to total domestic and industrial emissions of 417 million tonnes. So, we already sequester five times as much carbon dioxide as we emit.

I can’t be too hard on FMG given Dr Forrest started with a busted-up shell, namely Allied Mining & Processing, back in 2003 and turned it in to a 190M tpa iron ore producer with a FY 2022 EBITDA of $9.9 billion.

Not a bad day at the office…

Gold had a solid week bouncing off US$1,900, up 1.4% to close at US$1,940/ounce on safe haven buying.

The DXY (US dollar index), after a soft week, closed up strongly later in the week closing at 104.28 for a 15-basis point gain while US 10-year treasuries moved from 4.06% to 4.19%. 10-2-year US Treasuries continue their 18-month inversion.

Volatility as measured by the VIX remains sharply lower this week at 13.1 despite poor consumer confidence, lower GDP up 4.2%, higher unemployment and soft manufacturing PMI figures at 47.4 (well below the breakeven figure of 50).

Silver was off 6 cents to US$24.15/ounce after a strong rise in the previous week while platinum was basically flat at US$960/ounce. Palladium continues to be under selling pressure all year, down US$2 to close at US$1,192/ounce.

Copper was up 10 cents on news of further Chinese stimulus (or more correctly the hope of stimulus) closing the week at US$3.83/lb with the 3-month forward contract remaining in a modest 1-2 cent contango.

Chinese constructors recently returned sharp losses in the latest quarterly earnings as demand plunged and oversupply concerns for new housing. Beijing immediately set about easing mortgage curbs in Guangzhou and Shenzhen. Twelve provinces were also given the green light to issue CNY 1.5 trillion of special financing bonds.

Chinese steelmakers ramped up production to undercut imminent output cuts mandated by policymakers, in the process depleting inventories and raising the outlook for iron ore purchasing activity. In response, 63.5% iron ore cargoes for delivery in Tianjin were at $115 per tonne, testing their highest level since April.

The big mover last week however was WTI, up a whopping 7% closing at US$85.69 with supply/demand fundamentals kicking in.

US production remains at 12.8m BOPD, a post pandemic high compared to 13.2m BPOD during the Trump administration. Inventories were down at 10.5m BOPD with US imports remaining high at 6.6m BOPD and refineries up slightly at 6.7m BOPD on increased demand. US gasoline prices also remain at year-to-date highs.

On EV news it appears sales have been a little sluggish with Tesla slashing prices (up to 20%) both domestically and in China. The production of EVs out of China is a fraction of the cost of production in the US.

It will be interesting to see how sales around the world go as government subsidies are eventually wound back.

On the nickel front, according to Argus (28 August 2023), Chinese battery metals producer Huayou Cobalt recently signed an agreement with Vale Indonesia to develop a High-Pressure Acid Leach (HPAL) plant for a mixed hydroxide precipitate in south Sulawesi (Indonesia). The Huali Nickel project is scheduled to come online in early 2027 at 60,000t/yr nickel (equivalent) and 5,000t/yr of cobalt.

Uranium finally broke through US$60/lb with prices now up six of the last seven weeks, surging this week to US$61.13/lb or a five per cent gain. This represents a high since the Sprott Physical Uranium Trust started buying uranium in April 2022.

Equities however appear to be lagging so are they about to pop? Ironically the Sprott Uranium Trust is still trading at a 3% discount to NAV – probably not a bad exposure to the yellow-cake for the uranium bulls out there.

New Ideas – Legion of the Damned (The Poison Chalice)

The other seismic event, whose aftershocks have been rumbling over the weekend, was the Chalice Mines (ASX:CHN) Scoping Study which was released on 29 August 2023.

You will notice our headline here is a death metal band.

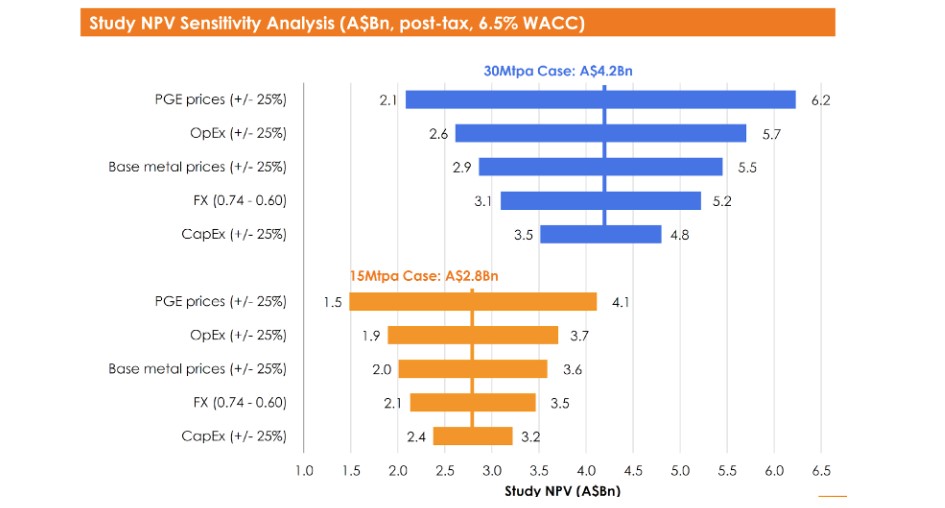

I note that in order to deliver the NPVs set out in figure 4 the following metal price assumptions were made (table 1). Note the variance of these assumptions to current spot prices:

I would like to bring the attention of the Stockhead Faithful to an excerpt from my November 2021 “Guy on Rocks” article regarding CHN:

“Time will tell but I think a higher-grade core of mineralisation is needed to make Julimar work — hopefully exploration will find additional near surface, higher grade mineralisation along strike”.

