Guy on Rocks: Will sanctions nuke the Russian economy — or spark one of the great wealth transfers of all time?

Lenin addressing crowd during Russian Revolution in 1917. Pic: PHOTOS.com>> / Getty Images Plus

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: This is uncharted territory

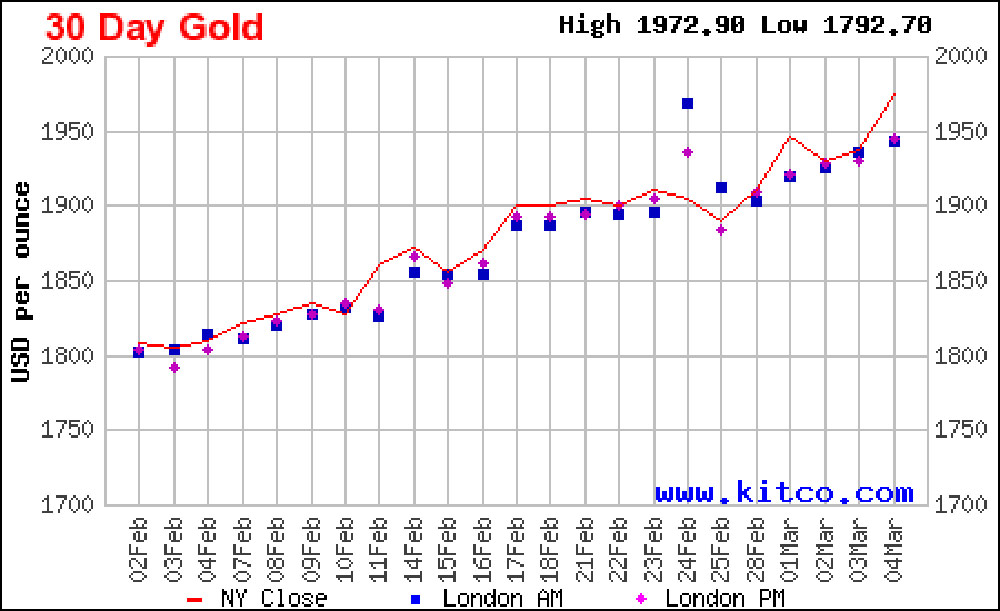

Last week was a wild ride by any measure with gold (figure 1) closing up just over 4% for the week at US$1,972/ounce, despite a strong US Index closing at 98.5 in a risk-off market.

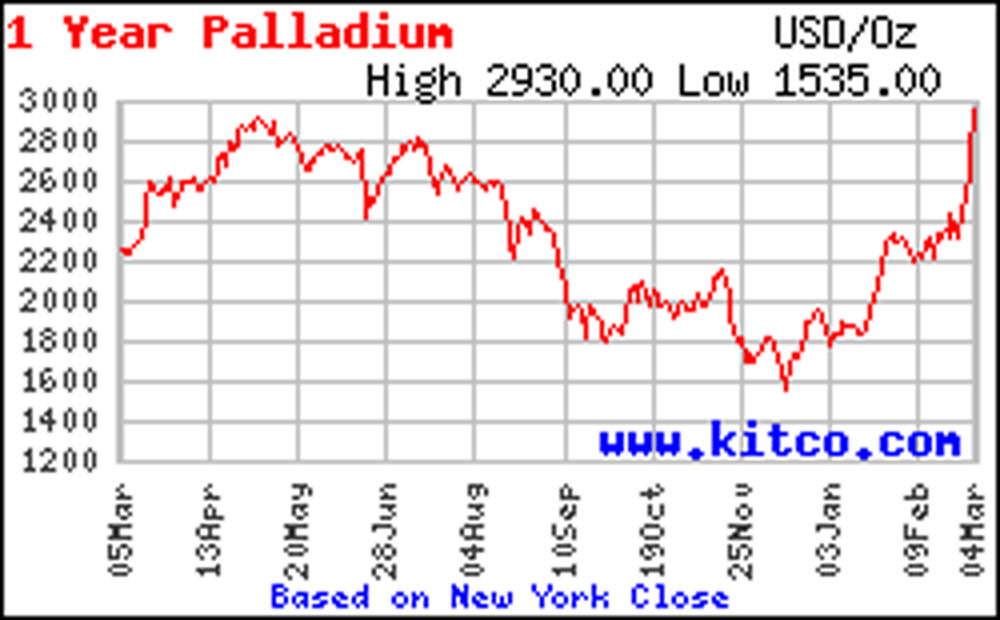

Platinum was also up 5.7% for the week to close at US$1,122/oz, but the big news of course was palladium (figure 2) that reached an all-time high of US$2,915/ounce up a staggering 26% for the week.

