Guy on Rocks: Two correct stock predictions and an advanced nickel explorer to look out for

Pic: d3sign / Moment via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

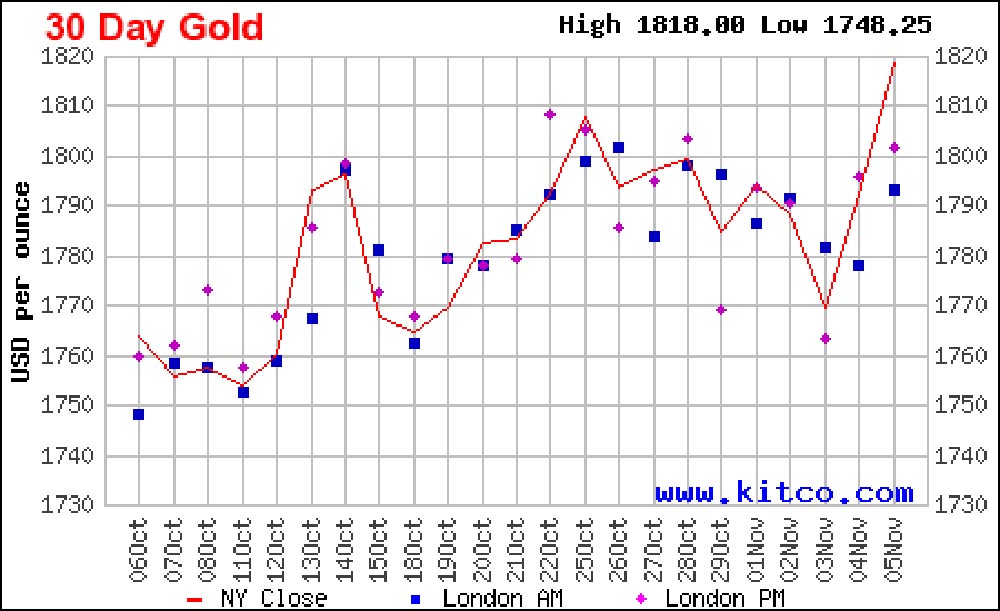

The stars continue to align for gold, which is trading around US$1,817/ounce (up almost 2% for the week – figure 1) in spite of a strong US jobs report last week that showed an addition of 513,000 jobs compared to a three-month average of around 440,000 jobs.

Mind you, inflation pressures are mounting and despite Jerome Powell claiming that the Federal Reserve is not ready to raise rates, the market is now factoring in a September 2022 rate hike.

Other precious metals were also strong with platinum up 1.5% last week to close at US$1,031/ounce and palladium up 2.3% to close at US$1,968/ounce.

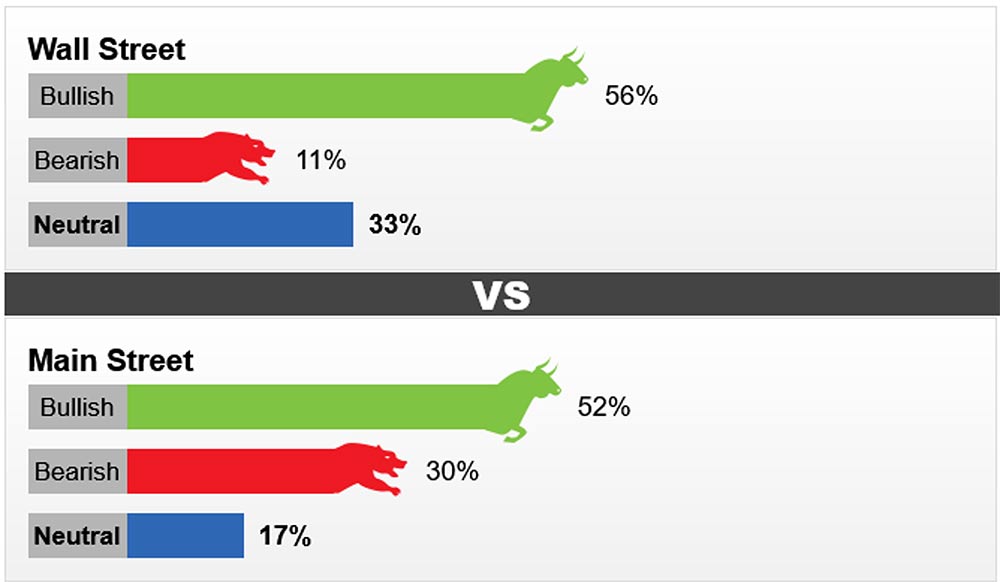

The recent Kitco gold survey (figure 3) comprising 16 analysts (Wall Street) and over 600 punters (Main Street), was also somewhat more bullish with over 50% of retail investors optimistic about gold price movements over the next seven days.

While I am not a chartist, Kitco editor Neils Christensen considers US$1,835 as a psychological barrier that gold needs to break through to provide solid evidence of the bull run.

Notably gold bottomed in 2015 just as the Federal Reserve started raising interest rates, so are we going to see this cycle repeat itself?

The next significant event this week (Wednesday US time) is a report on US Inflation which will no doubt have an immediate impact on the gold price.

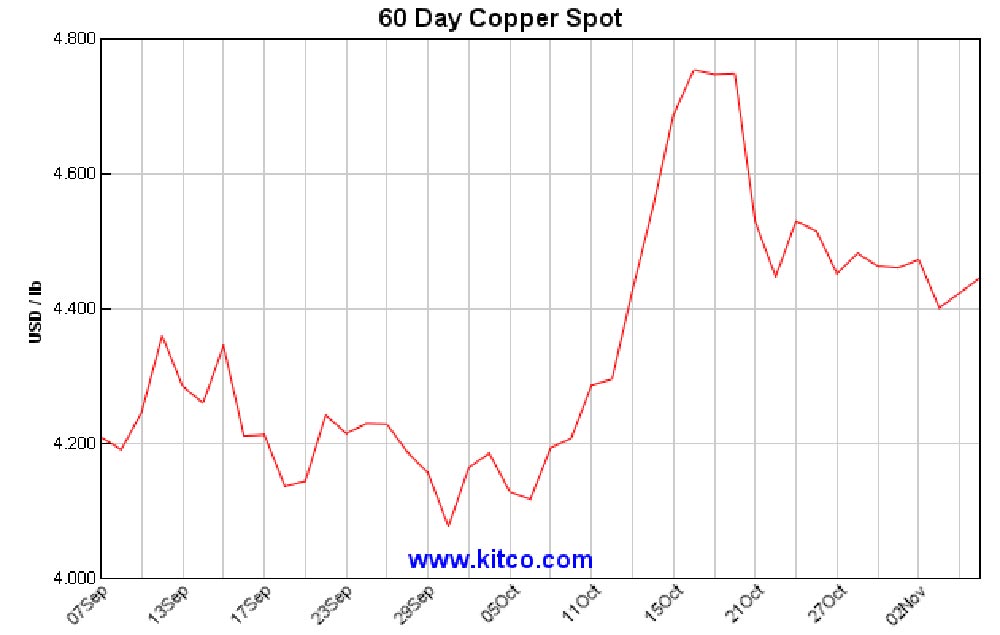

Copper (figure 3) remains flat at US$4.46/lb with the market continuing to ignore very low inventory levels.

The red metal also remains in backwardation with the forward curve trading 10 cents below spot. Meanwhile the recently appointed Peruvian Finance Minister Pedro Francke made comments last week to the effect government coffers should rise by around $3.03 billion or 1.5% of GDP as a result of increasing taxation revenue from the mining sector, which, as we know, is dominated by copper production.

However, what the rate hikes will be remains unclear.

There may be a glimmer of hope for the supply chain with the Baltic Dry Index down to 2,715 after threatening 6,000 last month (figure 4).

