Mooners and Shakers: SEC sues Bittrex exchange; Bitcoin dips below $30k as analysts offer mixed outlooks

Not actually SEC boss Gary Gensler, yesterday. (Getty Images)

Crypto market soothsayers are working overtime this week, with predictions and opinions about what comes next as divided as ever. Meanwhile, Gary Gensler’s SEC is suing the Seattle-based crypto exchange Bittrex.

More on that, further below.

At the time of writing, as the US dollar ticks up a bit, BTC has dipped its head back under the US$30k mark, falling as low as US$29,300 at one stage over the past 24 hours. It could be in for a deeper correction according to some trader/analysts, while others believe it’s part of a small dip/retest before a rebound.

Tone Vays, a former Wall Street analyst with Bear Stearns and JPMorgan, is one of those who think the top crypto could fall down to about US$29k before setting up for a further rally – towards US$34k. This is his “bullish pessimistic scenario”, he told his YouTube subscribers earlier this week.

Meanwhile, Bloomberg Intelligence’s senior macro strategist Mike McGlone, who’s been reasonably bullish on Bitcoin and Ethereum in the past, thinks the performance of the ETH/BTC pair could be peaking for now, and may be acting as a leading indicator for risk assets. He suggests there may be an incoming correction in stocks and possibly crypto, too, as markets adjust to a transition into disinflation brought about by the Fed’s tightening policy.

#Nasdaq Rollover vs. S&P 500 and #Ethereum/#Bitcoin – "The main factor depressing aggregate demand was a worldwide contraction in money supplies." This from former #FederalReserve chair Ben Bernanke's "Essays on the Great Depression" may pertain to current markets. pic.twitter.com/h9G5btxAE6

— Mike McGlone (@mikemcglone11) April 14, 2023

Okay, so that’s bearish. Where are the bulls? Here are a few crypto-centric takes from some of the usual suspects…

This current #BTC dip doesn't interrupt the progress of the Bull Market

The dip is part of it$BTC #Crypto #Bitcoin https://t.co/EDPpzTHxxt

— Rekt Capital (@rektcapital) April 17, 2023

Some of the better analysts i follow + myself are trying to tell you to look for alts on this pullback.

If the set up is there, it will be more rewarding than $BTC pump to 32k.#bitcoin #cryptocurrency #cryptotrading #cryptonews

— Roman (@Roman_Trading) April 17, 2023

#Altcoins holding up significantly, while #Bitcoin corrects can mean two things:

– #Bitcoin is right and will correct further, through which altcoins have a 20-30% correction.

– Altcoins are stronger and will continue a strong rally if Bitcoin bounces.

— Michaël van de Poppe (@CryptoMichNL) April 17, 2023

That scenario there from Michaël van de Poppe – “if Bitcoin bounces” – seems crucial. So let’s see where it’s at right now.

