Mooners and Shakers: Crypto market dips amid reports of SEC crackdown on Kraken and staking

Coinhead

Coinhead

Not a great way to end the working week, this. Amid reports that US regulator the SEC has shut down the Kraken exchange’s staking program, fears of broader consequences for the crypto industry are spreading.

Crypto prices have taken a tumble overnight on the news, and we’ll get to that further below.

Yesterday, the CEO of major crypto exchange Coinbase Brian Armstrong highlighted rumours that the US Securities and Exchange Commission (SEC) has a hard-on for banning crypto staking.

Staking, if you didn’t know, refers to the process of locking up certain cryptocurrencies to earn percentage-rate rewards. Generally speaking, by staking “Proof-of-Stake” (PosS) cryptos, such as ETH or ADA, you’re also helping as a cog in the mechanism of securing a specific PoS blockchain network as well as gaining a passive income over time.

— Will Clemente (@WClementeIII) February 9, 2023

Another rumour surfaced, too – circulated by venture capitalist and non-maxi Bitcoiner Nic Carter – that the Biden administration is planning to “quietly” move against the crypto industry in the US more broadly.

Carter describes it as a “sophisticated, widespread crackdown” on the industry in the US and refers to it as “Operation Choke Point 2.0”, which is a reference to an Obama-era move to remove perceived undesirable players in the banking industry.

I don't want to alarm, but since the turn of the year, a new Operation Choke Point type operation began targeting the crypto space in the US. it is a well-coordinated effort to marginalize the industry and cut of its connectivity to the banking system – and it's working

— nic carter (@nic__carter) February 7, 2023

And now, in the most immediate revelation in this disturbing news, the prominent, US-founded Kraken crypto exchange has shut down its crypto staking service in the US after being formally investigated by the SEC for offering digital assets products that the US agency believes could be deemed as unregistered securities.

Kraken has reportedly now made a US$30 million settlement with the SEC in charges for “disgorgement, prejudgment interest and civil penalties” and has agreed to end its staking program for US clients.

Settlements are not law. They're a decision that the economics of settling are better than fighting, no more.

The SEC thinks staking-as-a-service is a security. Kraken didn't admit or deny either way.

It may be a tough question, but the SEC hasn't answered it either way today.

— Jake Chervinsky (@jchervinsky) February 9, 2023

One SEC commissioner who regularly takes an opposing stance to SEC chief Gary Gensler’s crypto-industry views, is Hester Peirce, aka “Crypto Mom” to some.

Peirce has been quick to release a statement condemning the agency’s latest actions.

My thoughts on today's Kraken settlement: https://t.co/mijt3MNN4U

— Hester Peirce (@HesterPeirce) February 9, 2023

The whole statement is worth a read, but here are the chief highlights:

“Today, the SEC shut down Kraken’s staking program and counted it as a win for investors. I disagree and therefore dissent.

“Using enforcement actions to tell people what the law is in an emerging industry is not an efficient or fair way of regulating. Moreover, staking services are not uniform, so one-off enforcement actions and cookie-cutter analysis does not cut it.

“Most concerning, though, is that our solution to a failure to register violation is to shut down entirely a program that has served people well…

“A paternalistic and lazy regulator settles on a solution like the one in this settlement: do not initiate a public process to develop a workable registration process that provides valuable information to investors, just shut it down.

“More transparency around crypto-staking programs like Kraken’s might well be a good thing. However, whether we need a uniform regulatory solution and if that regulatory solution is best provided by a regulator that is hostile to crypto, in the form of an enforcement action, is less clear.”