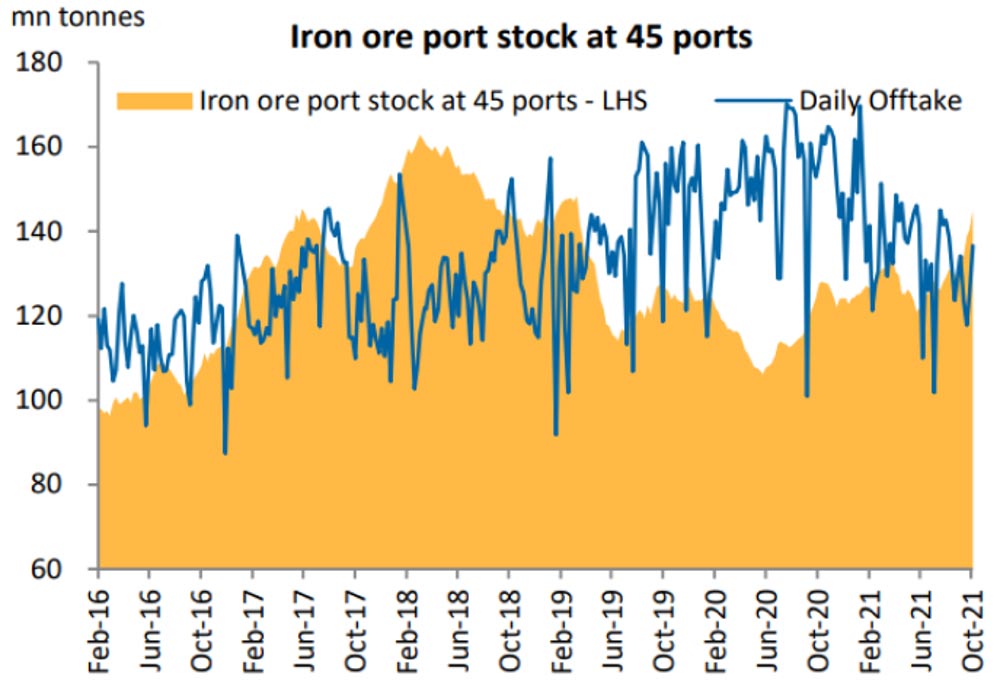

Finally, reports from Mysteel last week showed steel production up by 4.9%, however blast furnace capacity utilisation was off 1.4% week–on-week, contributing to lower iron ore prices which have fallen back to around US$92/tonne (62% Fines) as port stocks start to increase, however daily offtake has turned the corner (figure 5).

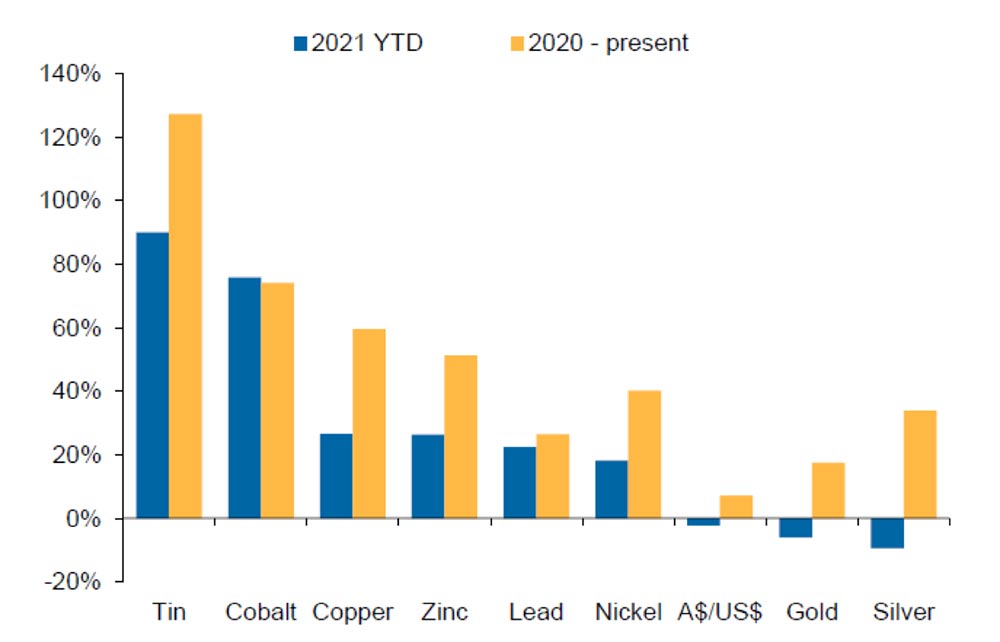

Interestingly tin and cobalt have performed exceptionally well this year (figure 6).

