You might be interested in

Director Trades

Director Trades: Which former managing director of an ASX gold stock sold $18 million of stock?

Director Trades

ASX Director Trades: Who is buying in BIG and selling down even BIGGER?

Director Trades

Director Trades

Director trades are often considered a good indicator of a company’s future prospects. Our fortnightly ASX Director Trades column informs you who is buying in and who is selling down. Often referred to as insider buying or selling, directors are legally permitted to buy and sell shares of the company and any subsidiaries. However, these transactions must be properly registered and divulged.

Insider buying or selling is not to be confused with insider trading, which is buying shares based on non-public information, a big no-no and illegal.

We troll through the ASX company announcements looking at director trades of interest over the past fortnight. It’s usually the big ones that stand out or those coinciding with company news.

Directors may get shares as part of employee incentive schemes, share purchase plans, rights issues, participate in dividend reinvestment plans or purchase on-market. It’s the on-market trades we think are worth noting, where directors directly or indirectly through entities they are associated either put up cash or cash in a stake.

When a director buys shares on-market, it can signify confidence the share price will rise in the future and if multiple directors are buying, especially at larger amounts, that is even more of an indication. Of course, it’s not a sure win that the share price will rise, so it’s always worth further research on a company.

Directors will often buy company shares after a sharp price decrease. Directors may think the stock has been oversold and represents good value, sometimes they want to show confidence in their company’s prospects, other times they’ve just got another good reason to buy or sell a stock which will be divulged, like paying the good ol’ taxman.

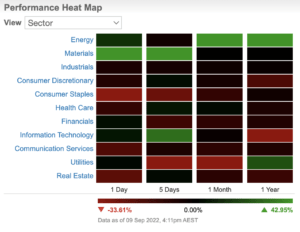

Local shares ended last week higher with the ASX 200 index lifting almost 1% for the week. Materials and information technology led the gainers, while consumer staples and utilities were among the greatest laggards.

Heading into the start of the week, the S&P/ASX200 finished Monday 1.12% higher tracking Friday’s rally on Wall Street.

| Code | Company | Director | Direct or Indirect | Date | Volume | $ | Nature of change |

|---|---|---|---|---|---|---|---|

| SRV | Servcorp | Alfred George Moufarrige | Indirect | Sept-07 | 200,000 | $718,485.24 | On-Market |

| CPU | Computershare Limited | Paul Joseph Reynolds | Indirect | Sept-06 | 16,000 | $387,840.00 | On-Market |

| IRE | IRESS | Marcus Colin Price | Indirect | Sept-07 | 27,272 | $300,321.99 | On-Market |

| CYG | Coventry Group | Alexander James White | Direct & Indirect | Sept-09 | 221,942 | $262,690.55 | On-Market |

| NXL | Nuix | Jonathan Rubinsztein | Indirect | Sept 6,7,8 | 350,000 | $236,259.60 | On-Market |

| TEK | Thorney Technologies | Alex Waislitz | Indirect | Sept-09 | 1,000,000 | $211,100.00 | On-Market |

| CCX | City Chic Collective | Michael Kay | Indirect | Sept 6,7,8 | 100,000 | $156,440.87 | On-Market |

| SFC | Schaffer Corporation | John Michael Schaffer AM | Indirect | Sept-07 | 8,387 | $150,962.13 | On-Market |

| ST1 | Spirit Technology Solutions | Julian Challingsworth | Direct & Indirect | Sept 2,5,7,8 | 1,591,655 | $119,336.00 | On-Market |

| BST | Best & Less Group Holdings | Stephen Heath | Indirect | Aug-31 | 50,000 | $113,750.00 | On-Market |

| MSB | Mesoblast | Jane C. Bell | Indirect | Sept-07 | 133,333 | $109,999.73 | On-Market |

Data analytics company Nuix (ASX:NXL) saw CEO Jonathan Rubinsztein pony up for more than $230k worth of shares over three days in early September.

