FREE WHELAN: Emerging Markets are still cutting rates. Money for jam. Bring a spoon.

Experts

Experts

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

A massive weekend of sports, dance comps and manning the BBQ to raise money for our Jump Rope team. I love living in a country where people will stop by a BBQ on the street for a chat, grab a snag and chip in $20 for the raffle to help the kids stay in a great sport. It’s easy to criticise Australia (and it’s our democratic right to do so) but as long as weekends like the one just past keep being possible you have to love it deep down.

Now onto a group that is easy to criticise all the time and who are just awful all the time to watch.

Heath and I go through the ins and outs of the data last week and this week and review just how badly things are for Australian Rugby.

I wanted to have a little look at a space that I haven’t talked about for a while and that’s the Emerging Markets space.

For a start you know my love for India and the Indian economy and the Indian market which is actually closely linked to the Indian economy.

However, the bigger it gets the more weight they can throw around, especially on tenuous things like food.

Currently there is a massive brouhaha in food there and anyone who knows me knows how across the food market I am and how important India is to much of it (remember Indian mangoes).

Last week India cut exports of most forms of rice to the world in order to keep local prices down; with an election on the horizon for Modi it’s important they stay down.

Tomato prices have tripled since June and rice is up 10% year on year.

Either way the droughts and heatwaves around the world are putting pressure on local prices and it’s causing local governments to take action so that their people don’t starve (or vote them out, whichever comes first).

FOOD has come back onto the radar as the ETF to capture these ongoing moves.

I’ve allocated to it before and may do so again.

If anything, I’d be more in favour of owning a basket of these softer commodities instead of companies in farming machinery and food production. For now, it’s just a watch and see with regards to the geopolitical tensions these things bring.

Sticking with Emerging Markets we’ve seen some cuts by some smaller countries’ interest rates:

There will be more to come.

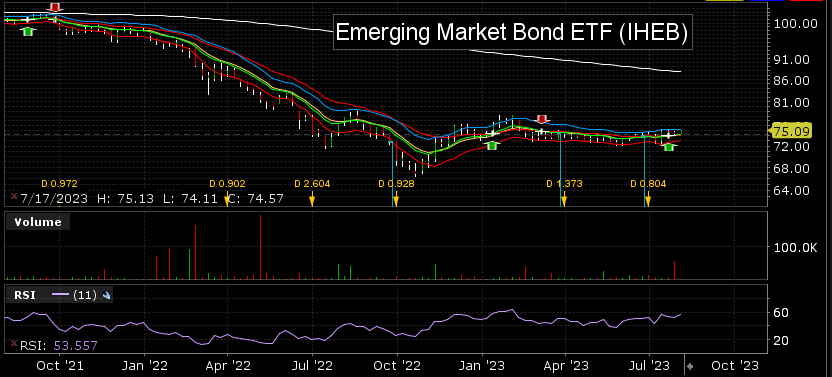

Without getting too bogged down on the specifics, if the EMs are cutting and will continue to do so (they were early to raise too) then the easiest place to invest is either an Emerging Markets ETF (We’re already long India and partially China depending on profile)…

The Emerging market bond ETF should rally on continued cutting. And it currently yields ~4%.

So if you need to maintain your bond exposure or add to it then this is a potential to be added to this week.

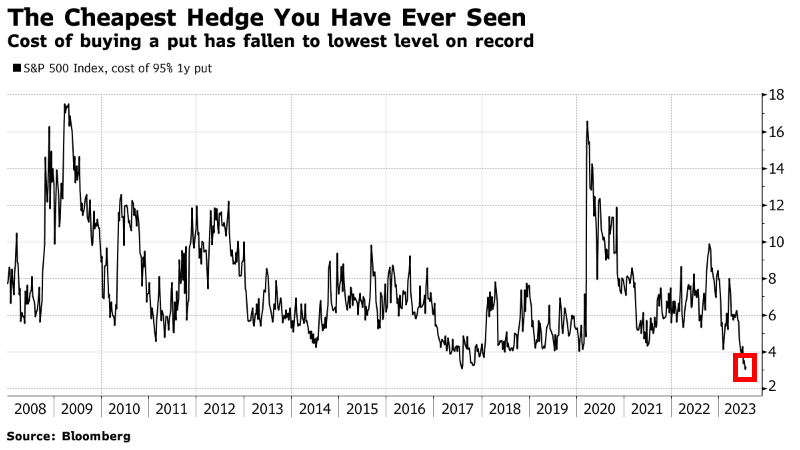

A straight quote with a self-explanatory chart.