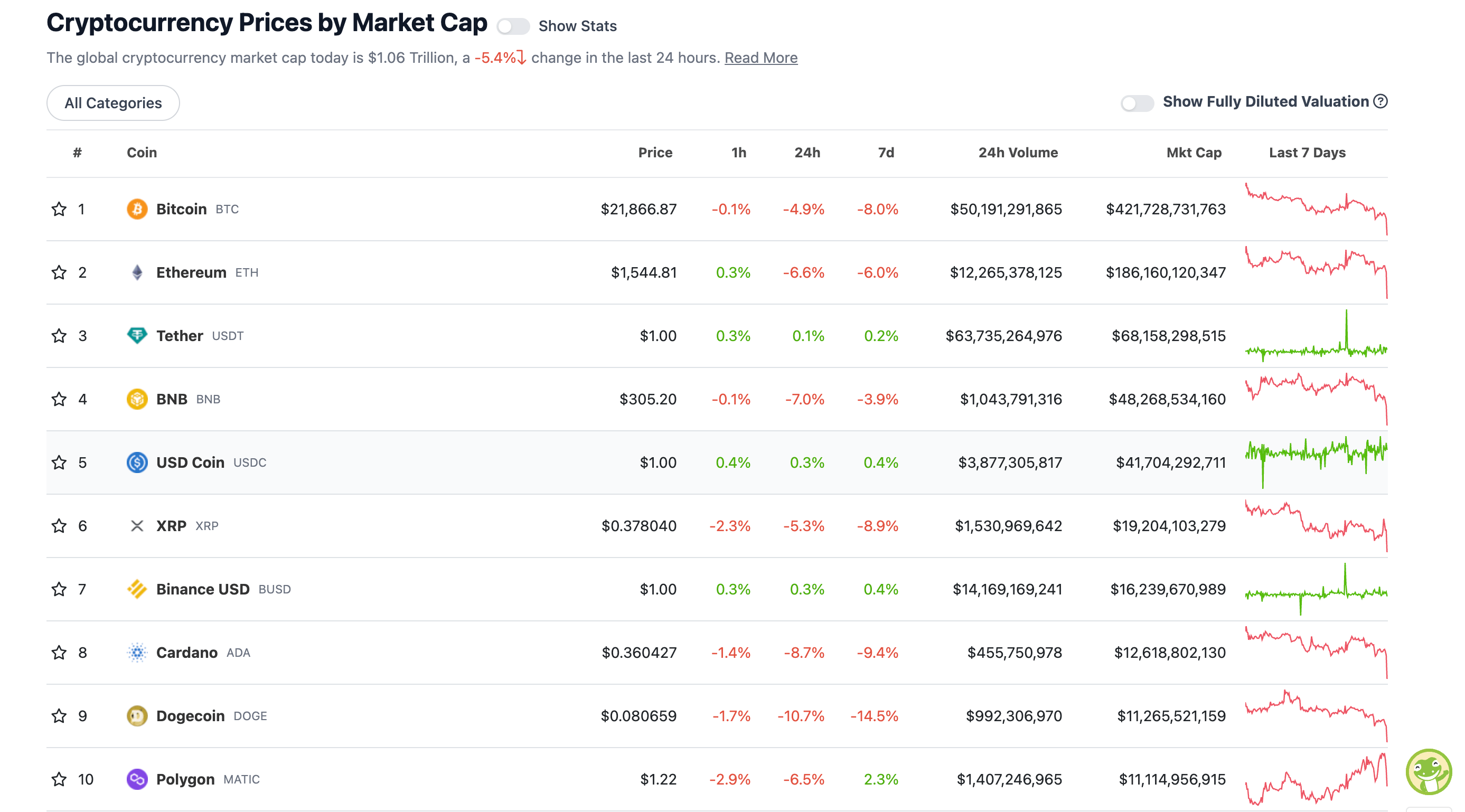

With the overall crypto market cap at US$1.06 trillion, down more than 5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Yikes. Blood in the water here, and the US regulatory sharks are circling.

Chartists’ eyes naturally turn to Bitcoin (BTC) first as the market’s health barometer, but it’s the altcoins that bleed out faster once the leading crypto takes a few heavy body blows.

