Top 10 overview

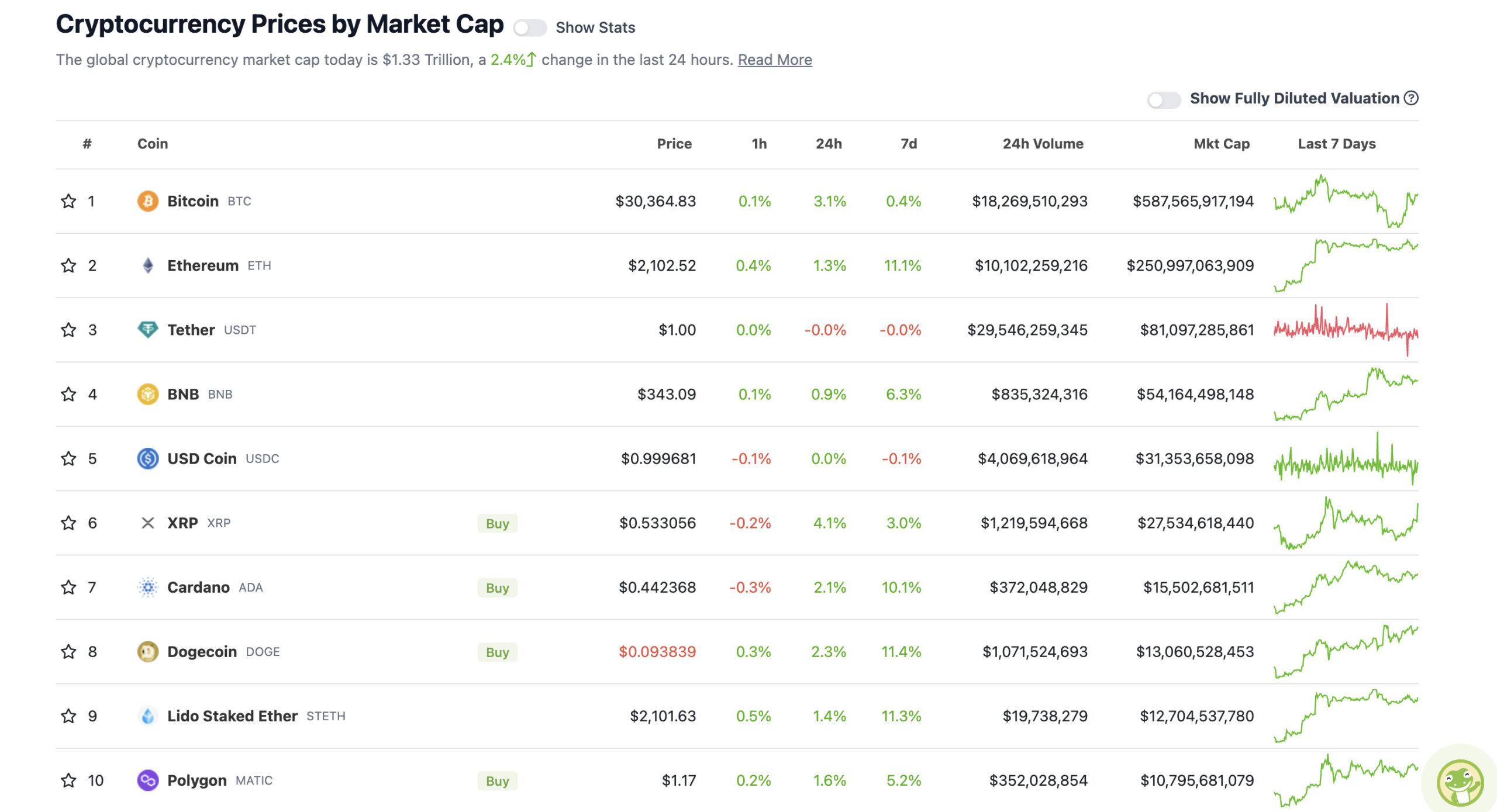

With the overall crypto market cap at US$1.33 trillion, up 2.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

We couldn't find a 'Gary Gensler Grilled' image, so this had to suffice. (Getty Images)

Bitcoin has clawed its way back above US$30k at the time of writing, while several altcoins are taking it as a sign to steam ahead. But for how long? Meanwhile SEC boss Gary Gensler has been absolutely roasted in his hearing in front of Congress.

