- Australia’s EV uptake is rapidly growing, but we still have a long way to go

- The National EV strategy could change all that

- And what ASX stocks/ETF could benefit from the EV revolution

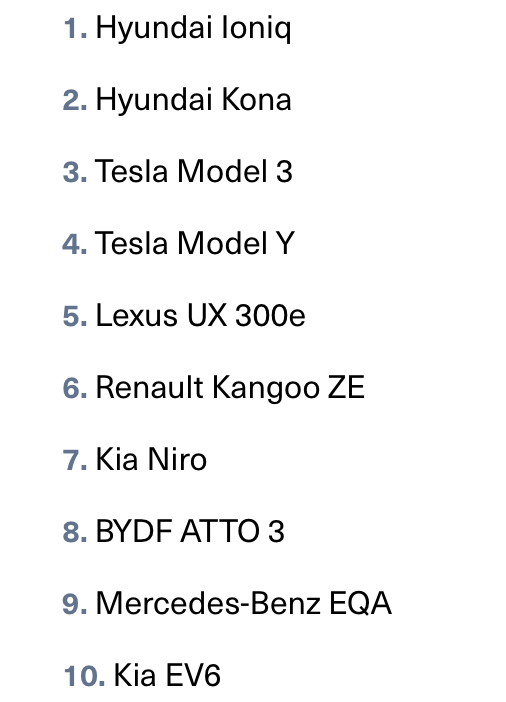

Based on the CO2 emissions, the Australian government’s Green Vehicle Guide ranks the following cars as the nation’s 10 greenest:

You may notice that some of the most popular car brands aren’t on this list; Toyota’s hybrid and EV options for instance failed to make the green list.

According to the Guide, there are a few things that people need to know before buying an “emission efficient” vehicle.

These are emissions produced during a vehicle’s manufacturing process, operation and disposal, and are often collectively called “lifecycle emissions”.

They include emissions produced during the transport of the vehicle to its first point of sale, and the refining and transport of liquid fuels.

And like any product, the disposal of a motor vehicle also creates negative environmental impacts. These are effected by the recyclability of components, and the percentage of recyclable material used.

Emissions from electric vehicles

Yes, you can also emit carbon from electric vehicles.

“If you recharge an electric vehicle using electricity from the grid, your electricity emissions will depend on how this electricity is generated,” said the Green Vehicle Guide.

“Electricity in places with less renewable energy will produce higher emissions than places with more renewable energy.”

Calculations for fuel lifecycle emissions

The Australian government calculates Lifecycle emissions as:

* Scope 1 emissions (from fuel combustion),

* Scope 2 emissions (electricity generation) and

* Scope 3 emissions (domestic extraction, processing and transport of fuels)

Australia is slow to get going

Over the past 12 months, interest in electric vehicles has significantly expanded in Australia, but we still have some way to go in ensuring local EV adoption aligns with our emission reduction targets.

Around 8.5% of all new cars sold in 2023 were EVs. This is more than a 120% increase compared to all of 2022, and the runway to expand here is potentially very long.

“While this trend is encouraging, it is important to note that the vast majority of EV sales is made up of only 3 models (Tesla Model Y, Tesla Model 3, BYD Atto 3), representing over 68% of the EV market,” said a report from the Electric Vehicle Council (EVC).

And while there are now close to 100 electric car, van and ute models available in Australia, most of these are only being supplied in small volumes.

“This is a consequence of Australia not having a New Vehicle Efficiency Standard to ensure car manufacturers increase the supply of EVs to our country,” said the EVC.

“Unfortunately, the local adoption of heavy EVs, including buses and trucks, is still lagging – in large part due to a lack of regulatory reform by government to enable uptake.”

This could jumpstart the industry

In terms of car manufacturing, Australia hasn’t hosted mass production of vehicles since Toyota and Holden shut down assembly plants in 2017.

Multiple hurdles exist – for example high wages, a relatively small domestic market, and our geographical remoteness.

But a turning point came when the Albanese government won the election in May 2022. The Albanese government has released Australia’s first National EV Strategy in April 2023, which is a step in the right direction.

The Strategy declared that Australia “has the capability and capacity to develop manufacturing opportunities to support EV supply, including in component parts and batteries.”

The document discusses things like ramping up adjacent EV industries such as battery manufacturing and recycling. The government has also created a $15 billion fund to encourage investment in EV technology.

The strategy also unveiled the path to greater EV affordability, access to charging stations, and a massive reduction in emissions.

But is it ambitious enough to meet our emission reduction targets?

According to Hussein Dia, Professor of Future Urban Mobility at Swinburne University of Technology, the strategy falls short of providing any substantial policy directions or targets to accelerate the transition to electric vehicles.

“Instead, it mainly confirms existing programs and policies, such as the electric car discount, and other already announced plans to upgrade charging infrastructure and the National Reconstruction Fund to boost local manufacturing,” Dia told The Conversation.

How ASX investors could capture EV opportunity

Although investing in cobalt, nickel, lithium and manganese mining stocks is a no-brainer when it comes capturing the EV opportunity, the national EV strategy may have opened the path for stocks like:

NOVONIX is a global, innovative lithium-ion battery technology company with sustainable technologies, high-performance materials, and more efficient production methods.

The company manufactures battery cell testing equipment, and is growing its high-performance synthetic graphite anode material manufacturing operations.

It has developed an all-dry, zero-waste cathode synthesis process, and through strategic partnerships, NOVONIX has gained a prominent position in the electric vehicle and energy storage systems battery industry.

Recently, NOVONIX announced the signing of a binding off-take agreement for high-performance synthetic graphite anode material to be supplied to Panasonic Energy’s North American operations from the company’s Riverside facility in Chattanooga, Tennessee.

