Guy on Rocks: ‘Short the market and go long gold’ as inflation monster looms large

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Precious metals moved up marginally during the week on the back of a higher than expected 75 basis point interest rate hike from the Fed that saw the US dollar index nudge 106 and US 10-year treasury yields reach as high as 3.5%; this would suggest that longer term inflationary expectations remain high.

The Fed’s monetary policy now appears to be prioritising a reduction in inflation, even as the risks of recession sharply increase.

Randy Smallwood, president, and CEO of Wheaton Precious Metals (speaking at last week’s PDAC Conference in Toronto), believes we are at the start of the “inflation monster”, suggesting inflation could top 15-20% spurred on by the Federal Reserve’s loose monetary policy and supply chain shortages.

A deep recession, according to Smallwood, is a likely outcome.

The Stockhead faithful will be pleased to know that Smallwood is also chairman of the World Gold Council (so we can’t accuse him of drinking his own Kool-Aid), which recently reported that 25% of recently surveyed central banks are accumulating gold as an inflationary hedge.

China appears to have moved away from purchasing US Treasuries and has opted instead to increase its gold holdings, a move which Willem Middlekoop (author of “The Big Reset”) likens to a financial World War Three.

In my view, the US dollar’s position as a safe haven looks precarious.

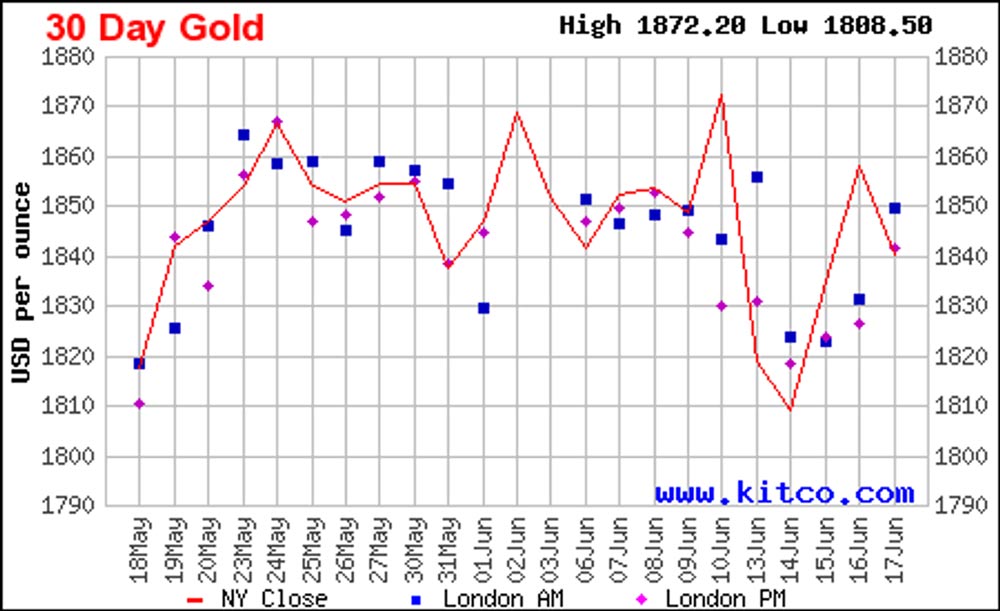

In response to last week’s rate hike, gold moved up slightly, putting on US$7 to close at US$1,837/ounce (figure 1) with the more industrial use metals such as palladium closing at US$1,746/ounce and platinum at US$930/ounce, down 4% and 2.6% respectively.

To give investors some comfort here is Myrmikan Research’s (14 June 2022) take on where we are heading:

“The late Autumn promises rising unemployment, plunging asset prices, soaring deficits, a temporarily softening official CPI number (even while the costs of living continue to increase), and more war — and, if the adjustment is quick enough, all in the context of a looming mid-term election.”

