Emission Control: ExxonMobil’s carbon capture and storage project consistently fails to meet targets

Energy

Energy

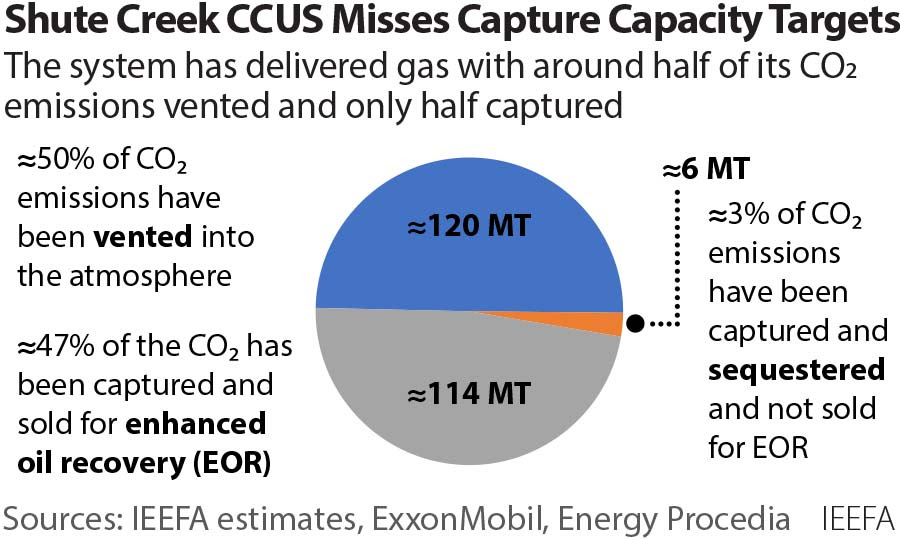

ExxonMobil’s Shute Creek — one the biggest Carbon Capture Utilisation and Storage (CCUS) project in the world and one of the longest running — has failed to reach its CO2 nominal capture capacity during its 35-year lifetime, according to a new report by the Institute for Energy Economic and Financial Analysis (IEEFA).

The facility in Wyoming, US started operations in the era before climate change was a widespread public concern with the purpose of selling captured CO2 for Enhanced Oil Recovery (EOR).

EOR, which uses CO2 to produce more oil from depleted reservoirs, has been re-labelled by the oil and gas industry as CCUS and is now being promoted as a ‘climate-friendly solution’.

Around 73% of all captured CO2 from carbon capture projects globally is used in EOR, the report states.

Since 1986, ExxonMobil’s Shute Creek project has captured around 40% of all anthropogenic (human-induced) CO2 captured in history – equalling to around 120 million tonnes, which is 34% less than its specified capture capacity.

With one project accounting for 40% of all anthropogenic CO2 captured during 50 years of the technology’s existence, IEEFA highlights carbon capture and storage (CCS) technology has not been successfully scaled up despite its longevity.

Report author and LNG analyst Bruce Robertson says that with projects designed to capture CO2 generally attracting a significant amount of government subsidies and tax credit incentives, the business model of fossil fuel projects with CCS therefore needs closer examination.

“Oil and gas companies with carbon capture facilities are selling captured CO2 for EOR and what can’t be sold is more often vented,” says Robertson.

“CCS/CCUS effectively extends the life of fossil fuel companies, giving them a licence to ramp up production.”

Despite having the largest capture capacity in the world, IEEFA estimates that on average, the Shute Creek CCUS facility has fallen short of its capture capacity target by around 34% over its lifetime, which translates to approximately 66 MT of CO2 failing to be sold for EOR and consequently being released into the atmosphere.

Robertson says governments, companies and investors should take note.

“CCUS projects could prove to be unsustainable both economically and environmentally.

Each project’s emission reduction projections and performance must be questioned and this is a point that IEEFA has made repeatedly,” he says.

Origin Energy (ASX:ORG) has signed long term agreements for renewable energy supply with seven customers across infrastructure assets in New South Wales and Victoria such as Melbourne Airport, Ausgrid, Nexus Hospitals, Southern Cross Station, NSW Ports, Transurban’s CityLink (Sydney), and Westlink M7 (Melbourne).