Great news for investors but concerning for the European auto sector that is reliant on palladium for use in catalytic converters. Soaring energy prices and runaway inflation drive up input prices.

Brent crude traded in a whopping US$25/range from US$90-US$115 bbl last week accompanied by record LNG prices in Asia and natural gas in the UK hitting a record 764p/therm.

On 7th March, Brent traded up to US$123/bbl. In response the IEA released 60MBOE to increase supply however this represents only 15 hours of world demand.

Mickey Fulp (the Mercenary Geologist) pointed out the Germans are paying a high price for switching off nuclear plants with energy costs rising 130% YoY.

Uranium traded at over US$51.45, up 14% for the week. The Sprott uranium trust purchased 49.6 million points last week, up from their normal 200,000 pounds per day.

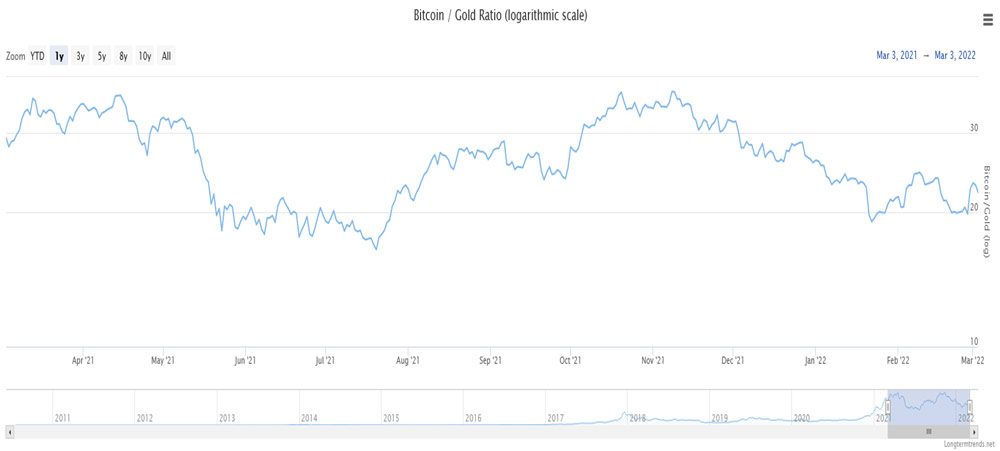

Gold appears to be outperforming Bitcoin (up over 16% YoY v Bitcoin which is off 15.6%-figure 3) which may lend weight to its status as a safe haven.

However, it appears that Bitcoin has enabled Ukrainian refugees to move funds out of the country and could also enable the upper echelons of Russia to dodge economic sanctions.

Interestingly, the Ukrainian government has been seeking donations in Bitcoin and Ethereum with around A$15 million received so far in the Bitcoin and A$7.0 million in the Ethereum wallet.

A long-time gold bull Mickey Fulp (Podcast, 4 March 2022) highlighted gold’s resilience over the centuries with only parts of West Africa trading gold for salt as an alternative store of wealth.

Base metals are also on a tear with copper up to US$4.82/lb up 6% for the week and only 2 cents off all time high (May 2020) and now in strong contango.

Aluminium (figure 4) also touched an all-time high of US$3,849/tonne and zinc is at a 15 year high of US$1.83/lb.

