UBS: These oil & gas plays are best positioned for the global ESG shift

Energy

Analysts at UBS reckon Santos (ASX:STO) is the pick of the bunch among ASX oil & gas plays, amid shifting stakeholder demands around the ‘E’ in ESG (Environmental, Social, Governance) investing.

The company was one of seven stocks across Australia and the Asia-Pacific that are best positioned within the context of UBS’ “ESG framework”.

The UBS Risk Radar address the risks and opportunities for oil, gas and chemicals companies stemming from the ESG transition based on impact, likelihood of happening, and whether they are near-term or long-term:

– Climate Change

– Alternative Fuels

– Pollutants and Waste

– Post COVID Shifts

– Brand

– Safety

– Government Service

– Capital Allocation

Climate change — viewed by the bank as a longer-term threat — is where Santos’ actions leave it best positioned to meet the demands of ESG stakeholders, UBS said.

“Santos’ longer term strategy is to transition from a natural gas company to a green gas company, which we consider aligns the business model with the global energy transition,” UBS said.

The company has also set a reduction target of 26-30pc by 2030 for its Scope 1 and 2 emissions — a market which is “Australian industry leading”, the bank added.

Scope 1 is the term for direct emissions generated by owned sources, while Scope 2 covers indirect emissions electricity purchases.

A key part of that relates to STO’s carbon capture and storage (CCS) program, which directly addresses the Climate Change category outlined in the UBS risk radar.

“In response to stakeholder demands, oil & gas companies are devising strategies and investing in solutions to lower or offset carbon and methane emissions,” UBS said.

On that front, Santos has converted words into action with its CCS plant at Moomba, around 800km north of Adelaide.

The project has progressed to its final investment decision, and will sequester 1.7 million tonnes per annum of carbon dioxide — making it one of the world’s largest CCS plants, UBS said.

Longer term, Santos plans to produce zero-emission hydrogen via methane steam reforming at the Moomba plant, UBS said.

While ESG-adherence remains broad in scope with aspects that are difficult to define, increased government regulation and institutional investor demands means it will remain a central theme for ASX energy stocks that derive most of their income from fossil fuels.

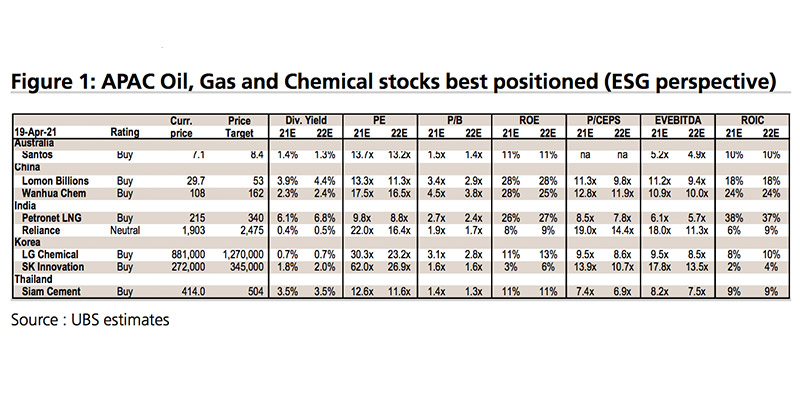

Elsewhere, UBS highlighted the following oil & gas plays across the Asia-Pacific region as best-placed from an ESG perspective: