FREE WHELAN: This is what a bull market in 2024 probably looks like

Experts

Experts

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Ed: This is to confirm that the Superbowl prediction at the end of this edition of Free Whelan, was received before kick off in Nevada and was brought to you by Taylor Swift’s new album.

Starting off with a bit of a rant on this Super Bowl Monday and as someone who works – and has worked quite closely – with professional athletes there’s nothing here that I can fault:

Sigh. Barnaby.

We have a former deputy PM who we just expect is in a perennial state of oblivion while on the job, and we’re all just okay with it.

I’d be okay with it were it not for the double standard the media has in this regard.

We cover this and more on the latest episode of the podcast.

A few decent market tips as well in there.

I’m in particularly fine form.

I’ll grant that the above is tenuous at best with regards to market related content but it had to be said.

Something else that is very much market related is having to watch the painful charade around President Biden’s cognitive abilities. If you didn’t follow it he was being investigated for knowingly taking classified documents when leaving the VP gig in 2017.

“Special Counsel Robert Hur said in a report that he opted against bringing criminal charges following a 15-month investigation because Biden cooperated and would be difficult to convict, describing him as a…

“…well-meaning, elderly man with a poor memory.”

In short, bullish markets.

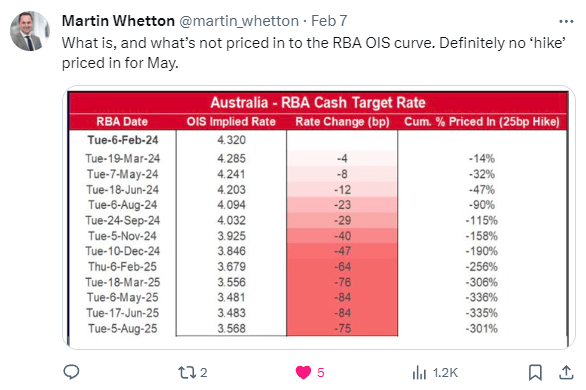

Anyone who says there’s a chance of hikes is wrong, plain and simple.

At least as per last week re: RBA Governor Bullock’s messaging.

Listen to the head of Financial Markets Strategy at Westpac if you actually want to know what’s going on:

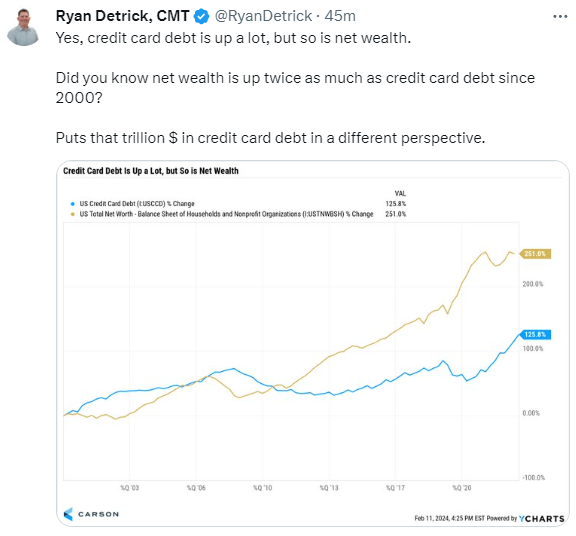

Finally there’s a few things flashing around about how much credit card debt is rising in the States.

Beware jumping at shadows when it comes to dollar figures like that. Most things in dollar terms are getting bigger (if you think about it).

Wealth is also going up. Bigger numbers are getting bigger. Relax.

Markets continue to track higher against February seasonality. The stats say ease off a little exposure into the back half of the month.

Stay safe and all the best,

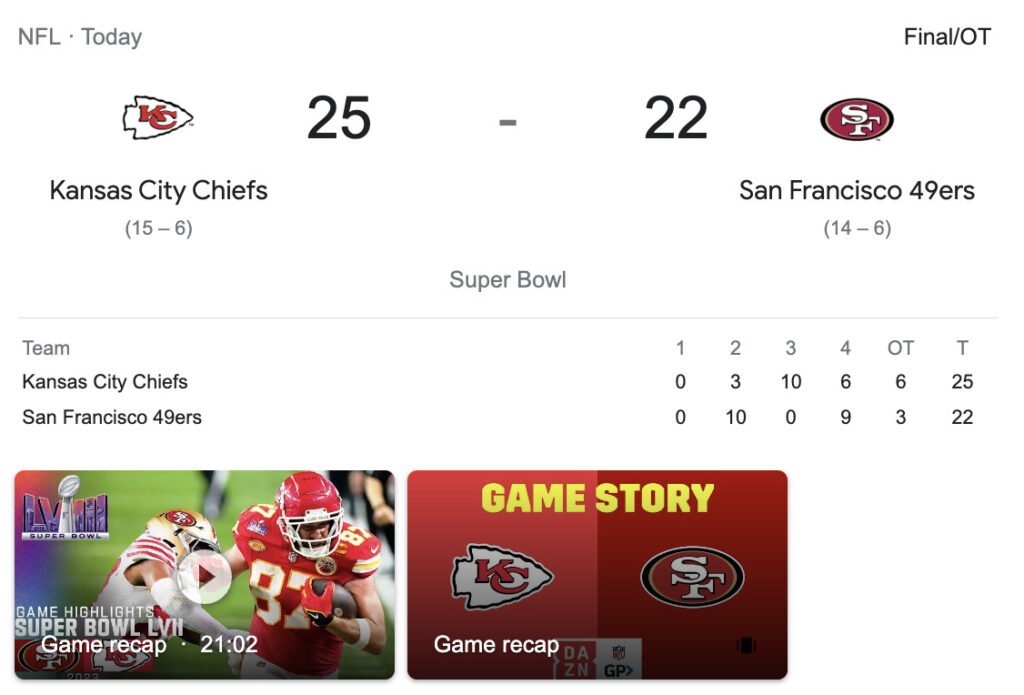

(Kansas City Chiefs by 3!)

James

Ed: As previously mentioned…

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.