The Nuix share price rocketed more than 18% higher on reports it could be the targets of a takeover by US software company Reveal. Trading in the company was paused on Friday with an ASX announcement saying “the company confirms that it has not received a bid or a written proposal from Reveal.”

“Nuix will inform the market if or when there are material matters to disclose, in accordance with its continuous disclosure requirements,” the statement said.

“Nuix also confirms the recent change of Director’s interests was compliant with the Company’s Securities Trading Policy.”

The Nuix share price has fallen more than 63% year to date.

Founder and chairman of listed investment group Thorney Technologies (ASX:TEK), billionaire investor Alex Waislitz, topped up his holdings on September 9.

While at this stage not much is known about the deal, Thorney and associated entities recently became a substantial shareholder of BNPL platform Splitit (ASX:SPT).

The Thorney share price is down ~4.5% year to date.

| Code | Company | Director | Direct or Indirect | Date | Volume | $ | Nature of change |

|---|---|---|---|---|---|---|---|

| RHY | Rhythm Biosciences | Otto Buttula | Indirect | Sept-08 | 5,000,000 | $6,498,570.00 | On-Market |

| CPU | Computershare Limited | Stuart James Irving | Direct & Indirect | Sept 2-5 | 238,506 | $5,776,674.00 | On-Market |

| CAR | Carsales.com | Walter James Pisciotta | Indirect | Sept 2 & 8 | 250,000 | $5,536,582.58 | On-Market |

| AKE | Allkem | Martín Pérez de Solay | Indirect | Aug 31 & Sept 6 | 190,148 | $2,659,075.15 | On-Market |

| AKE | Allkem | Martin Rowley | Indirect | Sept-06 | 149,459 | $2,094,188.00 | On-Market |

| CAR | Carsales.com | Steven Anthony Kloss | Direct | Sept-02 | 47,248 | $1,067,990.40 | On-Market |

| EXP | Experience Co | Anthony Boucaut | Direct & Indirect | Sept-06 | 4,000,000 | $800,000.00 | On-Market |

| PTB | PTB Group | Andrew Peter Somerville Kemp | Indirect | Sept-06 | 245,817 | $384,242.00 | On-Market |

| SLR | Silver Lake Resources | Luke Tonkin | Indirect | Sept-06 | 290,000 | $359,890.00 | On-Market |

Independent non-executive chairman and nomination and governance committee chairman of lithium play Allkem (ASX:AKE) Martin Rowley has continued his large sell-down of stock. Rowley still owns more than 2.6 million ordinary shares directly and indirectly.

Managing director and CEO Martín Pérez de Solay also sold more than $2.6 million worth of stock. In an ASX announcement Allkem said the proceeds would be “used to meet tax obligations from vesting of performance rights”. Pérez de Solay still owns 152,818 fully paid ordinary shares and 770,507 unlisted performance rights under the performance rights and option plan.

Allkem recently announced ‘record financial results’ have been achieved in the first year of its highly successful merger of Orocobre and Galaxy Resources.

The stock price has risen more than 42% year to date.

Carsales.com (ASX:CAR) non-executive director Walter Pisciotta OAM and alternate non-executive director Steve Kloss recently sold down large amounts of stock.

In August CAR posted strong FY22 results including $509 million of revenue, and $161 million in after-tax profit. The company also increased its fully franked final dividend to 24.5 cents a share.

The CAR share price has risen 1.52% in the past month after falling more than 11% year to date.

Stock transfer company Computershare (ASX:CPU) president and CEO Stuart Irving has sold down almost $5.8 million worth of shares, while non-executive director Paul Reynolds has purchased almost $400k worth of stock.

According to an ASX release, the sale was partially to satisfy withholding tax obligations arising from the vesting of shares through the company’s employee incentive plans. The release further noted that Irving sold additional shares to fund a home purchase in the UK.

Irving retains 132,580 ordinary shares and more than 653,000 performance and share appreciation rights.

The company’s share price has rise more than 23% year to date.