Ethereum, as the industry’s major Proof-of-Stake (PoS) protocol, is not liking the SEC crackdown news at all today, which is more than understandable. The ETH token has sunk by 6.6% at the time of writing, but other top-tenners, such as Dogecoin, Ethereum L2 Polygon and fellow PoS chain Cardano are taking it harder.

Meanwhile in technical “let’s just look at the charts, shall we?” analysis land, here are a couple of different takes for the short term from two US-based line, candle and triangle watchers.

Justin Bennett notes that US$20 billion of Bitcoin long liquidations got flushed down the trading toilet and that unless we get a bounce tout suite, then BTC is heading below US$21k again soon.

So we got the $BTC pullback after the bearish divergence from volume. #Bitcoin also flushed about $20 billion worth of long liquidations at $22,000 today.

Either bounce here or risk a deeper correction toward $20,800. https://t.co/mNP92gxeFV pic.twitter.com/1cgjbwev5b

— Justin Bennett (@JustinBennettFX) February 9, 2023

Roman Trading, on the other hand, sees support at US$21.2k and a potential bounce there…

$BTC 1D

Support lost. Looking for the next long opportunity around 21.2 area.

Didn’t take longs in this demand zone as there wasn’t a set up.

Waiting for the next play. 1D still bullish even if we retest 21.2 IMO.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/aGO2mbEsl7

— Roman (@Roman_Trading) February 9, 2023

Sweeping a market-cap range of about US$9.7 billion to about US$419 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Rocket Pool (RPL), (market cap: US$908 million) +16%

• Lido DAO (LDO), (mc: US$2.16 billion) +4%

• Frax Share (FXS), (mc: US$898 million) +4%

What’s interesting here on this shorter-than-usual pumpers list today is that these three (RPL, LDO and FXS) are all top decentralised liquid staking plays.

The fact a centralised staking service has shut itself down in the face of heavy-handed regulatory actions is telling for this rogue narrative bump-up today, as these three tokens very much push the benefits of DeFi and decentralisation in crypto.

DAILY SLUMPERS

• SingularityNET (AGIX), (market cap: US$452 million) -21%

• The Graph (GRT), (market cap: US$1.29 billion) -17%

• Baby Doge Coin (BABYDOGE), (market cap: US$460 million) -17%

• NEAR Protocol (NEAR), (market cap: US$1.92 million) -16%

• Fantom (FTM), (market cap: US$1.24 million) -15%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Not sure if the rumors of the US gvt coordinating an attack on the industry are true — but what I do know is this would be the biggest regulatory blunder of all time; Limiting adoption/innovation in the United States while allowing the rest of the world to get a head start.

— Will Clemente (@WClementeIII) February 9, 2023

1/2

So the SEC got buddy-buddy with SBF and almost gave them an exception to offer more services in the US.

But then goes after Kraken and Coinbase, the two most compliant US exchanges for services that the SEC previously refused to provide guidance on?

— Adam Cochran (adamscochran.eth) (@adamscochran) February 9, 2023

I feel really sorry for US retail investors. The SEC is systematically stripping away any opportunities they have in the crypto world….

— Ran Neuner (@cryptomanran) February 9, 2023

See this spin kicking in in a few weeks … similar to how it happened when China banned bitcoin (the last time!) and narrative spinners turned it into "this is good for Bitcoin as now mining will be concentrated in the US instead of in China"

— Alex Krüger (@krugermacro) February 9, 2023

Meanwhile, Joe Biden (via an interpretation from Twitter account @VentureCoinist) wants you to “make no mistake” about what’s going on…

The reason for this sell-off is obvious to anyone that watched the State of the Union.

It was wild to hear Biden go this deep on crypto but his stance is clear. They are prepared to do anything to kill this rally.

I recorded the most important part in case you missed it: pic.twitter.com/sVTwSqVID3

— Luke Martin (@VentureCoinist) February 9, 2023