Executed by Origin’s newly established Origin Zero business unit, all agreements will be supplied with renewable energy from the Stockyard Hill Wind Farm west of Ballarat – which will be the biggest in the state (and the country) when it gets to full production.

Each customer has signed its own agreement but they range in supply from six to nine years out to December 2030 totalling 132 GWh of renewable energy per annum in its first stage.

Two of Australia’s largest infrastructure fund managers, IFM Investors and QIC, facilitated the agreements which will see enough renewable energy to power 23,000 Australian homes per year.

Last week Fortescue Future Industries sealed another hydrogen agreement, this time with Powerlink and Economic Development Queensland (EDQ) to connect sites at Gibson Island and Aldoga near Gladstone to Powerlink’s transmission network, allowing renewable electricity to power proposed hydrogen projects.

Deputy Premier and Minister for State Development Steven Miles said the parties had agreed to work together to build new transmission connections that will power FFI’s Queensland developments.

Twiggy Forrest’s FFI intends to build a facility at Gibson Island to produce around 50,000 tonnes of renewable hydrogen per year.

“Connection to the transmission network is vital to allow green energy to power this facility,” Miles said.

“By working with Powerlink, FFI will receive a streamlined service across their Queensland connection developments, which could be up and running as soon as 2023.”

To support the Gibson Island facility, Powerlink will construct a new 275kV switchyard at its existing Murarrie Substation and two 275kV feeders to Gibson Island.

Turning to Australian Carbon Credit Units (ACCUs) now, where the spot price has continued its downward dip closing at $47/t on Wednesday.

This marks a decrease of 6.5% on the week with 18% wiped off the market since late January – the largest monthly decline since 2017.

Energy research consultants, RepuTex Energy says these lower prices have come on improved supply attributed to profit taking and newly available issuance, the net result of which has seen many large entities pull back their positions since late January.

“More recent concerns over the Russia-Ukraine conflict have also cascaded into a selloff across key global carbon markets this week, irrespective of market linkages and/or fundamentals, reflecting the increasing presence of global trading houses now active in the Australian market,” the firm said.

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NMT | Neometals Ltd | 1.61 | 22% | 11% | 127% | 384% | $811,597,066.08 |

| HXG | Hexagon Energy | 0.057 | 21% | 6% | -21% | -40% | $24,553,057.82 |

| AVL | Aust Vanadium Ltd | 0.0395 | 20% | -1% | 80% | 88% | $128,708,186.69 |

| CXL | Calix Limited | 6.46 | 14% | 17% | 55% | 200% | $1,021,926,796.56 |

| PH2 | Pure Hydrogen Corp | 0.43 | 13% | -5% | 110% | 69% | $143,966,111.18 |

| RFX | Redflow Limited | 0.042 | 11% | -2% | -28% | -39% | $61,252,364.33 |

| GEV | Global Ene Ven Ltd | 0.1 | 9% | -5% | 37% | 8% | $49,547,722.32 |

| M8S | M8 Sustainable | 0.018 | 6% | 0% | -31% | -60% | $7,131,159.32 |

| VUL | Vulcan Energy | 9.48 | 5% | -2% | -29% | 53% | $1,232,198,042.40 |

| LIO | Lion Energy Limited | 0.054 | 4% | -5% | 26% | 80% | $22,583,841.82 |

| TNG | TNG Limited | 0.065 | 3% | -14% | -19% | -31% | $93,024,020.87 |

| IRD | Iron Road Ltd | 0.185 | 3% | 3% | -14% | -35% | $147,168,992.03 |

| IFT | Infratil Limited | 7.61 | 3% | 5% | 8% | 10% | $5,438,807,812.50 |

| MPR | Mpower Group Limited | 0.041 | 3% | 5% | -41% | -61% | $8,884,797.84 |

| PGY | Pilot Energy Ltd | 0.05 | 2% | -2% | -24% | -39% | $24,210,734.98 |

| EGR | Ecograf Limited | 0.6 | 2% | -13% | -27% | -13% | $267,948,408.11 |

| EOL | Energy One Limited | 6.36 | 2% | -4% | 0% | 4% | $168,809,956.56 |

| FMG | Fortescue Metals Grp | 19.39 | 0% | -5% | -6% | -10% | $57,237,957,825.62 |

