FREE WHELAN: Soft landing ahead, brace for impact

Experts

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in-between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

What a weekend just gone.

I was fortunate enough to be offered a ticket to the commissioning of the USS Canberra.

Yes, the USS Canberra, the second time a US ship has borne the name of an Australian city and the first time a US ship was commissioned on foreign shores.

This is of the team that throws the rifles around as part of the spectacle. Precision and accuracy.

And this is the actual ship.

Once in a lifetime opportunity.

Built by ASX listed company Austal in Alabama and a strong symbol of the strong and growing stronger relationship between the USA and Australia. We are a small country continuing to punch well above our weight.

Some takeaways, because I don’t do anything without a focus on my job:

I’ll try and keep it away from a geopolitical insight as to our role in the South China Sea but make no mistake we are being made ready for this to be in our existence within the medium term future.

“The Algo” did seem to hear some chatter about China on my phone and has since started recommending me the sort of thing you only read late at night. I.E. – Salt grain time.

There’s this… About why Kissinger travelled to China and ends here:

And this one about the battleground ahead:

Sometime in the next seven years, a human being will set foot on the Moon for the first time since 1972.

That human will probably be a Chinese taikonaut, and the outrage from the West will be like nothing we’ve seen.

A thread 🧵 on China 🇨🇳 and the New Space Race 🚀 pic.twitter.com/cf0TjspskD

— Kyle 🚄 (@KyleTrainEmoji) July 22, 2023

So some very exciting reading ahead for anyone wanting to get into the weeds on some borderline conspiracy stuff regarding China.

Invest accordingly.

Now to something a little more tangible, the collapse of the Russian grain deal has put pressure on grains.

India has banned exports of non-basmati white rice. Which would be okay except they’re the biggest exporter of the stuff. It’s done the obvious:

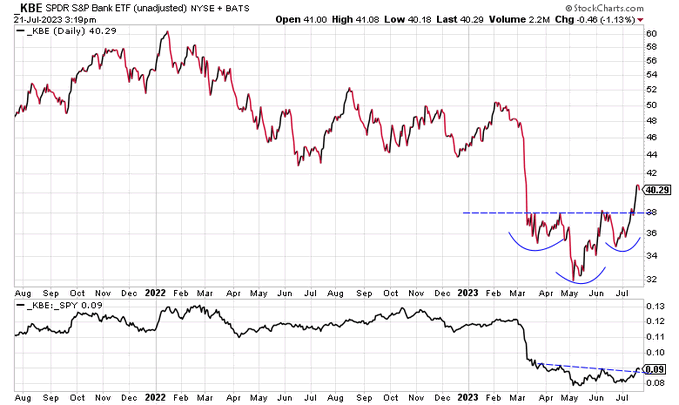

In other news the banks in the US have rallied.

Normality has resumed.

Soft landing seems like it’s now the norm.

It does mean that is now the thing that has to change…

And oil seems like it’s back on the right side of the big line.

In short – with a week ahead that we have some massive data drops (CPI and PMI) and more mega tech reporting and a FOMC meeting, maybe this week is the week to watch, look at boats, read on China and not do too much.

No change to the plan. Stay the course.

Fair winds and following seas to the good crew of the USS Canberra!!

All the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.