Top 10 overview

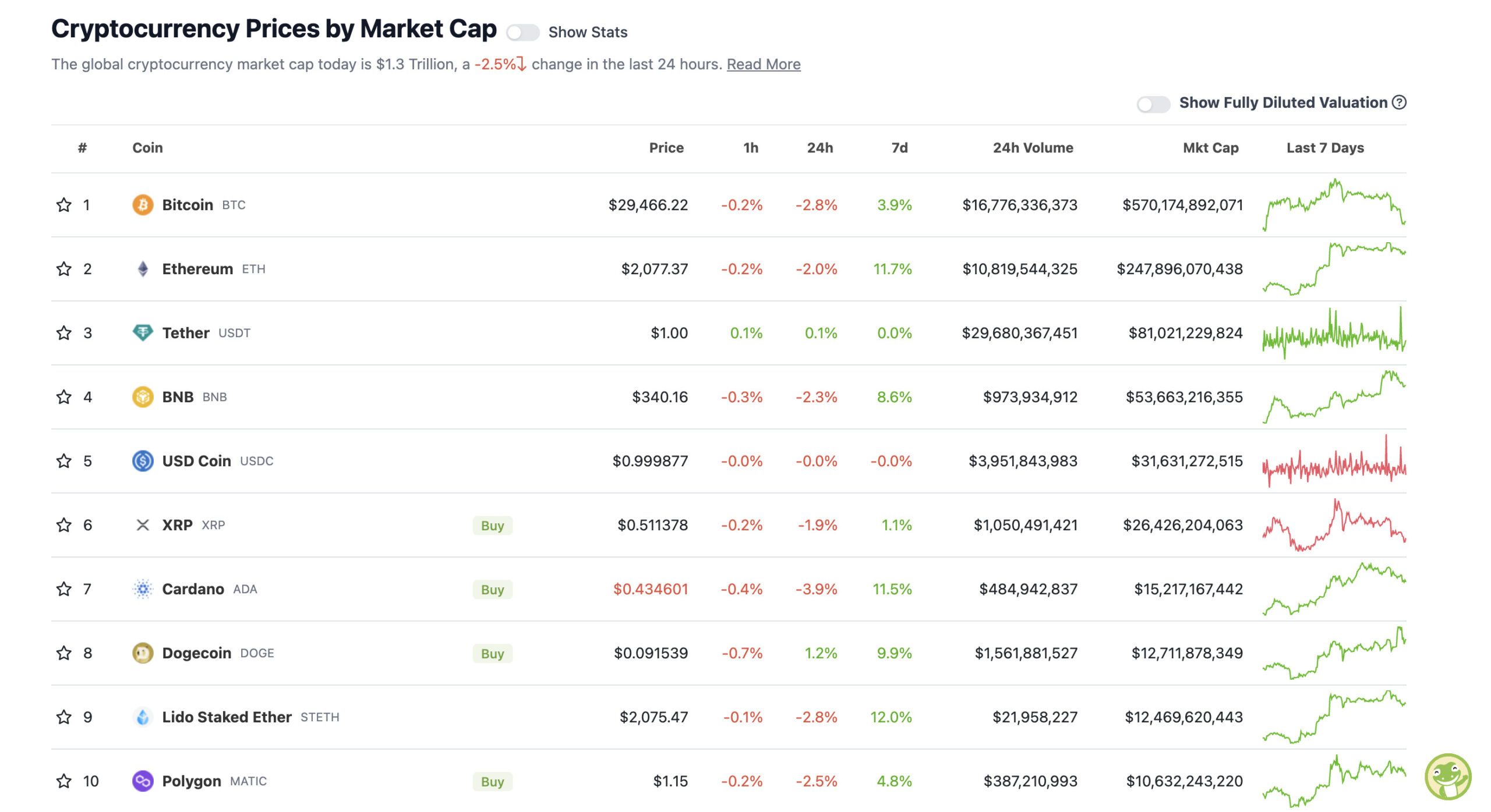

With the overall crypto market cap at US$1.3 trillion, down 2.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin has arrested its slide for now, if not “bouncing” back up with any strength just yet. And as for the altcoins, like Van de Poppe mentioned above, they’re indeed holding up relatively okay – particularly Ethereum, which is still up close to 12% over the past seven days.

Speaking of altcoins, though, the US Securities and Exchange Commission has a few more in its sights as it cracks down on the once-very-popular Seattle-based crypto exchange Bittrex.

Gary ‘The Destroyer’ Gensler goes after Bittrex

Yesterday, the SEC filed a complaint against Bittrex, even as the exchange prepares to stop offering services in America. It’s charged the exchange and its founder William Shihara for operating an unregistered national securities exchange, broker, and clearing agency. It’s also levelled a separate charge against Bittrex Global.

As part of its filing, the SEC has singled out the cryptos Dash, OMG, Algorand, Monolith, Naga and IHT Real Estate Protocol as being traded on Bittrex as unregistered securities.

Why it’s highlighted just those, when SEC boss Gary Gensler has made it clear he thinks all altcoins are securities, seems a little unclear.

“This guy Gary said Uber can run on Algorand. So I mortgaged the house and bought the top of ALGO at $2. Then I held it down -90% to $0.20. Now I want my money back from this promoter of unregistered securities. SEC!!”

Right? Or did I miss something?

— CTO Larsson (@ctoLarsson) April 17, 2023

"…on multiple occasions, we (Bittrex) asked them (the SEC) to tell us what digital assets they viewed as securities…They refused to do so."

So the SEC let Bittrex sell unregistered securities for years, and we're still supposed to believe it's about "investor protection"? https://t.co/CcmqE8O5C1

— Jeremy Hogan (@attorneyjeremy1) April 17, 2023

Meanwhile, here’s Gary Gensler congratulating himself on Twitter for a great two years at the SEC, all set to a tepid corporate soundtrack and slow-mo footage of satisfied, fully protected investors. Righto.

Trying to do a media blast before getting grilled tomorrow huh? We know what you're up to. You are a liar and the courts will expose you! pic.twitter.com/jOrqPpIOy6

— Tony Edward (Thinking Crypto Podcast) (@ThinkingCrypto1) April 17, 2023

Gensler faces a grilling in US Congress this week over the SEC’s oversight and treatment of the crypto industry. He will testify in front of the House Financial Services Committee for the first time in his two years in charge of the SEC.

Meanwhile, Ohio Republican Congressman Warren Davidson is introducing a bill to replace Gensler from the role.

Yep. To correct a long series of abuses, I am introducing legislation that removes the Chairman of the Securities and Exchange Commission and replaces the role with an Executive Director that reports to the Board (where authority resides). Former Chairs of the SEC are ineligible. https://t.co/VBnkgt8bhM

— Warren Davidson 🇺🇸 (@WarrenDavidson) April 16, 2023

This comes after SEC commissioner Hester Peirce, a well-known dissenter against the SEC chair, penned a statement criticising her own agency’s targeting of decentralised finance protocols.

“Stagnation, centralization, expatriation, and extinction are the watchwords of this release,” wrote Peirce. “Rather than embracing the promise of new technology as we have done in the past, here we propose to embrace stagnation, force centralization, urge expatriation, and welcome the extinction of new technology. Accordingly, I dissent…”

Uppers and downers: 11–100

Sweeping a market-cap range of about US$9.6 billion to about US$505 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Render (RNDR), (market cap: US$715 million) +12%

• Radix (XRD), (mc: US$947 million) +9%

• Decentraland (MANA), (mc: US$1.25 billion) +7%

• Loopring (LRC), (mc: US$511 million) +5%

• The Graph (GRT), (mc: US$1.5 billion) +2%

SLUMPERS

• Baby Doge Coin (BABYDOGE), (market cap: US$534 million) -6%

• Rocket Pool (RPL), (mc: US$1.07 billion) -6%

• ImmutableX (IMX), (mc: US$1.02 billion) -5%

• NEO (NEO), (mc: US$912 million) -5%

• Algorand (ALGO), (mc: US$1.58 billion) -5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

NEW‼️ Himalayan kingdom of Bhutan has quietly been investing millions of dollars into #Bitcoin and crypto – Forbes 🚀

— Bitcoin Archive (@BTC_Archive) April 17, 2023

U.S. congressman Warren Davidson is set to introduce legislation to fire Gary Gensler for crypto overreach 🇺🇸 pic.twitter.com/5B1FrDVc1x

— Crypto Crib (@Crypto_Crib_) April 17, 2023

https://twitter.com/HumansNoContext/status/1647963511807524864

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.