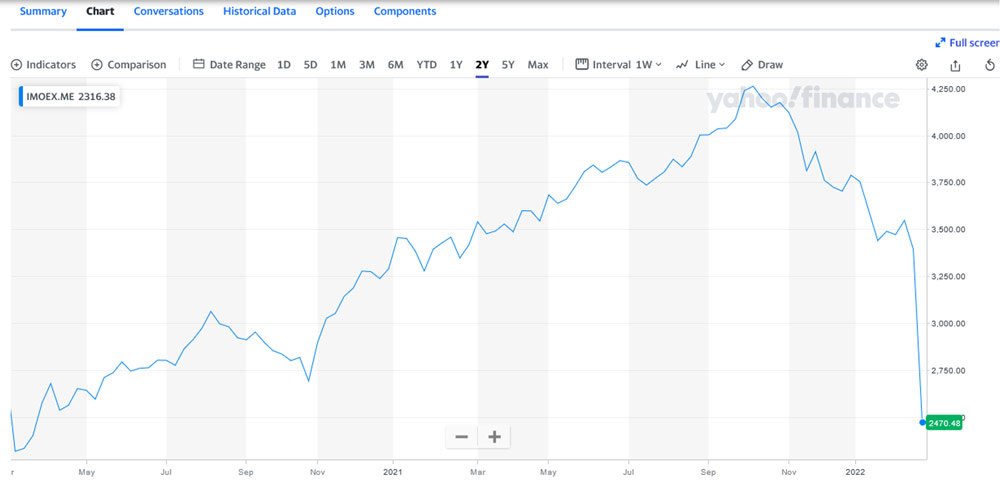

Spare a thought for the poor old Muscovites who have endured a collapsing currency (ruble now trading at 122 to the US$1), frozen foreign reserves, exclusion from SWIFT, a plummeting MOEX Index (figure 5) off over 40% since October 2021 and more recently, Visa, Mastercard and American Express pulling the plug.

I hope Mrs Putin has a few gift cards left over from Christmas, she might need them. Moody’s have also downgraded their credit rating to CCC or Junk Status.

I must say I didn’t think the West would come in like a low flying bomber and nuke the Russian economy which could be set back 30 years.

The remaining question is whether the West are prepared to use the H Bomb and ban Russian Oil and Gas imports.

This appears unlikely given this would amount to mutually assured destruction (M.A.D.) for most of Europe as energy prices would reach into the next galaxy.

There has been a question mark over whether Russia can secure and hold the Ukraine, however the economic war against Russia appears all but over.

Only some generosity from China buying oil, gas, nickel, and palladium (and whatever else they can unload) from Russia can stave off a complete economic collapse and a 1918 style rebellion (Russian civil war 1918-1920).

This may result in a very sticky end for Putin. My limited knowledge of Chinese business negotiations however is that their generosity only extends so far…

No doubt the Stockhead faithful will be aware that rampant inflation and food shortages got under the skin of the Russian people and precipitated the 1917 Russian revolution.

The seeds have been sewn for something cataclysmic to unfold here and this won’t be lost on the Russian Generals.

Company News

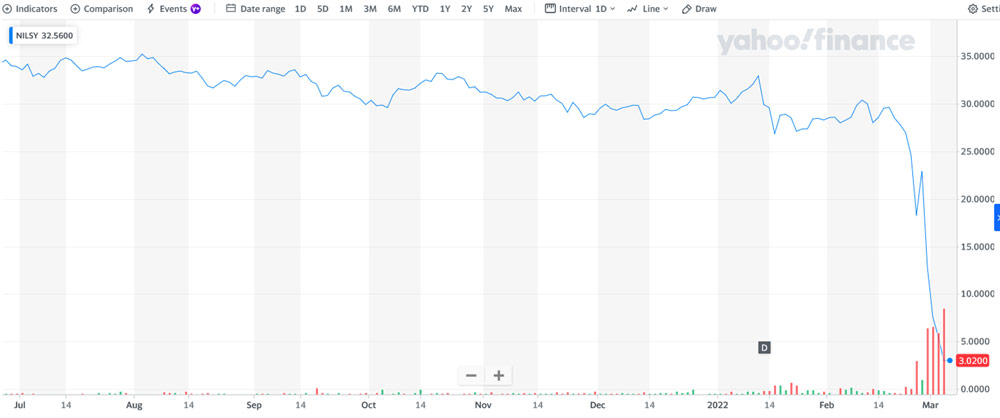

Norilsk Nickel (OTCMKTS: NILSY) has borne the full brunt of the exodus from Russian equities (figure 6) that will likely end up with many Russian company’s exclusion from Western stock exchanges and quotation platforms.

