FREE WHELAN: Everything’s totally fine and how to also urgently buy 2 x ASX-listed ETFs in US Treasuries

Things are starting to get weird. Via Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Amazed and proud of the Swans for making a Grand Final. Going to be a great game vs Geelong and I’ll be watching it from sunny Darwin. A note that I will be between Sydney and Darwin for a week starting this Friday. Contactable for the most part as always. Duty calls.

There have been numerous times over the years that I’ve written about zombie companies and the risks to them on a lift of interest rates. For clarity, the definition of a “zombie company” is one that is earning just enough to pay its debts and thus can’t grow. It merely survives day to day while rates stay flat until eventually it falls over or is taken over or rates rise and it implodes. The interest repayments are simply too high to be paid for without any growth happening.

There can be no denying that the number of articles warning of this impending situation is growing.

Just completely at random I’ll post the first chart I found off the AFR that sums it up really nicely.

The reasons behind these are clear: costs increasing that can’t be passed through, Covid support ending and rates rises adding to interest costs.

At the time there was a small but vocal group who argued that the pandemic gave the market a chance to weed out the perennially failed businesses and leave them in the rear view mirror. But you’re dealing with people’s jobs at the worst time.

The FT put a piece together last week as well (told you there was a lot of news on it) where they gathered a list of companies with debt trading more than 10% above government bonds and then ran a qualitative assessment to show the top 35 companies flashing red.

There’s some fascinating names in the list; I’m currently working through it to see if there’s any downside opportunities.

However that’s not for today. The main piece of info to be drawn from this is that the economy, the actually functioning economy, is teetering on the edge. Locally and globally.

It adds weight to my thesis that when inflation does come down it will come down quickly, primarily because of how scary the economy will look to someone with a mortgage repayment 2x last year’s number and no job.

If inflation drops and the economy breaks (or both, one causing the other) then the rate hike cycle ends. Hopefully we survive.

As it stands right now the BofA Fund Manager Survey thinks (in a bigger number than August) that rates will peak between 4%-4.25%. That’s quite a big move and in my view a little ambitious.

But pay attention to things like these showing just how sluggish everything is becoming.

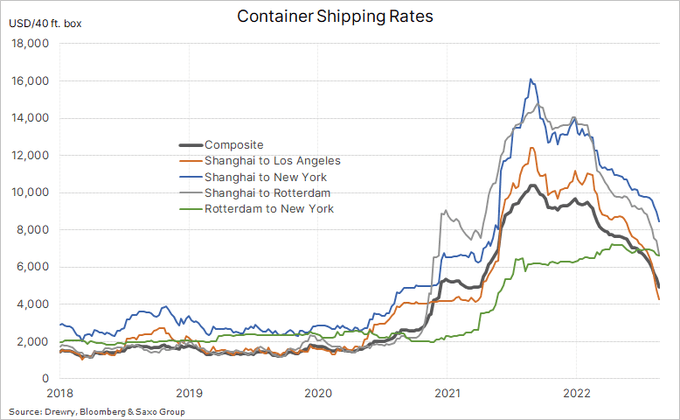

Shipping Rates are coming off, fuel is cheaper (than before) and the prospect of job losses increases here and abroad as the zombies get found out.

I strongly believe that rate hike expectations are overdone.

If that’s the case then being long treasuries here is the smart move. Yield expectations are overdone.

If you want to go long an ETF in US treasuries then there are two choices.

They’re both relatively new and very small but from what I can see they’re the only ways to get it done from an ASX listed ETF.

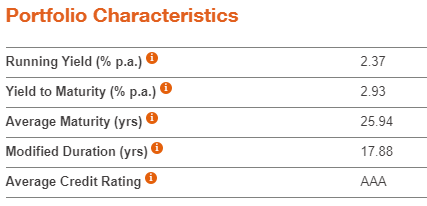

GGOV, managed by Betashares and, whilst new, provides a running yield of 2.37% with an average duration of ~18 years. The longer duration means it is more exposed to yield movements in the bond market. It will move more than an ETF made up of lesser duration bonds.

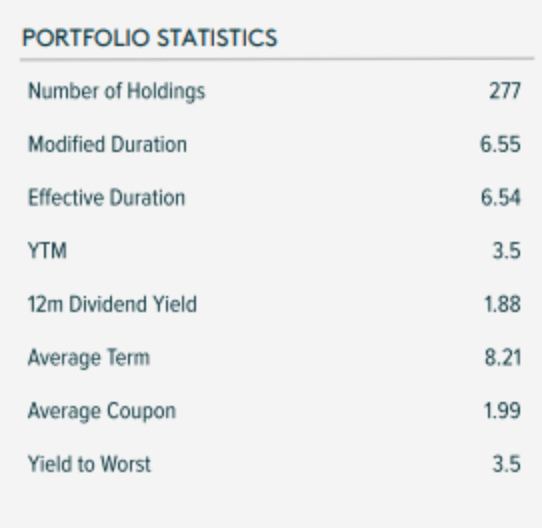

The other one is by the newly rebranded ETF Securities, now Global X with the code USTB that is smaller but has a shorter duration of 6.54 years.

This one we started buying late last week and I’ll probably be moving into the Betashares one as well shortly.

It’s really all about the conviction side of things which one you choose. However when you put all the above together you can see how I get to the stage of thinking yield moves are a little overdone.

All the best and stay safe,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.