Let’s start there, actually, as it’s pretty entertaining stuff, especially if you’re not a fan of desperate governmental overreach and suppression of innovation under the thin veil of consumer protection.

Just a touch of context and background to get you up to speed here first:

• Securities and Exchange Commission chairman Gary Gensler has been in charge of the US financial regulatory body for two years and has increasingly gone after the US crypto industry in that time. The SEC has levelled at least 55 enforcement actions against US crypto firms and claimed millions of dollars in settlement fines from several of them – for example, the US exchange Kraken, which settled by paying a US$30m fine for “disgorgement, prejudgment interest and civil penalties” and agreeing to terminate its staking/passive yield-income program for US clients.)

• Gensler, a former blockchain lecturer at MIT, has a swarming beehive in his bonnet about everything that isn’t Bitcoin, labelling all altcoins “securities” in his public discourse. He maintains rules and regulations for crypto compliance are clear, but the entire crypto industry disagrees, as do several members of US Congress. That said, he does have some powerful political supporters as well.

• Sidenote: While teaching at MIT, Gensler was mates with Silvio Micali – founder of the Algorand (ALGO) blockchain/crypto project. Gensler has, in the past, talked up Algorand on a handful of occasions, leading some to compare that with the celebrity shilling of cryptos – a practice he and his SEC heavily targets. Rich hypocrisy? You be the judge…

Now that the SEC says Algorand is a security, is the SEC going to sue Gary Gensler for promoting Algorand?pic.twitter.com/oajbCALOFW

— LilMoonLambo (@LilMoonLambo) April 17, 2023

https://twitter.com/0xfoobar/status/1648005780833017862?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1648006735527813136%7Ctwgr%5E8704eb8d7e82a2901a4d7a25088d508924d1216f%7Ctwcon%5Es2_&ref_url=https%3A%2F%2Fdecrypt.co%2F137142%2Fgary-gensler-kim-kardashian-shilling-algorand

The United States House Financial Services Committee proceeding, which occurred overnight (AEDT) in Congress, kicked off with a five-minute grilling from the chair of that body, Patrick McHenry.

McHenry repeatedly asked a visibly shaking Gensler one simple question: Is ETH a security or a commodity? To which the SEC boss bizarrely couldn’t give a straight answer. To many a crypto follower and industry participant, this pretty much summed up the state of confusion they’re getting from the regulatory body. Here, have a watch in the second tweet below…

.@GaryGensler's tenure has been defined by recklessness. His agenda runs roughshod over process, precedent, & the #SEC’s statutory authority. I look forward to speaking with him today.

📺 Tune in at 10:00am 👇https://t.co/qNdJ4wDkw5

— Patrick McHenry (@PatrickMcHenry) April 18, 2023

Gary Gensler getting grilled on whether he thinks ETH is a security or commodity

Enjoy pic.twitter.com/vrFVn3Ap63

— sassal.eth/acc 🦇🔊 (@sassal0x) April 18, 2023

If there’s a university course somewhere called Slimy Political Manoeuvring and Tactical Avoidance 101, they should absolutely study Genlser’s latest performances.

Rep. McHenry: “Is Ether a security or a commodity?”

Gensler doesn’t answer, over and over again.

If the law was clear, the answer would be immediate and easy.

