Hot Money Monday: Why it’s time to add bonds to your investment mix

Why it’s time to put bonds into your investment mix. Pic: Getty Images

- Interest rates have soared in recent years

- IAM says it’s time to consider bonds

- Why bonds might be better than TDs

It’s been a wild ride in the world of interest rates over the last few years.

Back in April 2022, the RBA cash rate was a super low 0.1%. Fast forward to November 2024, and we’re now at 4.35%. That’s a massive jump, which has been great for people with money in term deposits (TDs).

But here’s the thing: we’re at a turning point. Some experts think we might need a few more rate hikes to get inflation under control, while others are calling for cuts to avoid a slowdown.

Meanwhile, banks are already starting to cut their TD rates. ANZ recently dropped its TD rates by up to 0.9%.

So, while you could still get a TD with rates around 5%, there’s a catch—what happens when it’s time to roll that deposit over?

Which is why you should consider bonds

Instead of just filling your investment portfolio with term deposits, think about adding some Aussie bonds, says Darryl Bruce, Executive Director at ASX-listed Income Asset Management Group (ASX:IAM) .

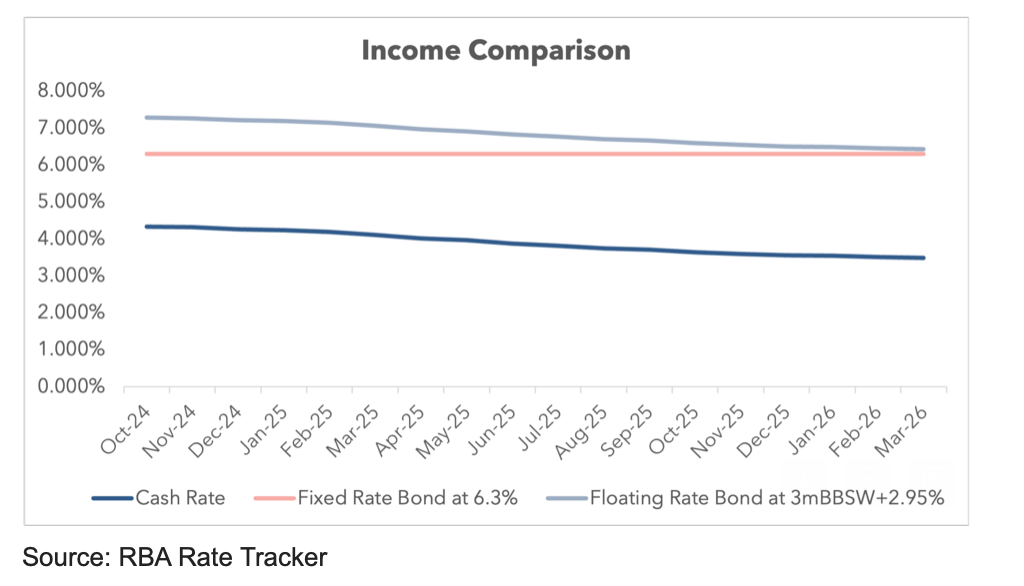

High-quality bonds can offer more stable returns over time; and right now you could lock in fixed-rate bonds with returns of 5% to 6% for 5 to 10 years.

This, Bruce believes, gives you the predictability you want while riding out potential rate cuts. (Note that bond prices rise when rates fall).

“You will be well rewarded through the higher returns available in bonds, especially given the relatively nominal increase in risk,” said Bruce.

If you’re feeling adventurous, floating-rate bonds are also on the table.

These bonds pay interest based on the Bank Bill Swap Rate (BBSW), which tends to move with the cash rate.

Some floating-rate bonds are currently yielding a tempting 7% to 7.5%, and while they might dip when rates fall, you’re still looking at decent returns for a while, said Bruce.

Balancing risk and reward

You might be thinking, “But aren’t bonds riskier than TDs?”

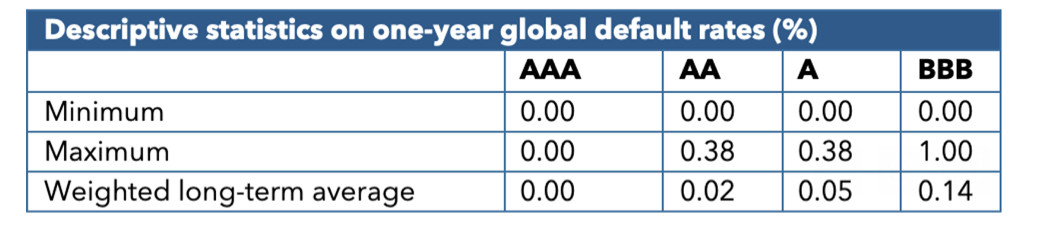

Generally, yes. But when it comes to investment-grade corporate bonds, the risk is quite manageable, said Bruce.

“The A and BBB rating bands offer the best balance of risk and return.”

The default rates on these bonds are very low, meaning the chances of losing your investment are minimal. In fact, even in tough times, the historical default rates are pretty reassuring, added Bruce.

Another advantage of bonds is flexibility.

Breaking a term deposit can be a hassle and often comes with penalties, especially since the GFC, when financial instability led to stricter regulation of banks.

“The liquidity in large investment-grade bond issues is relatively good, which is a significant advantage over TDs.”

Also, bonds are actively traded, making it easier to buy and sell when you need to access your cash.

Time to move your cash?

While term deposit investors have enjoyed high rates recently, the landscape is changing.

With many banks lowering their TD rates, now’s a good time to consider moving some cash into bonds, said Bruce, because you can benefit from higher returns without locking your money away for too long.

“While there are still some attractive returns on offer in TDs, the opportunity to lock in higher returns for longer, thereby avoiding short term refinancing risk, makes investment grade bonds very attractive at this point in the cycle,” he commented.

“The greater flexibility of bonds, through a liquid secondary market, also provides some peace of mind if you’re wary of locking capital away for extended periods.”

A bit about Income Asset Management

In just three years, IAM has grown to manage $2 billion in investments and over 2000 client accounts.

The company has teamed up with Perpetual to simplify its operations, moving services like custody and client reporting to one platform.

This change, the company says, should help IAM become profitable by the end of 2025.

IAM focuses on reliable income from secondary trading—essentially buying and selling many smaller trades—rather than just a few big deals.

The company recently launched new investment products, like a single-bond ETF, making it easier for everyday investors to access bonds.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.