Emission Control: BloombergNEF reckons carbon offset prices could increase 50-fold by 2050

No matter the scenario, corporations and other entities looking to buy carbon offsets shouldn’t expect them to be a get-out-of-jail-free card for much longer. Pic: Getty

BloombergNEF says prices for carbon offsets – verified emissions reductions equivalent to one ton of carbon each – could be as high as $120/ton or as low as $47/ton in 2050, depending on what types of supply are eligible to meet the rapidly expanding universe of sustainability goals, as well as who the primary customers are in the market.

In its inaugural Long-Term Carbon Offset Outlook 2022 report, the research firm claims that if all offsets continue to be permitted, including those which avoid emissions that would otherwise occur, the market will be oversupplied with largely worthless credits, thereby driving down prices and attracting criticism around quality.

Equally, if the market is restricted to just offsets that remove, store or sequester carbon, there will be insufficient supply to keep up with demand, causing significant near-term price hikes and damaging liquidity.

And if the market evolves to primarily help countries achieve their climate targets rather than companies – a possibility outlined at COP26 – it will soften this supply shortfall. Yet, this is still not ideal for the long-term success of carbon offsets.

Kyle Harrison, head of sustainability research at BloombergNEF and the lead author of the report, said: “There will be growing pains in the coming years as stakeholders try to understand how to sustainably grow the carbon offset market and determine who it will serve.

“If done correctly, their patience could be rewarded with a market valued at more than $550 billion by mid-century,” he said.

“Suppliers, buyers of offsets, traders and investors will need to balance what is idealistic and what is realistic otherwise, they risk the offset market burning out just as it’s getting started.”

Demand and prices for carbon offsets under three scenarios

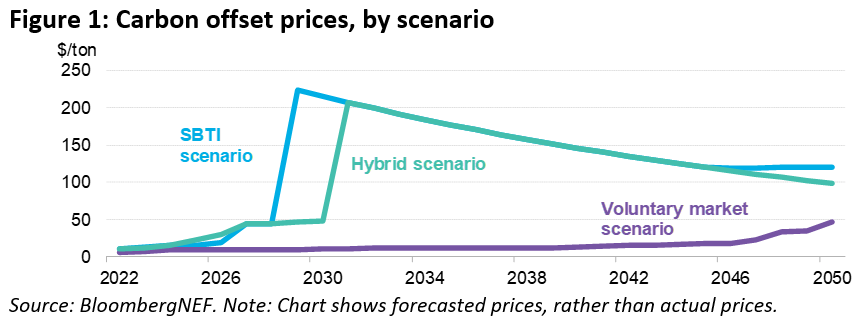

BNEF models supply, demand and prices for carbon offsets under three scenarios: a voluntary market scenario, an SBTI (Science Based Targets initiative) scenario and a hybrid scenario.

Offset prices range from $11-$215/ton in 2030, up from just $2.50 on average in 2020, before narrowing to $47-$120/ton in 2050.

The voluntary market scenario assumes the offset market remains similar to how it looks today.

Demand comes from corporations with sustainability goals and surges to 1 billion metric tons of carbon dioxide equivalent in 2030 and 5.2GtCO2 in 2050 – the latter of which is equivalent to 10% of global emissions today.

All types of supply are permitted, including offsets that avoid emissions rather than removing them, like clean energy and avoided deforestation.

Due to the lack of regulation, supply is nearly four times greater than demand in 2030 and is still 30% greater in 2050.

Low prices give companies flexibility to meet their sustainability goals, but subsequently undermine their ability to drive true additional decarbonisation, inviting criticism for a lack of quality.

It also provides developers and traders with little financial incentive to participate, meaning the market never takes off and is relegated to back-alley deals for low-quality credits.

The SBTI scenario limits supply to removal offsets like reforestation and nascent technologies such as direct air capture.

Activity is still driven by corporations, but only for offsets that store or sequester carbon, rather than avoiding emissions that would otherwise happen – an outcome pushed by a number of groups.

Hybrid scenario: assumes removal-only market for countries by mid-century

The hybrid scenario looks at a gradual evolution of the offset market, from the voluntary market today, to a removal-only market for corporations and finally to a removal-only market primarily for countries, rather than companies, by mid-century.

This assumes that a global carbon market allowing countries to buy and sell verifiable emission reductions – similar to what is being discussed under Article 6 at COP26 – overtakes the current company-run market.

Prices rise to a manageable $48/ton in 2030 before shooting up to $217/ton the following year and gradually dropping to $99/ton in 2050. While the price outcome of the hybrid scenario is more ideal for all parties involved, it assumes some major market developments in the coming years and is still an unpalatable jump from today’s prices.

“No matter the scenario, corporations and other entities looking to buy carbon offsets shouldn’t expect them to be a get-out-of-jail-free card for much longer,” said Harrison. “As the market matures – which it will – and processes are put in place to make offsets resemble a traditional commodity, prices will inevitably rise and companies will need to prioritize their gross emissions more than ever.”

Major energy project on VIC Mornington Peninsula gets green light

Australian renewables company, Maoneng, has nabbed development approval for its proposed 240MWp/480MWh Battery Energy Storage System (BESS).

The $190M project – targeted for completion in mid 2023 – will draw and store energy from the grid during off-peak periods and dispatch energy to the grid during peak periods, generating power for about 400,000 homes.

An engineering, procurement, and construction contractor is scheduled to be announced in the coming weeks.