Figure 6 is an updated version of the bubble chart (courtesy of Kingsrose Mining, ASX:KRM) showing Julimar and the Julimar high-grade near the bottom of the grade pile and below the line where KRM have rightly pointed out (3g/t total precious metals grade) you will find very few operating mines. It appears Julimar is sitting just under 1g/t.

KRM, for those of you who are interested, has an enterprise value of just $20 million with an exploration target of 21 to 32 million tonnes at 4.0-7.4g/t 6E, for 2.8-7.7 million ounces on their Penikat project which I think is realistic given results to date.

As I was at puppy training school on Saturday morning I recalled my old North Flinders Mines (later acquired by Normandy Mining) supervising geologist Gerard Bosch who used to say back in the 1990s (Tanami desert) when a project wasn’t looking so flash:

“it looks more like a Poodle than an Alsatian.”

Well Gerard, this one might be the former.

So, as in one of my favourite shows “Antiques Roadshow”, everyone wants to know what it’s worth?

I think Julimar currently has “option value” given the Scoping Study demonstrates (to me at least) that it is marginal at significantly higher metal prices (table 1).

I note that 55% of the revenue (figure 6) is from palladium and the Scoping Study uses a long-term price of US$2,000/ounce compared to the current spot price of US$1,186/oz or 69% higher than the spot price. AME, referenced in this study, is a credible entity as far as commodity price forecasting is concerned, a task which is challenging at the best of times, particularly when looking beyond 2-3 years.

Macquarie on the other hand (Macquarie Research, 26 July 2023) were forecasting palladium to decline to under US$1,000/ounce by July 2027 (figure 7).

While this doesn’t represent a life of mine assumption, it does appear that as Julimar moves nearer to financial investment decision in 2H of 2026 (slide 27 of the Scoping Study presentation), the palladium price according to Macquarie, is forecast to be less than half of what CHN are using in the Scoping Study life of mine projections.

I am not saying that I necessarily agree with Macquarie, what I am pointing out is the extreme divergence in views out there in the marketplace. The Stockhead Faithful would be aware that over 80% of palladium is currently used as an auto catalyst in conventionally aspirated motor vehicle engines.

Palladium prices have been extremely volatile (figure 7) and I am not saying that the metal price assumptions are unreasonable over the longer term, it is more the fact that even if these assumptions prove correct, the 27% internal rate of return does not justify the risk and capital to develop the project.

Given its low grade and marginal economics, the value of Julimar would equate to option value in the $50 million range or around 40 cents per share (inclusive of net cash of around $100m).

Another way to value CHN would be to use the base case Scoping Study after tax net present value of $2.5 billion, and discount this value based on the stage of the project. This all assumes of course that you agree with the Scoping Study base case assumptions.

I like to use an 80-90% discount to NPV at the Scoping Study level (level of certainty typically 30-50%) which would give you a value of say $280-$560 million, add in net cash of around $100m would give a value (assuming no value for exploration) of $1.03-$1.80/share.

As a project moves closer to production (i.e., advances through Pre-Feasibility, Feasibility, Financial Investment Decision, then production) I prefer to drop the discount to NPV to say 20% pre-production (depending on various factors including the level of risk associated with the project).

I think the NPVs as represented in the Scoping Study are optimistic however, so I prefer a value closer to $50 million (option value).

So, my view is that there is still significant downside from $2.80/share or just over a $1 billion market capitalisation.

Obviously there are a number of factors that could turn things around for CHN including a significant uplift in metal prices (over and above those assumptions outlined in the Scoping Study), metallurgical or technological advancements and/or the discovery of higher-grade mineralisation (nearer surface and/or at depth).

According to the Scoping Study presentation there are higher grade intercepts at depth including 34m @ 7.0g/t 3E, 0.16% Ni, 0.63% Cu, 0.02% Co (2.9% NiEq) from 432m downhole that may contribute to mineable resources at depth between ~400m to 1,100m+, and therefore could be blended or integrated with open pit material to improve project economics.

I would seriously question the benefits of moving into a pre-Feasibility Study without first outlining significant tonnes of higher-grade mineralisation somewhere (preferably nearer surface) in the system to improve the economics of the project. With 30km of mineralised strike there is certainly that potential.

Anyway, what would I know?

I thought I would check in with Elvis, after a recent sighting (from a credible source) at American West Metals’ (ASX:AW1) Storm Project in northern Canada and get his opinion.

His reply after reviewing the Scoping Study was “I’m all shook up”.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.