FREE WHELAN: So many tears we’ve cried… but it ain’t over till it’s over

Experts

Experts

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Good morning,

Firstly and strangely enough, a note to anyone and everyone that as a current director of an Australian business you are required to have a DIN (director’s identification number).

But what’s really odd is that we went from “directors absolved of fiduciary duty during Covid” to “$13k criminal offence for not having a number registered” in a heartbeat.

This country puzzles me sometimes. However, if you haven’t applied for a number yet then please do so.

Speaking of over-governed countries there’s something brewing in China to which attention needs to be paid. The protests are national and they’re getting bigger. Covid Zero either has to be wound back in that country or a massive crackdown is about to be unleashed on the population.

I reiterate that second guessing the pivot on Chinese Covid policy is a mug’s game. Until it’s done, it’s not done. Stay away or be short China while that is the case.

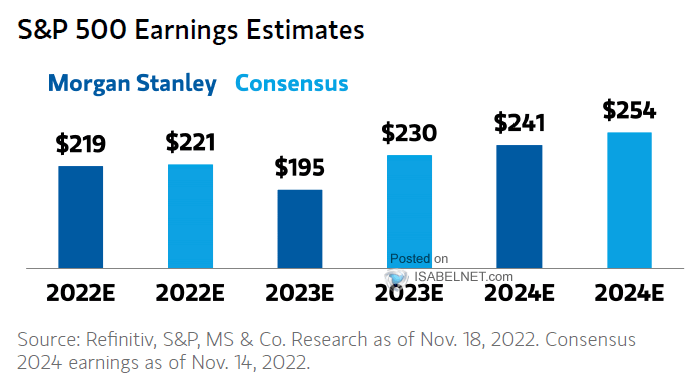

Now on to valuations. Morgan Stanley’s 2023 outlook which I mentioned last week has some earnings estimates that look a little… grim.

The dark blue is their estimates. Wow.

Again reiterating I don’t think being lazily long a US index is a great way to enjoy your year ahead. There’s companies you want to own and then there’s not.

I map out a few things of interest last week on Ausbiz with a list of 10 ETFs and what I think of them. There’s a few good ones on the list so if you want to hear about it instead of read about it then follow the link to find out more.

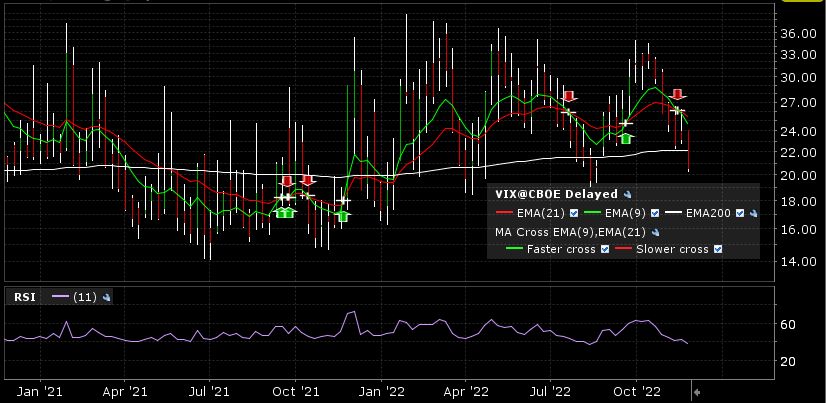

Something else of interest regarding the choppiness we expect for 2023 is this counter intuitive strategy on being in or out of the market depending on how the volatility is looking.

Sell when everything is calm, buy when everything is not calm. We’ve all heard the Buffett quotes but here is the simple number. 20 and 30.

Here is the Volatility Index on a long term chart.

You can see I’m keen to lighten US equity exposure in the coming days.

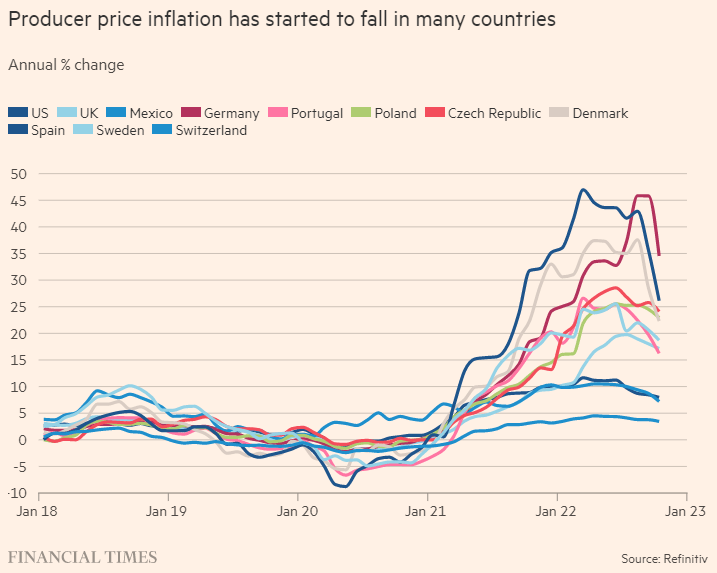

I’m also going to say something bold (not really) – I think inflation has peaked. There’s a wealth of signals out there but the FT covers it well.

If this finally is the case then we truly have seen the end to rate rises (soon) which many would think would be bullish for markets.

Except remember that they’ve also caused the economic weakness that will make stocks choppy at best.

Finally here are two things of interest.

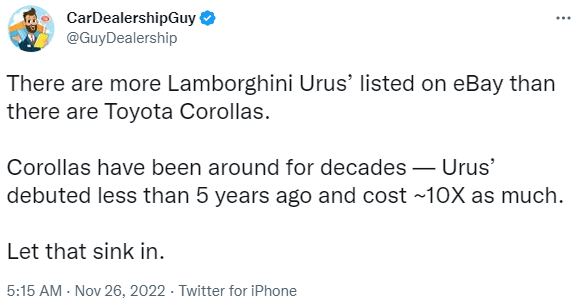

The high end vehicle market is getting destroyed. There are more Lambos on eBay than Corollas. That’s gotta be because of the crypto thing, right?

Also the money trail from FTX just keeps getting weirder. Follow this thread to find out how they paid $11.5m for a tiny bank in a tiny town, worth $5m bank.

FTX owned an $11.5 million stake in this rural bank with just a few employees.

What the hell is going on here?

Time for a 🧵👇 pic.twitter.com/yWHCGE2WaT

— Genevieve Roch-Decter, CFA (@GRDecter) November 25, 2022

Odd… very odd.

Urging caution into the month-end. Looking to buy into extreme weakness for year-end.

All the best and stay safe,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.