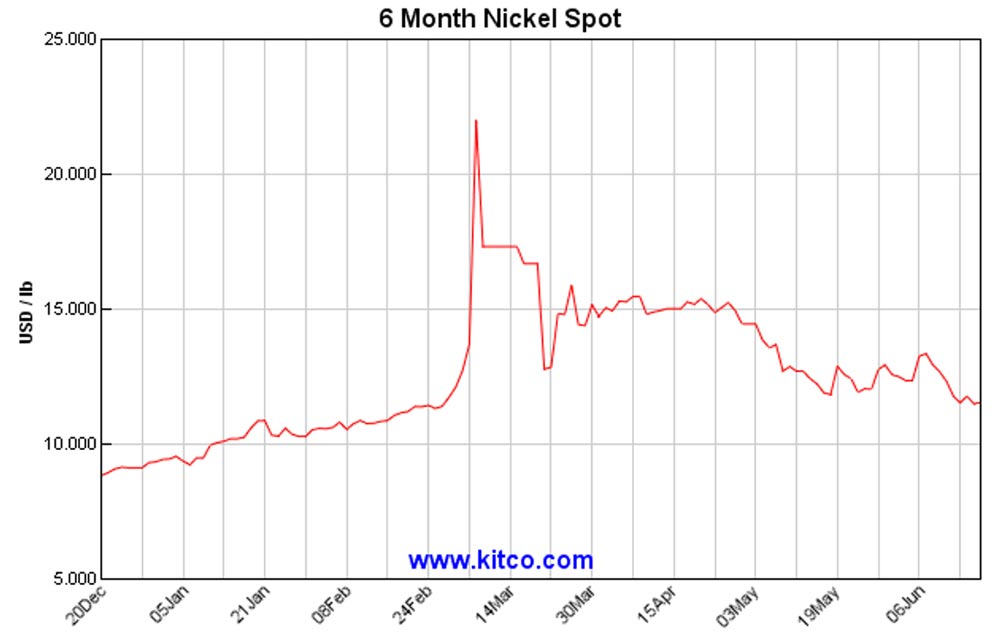

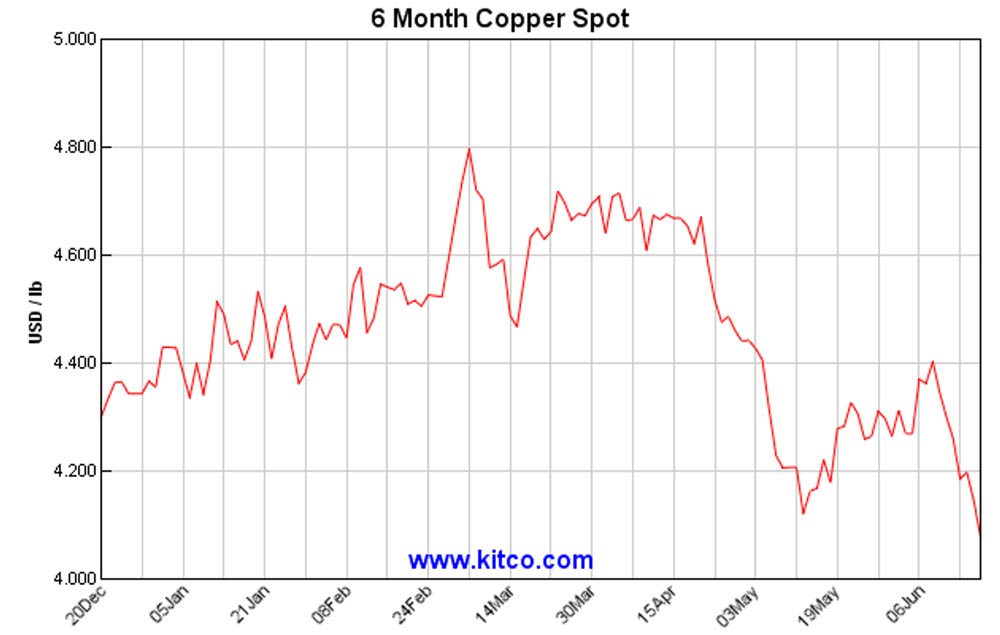

Nickel (figure 2) and copper (figure 3) have continued their downward trend with copper closing at US$4.08/lb, off 10% for the week with three-month futures remaining in backwardation, 6 cents under the spot price.

Not surprisingly talk of a recession has contributed to recent price declines.

As I have repeated on many occasions, the longer-term supply of copper has never looked more questionable, so I don’t anticipate a collapse in copper, or the other base metals for that matter.

Volumes on the TSX-V were up 50% from last week but remain at very low levels as a likely sell-off continues as we move into the northern hemisphere summer. The index finished down 10% for the week to close at 641.

Oil had its second largest weekly decline this calendar year, closing at US$109.90, down 8.7% with OPEC failing to deliver on production increases. Meanwhile US oil imports surged to 7MBOE up 830,000 bbls for the week while gas prices remain stubbornly high over US$5/MMBTU.

Uranium dropped 10% over the week to close at US$46.75lb with the US Government deciding not to impose sanctions on Russian enriched uranium, given Russia produces 43% of the world’s enriched nuclear fuel.

Iron ore has held up reasonably well, trading around US$122/tonne (62% fines) however premiums for lump have dropped sharply.