Norilsk is world’s largest producer of refined nickel, palladium, and platinum, was trading at a dividend yield of 7.37% prior to the meltdown.

Nickel, palladium, and platinum were substantially above their 12-month averages even before the Ukrainian crisis, meaning that dividends in the forward 12-months should have been reasonably expected to increase.

Fast forward to today, Norilsk Nickel has crashed and is now priced at a dividend yield of 111%.

In other words, assuming the total payout ratio, Norilsk could pay out a special dividend of 11% to Shareholders and purchase all of its stock on issue at the current price of $USD 3.02 from one year of earnings.

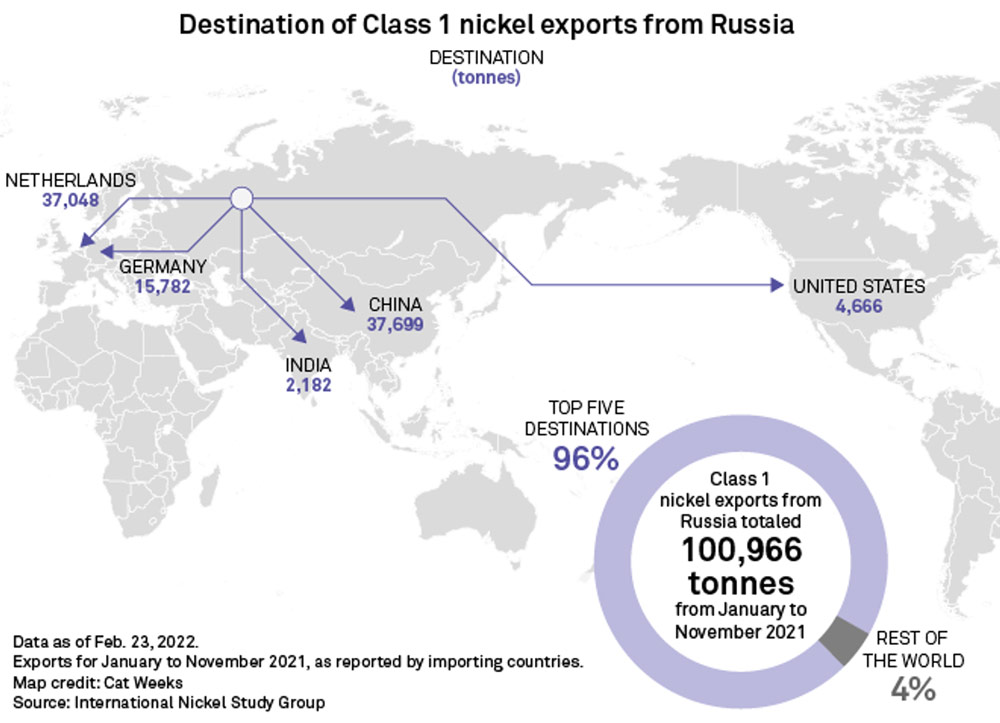

As you can see (figure 7), the world is heavily dependent on Norilsk nickel.

So why haven’t the arbitrageurs of the world stepped in to correct this price madness? Russian stocks have become untradeable from a liquidity perspective.

Russia’s stock market has frozen for several days – the Russian Central Bank will provide an update on the resumption of trading on Wednesday.

Nonetheless, accessing the Russian market may be impossible for Western investors.

Turning to Norilsk’s overseas ADRs, the LSE suspended Norilsk’s London-listed ADR last week, the US’ OTC Markets Group suspended its ADR, and Germany’s Frankfurt and Berlin-Bremen exchanges have also suspended trading.

In the days the preceded these suspensions, Western funds sold down their Norilsk (and other Russian) holdings at the behest of their investors and government authorities.

“(the government has a) strong expectation that Australian superannuation funds with review their investment portfolios and take steps to divest any holdings in Russian assets” – Josh Frydenberg, Treasurer of Australia.