ASX green energy stocks

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| AST | AusNet Services Ltd | 2.5 | -2% | -1% | 39% | 44% | $9,651,510,505 |

| AVL | Aust Vanadium Ltd | 0.046 | 39% | 59% | 142% | 84% | $154,226,228 |

| BSX | Blackstone Ltd | 0.805 | 11% | 40% | 115% | 92% | $316,966,283 |

| DEL | Delorean Corporation | 0.225 | -4% | 10% | 13% | 0% | $39,529,222 |

| ECT | Env Clean Tech Ltd. | 0.029 | -3% | -36% | 123% | 190% | $46,059,216 |

| FMG | Fortescue Metals Grp | 21.39 | 2% | 13% | -16% | -14% | $62,934,042,924 |

| GEV | Global Ene Ven Ltd | 0.105 | -5% | 8% | 57% | 24% | $57,117,949 |

| GNX | Genex Power Ltd | 0.19 | -3% | -7% | -19% | -16% | $197,931,508 |

| HXG | Hexagon Energy | 0.075 | -1% | 9% | 3% | -32% | $31,666,982 |

| HZR | Hazer Group Limited | 1.17 | -7% | 9% | 39% | -9% | $190,589,717 |

| IFT | Infratil Limited | 7.64 | -1% | 2% | 5% | 14% | $5,591,094,431 |

| IRD | Iron Road Ltd | 0.19 | 0% | -5% | -31% | -10% | $151,146,532 |

| LIO | Lion Energy Limited | 0.062 | -13% | 0% | 32% | 88% | $27,697,164 |

| MEZ | Meridian Energy | 4.38 | 0% | -3% | -14% | -35% | $5,458,714,393 |

| MPR | Mpower Group Limited | 0.046 | 15% | 10% | -44% | -23% | $10,217,518 |

| NEW | NEW Energy Solar | 0.81 | -1% | -1% | 1% | -10% | $259,676,269 |

| PGY | Pilot Energy Ltd | 0.054 | 0% | -4% | -34% | 38% | $27,588,094 |

| PH2 | Pure Hydrogen Corp | 0.475 | -10% | -6% | 179% | 228% | $169,330,660 |

| PRL | Province Resources | 0.155 | 11% | 11% | 11% | 675% | $158,152,374 |

| PRM | Prominence Energy | 0.012 | 9% | 50% | 0% | 33% | $15,415,306 |

| QEM | QEM Limited | 0.21 | 8% | 17% | 24% | 147% | $24,386,017 |

| RFX | Redflow Limited | 0.05 | 0% | 6% | -19% | 80% | $69,799,206 |

| SKI | Spark Infrastructure | 0 | -100% | -100% | -100% | -100% | $5,036,718,784 |

| VUL | Vulcan Energy | 10 | -1% | -18% | 10% | 1% | $1,297,650,916 |

| CXL | Calix Limited | 6.41 | 1% | 6% | 109% | 519% | $1,088,883,857 |

| KPO | Kalina Power Limited | 0.025 | 4% | 4% | -17% | -46% | $34,770,894 |

| RNE | Renu Energy Ltd | 0.092 | 0% | 12% | 70% | 56% | $14,483,826 |

| LCK | Leigh Crk Energy Ltd | 0.155 | 3% | 3% | 11% | 3% | $138,593,986 |

| LIT | Lithium Australia NL | 0.13 | 13% | 24% | 13% | -24% | $133,714,556 |

| CWY | Cleanaway Waste Ltd | 3.05 | 0% | 2% | 20% | 19% | $6,308,585,101 |

| EDE | Eden Inv Ltd | 0.018 | -10% | -10% | -22% | -40% | $43,974,378 |

| M8S | M8 Sustainable | 0.019 | 15% | 27% | -21% | -64% | $7,970,119 |

| EGR | Ecograf Limited | 0.66 | -4% | 3% | -8% | 110% | $315,233,421 |

| CNQ | Clean Teq Water | 0.655 | -6% | -8% | -42% | 0% | $29,926,337 |

| CPV | Clearvue Technologie | 0.38 | 12% | 58% | 12% | 29% | $83,605,393 |

| MR1 | Montem Resources | 0.046 | -8% | -22% | -4% | -79% | $11,712,515 |

| SRJ | SRJ Technologies | 0.43 | 0% | 0% | 110% | 4% | $31,927,139 |

| SPN | Sparc Tech Ltd | 2.12 | 37% | 45% | 524% | 563% | $126,266,996 |

| TNG | TNG Limited | 0.09 | 10% | 15% | 48% | -10% | $122,180,804 |

| ADX | ADX Energy Ltd | 0.008 | -20% | -11% | 0% | 14% | $28,257,153 |

| FGR | First Graphene | 0.22 | 7.5% | 2.5% | -15% | -25% | $121,070,000 |

| NMT | Neometals Ltd | 1.8 | 9% | 5 | 251% | 442% | $915,788,581 |

The two biggest winners this fortnight – Australian Vanadium (ASX:AVL) and Sparc Technologies (ASX:SPN) – are up on no news.

Lithium extraction technology developer Lithium Australia NL (ASX:LIT) gained 13% after the reveal of a large lithium system identified at the Bynoe Lithium Project – a joint venture project with Charger Metals NL (ASX:CHR) where LIT owns 30%.

The company is also focused on the recycling of energy metals from spent batteries, such as lithium-ion batteries, through its 90%-owned subsidiary, Envirostream Australia Pty Ltd.

Nickel explorer Blackstone Minerals (ASX:BSX) made a strategic investment in battery metal player, NiCo Resources (ASX:NC1) – the owner of one of the largest, undeveloped cobalt-nickel projects’ in the world, the Wingellina project.

The project straddles the triple-point of the Western Australia, Northern Territory, and South Australia borders.

Surging 7.5% this fortnight is First Graphene (ASX:FGR), after announcing its five-year collaboration agreement with global construction chemical manufacturer, Fosroc International for the development of ‘green cement’, which will include graphene-enhanced cement additives.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.