| BSX | Blackstone Ltd | 0.48 | 0% | -24% | 2% | -4% | $195,574,940.78 |

| DEL | Delorean Corporation | 0.22 | 0% | -4% | -2% | 0% | $38,630,830.20 |

| NEW | NEW Energy Solar | 0.91 | 0% | 11% | 13% | 21% | $293,338,007.19 |

| QEM | QEM Limited | 0.165 | 0% | -8% | 10% | 94% | $18,714,849.95 |

| KPO | Kalina Power Limited | 0.02 | 0% | -7% | -31% | -57% | $30,235,559.70 |

| LCK | Leigh Crk Energy Ltd | 0.145 | 0% | -6% | 7% | 7% | $127,359,435.14 |

| SRJ | SRJ Technologies | 0.43 | 0% | 0% | 54% | 46% | $31,927,138.80 |

| CWY | Cleanaway Waste Ltd | 2.85 | 0% | -3% | 6% | 31% | $5,896,259,277.48 |

| CNQ | Clean Teq Water | 0.6 | 0% | -7% | -13% | 0% | $27,693,027.88 |

| MEZ | Meridian Energy | 4.83 | 0% | 12% | -5% | -14% | $6,240,331,696.50 |

| HZR | Hazer Group Limited | 0.91 | -2% | -7% | -14% | -28% | $147,421,960.57 |

| ECT | Env Clean Tech Ltd. | 0.023 | -4% | -26% | 130% | 53% | $35,510,940.05 |

| LIT | Lithium Australia NL | 0.105 | -5% | -9% | -13% | -19% | $108,419,912.58 |

| FGR | First Graphene Ltd | 0.17 | -6% | -11% | -15% | -29% | $96,855,878.35 |

| GNX | Genex Power Ltd | 0.14 | -7% | -22% | -38% | -39% | $187,119,339.68 |

| PRM | Prominence Energy | 0.012 | -8% | 9% | 9% | -8% | $16,764,914.65 |

| MR1 | Montem Resources | 0.045 | -8% | 10% | 7% | -74% | $11,457,895.05 |

| PRL | Province Resources | 0.11 | -8% | -19% | -24% | 24% | $137,559,177.24 |

| CPV | Clearvue Technologie | 0.335 | -9% | -7% | -9% | -28% | $74,109,120.40 |

| EDE | Eden Inv Ltd | 0.016 | -11% | -6% | -6% | -56% | $39,345,496.51 |

| RNE | Renu Energy Ltd | 0.052 | -19% | -35% | -4% | -42% | $19,980,791.14 |

| AST | AusNet Services Ltd | 0 | -100% | -100% | -100% | -100% | $9,919,608,018.74 |

| SKI | Spark Infrastructure | 0 | -100% | -100% | -100% | -100% | $5,036,718,783.60 |

The biggest gainer this past fortnight is lithium-ion battery recycling company NMT after it started trading on the Alternative Investment Market (AIM) of the London Stock Exchange.

AIM is London’s market for small and medium growth companies.

Second biggest gainer is HXG, the developers of the Clean Hydrogen Pedirka Project in Alice Springs, Northern Territory.

The company recently completed a comprehensive pre-feasibility study (PFS) at the project which was based on the initial Pedirka scoping study and focused on analysing broader routes to market.

HXG’s PFS demonstrated the following key findings:

AVL signed a joint co-operation agreement with the Mid West Ports Authority (MWPA) for the future use of facilities as it moves towards approval, funding and development of the Australian Vanadium Project, one of the most advanced vanadium projects being developed globally.

AVL’s generation of an iron-titanium co-product for sale, in addition to the production of a high purity vanadium pentoxide product for steel and battery industries is a key differentiator for the company.

Not a big gainer this week but newly listed FHE resumed ASX trading yesterday after an $8 million capital raising to fund development of its Bristol Springs solar project in Western Australia’s South West.

The capital raising saw the issue of 61.5 million shares at $0.13 each.

Backing the capital raising was Frontier’s own board and management, which kicked-in $1.9 million of the full $8 million.

Of this $1.9 million, non-executive chairman Grant Davey invested $1 million into the company.