The challenge is to find small to mid-cap players with decent projects that provide enough leverage to incoming investors.

Chalice Mining (see below) have a significant component of cobalt at Julimar, so that may present an opportunity.

Company News

Looks like Gold Road Resources ASX:GOR) have folded their tent and walked away from their bid for Apollo Consolidated (ASX:AOP) following the improved offer by Ramelius Resources (ASX:RMS) who will pay an implied offer price of $0.621/Share ($0.34 in cash and 0.1778 Ramelius shares/AOP share).

The Stockhead faithful were given the heads up on AOP as a potential takeover target in the 21 February 2021 edition, so all gifts should be dispatched to Cigar Social in West Perth as soon as possible and marked to my attention (preferably under the soft dollar benefit limit of $300, however you can always split the parcel).

In other M&A activity news, Westgold Resources (ASX:WGX) have missed out on the takeover of Gascoyne Resources (ASX:GCY) with the Supreme Court approving the merger with Firefly Resources (ASX:FFR) whose Yalgoo assets should be a good fit for Gascoyne’s Dalgaranga Gold Mine (WA).

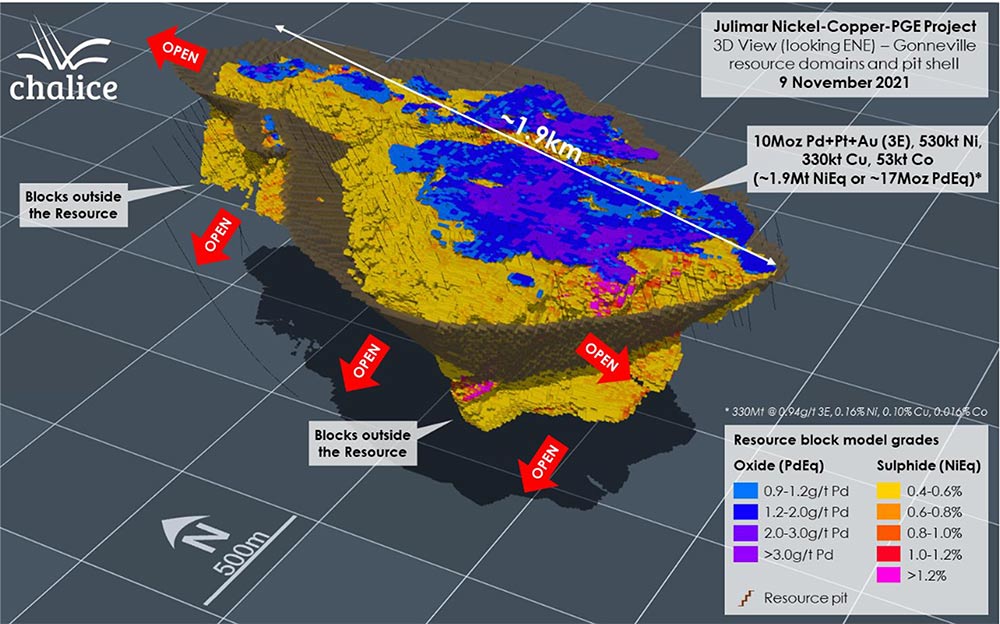

The big news however was the maiden resource statement from Chalice Mining (ASX:CHN) (figure 8) which reads like a promotion from World Wrestling Federation back in the 1980s.