@SECGov is not credible or ethical

— Erik Voorhees (@ErikVoorhees) April 18, 2023

Gensler knew he’d be in for a tough time from certain members of Congress, who all had only five minutes to level their questioning. Here’s Republican Congressman Tom Emmer, who serves as the House Majority Whip, which somehow seems appropriate. It’s great theatre, this one…

🚨BREAKING!!!!! @GOPMajorityWhip TORCHING Gary Gensler and highlighting his and the SEC's complete and utter failure to protect ANY retail investors whatsoever

And lack of regulatory clarity + hostile enforcement against crypto in the US is pushing innovation offshores… pic.twitter.com/cDlt2BbUW2

— Tyler Strejilevich (@TylerSCrypto) April 18, 2023

We cheered Gensler when he became SEC Chairman because he taught about Bitcoin and blockchain at MIT.

Turns out, he’s never even owned it.

This guy is a sham. pic.twitter.com/wEdebrTZRg

— The Wolf Of All Streets (@scottmelker) April 18, 2023

However, certain Congress members vehemently attacked the SEC boss for a lack of transparency regarding compliance rulings for the US crypto industry.

— Jamie Burke ⛺️ (@jamie247) April 18, 2023

🚨I’m calling to restructure the @SECGov and the removal of Chair @GaryGensler.

Watch my closing remarks from today’s hearing where I lay out the abuse of power and failure to protect investors that has occurred. pic.twitter.com/SNXio9Zbej

— Warren Davidson 🇺🇸 (@WarrenDavidson) April 18, 2023

Okay, that’s enough Gensler grilling for now. Onto some daily price action…

A reclamation of the US$30k zone for Bitcoin occurred over night. Now then, can it, will it, push higher after a retest in the $29ks? That’s the question many a crypto chart watcher is asking right now…

Scenario on #Bitcoin is still following through.

Preferably above $29.5K you'd like to see #Bitcoin hold and then test range high at $31K again. pic.twitter.com/ttz5mnYZ4a

— Michaël van de Poppe (@CryptoMichNL) April 18, 2023

#BTC is fighting to reclaim this Higher High

We'll know in a few hours as the Daily Candle Closes soon$BTC #Crypto #Bitcoin https://t.co/UquQLL4VWS pic.twitter.com/yLiOgJfMrh

— Rekt Capital (@rektcapital) April 18, 2023

Sweeping a market-cap range of about US$9.7 billion to about US$508 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Radix (XRD), (market cap: US$1.51 billion) +47%

• Zilliqa (ZIL), (mc: US$549 million) +11%

• Theta Network (THETA), (mc: US$1.22 billion) +9%

• Internet Computer (ICP), (mc: US$2.93 billion) +9%

• Synthetix Network (SNX), (mc: US$948 million) +8%

SLUMPERS

• Injective (INJ), (market cap: US$694 million) -5%

• Bitget Token (BGB), (mc: US$577 million) -3%

• WOO Network (WOO), (mc: US$515 million) -2%

• Huobi (HT), (mc: US$627 million) -2%

• MultiversX (EGLD), (mc: US$1.1 billion) -1%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

✅ Nov 2022 $15.5K was the bottom

⌛️ Closing in on $32K

❓ >$100K bull .. we'll see in 2025😅

3 months after this Jan12 prediction, I feel confident enough to say that Nov 2022 $15.5K was indeed the bottom.

If we reach $32K target soon, I will up my halving prediction to >$60K. https://t.co/V74Y8VYCVo— PlanB (@100trillionUSD) April 18, 2023

NEW‼️ UAE now taking applications from #Bitcoin and crypto firms to operate in the country – Coindesk

— Bitcoin Archive (@BTC_Archive) April 18, 2023

JUST IN‼️ Weakness in banks highlight the strength of #Bitcoin says founder of $170 Billion Asset Manager, Howard Marks – Blockworks 🤝

— Bitcoin Archive (@BTC_Archive) April 18, 2023

Ah, one more on Gensler, just for (steel-capped) kicks…

Gensler on Digital assets under oath before congress. The last question really put him on the spot. #GenslerKnew #Bitcoin #digitalassets@CoinDesk pic.twitter.com/5U10pcvWaY

— KellyKellam (@Kellykellam) April 18, 2023

— 𝕏RP Beast 🇺🇲 (@XRP_Bossman) April 17, 2023

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.