This is in spite of soft May economic data coming out of China showing a fairly modest recovery from the recent lockdowns. Australian iron ore miners will be watching China’s move to consolidate the country’s iron ore imports with interest as the China Iron and Steel Association attempts to establish a centrally controlled group later in CY 2022 to increase Beijing’s pricing power over iron ore.

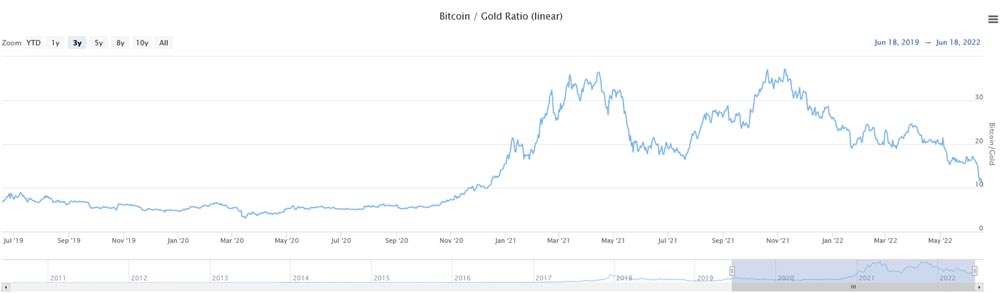

Finally, a brief look at our Bitcoin v Gold chart, and it’s looking ominous for the Bitcoin believers; it appears gold is winning this race (figure 4).

I am maintaining my view of being short the market and long gold, however I thought I would roll out Kingsrose Mining (ASX:KRM) which I mentioned back in November last year.

The stock has come off from highs around 10 cents and is now trading just under 6 cents.

In early May the company reported some interesting rhodium (“Rh”, trading at US$18,000/0z), iridium (“Ir” trading at US$5,000/oz) and ruthenium (“Ru”) assays from previously reported palladium, platinum, gold and base metal intersections at their Penikat, Finland.

Highlights included:

The company reported average grades for rhodium at the SJ Reef of 0.25g/t Rh, and the AP and PV Reefs of 0.10g/t Rh based on the recent resampling.

At an EV of just under $30 million, this is definitely one of the higher-grade and more interesting PGM plays listed on ASX.

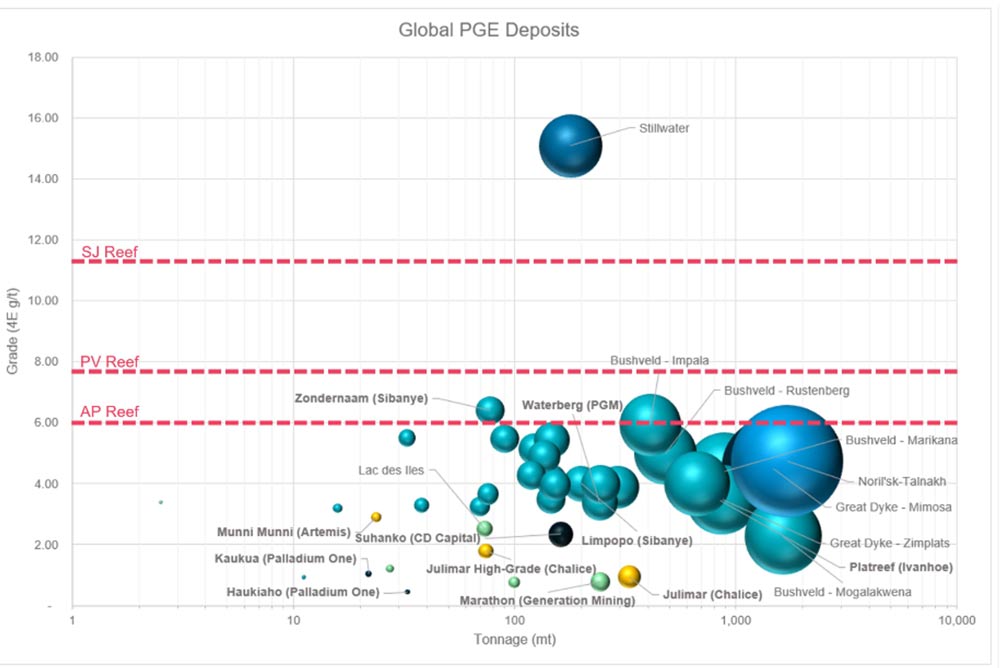

Just a reminder (figure 6) of where the KRM deposits potentially sit on the grade tonnage curve which presents an interesting contrast with Chalice Mining (ASX:CHN) on the other end of the spectrum.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.