The maiden JORC Resource for the Gonneville PGE-Ni-Cu-Co-Au deposit has come in at 330Mt @ 0.94g/t 3E1, 0.16% Ni, 0.10% Cu, 0.016% Co (~0.58% NiEq2 or ~1.6g/t PdEq3) and includes a higher grade 74Mt @ 1.8g/t 3E, 0.22% Ni, 0.21% Cu, 0.021% Co (~1.0% NiEq or ~2.8g/t PdEq) that will significantly enhance project economics in the initial years of operation (figure 9).

According to CHN this is the largest nickel sulphide discovery worldwide since 2004 (>20 years), and the largest PGE discovery in Australian history.

It is no surprise that Tim Goyder (also a director and major shareholder of aspiring lithium producer Liontown Resources Ltd (ASX:LTR)) was recently seen walking on water across the Swan River (figure 10) after a big night at the Royal Freshwater Bay Yacht Club.

This makes him only the second man in WA history, along with Andrew Forrest, to achieve this feat.

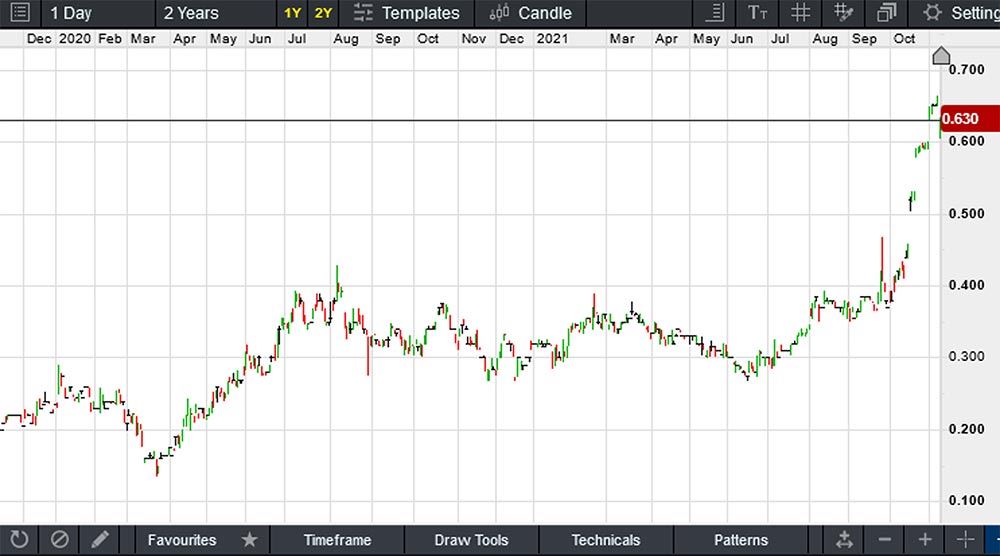

Just so you don’t forget, CHN was brought to the attention of the Stockhead disciples earlier in 2020 around 50 cents. Not that I am ever one to blow my own trumpet…