The sell-down begs the question of who is the counterparty to these trades?

There must be entities that are gaining Russian exposure. To me, it seems that the most likely answer is Russian funds or even the Russian Central Bank.

Indeed, on March 1, the Russian Government ordered the finance ministry to channel USD$ 10.3 billion from the National Wealth Fund to by shares in Russian companies.

The net effect is that Russia is buying back its assets at bargain prices not seen since the well-publicised privatisation following the dissolution of the USSR.

The perverse nature of this is that the vicious market-order selldown of Russian stocks may result in one of the greatest wealth transfers of all time back to Russia.

Perhaps the best way for Putin to keep the oligarchs onside is to again involve them in the wealth transfer and the acquisition of world-class assets when there is not an efficient market to facilitate the transaction of them.

However, the speed and extent of Western sanctions on Russian oligarchs may mean that there is simply zero dry powder for this to be possible.

Nonetheless, there may be some Western investors who have taken a private equity perspective on the time horizon for these now illiquid investments – and these investors could make away like total bandits if these assets become liquid again.

New Ideas

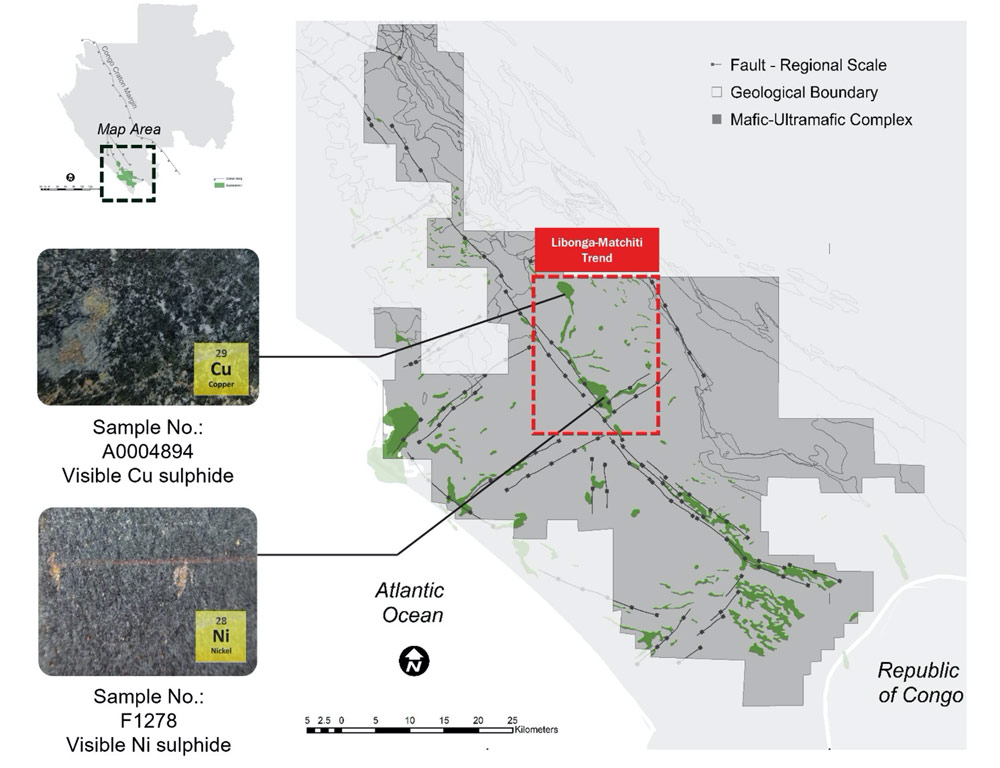

With nickel, copper on the march the recently ASX listed (December 2021) Armada Metals (ASX:AMM), which boasts a large land position covering around 3,000 square kilometres in southern Gabon targeting magmatic nickel copper deposits, is one to keep an eye on. The projects (figure 8) contain a number of drill ready targets and is led by Managing Director and CEO Dr Ross McGowan, a geologist with over 20 years’ experience and the recipient of the prestigious PDAC Thayer Lindsley Award for an International Mineral Discovery (Kamoa) in 2015.