MAGNIS ENERGY TECHNOLOGIES (ASX:MNS)

Magnis is also a lithium-ion battery technology and materials company.

The company’s US based subsidiary, Imperium3 New York, operates a Gigawatt scale Lithium-ion battery manufacturing plant in Endicott, New York.

Magnis has produced high-performance active anode materials for lithium-ion batteries utilising its high purity graphite feedstock from their Nachu Graphite project in Tanzania.

Carly is a car subscription company which supports the transition to electric vehicles.

Launched in 2019, Carly Car Subscription is a flexible alternative to buying or financing a vehicle, for individuals and businesses, with insurance, registration and servicing included in one monthly payment.

Average subscription period is over five months. Carly has secured auto industry leaders SG Fleet (ASX:SGF) and Turners Automotive (ASX:TRA) as significant shareholders, joining long-term shareholder, RACV and OEM partner, Hyundai.

For those looking for a more diversified exposure, these two below are probably ones to look at:

SOR is actively funding the development of projects in the technology and resource sector related to the EV thematic.

SOR says its moisture based renewable energy technology – Energy Ink – has achieved unprecedented power density from moisture in the air and has set an ambitious goal to provide a charge to an electric car in future.

Lab testing shows that the Energy Ink prototype has exceeded the power density of commercial solar cells.

Performance testing of a small device cell is planned in 2024.

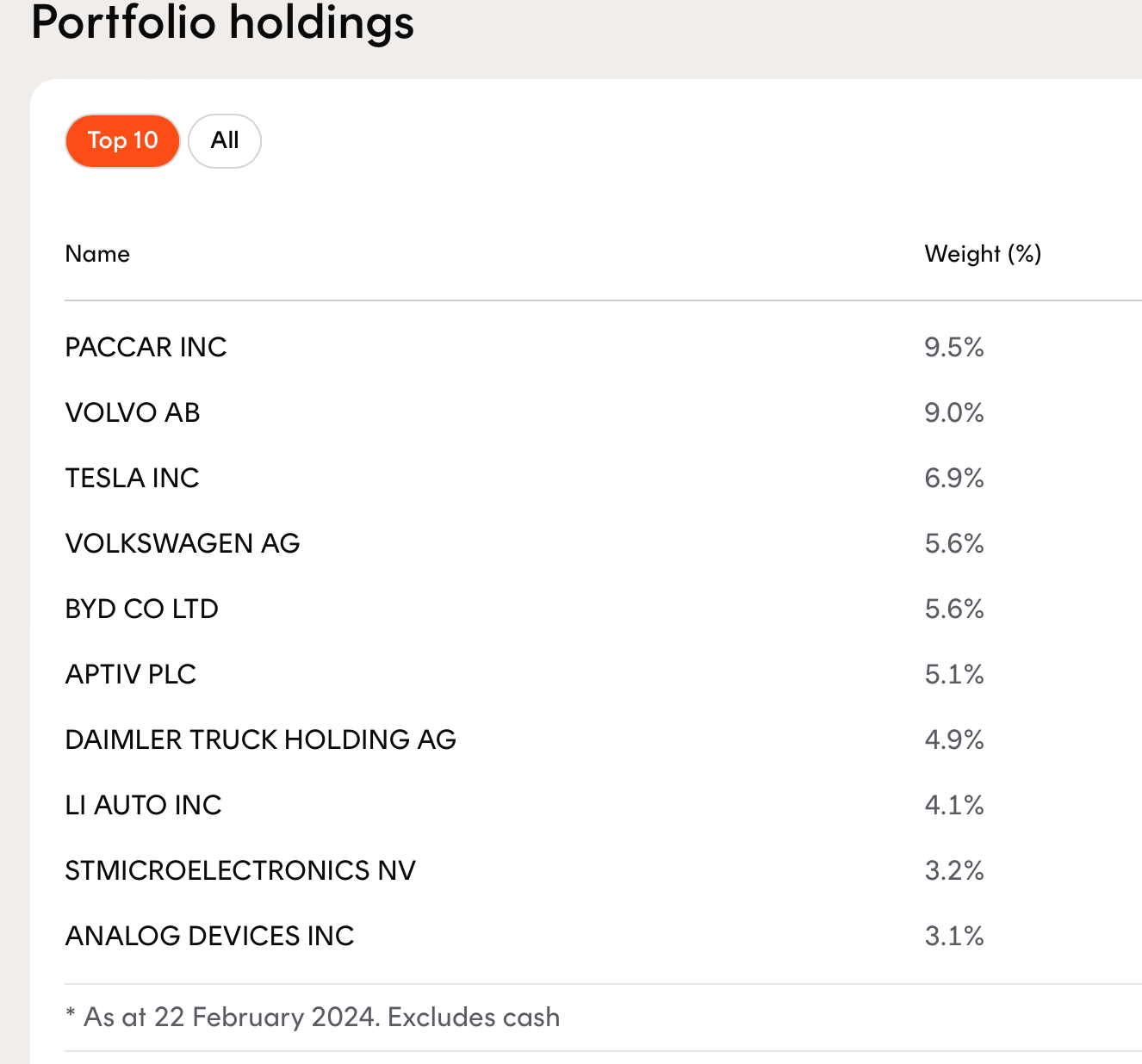

FUTURE MOBILITY ETF (ASX:DRIV)

For those looking for a more diversified exposure, the DRIV ETF is probably one to look at.

Managed by Betashares, the fund invests in global shares that expose you to the potential of the automotive technology revolution.

Its top 10 portfolio holdings, as of February 22, 2024, were:

At Stockhead we tell it like it is. While Strategic Elements is a Stockhead advertiser, it did not sponsor this article.

Read MoreESG