New Ideas

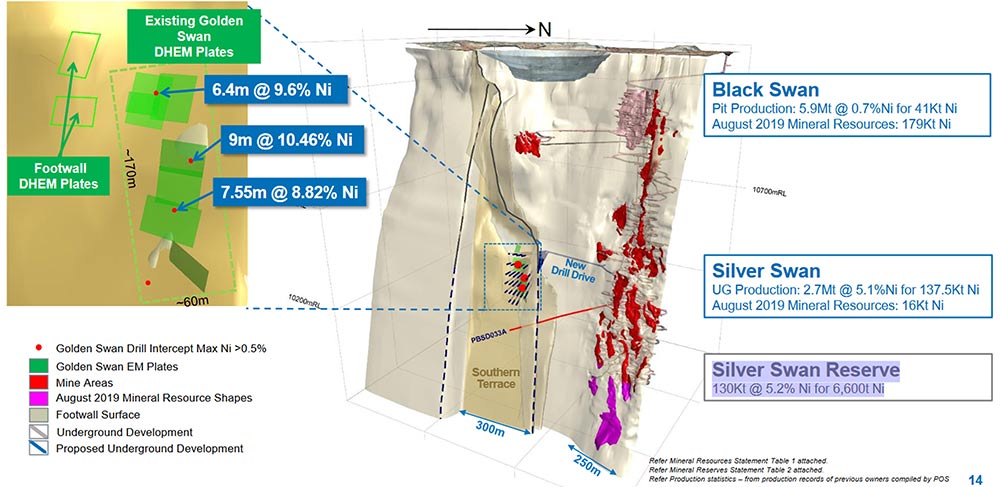

Another company set to ride the uptick in nickel demand is the Peter Harold-led Poseidon Nickel (ASX:POS) which recently published a maiden JORC Resource at its recently discovered (2020) Golden Swan Prospect of 160,000 tonnes @ 3.9% nickel for 6,250 tonnes of contained nickel.

Not a bad start with the ore potentially accessed from the adjacent decline at Silver Swan (figures 12 and 13) that also contains JORC Reserves of 130Kt @ 5.2% nickel for 6,600t of contained nickel.

The plan is to blend this material with the lower grade Black Swan ore and Silver Swan tailings comprising 179K tonnes of nickel at 0.60% following the reconfiguration of the existing plant from 2.2Mtpa to 1.1Mtpa for an estimated CAPEX in the range of $22 million.

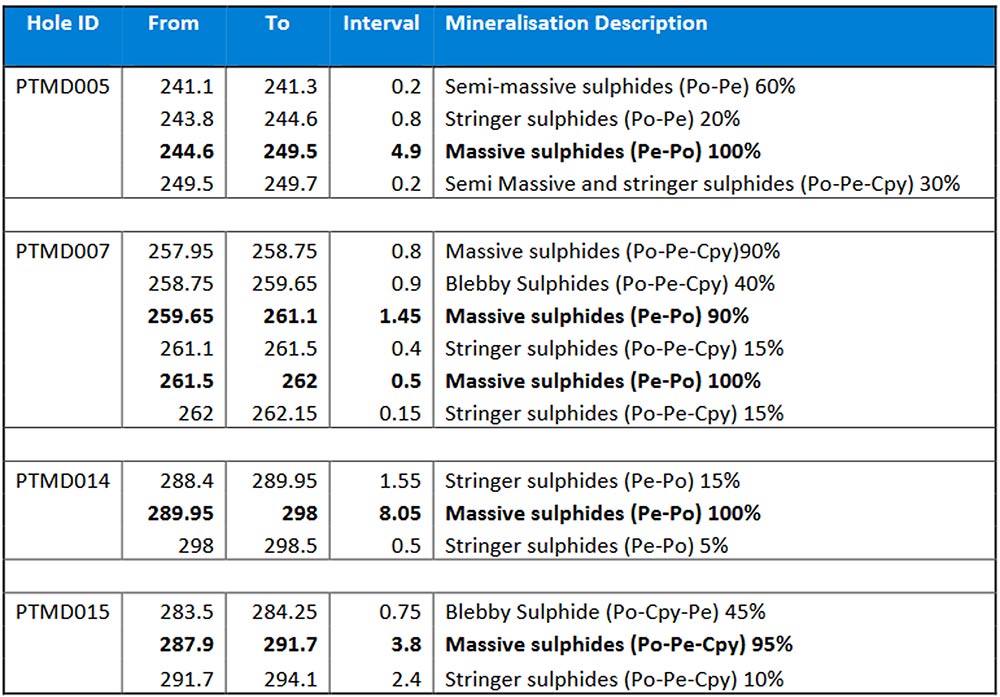

The potential for additional high-grade resources looks encouraging in and around Silver Swan and Golden Swan with the recent announcement (POS ASX Announcement, 9th November 2021, table 1) of further encouraging massive sulphide and stringers of nickel and copper mineralisation intersections (assays pending) from additional prospects (Tundra Mute) at the Silver Swan Project.

With few advanced/near production nickel plays on the horizon, this is one to look out for.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.