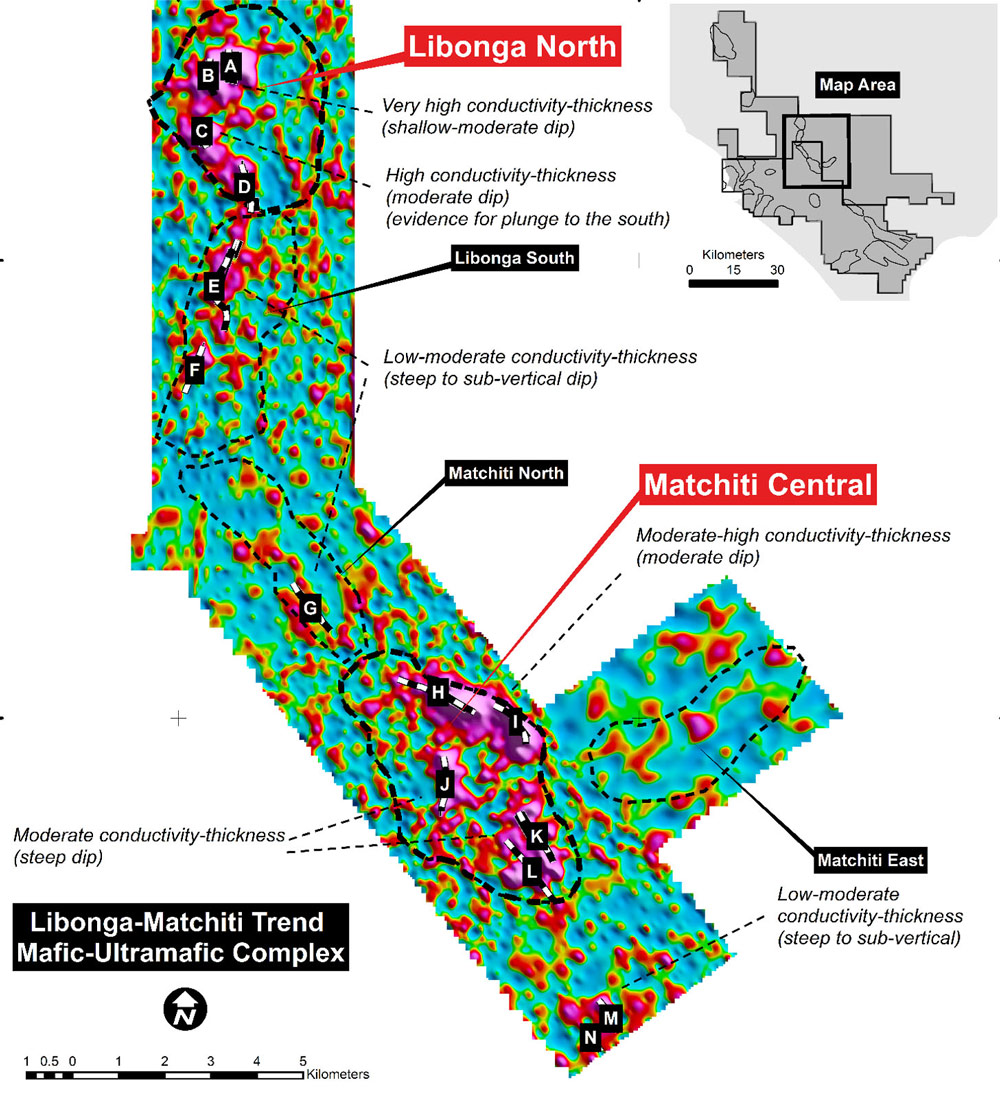

There are around 18 targets already identified along the 25-kilometre long Libonga-Mathchiti trend (figures 10 and 11) comprising gabbroic and peridotitic fractioned rocks, of which five are coincident with anomalous copper and nickel in soils and visible copper and nickel sulphides.

A number of electromagnetic plates have already been modelled within 25m to 140 metres from surface and are ready for drilling (figure 11).

With an EV of just over $4.0 million at 13.5 cents and a 3,000-drill program underway this quarter (figure 12) I am hoping Armada can stay on course and deliver a decent result in this highly prospective terrain.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.