The Cheapest Hedge You Have Ever Seen: “US stock bulls have grown so confident in the market that the cost of buying protection against a 5% dip in the next YEAR has fallen to what BofA strategist Ben Bowler is calling the ‘cheapest you likely have ever seen.’”

It costs peanuts to protect the downside. We’ve had a few months of caution and the market has rallied significantly. This is just straight complacency and should not be disregarded.

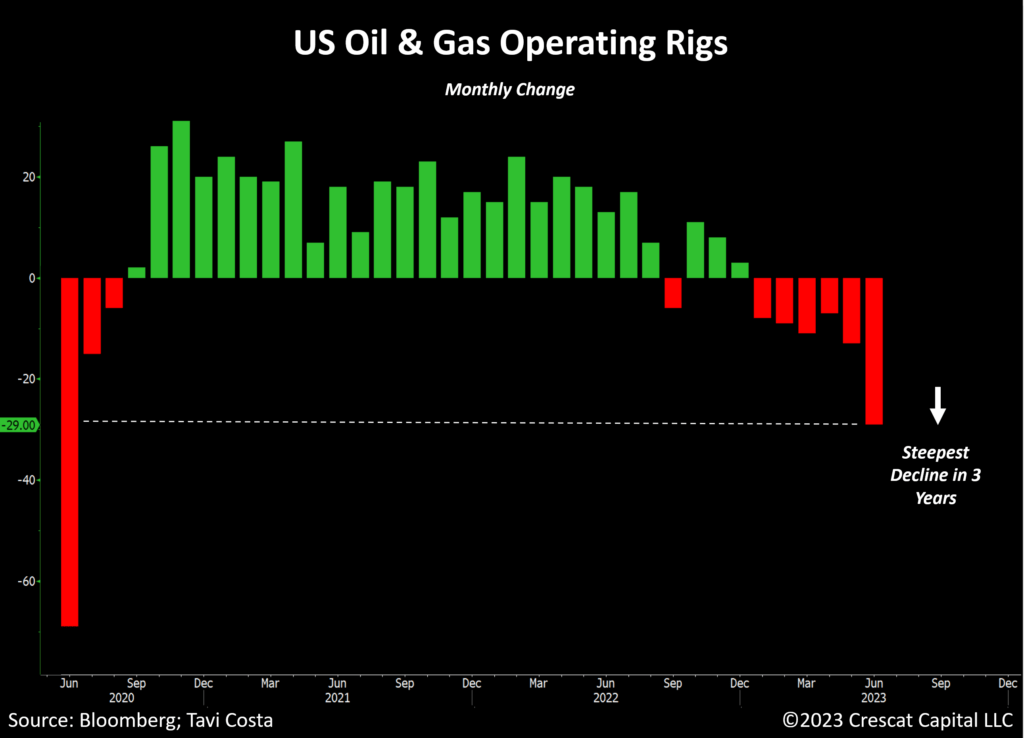

Energy, another sector I like, shows that there’s a lack of getting oil out of the ground. Along with a potential global soft landing, China introducing more policy measures to bolster consumption and rate cutting forecast around the emerging market space and you have a recipe for a bullish second half for oil.

Stay the course.

The fast WTI has had two consecutive closes above the 40-week moving average for the first in a year should tell you something.

I prefer FUEL ETF as a way to capture this.

Finally when I see headlines like this, along with all the reasons stated above for oil, all I can think about is copper.

I prefer WIRE ETF for this equities access which we also hold.

In short, staying the course on what we hold for some significant reasons but understanding that the cost of protection is obscenely cheap and should not be ignored.

That being said, there’s been “obvious” times to short the market that absolutely turned out wrong…

All the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.